Business

CBC staff with six figure salaries balloons under Trudeau government

From the Canadian Taxpayers Federation

Author: Ryan Thorpe

The number of Canadian Broadcasting Corporation staff taking home a six-figure annual salary has soared by 231 per cent under Prime Minister Justin Trudeau.

Last year, 1,450 CBC staff took home more than $100,000 in base salary, according to access-to-information records obtained by the Canadian Taxpayers Federation.

That’s a 231 per cent increase over 2015, when just 438 CBC employees took home a six-figure annual salary.

Six-figure salaries at the state broadcaster cost taxpayers more than $181 million last year, for an average of $125,000 for those employees.

“The CBC has been raking in big paycheques and bonuses while the taxpayers footing the bills have been struggling,” said Franco Terrazzano, CTF Federal Director. “Is anyone in government going to step in, stick up for taxpayers and put an end to the CBC gravy train?”

The CBC also dished out more than $11.5 million in pay raises last year to 87 per cent of its workforce, according to separate access-to-information records.

No CBC employee received a pay cut in 2023.

All told, raises at the CBC total $97 million since 2015.

This week, the Canadian Press reported the CBC paid out $18.4 million in bonuses in 2024, after it eliminated hundreds of jobs.

That included $3.3 million in bonuses for 45 executives, for an average of $73,000 each – more than the average salary for Canadian workers, according to Statistics Canada.

The bonuses also included $10.4 million paid out to 631 managers and $4.6 million for 518 other employees.

Bonuses at the CBC now total $132 million since 2015. Combined, raises and bonuses at the CBC total more than $229 million and counting since 2015.

“It’s time to end these taxpayer-funded bonuses and defund the CBC,” Terrazzano said.

|

Year |

Raise |

Bonus |

Combined Cost |

|

2015 |

$7,958,060 |

$8,254,599 |

$16,212,569 |

|

2016 |

$8,187,668 |

$8,097,155 |

$16,284,823 |

|

2017 |

$10,134,964 |

$8,903,882 |

$19,038,846 |

|

2018 |

$14,544,563 |

$13,337,262 |

$27,881,825 |

|

2019 |

$11,048,543 |

$14,257,933 |

$25,306,476 |

|

2020 |

$11,989,307 |

$15,013,838 |

$27,003,145 |

|

2021 |

$9,218,379 |

$15,398,101 |

$24,616,480 |

|

2022 |

$12,505,938 |

$16,052,148 |

$28,558,086 |

|

2023 |

$11,528,793 |

$14,902,755 |

$26,431,548 |

|

2024 |

N/A |

$18,400,000 |

$18,400,000 |

|

Total |

$97,116,215 |

$132,617,673 |

$229,733,888 |

The CBC News Network’s share of the national prime-time viewing audience is 2.1 per cent, according to its latest third-quarter report.

Put another way, 97.9 per cent of TV-viewing Canadians choose not to watch CBC’s English language prime-time news program.

Nevertheless, the state broadcaster considers this a success, claiming CBC News Network “continues to track above” its target of 1.7 per cent, “driven by major news stories drawing large audiences.”

In 2018, the CBC’s share of the national prime-time viewing audience was 7.6 per cent. That means in six years, CBC News Network’s share has plummeted by 72 per cent.

The CBC will take more than $1.4 billion from taxpayers in 2024-25.

That’s enough money to pay the annual grocery bill for roughly 86,000 Canadian families of four.

