Business

Not a ‘vibecession’—Canadian living standards are declining

From the Fraser Institute

By Grady Munro

In June 2019, inflation-adjusted per-person GDP was $59,905 compared to $58,601 in September 2024, a decline of 2.2 per cent. And while per-person GDP has ebbed and flowed during this decline, the third quarter of 2024 marks the sixth consecutive quarter that living standards have fallen in Canada.

During a recent press conference about the Trudeau government’s plan to send $250 cheques to many Canadians and suspend the GST on certain goods and services for two months, federal Finance Minister Chrystia Freeland said Canadians are experiencing a “vibecession,” which is creating negative feelings about the economy despite “really positive economic news.” According to Freeland, these two proposals, which will cost billions, will “help Canadians get past that vibecession.”

But in reality, the economic woes of Canadians are real, and new data from Statistics Canada show that Canadian living standards are declining.

Let’s look at the numbers. From July to September of 2024, after adjusting for inflation, the Canadian economy (as measured by GDP) grew by 0.3 per cent yet per-person GDP (an indicator of living standards and incomes) actually fell by 0.4 per cent.

How can the economy grow while living standards decline?

Because Canada’s rapid population growth, fuelled by high levels of immigration, means the overall economy has increased in size but per-person GDP has not. And during the same three-month period (July to September), Canada’s population increased by 0.6 per cent (or 250,229 people), outpacing the rate of economic growth.

Not merely a one-off, this continues a historic decline in Canadian living standards over the last five years. In June 2019, inflation-adjusted per-person GDP was $59,905 compared to $58,601 in September 2024, a decline of 2.2 per cent. And while per-person GDP has ebbed and flowed during this decline, the third quarter of 2024 marks the sixth consecutive quarter that living standards have fallen in Canada.

Last week, the House of Commons approved the government’s plan to temporarily suspend the GST on select items from December 14 to February 15, at an estimated cost of $1.6 billion (the legislation now goes to the Senate for approval). The government has delayed the “$250 cheques” plan to potentially accommodate NDP demands to expand eligibility to include seniors (the original proposal would have sent cheques to an estimated 18.7 million Canadians at a cost of $4.7 billion).

Neither one of these proposals will incentivize Canadians to work and invest, and therefore these proposals won’t help raise living standards. To help drive economic growth, create jobs and provide more economic opportunities for workers across the income spectrum, the federal government should reduce the overall tax burden on workers and businesses, and make Canada a more attractive place to work and invest.

Despite any claims of a “vibecession,” Canadians remain mired in an actual recession in their standard of living. Minister Freeland’s comments once again prove that this government is disconnected from the reality many Canadians face. It’s not just bad vibes—data shows Canadians are actually worse off today than they were in 2019.

Business

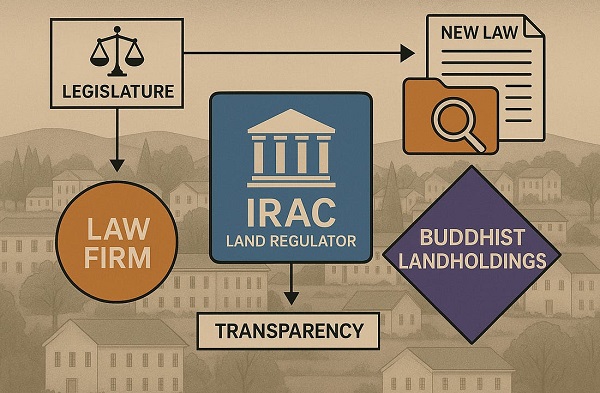

P.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

Following an exclusive report from The Bureau detailing transparency concerns at Prince Edward Island’s land regulator — and a migration of lawyers from firms that represented the Buddhist land-owning entities the regulator had already probed — the P.E.I. Legislature has passed a new law forcing the Island Regulatory and Appeals Commission (IRAC) to make its land-investigation reports public.

The bill — introduced by Green Party Leader Matt MacFarlane — passed unanimously on Wednesday, CTV News reported. It amends the Lands Protection Act to require IRAC to table final investigation reports and supporting documents in the Legislature within 15 days of completion.

