Great Reset

Canadian author with cerebral palsy says nurse called her ‘selfish’ for refusing euthanasia

From LifeSiteNews

She was shamed by a nurse in 2019 for refusing MAiD at Medicine Hat Regional Hospital

In 2019, an Alberta nurse reportedly told Christian author Heather Hancock that she was “selfish” for not ending her life through the Medical Assistance in Dying (MAiD) euthanasia program.

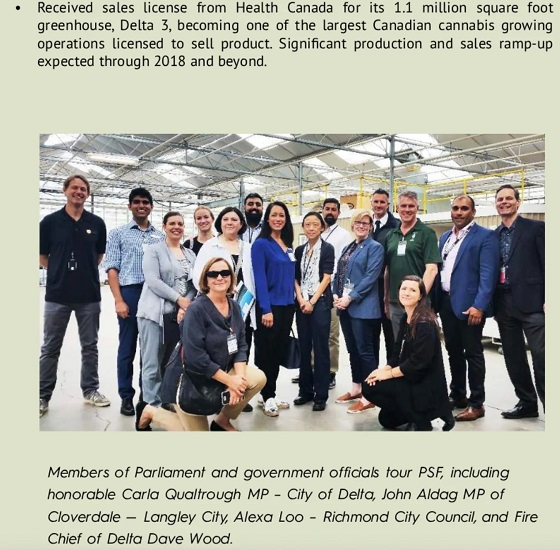

In a July 12 interview with the Daily Mail, Heather Hancock, a 56-year-old Christian author who suffers from cerebral palsy, said that she was shamed by a nurse in 2019 for refusing MAiD at Medicine Hat Regional Hospital in Alberta.

According to Hancock, during a lengthy hospital stay in 2019 for a bout of muscle spams, a nurse told her while helping her to the bathroom that Hancock “should do the right thing and consider MAiD,” and that her refusing MAiD was her “being selfish” and she is “not living” but “merely existing.”

Hancock recalled feeling “gobsmacked” and told the nurse that her life had value even if she spent most of it in a wheelchair.

“You have no right to push me to accept MAiD,” she says she told the nurse.

“They just view me as a drain on the medical system and that my healthcare dollars could be spent on an able-bodied person,” Hancock told the Daily Mail.

In addition to the alleged 2019 incidents, Hancock says she has been routinely encouraged to end her life via euthanasia.

Hancock, who has cerebral palsy, says she has been encouraged to take MAiD on three separate occasions since Canada launched its euthanasia program in 2016.

Hancock currently lives in an assisted-living center in Moose Jaw, Saskatchewan. Despite her disability, she remains an active writer and activist against Canada’s growing euthanasia program.

Unfortunately, Hancock’s experience is not unique as many Canadians have been reportedly offered MAiD.

In May, LifeSiteNews reported on a Canadian man who felt “completely traumatized” and violated that he was offered MAiD “multiple times” instead of getting the proper care he needed while in the hospital.

First introduced in 2016, MAiD was initially only available to those who were terminally ill. However, in 2021, the Trudeau government expanded the deadly practice to be available to those who were not a risk of death, but who suffered from chronic illness.

While MAiD does not yet apply to the mentally ill, this is not due to a lack of trying on behalf of the Trudeau government, who decided to delay the expansion of euthanasia to those suffering solely from such illnesses until 2027 following backlash from Canadians and prominent doctors.

The most recent reports show that MAiD is the sixth highest cause of death in Canada. However, it was not listed as such in Statistics Canada’s top 10 leading causes of death from 2019 to 2022. When asked why MAiD was left off the list, the agency explained that it records the illnesses that led Canadians to choose to end their lives via euthanasia, not the actual cause of death, as the primary cause of death.

According to Health Canada, in 2022, 13,241 Canadians died by MAiD lethal injections. This accounts for 4.1 percent of all deaths in the country for that year, a 31.2 percent increase from 2021.

While the numbers for 2023 have yet to be released, all indications point to a situation even more grim than 2022.

Digital ID

Thousands protest UK government’s plans to introduce mandatory digital IDs

From LifeSiteNews

Protestors rallied in London in opposition to ‘BritCard’, which would require the personal information of all UK workers

Thousands of protestors gathered in London to voice their opposition to the UK government’s plan to introduce mandatory digital IDs.

