Alberta

Free Alberta Strategy trying to force Trudeau to release the pension calculation

Just over a year ago, Alberta Finance Minister Nate Horner unveiled a report exploring the potential risks and benefits of an Alberta Pension Plan.

The report, prepared by pension analytics firm LifeWorks – formerly known as Morneau Shepell, the same firm once headed by former federal Finance Minister Bill Morneau – used the exit formula outlined in the Canada Pension Plan Act to determine that if the province exits, it would be entitled to a large share of CPP assets.

According to LifeWorks, Alberta’s younger, predominantly working-class population, combined with higher-than-average income levels, has resulted in the province contributing disproportionately to the CPP.

The analysis pegged Alberta’s share of the CPP account at $334 billion – 53% of the CPP’s total asset pool.

We’ve explained a few times how, while that number might initially sound farfetched, once you understand that Alberta has contributed more than it’s taken out, almost every single year CPP has existed, while other provinces have consistently taken out more than they put in and technically *owe* money, it starts to make more sense.

But, predictably, the usual suspects were outraged.

Media commentators and policy analysts across the country were quick to dismiss the possibility that Alberta could claim such a significant portion. To them, the idea that Alberta workers had been subsidizing the CPP for decades seemed unthinkable.

The uproar prompted an emergency meeting of Canada’s Finance Ministers, led by now-former federal Finance Minister Chrystia Freeland. Alberta pressed for clarity, with Horner requesting a definitive number from the federal government.

Freeland agreed to have the federal Chief Actuary provide an official calculation.

If you think Trudeau should release the pension calculation, click here.

Four months later, the Chief Actuary announced the formation of a panel to “interpret” the CPP’s asset transfer formula – a formula that remains contentious and could drastically impact Alberta’s entitlement.

(Readers will remember that how this formula is interpreted has been the matter of much debate, and could have a significant impact on the amount Alberta is entitled to.)

Once the panel completed its work, the Chief Actuary promised to deliver Alberta’s calculated share by the fall. With December 20th marking the last day of fall, Alberta has finally received a response – but not the one it was waiting for:

“We received their interpretation of the legislation, but it did not contain a number or even a formula for calculating a number,” said Justin Brattinga, Horner’s press secretary.

In other words, the Chief Actuary did the complete opposite of what they were supposed to do.

The Chief Actuary’s job is to calculate each province’s entitlement, based on the formula outlined in the CPP Act.

It is not the Chief Actuary’s job to start making up new interpretations of the formula to suit the federal government’s agenda.

In fact, the idea that the Chief Actuary spent all this time working on the issue, and didn’t even calculate a number is preposterous.

There’s just no way that that’s what happened.

Far more likely is that the Chief Actuary did run the numbers, using the formula in the CPP Act, only for them – and the federal government – to realize that Alberta’s LifeWorks calculation is actually about right.

Cue panic, a rushed attempt to “reinterpret” the formula, and a refusal to provide the number they committed to providing.

In short, we simply don’t believe that the Chief Actuary didn’t, you know, “actuarialize” anything.

For decades, Alberta has contributed disproportionately to the CPP, given its higher incomes and younger population.

Despite all the bluster in the media, this is actually common sense.

A calculation reflecting this reality would not sit well with other provinces, which have benefited from these contributions.

By withholding the actual number, Ottawa confirms the validity of Alberta’s position.

The refusal to release the calculation only adds fuel to the financial firestorm already underway in Ottawa.

Albertans deserve to know the truth about their contributions and entitlements.

We want to see that number.

If you agree, and want to see the federal government’s calculation on what Alberta is owed, sign our petition – Tell Trudeau To Release The Pension Calculation:

Once you’ve signed, send this petition to your friends, family, and all Albertans.

Thank you for your support!

Regards,

The Free Alberta Strategy Team

Alberta

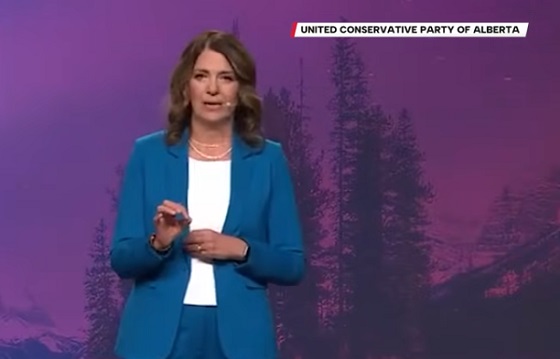

Keynote address of Premier Danielle Smith at 2025 UCP AGM

Alberta

Net Zero goal is a fundamental flaw in the Ottawa-Alberta MOU

From the Fraser Institute

By Jason Clemens and Elmira Aliakbari

The challenge of GHG emissions in 2050 is not in the industrial world but rather in the developing world, where there is still significant basic energy consumption using timber and biomass.

The new Memorandum of Understanding (MOU) between the federal and Alberta governments lays the groundwork for substantial energy projects and infrastructure development over the next two-and-a-half decades. It is by all accounts a step forward, though, there’s debate about how large and meaningful that step actually is. There is, however, a fundamental flaw in the foundation of the agreement: it’s commitment to net zero in Canada by 2050.