MacFarlane told CTV the reform was necessary because “public trust … is at an all-time low in the system,” adding that “if Islanders can see that work is getting done, that the (LPA) is being properly administered and enforced, that will get some trust rebuilt in this body.”

The Bureau’s report last week underscored that concern, showing how lawyers from Cox & Palmer — the firm representing the Buddhist landholders — steadily moved into senior IRAC positions after the regulator quietly shut down its mandated probe into those same entities. The issue exploded this fall when a Legislative Committee subpoena confirmed that IRAC’s oft-cited 2016–2018 investigation had never produced a final report at all.

There have been reports, including from CBC, that the Buddhist landholders have ties to a Chinese Communist Party entity, which leaders from the group deny.

In the years following IRAC’s cancelled probe into the Buddhist landholders, The Bureau reported, Cox & Palmer’s general counsel and director of land joined IRAC, and the migration of senior former lawyers culminated this spring, with former premier Dennis King appointing his own chief of staff, longtime Cox & Palmer partner Pam Williams, as IRAC chair shortly after the province’s land minister ordered the regulator to reopen a probe into Buddhist landholdings.

The law firm did not respond to questions, while IRAC said it has strong measures in place to guard against any conflicted decision-making.

Reporting on the overall matter, The Bureau wrote that:

“The integrity of the institution has, in effect, become a test of public confidence — or increasingly, of public disbelief. When Minister of Housing, Land and Communities Steven Myers ordered IRAC in February 2025 to release the 2016–2018 report and reopen the investigation, the commission did not comply … Myers later resigned in October 2025. Days afterward, the Legislative Committee on Natural Resources subpoenaed IRAC to produce the report. The commission replied that no formal report had ever been prepared.”

The Bureau’s investigation also showed that the Buddhist entities under review control assets exceeding $480 million, and there is also a planned $185-million campus development in the Town of Three Rivers, citing concerns that such financial power, combined with a revolving door between key law firms, political offices and the regulator, risks undermining confidence in P.E.I.’s land-oversight regime.

Wednesday’s new law converts the expectation for transparency at IRAC, voiced loudly by numerous citizens in this small province of about 170,000, into a statutory obligation.

Housing, Land and Communities Minister Cory Deagle told CTV the government supported the bill: “We do have concerns about some aspects of it, but the main principles of what you’re trying to achieve are a good thing.”

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

Mark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

After scathing warnings from interim budget officer Jason Jacques, Liberals move to silence dissent and install a compliant insider with “tact and discretion.”

It’s remarkable, isn’t it? After a decade of gaslighting Canadians about their so-called “fiscally responsible” governance, the Liberal Party, now under the direction of Mark Carney, finally runs into a problem they can’t spin: someone told the truth. Jason Jacques, the interim Parliamentary Budget Officer, was appointed for six months, six months. And within weeks, he did something this government considers a fireable offense: he read the books, looked at the numbers, and spoke plainly. That’s it. His crime? Honesty.

Here’s what he found. First, the deficit. Remember when Trudeau said “the budget will balance itself”? That myth has now mutated into a projected $68.5 billion deficit for 2025–26, up from $51.7 billion the year before. Jacques didn’t just disagree with it. He called it “stupefying,” “shocking,” and, this is the one they hate the most, “unsustainable.” Because if there’s one thing Ottawa elites can’t handle, it’s accountability from someone who doesn’t need a job after this.

But Jacques didn’t stop there. He pointed out that this government has no fiscal anchor. None. Not even a fake one. A fiscal anchor is a target, like a deficit limit or a falling debt-to-GDP ratio—basic stuff for any country pretending to manage its money. Jacques said the Liberals have abandoned even that pretense. In his words, there’s no clear framework. Just blind spending. No roadmap. No compass. No brakes.

And speaking of GDP, here’s the kicker: the debt-to-GDP ratio, which Trudeau once swore would always go down, is now heading up. Jacques projects it rising from 41.7% in 2024–25 to over 43% by 2030–31. And what happens when debt rises and growth slows? You pay more just to service the interest. That’s exactly what Jacques warned. He said the cost of carrying the debt is eating into core government operations. That means fewer services. Higher taxes. Slower growth. The burden gets passed to your children while Mark Carney gives another speech in Zurich about “inclusive capitalism.”