Last Saturday, the protestors marched through central London carrying signs that read “No to Digital ID,” “If You Accept Digital ID Today, You’ve Accepted Social Credit Tomorrow,” and “Once Scanned, Never Free.”

The protests came in response to Labour Prime Minister Keir Starmer announcing the government’s plan to introduce a mandatory digital ID, called “BritCard,” for everyone who wants to work in the UK. The plan has been met with a strong backlash from the public, including protests in other cities, as reported by LifeSiteNews. Almost three million people have signed a petition opposing the government’s plan to make the “BritCard” mandatory for all workers by 2029. According to the petition, “no one should be forced to register with a state-controlled ID system,” which it describes as a “step towards mass surveillance and digital control.”

Starmer and his government used the problem of illegal immigration, for which they are at least partly responsible, as a pretext to mandate digital ID. However, critics say the real purpose of the scheme is to introduce mass surveillance of British citizens in order to control them.

The globalist NGO of the former British Prime Minister Tony Blair, the “Tony Blair Institute for Global Change,” is one of the premier proponents of the digital ID scheme.

The protest in London was led by former Tory MP Andrew Bridgen, who was expelled from the Conservative Party in 2023 over his opposition to the COVID shots.

Silkie Carlo, director of civil liberties group Big Brother Watch, told the Daily Mail that digital ID was “fast becoming a digital permit required to live our everyday lives.”

“Starmer has sold his Orwellian digital ID scheme to the public on the lie that it will only be used to stop illegal working but now the truth, buried in the small print, is becoming clear,” she continued.

“We now know that digital IDs could be the backbone of a surveillance state and used for everything from tax and pensions to banking and education.”

“The prospects of enrolling even children into this sprawling biometric system is sinister, unjustified and prompts the chilling question of just what he thinks the ID will be used for in the future.”

“No one voted for this and millions of people who have signed the petition against it are simply being ignored,” Carlo concluded.

The BritCard would be stored on smartphones and include personal details such as name, date of birth, residency status, nationality, a photograph, and potentially more sensitive personal data. The government is reportedly considering introducing digital IDs for children as young as 13.

Conservative Party leader Kemi Badenoch said the proposal was a “gimmick that will do nothing to stop the boats,” while the head of Reform UK, Nigel Farage, said he was “firmly opposed” to it.

Farage has vowed to undo any digital ID system rolled out by the Labour government if he becomes UK’s next prime minister.

“It will make no difference to illegal immigration, but it will be used to control and penalize the rest of us,” Farage said regarding the BritCard. “The state should never have this much power.”

Brownstone Institute

The Doctor Will Kill You Now

From the Brownstone Institute

Way back in the B.C. era (Before Covid), I taught Medical Humanities and Bioethics at an American medical school. One of my older colleagues – I’ll call him Dr. Quinlan – was a prominent member of the faculty and a nationally recognized proponent of physician-assisted suicide.

Dr. Quinlan was a very nice man. He was soft-spoken, friendly, and intelligent. He had originally become involved in the subject of physician-assisted suicide by accident, while trying to help a patient near the end of her life who was suffering terribly.

That particular clinical case, which Dr. Quinlan wrote up and published in a major medical journal, launched a second career of sorts for him, as he became a leading figure in the physician-assisted suicide movement. In fact, he was lead plaintiff in a challenge of New York’s then-prohibition against physician-assisted suicide.

The case eventually went all the way to the US Supreme Court, which added to his fame. As it happened, SCOTUS ruled 9-0 against him, definitively establishing that there is no “right to die” enshrined in the Constitution, and affirming that the state has a compelling interest to protect the vulnerable.

SCOTUS’s unanimous decision against Dr. Quinlan meant that his side had somehow pulled off the impressive feat of uniting Antonin Scalia, Ruth Bader Ginsberg, and all points in between against their cause. (I never quite saw how that added to his luster, but such is the Academy.)

At any rate, I once had a conversation with Dr. Quinlan about physician-assisted suicide. I told him that I opposed it ever becoming legal. I recall he calmly, pleasantly asked me why I felt that way.

First, I acknowledged that his formative case must have been very tough, and allowed that maybe, just maybe, he had done right in that exceptionally difficult situation. But as the legal saying goes, hard cases make bad law.

