Business

New York and Vermont Seek to Impose a Retroactive Climate Tax

From Heartland Daily News

By Joshua Loucks for the Cato Institute.

Energy producers will be subject to retroactive taxes in New York if the state assembly passes Senate Bill S2129A, known as the “Climate Change Superfund Act.” The superfund legislation seeks to impose a retroactive tax on energy companies that have emitted greenhouse gases (GHGs) and operated within the state over the last seventy years.

If passed, the new law will impose $75 billion in repayment fees for “historical polluters,” who lawmakers assert are primarily responsible for climate change damages within the state. The state will “assign liability to and require compensation from companies commensurate with their emissions” over the last “70 years or more.” The bill would establish a standard of strict liability, stating that “companies are required to pay into the fund because the use of their products caused the pollution. No finding of wrongdoing is required.”

New York is not alone in this effort. Superfunds built on retroactive taxes on GHG emissions are becoming increasingly popular. Vermont recently enacted similar legislation, S.259 (Act 122), titled the “Climate Superfund Act,” in which the state also retroactively taxes energy producers for historic emissions. Similar bills have also been introduced in Maryland and Massachusetts.

Climate superfund legislation seems to have one purpose: to raise revenue by taxing a politically unpopular industry. Under the New York law, fossil fuel‐producing energy companies would be taxed billions of dollars retroactively for engaging in legal and necessary behavior. For example, the seventy‐year retroactive tax would conceivably apply to any company—going back to 1954—that used fossil fuels to generate electricity or produced fuel for New York drivers.

The typical “economic efficiency” arguments for taxing an externality go out the window with the New York and Vermont approach, for at least two reasons. First, the goal of a blackboard or textbook approach to a carbon tax is to internalize the GHG externality. To apply such a tax accurately, the government would need to calculate the social cost of carbon (SCC).

Unfortunately, estimating the SCC is methodologically complex and open to wide ranges of estimates. As a result, the SCC is theoretically very useful but practically impossible to calculate with any reasonable degree of precision.

Second, the retroactive nature of these climate superfunds undermines the very incentives a textbook tax on externalities would promote. A carbon tax’s central feature is that it is intended to reduce externalities from current and future activity by changing incentives. However, by imposing retroactive taxes, the New York and Vermont legislation will not impact emitters’ future behavior in a way that mimics a textbook carbon tax or improves economic outcomes.

Arbitrary and retroactive taxes can, however, raise prices for consumers by increasing policy uncertainty, affecting firm profitability, and reducing investment (or causing investors to flee GHG‐emitting industries in the state altogether). Residents in both New York and Vermont already pay over 30 percent more than the US average in residential electricity prices, and this legislation will not lower these costs to consumers.

Climate superfunds are not a serious attempt to solve environmental challenges but rather a way to raise government revenue while unfairly punishing an entire industry (one whose actions the New York legislation claims “have been unconscionable, closely reflecting the strategy of denial, deflection, and delay used by the tobacco industry”).

Fossil fuel companies enabled GHG emissions, of course, but they also empowered significant growth, mobility, and prosperity. The punitive nature of the policy is laid bare by the fact that neither New York nor Vermont used a generic SCC or an evidentiary proceeding to calculate precise damages.

Finally, establishing a standard in which “no finding of wrongdoing is required” to levy fines against historical actions that were (and still are) legally permitted sets a dangerous precedent for what governments can do, not only to businesses that have produced fossil fuels but also to individuals who have consumed them.

Cato research associate Joshua Loucks contributed to this post.

Originally published by the Cato Institute. Republished with permission under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

Business

Socialism vs. Capitalism

People criticize capitalism. A recent Axios-Generation poll says, “College students prefer socialism to capitalism.”

Why?

Because they believe absurd myths. Like the claim that the Soviet Union “wasn’t real socialism.”

Socialism guru Noam Chomsky tells students that. He says the Soviet Union “was about as remote from socialism as you could imagine.”

Give me a break.

The Soviets made private business illegal.

If that’s not socialism, I’m not sure what is.

“Socialism means abolishing private property and … replacing it with some form of collective ownership,” explains economist Ben Powell. “The Soviet Union had an abundance of that.”

Socialism always fails. Look at Venezuela, the richest country in Latin America about 40 years ago. Now people there face food shortages, poverty, misery and election outcomes the regime ignores.

But Al Jazeera claims Venezuela’s failure has “little to do with socialism, and a lot to do with poor governance … economic policies have failed to adjust to reality.”

“That’s the nature of socialism!” exclaims Powell. “Economic policies fail to adjust to reality. Economic reality evolves every day. Millions of decentralized entrepreneurs and consumers make fine tuning adjustments.”

Political leaders can’t keep up with that.

Still, pundits and politicians tell people, socialism does work — in Scandinavia.

“Mad Money’s Jim Cramer calls Norway “as socialist as they come!”

This too is nonsense.

“Sweden isn’t socialist,” says Powell. “Volvo is a private company. Restaurants, hotels, they’re privately owned.”

Norway, Denmark and Sweden are all free market economies.

Denmark’s former prime minister was so annoyed with economically ignorant Americans like Bernie Sanders calling Scandanavia “socialist,” he came to America to tell Harvard students that his country “is far from a socialist planned economy. Denmark is a market economy.”

Powell says young people “hear the preaching of socialism, about equality, but they don’t look on what it actually delivers: poverty, starvation, early death.”

For thousands of years, the world had almost no wealth creation. Then, some countries tried capitalism. That changed everything.

“In the last 20 years, we’ve seen more humans escape extreme poverty than any other time in human history, and that’s because of markets,” says Powell.

Capitalism makes poor people richer.

Former Rep. Jamaal Bowman (D-N.Y.) calls capitalism “slavery by another name.”