The first point of agreement in the MOU on the first page of text states: “Canada and Alberta remain committed to achieving net zero greenhouse gas emissions by 2050.” In practice, it’s incredibly difficult to offset emissions with tree planting or other projects that reduce “net” emissions, so the effect of committing to “net zero” by 2050 means that both governments agree that Canada should produce very close to zero actual greenhouse gas (GHG) emissions. Consider the massive changes in energy production, home heating, transportation and agriculture that would be needed to achieve this goal.

So, what’s wrong with Canada’s net zero 2050 and the larger United Nations’ global goal for the same?

Let’s first understand the global context of GHG reductions based on a recent study by internationally-recognized scholar Vaclav Smil. Two key insights from the study. First, despite trillions being spent plus international agreements and regulatory measures starting back in 1997 with the original Kyoto agreement, global fossil fuel consumption between then and 2023 increased by 55 per cent.

Second, fossil fuels as a share of total global energy declined from 86 per cent in 1997 to 82 per cent in 2022, again, despite trillions of dollars in spending plus regulatory requirements to force a transition away from fossil fuels to zero emission energies. The idea that globally we can achieve zero emissions over the next two-and-a-half decades is pure fantasy. Even if there is an historic technological breakthrough, it will take decades to actually transition to a new energy source(s).

Let’s now understand the Canada-specific context. A recent study examined all the measures introduced over the last decade as part of the national plan to reduce emissions to achieve net zero by 2050. The study concluded that significant economic costs would be imposed on Canadians by these measures: inflation-adjusted GDP would be 7 per cent lower, income per worker would be more than $8,000 lower and approximately 250,000 jobs would be lost. Moreover, these costs would not get Canada to net zero. The study concluded that only 70 per cent of the net zero emissions goal would be achieved despite these significant costs, which means even greater costs would be imposed on Canadians to fully achieve net zero.

It’s important to return to a global picture to fully understand why net zero makes no sense for Canada within a worldwide context. Using projections from the International Energy Agency (IEA) in its latest World Energy Outlook, the current expectation is that in 2050, advanced countries including Canada and the other G7 countries will represent less than 25 per cent of global emissions. The developing world, which includes China, India, the entirety of Africa and much of South America, is estimated to represent at least 70 per cent of global emissions in 2050.

Simply put, the challenge of GHG emissions in 2050 is not in the industrial world but rather in the developing world, where there is still significant basic energy consumption using timber and biomass. A globally-coordinated effort, which is really what the U.N. should be doing rather than fantasizing about net zero, would see industrial countries like Canada that are capable of increasing their energy production exporting more to these developing countries so that high-emitting energy sources are replaced by lower-emitting energy sources. This would actually reduce global GHGs while simultaneously stimulating economic growth.

Consider a recent study that calculated the implications of doubling natural gas production in Canada and exporting it to China to replace coal-fired power. The conclusion was that there would be a massive reduction in global GHGs equivalent to almost 90 per cent of Canada’s total annual emissions. In these types of substitution arrangements, the GHGs would increase in energy-producing countries like Canada but global GHGs would be reduced, which is the ultimate goal of not only the U.N. but also the Carney and Smith governments as per the MOU.

Finally, the agreement ignores a basic law of economics. The first lesson in the very first class of any economics program is that resources are limited. At any given point in time, we only have so much labour, raw materials, time, etc. In other words, when we choose to do one project, the real cost is foregoing the other projects that could have been undertaken. Economics is mostly about trying to understand how to maximize the use of limited resources.

The MOU requires massive, literally hundreds of billions of dollars to be used to create nuclear power, other zero-emitting power sources and transmission systems all in the name of being able to produce low or even zero-emitting oil and gas while also moving to towards net zero.

These resources cannot be used for other purposes and it’s impossible to imagine what alternative companies or industries would have been invested in. What we do know is that workers, entrepreneurs, businessowners and investors are not making these decisions. Rather, politicians and bureaucrats in Ottawa and Edmonton are making these decisions but they won’t pay any price if they’re wrong. Canadians pay the price. Just consider the financial fiasco unfolding now with Ottawa, Ontario and Quebec’s subsidies (i.e. corporate welfare) for electric vehicle batteries.

Understanding the fundamentally flawed commitment to Canadian net zero rather than understanding a larger global context of GHG emissions lays at the heart of the recent MOU and unfortunately for Canadians will continue to guide flawed and expensive policies. Until we get the net zero policies right, we’re going to continue to spend enormous resources on projects with limited returns, costing all Canadians.

-

Opinion1 day ago

Opinion1 day agoLandmark 2025 Study Says Near-Death Experiences Can’t Be Explained Away

-

Focal Points1 day ago

Focal Points1 day agoSTUDY: TikTok, Instagram, and YouTube Shorts Induce Measurable “Brain Rot”

-

Alberta1 day ago

Alberta1 day agoRed Deer’s Jason Stephan calls for citizen-led referendum on late-term abortion ban in Alberta

-

Business1 day ago

Business1 day agoBlacked-Out Democracy: The Stellantis Deal Ottawa Won’t Show Its Own MPs

-

Health2 days ago

Health2 days agoTens of thousands are dying on waiting lists following decades of media reluctance to debate healthcare

-

Agriculture19 hours ago

Agriculture19 hours agoHealth Canada pauses plan to sell unlabeled cloned meat

-

Artificial Intelligence12 hours ago

Artificial Intelligence12 hours agoGoogle denies scanning users’ email and attachments with its AI software

-

Indigenous1 day ago

Indigenous1 day agoIndigenous activist wins landmark court ruling for financial transparency