Economy

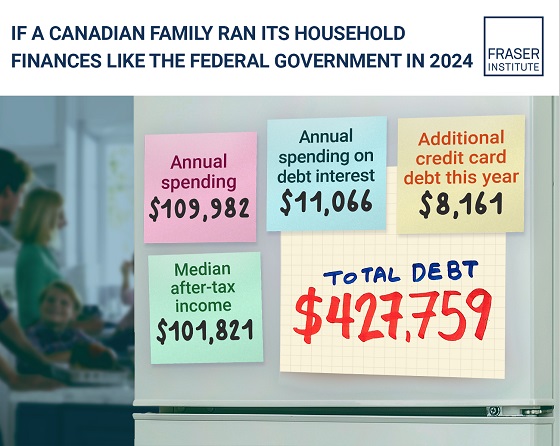

If Canadian families spent and borrowed like the federal government, they would be $427,759 in debt

From the Fraser Institute

By Grady Munro and Jake Fuss

If the median Canadian family spent and borrowed like the federal government, they would already be $427,759 in debt and continuing to borrow, finds a new study published today by the Fraser Institute.

“If the median family in Canada spent and borrowed like the federal government, they would be in serious financial trouble,” said Grady Munro, a Fraser Institute policy analyst and co-author of Understanding the Scale of Canada’s Federal Deficit.

The $39.8 billion deficit expected by Ottawa in 2024/25 represents the 17th consecutive annual federal deficit, with continued deficits expected into the foreseeable future, eventually resulting in higher taxes for Canadians.

Continuous annual borrowing by Ottawa to finance increased spending has driven federal total debt from 53.0 per cent of the economy ($1.1 trillion) in 2014/15 up to an expected 69.8 per cent ($2.1 trillion) in 2024/25.

To put this into perspective, the study’s analysis offers an example of what a median family’s household finances would look like if they were to spend and borrow like the federal government in 2024.

The study found that the median Canadian family in 2024 would spend $109,982 while only earning $101,821, meaning that it would borrow $8,161 just to pay for its normal spending. This $8,000-plus in additional debt is on top of the $427,759 in existing debt the family would already hold based on previous borrowing.

Illustrative of the burden of debt, $11,066 of the family’s income, representing almost 11 per cent, would be spent on just the interest costs of existing debt.

“Unlike most households, where debt is often offset by assets such as a home or investments, the federal government has little in the way of assets to offset its enormous debt,” said Jake Fuss, director of fiscal policy at the Fraser Institute and coauthor. “And it’s important to note that this government debt burden on Canadian families does not include the burden of provincial and municipal government debt, which depending on one’s location, can be significant.”

- For many years the federal government’s approach to government finances has relied on spending-driven deficits and a growing debt burden, causing a deterioration in the state of federal finances.

- While deficits can sometimes be justified in certain circumstances, perpetual spending-driven deficits have become the norm rather than a temporary exception for the federal government. The $39.8 billion deficit expected in 2024/25 is the 17th consecutive annual deficit, and deficits are expected to continue into the foreseeable future.

- Deficits have helped drive federal gross debt from 53.0% of the economy ($1.1 trillion) in 2014/15 up to an expected 69.8% ($2.1 trillion) in 2024/25.

- This increase in the level of federal debt comes with costs and will result in higher taxes on Canadians.

- It may be hard to comprehend the scale of the deficits and debt, so to contextualize the current state of federal finances this bulletin provides an example of what a median family’s household budget would look like in 2024 if it managed its finances the way the federal government does.

- The median family earning $101,821 in 2024 would be spending $109,982 if it spent the way the federal government does. To cover the difference, it would put $8,161 on a credit card, despite already being $427,759 in debt.

- Of the total amount spent, $11,066 would go towards interest on the debt his year. Simply put, a Canadian family that chose to spend like the federal government would be in financial trouble.

Authors:

Business

Liberal’s green spending putting Canada on a road to ruin

Once upon a time, Canadians were known for our prudence and good sense to such an extent that even our Liberal Party wore the mantle of fiscal responsibility.

Whatever else you might want to say about the party in the era of Jean Chrétien and Paul Martin, it recognized the country’s dire financial situation — back when The Wall Street Journal was referring to Canada as “an honorary member of the Third World” — as a national crisis.

And we (remember, I proudly served as Member of Parliament in that party for 18 years) made many hard decisions with an eye towards cutting spending, paying down the debt, and getting the country back on its feet.

Thankfully we succeeded.

Unfortunately, since then the party has been hijacked by a group of reckless leftwing fanatics — Justin Trudeau and his lackeys — who have spent the past several years feeding what we built into the woodchipper.

Mark Carney’s finally released budget is the perfect illustration of that.