Second, as a clinical physician, I felt strongly that no patient should ever see their doctor and have to wonder if he was coming to help keep them alive or to kill them.

Finally, perhaps most importantly, there’s this thing called the slippery slope.

As I recall, he replied that he couldn’t imagine the slippery slope becoming a problem in a matter so profound as causing a patient’s death.

Well, maybe not with you personally, Dr. Quinlan, I thought. I said no more.

But having done my residency at a major liver transplant center in Boston, I had had more than enough experience with the rather slapdash ethics of the organ transplantation world. The opaque shuffling of patients up and down the transplant list, the endless and rather macabre scrounging for donors, and the nebulous, vaguely sinister concept of brain death had all unsettled me.

Prior to residency, I had attended medical school in Canada. In those days, the McGill University Faculty of Medicine was still almost Victorian in its ways: an old-school, stiff-upper-lip, Workaholics-Anonymous-chapter-house sort of place. The ethic was hard work, personal accountability for mistakes, and above all primum non nocere – first, do no harm.

Fast forward to today’s soft-core totalitarian state of Canada, the land of debanking and convicting peaceful protesters, persecuting honest physicians for speaking obvious truth, fining people $25,000 for hiking on their own property, and spitefully seeking to slaughter harmless animals precisely because they may hold unique medical and scientific value.

To all those offenses against liberty, morality, and basic decency, we must add Canada’s aggressive policy of legalizing, and, in fact, encouraging industrial-scale physician-assisted suicide. Under Canada’s Medical Assistance In Dying (MAiD) program, which has been in place only since 2016, physician-assisted suicide now accounts for a terrifying 4.7 percent of all deaths in Canada.

MAiD will be permitted for patients suffering from mental illness in Canada in 2027, putting it on par with the Netherlands, Belgium, and Switzerland.

To its credit, and unlike the Netherlands and Belgium, Canada does not allow minors to access MAiD. Not yet.

However, patients scheduled to be terminated via MAiD in Canada are actively recruited to have their organs harvested. In fact, MAiD accounts for 6 percent of all deceased organ donors in Canada.

In summary, in Canada, in less than 10 years, physician-assisted suicide has gone from illegal to both an epidemic cause of death and a highly successful organ-harvesting source for the organ transplantation industry.

Physician-assisted suicide has not slid down the slippery slope in Canada. It has thrown itself off the face of El Capitan.

And now, at long last, physician-assisted suicide may be coming to New York. It has passed the House and Senate, and just awaits the Governor’s signature. It seems that the 9-0 Supreme Court shellacking back in the day was just a bump in the road. The long march through the institutions, indeed.

For a brief period in Western history, roughly from the introduction of antibiotics until Covid, hospitals ceased to be a place one entered fully expecting to die. It appears that era is coming to an end.

Covid demonstrated that Western allopathic medicine has a dark, sadistic, anti-human side – fueled by 20th-century scientism and 21st-century technocratic globalism – to which it is increasingly turning. Physician-assisted suicide is a growing part of this death cult transformation. It should be fought at every step.

I have not seen Dr. Quinlan in years. I do not know how he might feel about my slippery slope argument today.

I still believe I was correct.

-

Health2 days ago

Health2 days agoNew report warns WHO health rules erode Canada’s democracy and Charter rights

-

Courageous Discourse1 day ago

Courageous Discourse1 day agoNo Exit Wound – EITHER there was a very public “miracle” OR Charlie Kirk’s murder is not as it appears

-

Business1 day ago

Business1 day agoEmission regulations harm Canadians in exchange for no environmental benefit

-

Business1 day ago

Business1 day agoQuebecers want feds to focus on illegal gun smuggling not gun confiscation

-

Alberta1 day ago

Alberta1 day agoPetition threatens independent school funding in Alberta

-

National1 day ago

National1 day agoPolitically Connected Canadian Weed Sellers Push Back in B.C. Court, Seek Distance from Convicted Heroin Trafficker

-

Business24 hours ago

Business24 hours agoCanada Revenue Agency found a way to hit “Worse Than Rock Bottom”

-

Censorship Industrial Complex23 hours ago

Censorship Industrial Complex23 hours agoWho tries to silence free speech? Apparently who ever is in power.