Economy

Ottawa’s new ‘climate disclosures’ another investment killer

From the Fraser Institute

By Matthew Lau

The Trudeau government has demonstrated consistently that its policies—including higher capital gains taxes and a hostile regulatory environment—are entirely at odds with what investors want to see. Corporate head offices are fleeing Canada and business investment has declined significantly since the Trudeau Liberals came to power.

According to the Trudeau government’s emissions reduction plan, “putting a price on pollution is widely recognized as the most efficient means to reduce greenhouse gas emissions.” Fair enough, but a reasonable person might wonder why the same politicians who insist a price mechanism (i.e. carbon tax) is the most efficient policy recently announced relatively inefficient measures such “sustainable investment guidelines” and “mandatory climate disclosures” for large private companies.

The government claims that imposing mandatory climate disclosures will “attract more private capital into Canada’s largest corporations and ensure Canadian businesses can continue to effectively compete as the world races towards net-zero.” That is nonsense. How would politicians Ottawa know better than business owners about how their businesses should attract capital? If making climate disclosures were a good way to help businesses attract capital, the businesses that want to attract capital would make such disclosures voluntarily. There would be no need for a government mandate.

The government has not yet launched the regulatory process for the climate disclosures, so we don’t know exactly how onerous it will be, but one thing is for sure—the disclosures will be expensive and unnecessary, imposing useless costs onto businesses and investors without any measurable benefit, further discouraging investment in Canada. Again, if the disclosures were useful and worthwhile to investors, businesses seeking to attract investment would make them voluntarily.

Even the government’s own announcement casts doubt that increasing business investment is the likely outcome of mandatory climate disclosures. While the government says it’s “sending a clear signal to corporate boards and shareholders, at home and around the world, that Canada is their trusted partner for putting private capital to work in the race to net-zero,” most investors are not looking to put private capital to work to combat climate change. Most investors want to put their capital to work to earn a good financial return, after adjusting for the risk of the investment.

This latest announcement should come as no surprise. The Trudeau government has demonstrated consistently that its policies—including higher capital gains taxes and a hostile regulatory environment—are entirely at odds with what investors want to see. Corporate head offices are fleeing Canada and business investment has declined significantly since the Trudeau Liberals came to power. Capital per worker in Canada is declining due to weak business investment since 2015, and new capital per-Canadian worker in 2024 is barely half of what it is in the United States.

It’s also fair to ask, in the face of these onerous polices—where are the environmental benefits? The government says its climate disclosures are needed for Canada to progress to net-zero emissions and “uphold the Paris climate target of limiting global warming to 1.5°C above pre-industrial levels,” but its net-zero targets are neither feasible nor realistic and the economics literature does not support the 1.5 degrees target.

Finally, when announcing the new climate disclosures, Trudeau Environment Minister Steven Guilbeault said they are an important stepping stone to a cleaner economy, which is a “major economic opportunity.” Yet even the Canada Energy Regulator (a federal agency) projects net-zero policies would reduce real GDP per capita, increase inflation of consumer prices and reduce residential space (in other words, reduce living standards).

A major economic opportunity that will increase business investment? Surely not—mandatory climate disclosures will only further reduce our standard of living and impose useless costs onto business and investors, with the sure effect of reducing investment.

Author:

Business

Will the Port of Churchill ever cease to be a dream?

From Resource Works

The Port of Churchill has long been viewed as Canada’s northern gateway to global markets, but decades of under-investment have held it back.

A national dream that never materialised

For nearly a century, Churchill, Manitoba has loomed in the national imagination. In 1931, crowds on the rocky shore watched the first steamships pull into Canada’s new deepwater Arctic port, hailed as the “thriving seaport of the Prairies” that would bring western grain “1,000 miles nearer” to European markets. The dream was that this Hudson Bay town would become a great Canadian centre of trade and commerce.

The Hudson Bay Railway was blasted across muskeg and permafrost to reach what engineers called an “incomparably superior” harbour. But a short ice free season and high costs meant Churchill never grew beyond a niche outlet beside Canada’s larger ports, and the town’s population shrank.

False starts, failed investments

In 1997, Denver based OmniTrax bought the port and 900 kilometre rail line with federal backing and promises of heavy investment. Former employees and federal records later suggested those promises were not fully kept, even as Ottawa poured money into the route and subsidies were offered to keep grain moving north. After port fees jumped and the Canadian Wheat Board disappeared, grain volumes collapsed and the port shut, cutting rail service and leaving northern communities and miners scrambling.

