Energy

One (Megawatt) is the loneliest number, but hundreds of batteries are absurd

From the Frontier Centre for Public Policy

That comes out to $104,000,000,000, in batteries, alone, to cover those 18 hours on Feb. 8. To make it easier on you, $104 billion. If you use Smith’s numbers, it’s $80.6 billion. Even if I’m out by a factor of two, it’s an obscene amount of money.

SaskPower Minister Dustin Duncan recently told me I watch electricity markets like some people watch fantasy football. I would agree with him, if I knew anything about fantasy football.

I had some time to kill around noon on Feb. 8, and I checked out the minute-by-minute updates from the Alberta Electric System Operator. What I saw for wind power production was jaw-dropping to say the least. Alberta has built 45 wind farms with hundreds of wind turbines totalling an installed capacity of 4,481 megawatts.

My usual threshold for writing a story about this is output falling to less than one per cent – 45 megawatts. Its output at 11:07 a.m., Alberta time, in megawatts?

“1”

Ten minutes later:

“1”

30 minutes later:

“1”

How long can this last? Is there a fault with the website? There doesn’t seem to be.

12:07 p.m.

“1”

Strains of “One is the loneliest number” flow through my head.

I’ve seen it hit one before briefly. Even zero for a minute or two. But this keeps going. And going. I keep taking screenshots. How long will this last?

1:07 p.m.

“1”

1:29 p.m.

“1”

Finally, there’s a big change at 2:38. The output has doubled.

“2.”

That’s 2.5 hours at one. How long will two last?

3:45 p.m.

“2”

4:10 p.m. – output quadruples – to a whopping eight megawatts.

It ever-so-slowly crept up from there. Ten hours after I started keeping track, total wind output had risen to 39 megawatts – still not even one per cent of rated output. Ten hours.

It turns out that wind fell below one per cent around 5 a.m., and stayed under that for 18 hours.

Building lots of turbines doesn’t work

The argument has long been if it’s not blowing here, it’s blowing somewhere. Build enough turbines, spread them all over, and you should always have at least some wind power. But Alberta’s wind turbines are spread over an area larger than the Benelux countries, and they still had essentially zero wind for 18 hours. Shouldn’t 45 wind farms be enough geographic distribution?

The other argument is to build lots and lots of batteries. Use surplus renewable power to charge them, and then when the wind isn’t blowing (or sun isn’t shining), draw power from the batteries.

Alberta has already built 10 grid-scale batteries. Nine of those are the eReserve fleet, each 20 megawatt Tesla systems. I haven’t been able to find the price of those, but SaskPower is building a 20 megawatt Tesla system on the east side of Regina, and its price is $26 million.

From over a year’s frequent observation, it’s apparent that the eReserve batteries only put out a maximum of 20 megawatts for about an hour before they’re depleted. They can run longer at lower outputs, but I haven’t seen anything to show they could get two or five hours out of the battery at full power. And SaskPower’s press release explains its 20 megawatt Tesla system has about 20 megawatts-hours of power. This corresponds very closely to remarks made by Alberta Premier Danielle Smith, along with the price of about $1 million per megawatt hour for grid-scale battery capacity.

She said in late October, “I want to talk about batteries for a minute, because I know that everybody thinks that this economy is going to be operated on wind and solar and battery power — and it cannot. There is no industrialized economy in the world operating that way, because they need baseload. And, I’ll tell you what I know about batteries, because I talked to somebody thinking of investing in it on a 200-megawatt plant. One million dollars to be able to get each megawatt stored: that’s 200 million dollars for his plant alone, and he would get one hour of storage. So if you want me to have 12 thousand megawatts of storage, that’s 12 billion dollars for one hour of storage, 24 billion dollars for two hours of storage, 36 billion dollars for three hours of storage, and there are long stretches in winter, where we can go weeks without wind or solar. That is the reason why we need legitimate, real solutions that rely on baseload power rather than fantasy thinking.”

So let’s do some math to see if the premier is on the money.

If you wanted enough batteries to output the equivalent of the 4,481 megawatts of wind for one hour (minus the 1 megawatt it was producing), that’s 4480 megawatts / 20 megawatts per battery = 224 batteries like those in the eReserve fleet. But remember, they can only output their full power for about an hour. So the next hour, you need another 224, and so on. For 18 hours, you need 4032 batteries. Let’s be generous and subtract the miniscule wind production over that time, and round it to 4,000 batteries, at $26 million a pop. (Does Tesla offer bulk discounts?)