Business

Clean energy transition price tag over $150 billion and climbing, with very little to show for it

From the Fraser Institute

By Jake Fuss, Julio Mejía, Elmira Aliakbari, Karen Graham and Jock Finlayson

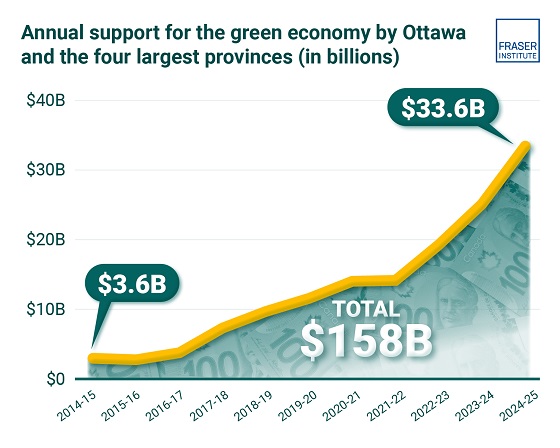

Ottawa and the four biggest provinces have spent (or foregone revenues) of at least $158 billion to create at most 68,000 “clean” jobs since 2014

Despite the hype of a “clean” economic transition, governments in Ottawa and in the four largest provinces have spent or foregone revenues of more than $150 billion (inflation-adjusted) on low-carbon initiatives since 2014/15, but have only created, at best, 68,000 clean jobs, according to two new studies published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Governments, activists and special interest groups have been making a lot of claims about the opportunities of a clean economic transition, but after a decade of policy interventions and more than $150 billion in taxpayers’ money, the results are

extremely underwhelming,” said Elmira Aliakbari, director of natural resource studies and co-author of The Fiscal Cost of Canada’s Low-Carbon Economy.

The study finds that since 2014/15, the federal government and provincial governments in the country’s four largest provinces (Ontario, Quebec, Alberta and British Columbia) combined have spent and foregone revenues of $158 billion (inflation adjusted to 2024 dollars) trying to create clean jobs, as defined by Statistics Canada’s Environmental and Clean Technology Products Economic Account.

Importantly, that cost estimate is conservative since it does not account for an exhaustive list of direct government spending and it does not measure the costs from Canada’s other six provinces, municipalities, regulatory costs and other economic

costs because of the low-carbon spending and tax credits.

A second study, Sizing Canada’s Clean Economy, finds that there was very little change over the 2014 to 2023 period in terms of the share of the total economy represented by the clean economy. For instance, in 2014, the clean economy represented 3.1 per cent of GDP compared to 3.6 per cent in 2023.

“The evidence is clear—the much-hyped clean economic transition has failed to fundamentally transform Canada’s $3.3 trillion economy,” said study co-author and Fraser Institute senior fellow Jock Finlayson.

State of the Green Economy

- The Fiscal Cost of Canada’s Low-Carbon Economy documents spending initiatives by the federal government and the governments of Ontario, British Columbia, Alberta, and Quebec since 2014 to promote the low-carbon economy, as well as how much revenue they have foregone through offering tax credits.

- Overall, the combined cost of spending and tax credits supporting a low-carbon economy by the federal government and the four provincial governments is estimated at $143.6 billion from 2014–15 to 2024–25, in nominal terms. When adjusted for inflation, the total reaches $158 billion in 2024 dollars.

- These estimates are based on very conservative assumptions, and they do not cover every program area or government-controlled expenditure related to the low-carbon economy and/or reducing greenhouse gas emissions.

- Sizing Canada’s Green Economy assesses the composition, growth, share of Gross Domestic Product (GDP) output, and employment of Canada’s “clean economy” from 2014 to 2023.

- Canada’s various environmental and clean technology industries collectively have accounted for between 3.07% and 3.62% of all-industry GDP over the 10-year period from 2014 to 2023. While it has grown, the sector as a whole has not been expanding at a pace that meaningfully exceeds the growth of the overall Canadian economy, despite significant policy attention and mounting public subsidies.

- The clean economy represents a respectable and relatively stable share of Canada’s $3.3 trillion economy. However, it remains a small part of Canada’s broader industrial mix, it is not a major source of export earnings, and it is not about to supplant the many other industries that underpin the country’s prosperity and dominate its international exports.

Agriculture

Cloned foods are coming to a grocer near you

This article supplied by Troy Media.

And you may never find out if Health Canada gets its way

Cloned-animal foods could soon enter Canada’s food supply with no labels identifying them as cloned and no warning to consumers—a move that risks public trust.