Rep. Alexandria Ocasio-Cortez (D-N.Y.) claims, “No one ever makes a billion dollars. You take a billion dollars.”

That’s another myth.

People think there’s a fixed amount of money. So when someone gets rich, others lose.

But it’s not true. In a free market, the only way entrepreneurs can get rich is by creating new wealth.

Yes, Steve Jobs pocketed billions, but by creating Apple, he gave the rest of us even more. He invented technology that makes all of us better off.

“I hope that we get 100 new super billionaires,” says economist Dan Mitchell, “because that means 100 new people figured out ways to make the rest of our lives better off.”

Former Labor Secretary Robert Reich advocates the opposite: “Let’s abolish billionaires,” he says.

He misses the most important fact about capitalism: it’s voluntary.

“I’m not giving Jeff Bezos any money unless he’s selling me something that I value more than that money,” says Mitchell.

It’s why under capitalism, the poor and middle class get richer, too.

“The economic pie grows,” says Mitchell. “We are much richer than our grandparents.”

When the media say the “middle class is in decline,” they’re technically right, but they don’t understand why it’s shrinking.

“It’s shrinking because more and more people are moving into upper income quintiles,” says Mitchell. “The rich get richer in a capitalist society. But guess what? The rest of us get richer as well.”

I cover more myths about socialism and capitalism in my new video.

Business

Resurfaced Video Shows How Somali Scammers Used Day Care Centers To Scam State

From the Daily Caller News Foundation

A resurfaced 2018 video from a Minneapolis-area TV station shows how Somali scammers allegedly bilked Minnesota out of millions of dollars for services that they never provided.

Independent journalist Nick Shirley touched off a storm on social media Friday after he posted a photo of one day-care center, which displayed a banner calling it “The Greater Learing Center” on X, along with a 42-minute video that went viral showing him visiting that and other day-care centers. The surveillance video, which aired on Fox 9 in 2018 after being taken in 2015, showed parents taking kids into the center, then leaving with them minutes later, according to Fox News.

“They were billing too much, they went up to high,” Hennepin County attorney Mike Freeman told Fox 9 in 2018. “It’s hard to imagine they were serving that many people. Frankly if you’re going to cheat, cheat little, because if you cheat big, you’re going to get caught.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Democratic Gov. Tim Walz of Minnesota was accused of engaging in “systemic” retaliation against whistleblowers in a Nov. 30 statement by state employees. Assistant United States Attorney Joe Thompson announced on Dec. 18 that the amount of suspected fraud in Minnesota’s Medicaid program had reached over $9 billion.

After Shirley’s video went viral, FBI Director Kash Patel announced the agency was already sending additional resources in a Sunday post on X, citing the case surrounding Feeding Our Future, which at one point accused the Minnesota government of racism during litigation over the suspension of funds after earlier allegations of fraud.

KSTP reported that the Quality Learning Center, one of the centers visited by Shirley, had 95 citations for violations from one Minnesota agency between 2019 to 2023.

President Donald Trump announced in a Nov. 21 post on Truth Social that he would end “Temporary Protected Status” for Somalis in the state in response to allegations of welfare fraud and said that the influx of refugees had “destroyed our country.”

-

Business16 hours ago

Business16 hours agoICYMI: Largest fraud in US history? Independent Journalist visits numerous daycare centres with no children, revealing massive scam

-

Alberta8 hours ago

Alberta8 hours agoAlberta project would be “the biggest carbon capture and storage project in the world”

-

Daily Caller2 days ago

Daily Caller2 days agoWhile Western Nations Cling to Energy Transition, Pragmatic Nations Produce Energy and Wealth

-

Daily Caller2 days ago

Daily Caller2 days agoUS Halts Construction of Five Offshore Wind Projects Due To National Security

-

Alberta2 days ago

Alberta2 days agoAlberta Next Panel calls for less Ottawa—and it could pay off

-

Bruce Dowbiggin2 days ago

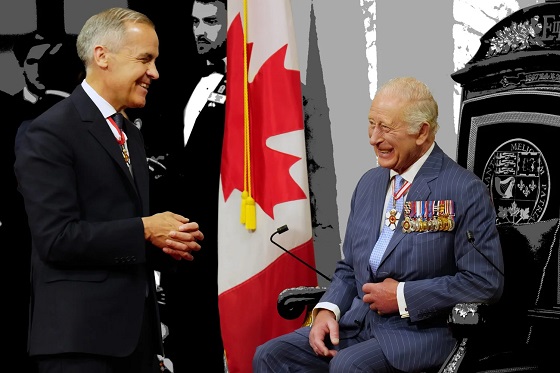

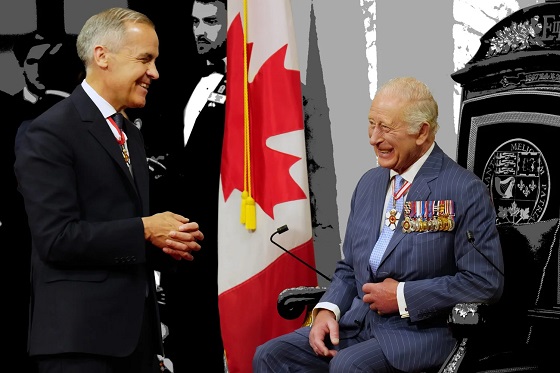

Bruce Dowbiggin2 days agoBe Careful What You Wish For In 2026: Mark Carney With A Majority

-

Energy5 hours ago

Energy5 hours agoCanada’s debate on energy levelled up in 2025

-

Energy7 hours ago

Energy7 hours agoNew Poll Shows Ontarians See Oil & Gas as Key to Jobs, Economy, and Trade