That comes out to $104,000,000,000, in batteries, alone, to cover those 18 hours on Feb. 8. To make it easier on you, $104 billion. If you use Smith’s numbers, it’s $80.6 billion. Even if I’m out by a factor of two, it’s an obscene amount of money.

But wait, there’s more!

You would also need massive amounts of transmission infrastructure to power and tie in those batteries. I’m not even going to count the dollars for that.

But you also need the surplus power to charge all those batteries. The Alberta grid, like most grids, runs with a four per cent contingency, as regulated by NERC. Surplus power is often sold to neighbours. And there’s been times, like mid-January, where that was violated, resulting in a series of grid alerts.

At times when there’s lots of wind and solar on the grid, there’s up to around 900 megawatts being sold to B.C and other neighbours. But for 18 hours (not days, but hours), you need 4,000 batteries * 20 megawatt-hours per battery = 80,000 megawatt hours. Assuming 100 per cent efficiency in charging (which is against the laws of physics, but work with me here), if you had a consistent 900 megawatts of surplus power, it would take 89 hours to charge them (if they could charge that fast, which is unlikely).

That’s surplus power you are not selling to an external client, meaning you’re not taking in any extra revenue, and they might not be getting the power they need. And having 900 megawatts is the exception here. It’s much more like 300 megawatts surplus. So your perfect 89 hours to charge becomes 267 hours (11.1 days), all to backfill 18 hours of essentially no wind power.

This all assumes at you’ve had sufficient surplus power to charge your batteries, that days or weeks of low wind and/or solar don’t deplete your reserves, and the length of time they are needed does not exceed your battery capacity.

Nor does it figure in how many years life are you going to get out of those batteries in the first place? How many charge cycles before you have to recapitalize the whole fleet?

For the dollars we’re talking here, you’re easily better off to four (or more) Westinghouse AP-1000 reactors, with 1,100 megawatts capacity each. Their uptime should be somewhere around 90 per cent.

Or maybe coal could be renewed – built with the most modern technology like high efficiency, low emissions (HELE), with integrated carbon capture from Day 1. How many HELE coal-fired power plants, with carbon capture and storage, could you build for either $80 billion or $104 billion? Certainly more than 4,481 megawatts worth.

Building either nuclear or HELE coal gives you solid, consistent baseload power, without the worry of the entire fleet going down, like wind did in Alberta on Feb. 8, as well as Feb. 4, 5, 6, and 7.

Indeed, according to X bot account @ReliableAB, which does hourly tracking of the Alberta grid, from Feb. 5 to 11:15 a.m., Feb. 9, Alberta wind output averaged 3.45 per cent of capacity. So now instead of 18 hours, we’re talking 108 hours needing 96+ per cent to be backfilled. I don’t have enough brain power to figure it out.

You can argue we only need to backfill X amount of wind, maybe 25 per cent, since you can’t count on wind to ever produce 100 per cent of its nameplate across the fleet. But Alberta has thousands more megawatts of wind on tap to be built as soon as the province lifts is pause on approvals. If they build all of it, maybe the numbers I provide will indeed be that 25 per cent. Who knows? The point is all of this is ludicrous.

Just build reliable, baseload power, with peaking capacity. And end this foolishness.

Brian Zinchuk is editor and owner of Pipeline Online, and occasional contributor to the Frontier Centre for Public Policy. He can be reached at [email protected].

Energy

Activists using the courts in attempt to hijack energy policy

2016 image provided by Misti Leon, left, sits with her mom, Juliana Leon. Misti Leon is suing several oil and gas companies in one of the first wrongful-death claims in the U.S. seeking to hold the fossil fuel industry accountable for its role in the changing climate.

From the Daily Caller News Foundation

By Jason Isaac

They twist yesterday’s weather into tomorrow’s crisis, peddle apocalyptic forecasts that fizzle, and swap “global warming” for “climate change” whenever the narrative demands. They sound the alarm on a so-called climate emergency — again and again.

Now, the Left has plunged to a new low: weaponizing the courts with a lawsuit in Washington State that marks a brazen, desperate escalation. This isn’t just legal maneuvering—it’s the exploitation of personal tragedy in service of an unpopular anti-energy climate crusade.

Consider the case at the center of a new legal circus: Juliana Leon, 65, tragically died of hyperthermia during a 100-mile drive in a car with broken air conditioning, as a brutal heat wave pushed temperatures to 108 degrees Fahrenheit.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

The lawsuit leaps from this heartbreaking event to a sweeping claim: that a single hot day is the direct result of global warming.