A new Indigenous-led revival — with limits

The current revival looks different. The port and railway are now owned by Arctic Gateway Group, a partnership of First Nations and northern municipalities that stepped in after washouts closed the line and OmniTrax walked away. Manitoba and Ottawa have committed $262.5 million over five years to stabilize the railway and upgrade the terminal, with Manitoba’s share now at $87.5 million after a new $51 million provincial pledge.

Prime Minister Mark Carney has folded Churchill into his wider push on “nation building” infrastructure. His government’s new Major Projects Office is advancing energy, mining and transmission proposals that Ottawa says add up to more than $116 billion in investment. Against that backdrop, Churchill’s slice looks modest, a necessary repair rather than a defining project.

The paperwork drives home the point. The first waves of formally fast tracked projects include LNG expansion at Kitimat, new nuclear at Darlington and copper and nickel mines. Churchill sits instead on the office’s list of “transformative strategies”, a roster of big ideas still awaiting detailed plans and costings, with a formal Port of Churchill Plus strategy not expected until the spring of 2026 under federal–provincial timelines.

Churchill as priority — or afterthought?

Premier Wab Kinew rejects the notion that Churchill is an afterthought. Standing with Carney in Winnipeg, he called the northern expansion “a major priority” for Manitoba and cast the project as a way for the province “to be able to play a role in building up Canada’s economy for the next stage of us pushing back against” U.S. protectionism. He has also cautioned that “when we’re thinking about a major piece of infrastructure, realistically, a five to 10 year timeline is probably realistic.”

On paper, the Port of Churchill Plus concept is sweeping. The project description calls for an upgraded railway, an all weather road, new icebreaking capacity in Hudson Bay and a northern “energy corridor” that could one day move liquefied natural gas, crude oil, electricity or hydrogen. Ottawa’s joint statement with Manitoba calls Churchill “without question, a core component to the prosperity of the country.”

Concepts without commitments

The vision is sweeping, yet most of this remains conceptual. Analysts note that hard questions about routing, engineering, environmental impacts and commercial demand still have to be answered. Transportation experts say they struggle to see a purely commercial case that would make Churchill more attractive than larger ports, arguing its real value is as an insurance policy for sovereignty and supply chain resilience.

That insurance argument is compelling in an era of geopolitical risk and heightened concern about Arctic security. It is also a reminder of how limited Canada’s ambition at Churchill has been. For a hundred years, governments have been willing to dream big in northern Manitoba, then content to underbuild and underdeliver, as the port’s own history of near misses shows. A port that should be a symbol of confidence in the North has spent most of its life as a seasonal outlet.

A Canadian pattern — high ambition, slow execution

The pattern is familiar across the country. Despite abundant resources, capital and engineering talent, mines, pipelines, ports and power lines take years longer to approve and build here than in competing jurisdictions. A tangle of overlapping regulations, court challenges and political caution has turned review into a slow moving veto, leaving a politics of grand announcements followed by small, incremental steps.

Churchill is where those national habits are most exposed. The latest round of investment, led by Indigenous owners and backed by both levels of government, deserves support, as does Kinew’s insistence that Churchill is a priority. But until Canada matches its Arctic trading rhetoric with a willingness to build at scale and at speed, the port will remain a powerful dream that never quite becomes a real gateway to the world.

Headline photo credit to THE CANADIAN PRESS/John Woods

Business

Canada is failing dismally at our climate goals. We’re also ruining our economy.

From the Fraser Institute

By Annika Segelhorst and Elmira Aliakbari

Short-term climate pledges simply chase deadlines, not results

The annual meeting of the United Nations Conference of the Parties, or COP, which is dedicated to implementing international action on climate change, is now underway in Brazil. Like other signatories to the Paris Agreement, Canada is required to provide a progress update on our pledge to reduce greenhouse gas (GHG) emissions by 40 to 45 per cent below 2005 levels by 2030. After decades of massive government spending and heavy-handed regulations aimed at decarbonizing our economy, we’re far from achieving that goal. It’s time for Canada to move past arbitrary short-term goals and deadlines, and instead focus on more effective ways to support climate objectives.

Since signing the Paris Agreement in 2015, the federal government has introduced dozens of measures intended to reduce Canada’s carbon emissions, including more than $150 billion in “green economy” spending, the national carbon tax, the arbitrary cap on emissions imposed exclusively on the oil and gas sector, stronger energy efficiency requirements for buildings and automobiles, electric vehicle mandates, and stricter methane regulations for the oil and gas industry.

Recent estimates show that achieving the federal government’s target will impose significant costs on Canadians, including 164,000 job losses and a reduction in economic output of 6.2 per cent by 2030 (compared to a scenario where we don’t have these measures in place). For Canadian workers, this means losing $6,700 (each, on average) annually by 2030.