According to Health Canada’s own consultation documents, Ottawa intends to remove foods derived from cloned animals from its “novel foods” list, the process that requires a pre-market safety review and public disclosure. Health Canada defines “novel

foods” as products that haven’t been commonly consumed before or that use new production processes requiring extra safety checks.

From a regulatory standpoint, this looks like an efficiency measure. From a consumer-trust standpoint, it’s a miscalculation.

Health Canada argues that cloned animals and their offspring are indistinguishable from conventional ones, so they should be treated the same. The problem isn’t the science—it’s the silence. Canadians are not being told that the rules for a controversial technology are about to change. No press release, no public statement, just a quiet update on a government website most citizens will never read.

Cloning in agriculture means producing an exact genetic copy of an animal, usually for breeding purposes. The clones themselves rarely end up on dinner plates, but their offspring do, showing up in everyday products such as beef, milk or pork. The benefits are indirect: steadier production, fewer losses from disease or more uniform quality.

But consumers see no gain at checkout. Cloning is expensive and brings no visible improvement in taste, nutrition or price.

Shoppers could one day buy steak from the offspring of a cloned cow without any way of knowing, and still pay the same, if not more, for it.

Without labels identifying cloned origin, potential efficiencies stay hidden upstream. When products born from new technologies are mixed with conventional ones, consumers lose their ability to differentiate, reward innovation or make an informed choice. In the end, the industry keeps the savings while shoppers see none.

And it isn’t only shoppers left in the dark. Exporters could soon pay the price too. Canada exports billions in beef and pork annually, including to the EU. If cloned origin products enter the supply chain without labelling, Canadian exporters could face additional scrutiny or restrictions in markets where cloning is not accepted. A regulatory shortcut at home could quickly become a market barrier abroad.

This debate comes at a time when public trust in Canada’s food system is already fragile. A 2023 survey by the Canadian Centre for Food Integrity found that only 36 per cent of Canadians believe the food industry is “heading in the right direction,” and fewer than half trust government regulators to be transparent.

Inserting cloned foods quietly into the supply without disclosure would only deepen that skepticism.

This is exactly how Canada became trapped in the endless genetically modified organism (GMO) debate. Two decades ago, regulators and companies quietly introduced a complex technology without giving consumers the chance to understand it. By denying transparency, they also denied trust. The result was years of confusion, suspicion and polarization that persist today.

Transparency shouldn’t be optional in a democracy that prides itself on science based regulation. Even if the food is safe, and current evidence suggests it is, Canadians deserve to know how what they eat is produced.

The irony is that this change could have been handled responsibly. Small gestures like a brief notice, an explanatory Q&A or a commitment to review labelling once international consensus emerges would have shown respect for the public and preserved confidence in our food system.

Instead, Ottawa risks repeating an old mistake: mistaking regulatory efficiency for good governance. At a time when consumer trust in food pricing, corporate ethics and government oversight is already fragile, the last thing Canada needs is another quiet policy that feels like a secret.

Cloning may not change the look or taste of what’s on your plate, but how it gets there should still matter.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta9 hours ago

Alberta9 hours agoFrom Underdog to Top Broodmare

-

Media1 day ago

Media1 day agoCarney speech highlights how easily newsrooms are played by politicians

-

Business1 day ago

Business1 day agoThe painful return of food inflation exposes Canada’s trade failures

-

Business11 hours ago

Business11 hours agoPaying for Trudeau’s EV Gamble: Ottawa Bought Jobs That Disappeared

-

Business14 hours ago

Business14 hours agoCBC uses tax dollars to hire more bureaucrats, fewer journalists

-

National12 hours ago

National12 hours agoElection Officials Warn MPs: Canada’s Ballot System Is Being Exploited

-

Economy6 hours ago

Economy6 hours agoIn his own words: Stunning Climate Change pivot from Bill Gates. Poverty and disease should be top concern.

-

Addictions8 hours ago

Addictions8 hours agoThe Shaky Science Behind Harm Reduction and Pediatric Gender Medicine