The budget is a 400 page monument to deficit delusion that raises spending to $644.4 billion over five years — including $141.4 billion in new spending — while revenues limp to $583.3 billion, yielding a record (non-pandemic) $78.3 billion shortfall, an increase of 116% from last year.

This isn’t policy; it’s plunder. Interest payments alone devour $55.6 billion this year, projected to hit $76.1 billion by 2029-30 — more than the entire defence budget and rising faster than healthcare transfers.

We can’t discount the possibility that this will lead to a downgrade of our credit rating, which will significantly increase the cost of borrowing and of doing business more generally.

Numbers this big start to feel very abstract. But think of it this way: that is your money they’re spending. Ottawa’s wealth is made up entirely of our tax dollars. We’ve entrusted that money to them with the understanding that they will use it responsibly. In the decade these Liberals have been in power, they have betrayed that trust.

They’ve pursued policies which have made life in Canada increasingly unaffordable. For example, at the time of writing it takes 141 Canadian pennies (up from 139 a few days ago) to buy one U.S. dollar, in which all of our commodities are priced. Well, that’s .25 cents per litre of gasoline. Imagine what that’s going to do to the price of heating, of groceries, of the various other commodities which we consume.

And this budget demonstrates that the Carney era will be more of the same.

Of course, the Elbows Up crowd are saying the opposite — that this shows how fiscally responsible Mark Carney is, unlike his predecessor. (Never mind that they also publicly supported everything that Trudeau did when he was in government.) They claim that Carney shows that he’s more open to oil and gas than Trudeau was.

Don’t believe it.

The oil and gas sector does get a half-hearted nod in the budget with, for instance, a conditional pathway to repeal the emissions cap. But those conditions are important. Repeal is tied to the effectiveness of Carney’s beloved industrial carbon tax. If that newly super-charged carbon tax, which continues to make our lives more expensive, leads to government-set emissions reductions benchmarks being met, then Ottawa might — might — scrap the emissions.

Meanwhile, the budget doubles down on the Trudeau government’s methane emissions regulations. It merely loosens the provisions of the outrageous Bill C-59, an act which should have been scrapped in its entirety. And it leaves in place the Trudeaupian “green” super structure, which has resource sector investment, and any business that can manage it, fleeing to the U.S.

In these perilous times, with Canada teetering on the brink of recession, a responsible government would be cutting spending and getting out of the way of our most productive sectors, especially oil and gas — the backbone of our economy.

It would be repealing the BC tanker ban and Bill C-69, the “no more pipelines act,” so that our natural resources could better generate revenue on the international market and bring down energy rates at home.

It would quit wasting millions on Electric Vehicle charging stations; mandating that all Canadians buy EVs, even with their elevated cost; and pressuring automakers to manufacture Electric Vehicles, regardless of demand, and even as they keep closing up shop and heading south.

But in this budget the Liberals are going the opposite direction. Spend more. Tax more. Leave the basic Net-Zero framework in place. Rearrange the deck chairs on the Titanic.

They’re gambling tomorrow’s prosperity on yesterday’s green dogma, And every grocery run, every gas fill-up, every mortgage payment will serve as a daily reminder that we are the ones footing the bill.

Once upon a time, the Liberals knew better. We made the hard decisions and got the country back on its feet. Nowadays, not so much.

Business

Carney doubles down on NET ZERO

If you only listened to the mainstream media, you would think Justin Trudeau’s carbon tax is long gone. But the Liberal government’s latest budget actually doubled down on the industrial carbon tax.

While the consumer carbon tax may be paused, the industrial carbon tax punishes industry for “emitting” pollution. It’s only a matter of time before companies either pass the cost of the carbon tax to consumers or move to a country without a carbon tax.

Dan McTeague explains how Prime Minister Carney is doubling down on net zero scams.

-

Crime2 days ago

Crime2 days agoCBSA Bust Uncovers Mexican Cartel Network in Montreal High-Rise, Moving Hundreds Across Canada-U.S. Border

-

Environment2 days ago

Environment2 days agoThe Myths We’re Told About Climate Change | Michael Shellenberger

-

Health2 days ago

Health2 days agoLack of adequate health care pushing Canadians toward assisted suicide

-

Alberta1 day ago

Alberta1 day agoATA Collect $72 Million in Dues But Couldn’t Pay Striking Teachers a Dime

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoAI Faces Energy Problem With Only One Solution, Oil and Gas

-

Media1 day ago

Media1 day agoBreaking News: the public actually expects journalists to determine the truth of statements they report

-

Artificial Intelligence1 day ago

Artificial Intelligence1 day agoAI seems fairly impressed by Pierre Poilievre’s ability to communicate

-

National1 day ago

National1 day agoWatchdog Demands Answers as MP Chris d’Entremont Crosses Floor