Yet even with all these costly measures, Canada will only achieve 57 per cent of its goal for emissions reductions. Several studies have already confirmed that Canada, despite massive green spending and heavy-handed regulations to decarbonize the economy over the past decade, remains off track to meet its 2030 emission reduction target.

And even if Canada somehow met its costly and stringent emission reduction target, the impact on the Earth’s climate would be minimal. Canada accounts for less than 2 per cent of global emissions, and that share is projected to fall as developing countries consume increasing quantities of energy to support rising living standards. In 2025, according to the International Energy Agency (IEA), emerging and developing economies are driving 80 per cent of the growth in global energy demand. Further, IEA projects that fossil fuels will remain foundational to the global energy mix for decades, especially in developing economies. This means that even if Canada were to aggressively pursue short-term emission reductions and all the economic costs it would imposes on Canadians, the overall climate results would be negligible.

Rather than focusing on arbitrary deadline-contingent pledges to reduce Canadian emissions, we should shift our focus to think about how we can lower global GHG emissions. A recent study showed that doubling Canada’s production of liquefied natural gas and exporting to Asia to displace an equivalent amount of coal could lower global GHG emissions by about 1.7 per cent or about 630 million tonnes of GHG emissions. For reference, that’s the equivalent to nearly 90 per cent of Canada’s annual GHG emissions. This type of approach reflects Canada’s existing strength as an energy producer and would address the fastest-growing sources of emissions, namely developing countries.

As the 2030 deadline grows closer, even top climate advocates are starting to emphasize a more pragmatic approach to climate action. In a recent memo, Bill Gates warned that unfounded climate pessimism “is causing much of the climate community to focus too much on near-term emissions goals, and it’s diverting resources from the most effective things we should be doing to improve life in a warming world.” Even within the federal ministry of Environment and Climate Change, the tone is shifting. Despite the 2030 emissions goal having been a hallmark of Canadian climate policy in recent years, in a recent interview, Minister Julie Dabrusin declined to affirm that the 2030 targets remain feasible.

Instead of scrambling to satisfy short-term national emissions limits, governments in Canada should prioritize strategies that will reduce global emissions where they’re growing the fastest.

Elmira Aliakbari

-

Health2 days ago

Health2 days agoCDC’s Autism Reversal: Inside the Collapse of a 25‑Year Public Health Narrative

-

Crime2 days ago

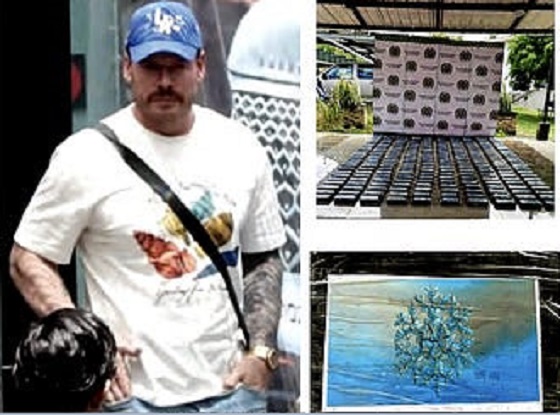

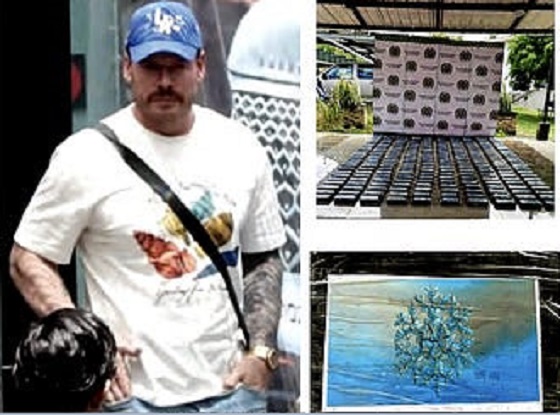

Crime2 days agoCocaine, Manhunts, and Murder: Canadian Cartel Kingpin Prosecuted In US

-

Health2 days ago

Health2 days agoBREAKING: CDC quietly rewrites its vaccine–autism guidance

-

Energy2 days ago

Energy2 days agoHere’s what they don’t tell you about BC’s tanker ban

-

National2 days ago

National2 days agoPsyop-Style Campaign That Delivered Mark Carney’s Win May Extend Into Floor-Crossing Gambits and Shape China–Canada–US–Mexico Relations

-

Great Reset1 day ago

Great Reset1 day agoEXCLUSIVE: A Provincial RCMP Veterans’ Association IS TARGETING VETERANS with Euthanasia

-

Daily Caller2 days ago

Daily Caller2 days agoBREAKING: Globalist Climate Conference Bursts Into Flames

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoBurying Poilievre Is Job One In Carney’s Ottawa