And let’s talk about definitions. Jacques flagged that the Liberals are now muddying the waters on what counts as operating spending versus capital spending. Why does that matter? Because if you redefine the terms, you can claim to be balancing the “operating budget” while secretly racking up long-term debt. It’s accounting gimmickry, a shell game with your tax dollars.

He also pointed to unaccounted spending, about $20 billion a year in campaign promises that haven’t even been formally costed yet. Add that to their multi-decade defense commitments, green subsidies, and inflated federal payroll, and you’re looking at an avalanche of unmodeled liabilities.

And just to make this circus complete, Jacques even criticized the way his own office was filled. The Prime Minister can handpick an interim PBO with zero parliamentary input. No transparency. No debate. Just a quiet appointment, until the appointee grows a spine and tells the public what’s really going on.

Now the Liberals are racing to replace Jacques. Why? Because he said all of this publicly. Because he didn’t play ball. Because his office dared to function as it was intended: independently. They’re looking for someone with “tact and discretion.” That’s what the job listing says. Not independence. Not integrity. Tact. Discretion. In other words: someone who’ll sit down, shut up, and nod politely while Carney and Champagne burn through another $100 billion pretending it’s “investment.”

Let’s be clear: this isn’t just about replacing a bureaucrat. It’s about neutering the last shred of fiscal oversight left in Ottawa. The Parliamentary Budget Officer is supposed to be a firewall between reckless political ambition and your wallet. But in Carney’s Canada, independence is an inconvenience. So now, instead of extending Jacques’ term, something that would preserve continuity and show respect for accountability, the Liberals are shopping for a compliant technocrat. Someone who won’t call a $68.5 billion deficit “stupefying.” Someone who’ll massage the numbers just enough to keep the illusion intact.

They don’t want an economist. They want a courtier. Someone with just enough credentials to fake credibility, and just enough cowardice to keep their mouth shut when the spending blows past every so-called “anchor” they once pretended to respect. That’s the game. Keep the optics clean. Keep the watchdog muzzled. And keep Canadians in the dark while this government drives the country off a fiscal cliff.

But let me say it plainly, thank god someone in this country still believes in accountability. Thank God Jason Jacques stepped into that office and had the guts to tell the truth, not just to Parliament, but to the Canadian people. And thank God Pierre Poilievre has the common sense, the spine, and the clarity to back him. While Mark Carney and his Laurentian elite pals are busy gutting oversight, rewriting the rules, and flooding the economy with borrowed billions, it’s men like Jacques who refuse to play along. He looked at the books and didn’t see “investment”—he saw a ticking fiscal time bomb. And instead of ducking, he sounded the alarm.

Poilievre, to his credit, is standing firmly behind the man. He understands that without a real watchdog, Parliament becomes a stage play, just actors and scripts, no substance. Backing Jacques isn’t just good politics. It’s basic sanity. It’s the minimum standard for anyone who still thinks this country should live within its means, tell the truth about its finances, and respect the people footing the bill.

So while the Liberals scramble to muzzle dissent and hire another smiling yes-man with a resume full of buzzwords and a Rolodex full of Davos invites, at least one opposition leader is saying: No. We need a watchdog, not a lapdog. And in a city full of spineless bureaucrats, that’s not just refreshing—it’s absolutely essential.

-

Alberta2 days ago

Alberta2 days agoMark Carney Has Failed to Make Use of the Powerful Tools at His Disposal to Get Oil Pipelines Built

-

Business2 days ago

Business2 days agoCarney shrugs off debt problem with more borrowing

-

Energy2 days ago

Energy2 days agoFor the sake of Confederation, will we be open-minded about pipelines?

-

Alberta1 day ago

Alberta1 day agoWhen Teachers Say Your Child Has Nowhere Else to Go

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoMaintenance Mania: Since When Did Pro Athletes Get So Fragile?

-

Automotive2 days ago

Automotive2 days agoThe high price of green virtue

-

Addictions1 day ago

Addictions1 day agoCanada is divided on the drug crisis—so are its doctors

-

Daily Caller1 day ago

Daily Caller1 day agoProtesters Storm Elite Climate Summit In Chaotic Scene