The lawsuit preposterously links a very specific hot weather event to theorized global warming. Buckle up—their logic is about to take a wild ride.

Some activist scientists have further speculated that what may be a gradual long-term trend of slight warming thought to be both cyclical and natural, might be possibly exacerbated by the release of greenhouse gases. Some of these releases are the result of volcanic activity while some comes from human activities, including the burning of oil, natural gas and coal.

Grabbing onto that last, unproven thread, the plaintiffs have zeroed in on a handful of energy giants—BP, Chevron, Conoco, Exxon, Phillips 66, Shell, and the Olympic Pipe Company—accusing them of causing Leon’s death. Apparently, these few companies are to blame for the entire planet’s climate, while other oil giants, coal companies, and the billions of consumers who actually use these fuels get a free pass.

Meanwhile, “climate journalists” in the legacy media have ignored key details that will surely surface in court. Leon made her journey in a car with no air conditioning, despite forecasts warning of dangerous heat. She was returning from a doctor’s visit, having just been cleared to eat solid food after recent bariatric surgery.

But let’s be clear: this lawsuit isn’t about truth, justice, or even common sense. It’s lawfare, plain and simple.

Environmental extremists are using the courts to hijack national energy policy, aiming to force through a radical agenda they could never pass in Congress. A courtroom win would mean higher energy prices for everyone, the potential bankruptcy of energy companies, or their takeover by the so-called green industrial complex. For the trial lawyers, these cases are gold mines, with contingency fees that could reach hundreds of millions.

This particular lawsuit was reportedly pitched to Leon’s daughter by the left-leaning Center for Climate Integrity, a group bankrolled by billionaire British national Christopher Hohn through his Children’s Investment Fund Foundation and by the Rockefeller Foundation. It’s yet another meritless claim in the endless list of climate lawsuits that are increasingly being tossed out of courts across the country.

Earlier this year, a Pennsylvania judge threw out a climate nuisance suit against oil producers brought by Bucks County, citing lack of jurisdiction. In New York, Supreme Court Justice Anar Patel dismissed a massive climate lawsuit by New York City, pointing out the city couldn’t claim both public awareness and deception by oil companies in the same breath.

But the Washington State case goes even further, threatening to set a dangerous precedent: if it moves forward, energy companies could face limitless liability for any weather-related injury. Worse, it would give unwarranted credibility to the idea — floated by a leftwing activist before the U.S. Senate — that energy executives could be prosecuted for homicide, a notion that Republican Texas Sen. Ted Cruz rightly called “moonbeam, wacky theory.”

The courts must keep rejecting these absurd lawfare stunts. More importantly, America’s energy policy should be set by Congress—elected and accountable—not by a single judge in a municipal courtroom.

Jason Isaac is the founder and CEO of the American Energy Institute. He previously served four terms in the Texas House of Representatives.

Alberta

Temporary Alberta grid limit unlikely to dampen data centre investment, analyst says

From the Canadian Energy Centre

By Cody Ciona

‘Alberta has never seen this level and volume of load connection requests’

Billions of investment in new data centres is still expected in Alberta despite the province’s electric system operator placing a temporary limit on new large-load grid connections, said Carson Kearl, lead data centre analyst for Enverus Intelligence Research.

Kearl cited NVIDIA CEO Jensen Huang’s estimate from earlier this year that building a one-gigawatt data centre costs between US$60 billion and US$80 billion.

That implies the Alberta Electric System Operator (AESO)’s 1.2 gigawatt temporary limit would still allow for up to C$130 billion of investment.

“It’s got the potential to be extremely impactful to the Alberta power sector and economy,” Kearl said.

Importantly, data centre operators can potentially get around the temporary limit by ‘bringing their own power’ rather than drawing electricity from the existing grid.

In Alberta’s deregulated electricity market – the only one in Canada – large energy consumers like data centres can build the power supply they need by entering project agreements directly with electricity producers.

According to the AESO, there are 30 proposed data centre projects across the province.

The total requested power load for these projects is more than 16 gigawatts, roughly four gigawatts more than Alberta’s demand record in January 2024 during a severe cold snap.

For comparison, Edmonton’s load is around 1.4 gigawatts, the AESO said.

“Alberta has never seen this level and volume of load connection requests,” CEO Aaron Engen said in a statement.

“Because connecting all large loads seeking access would impair grid reliability, we established a limit that preserves system integrity while enabling timely data centre development in Alberta.”

As data centre projects come to the province, so do jobs and other economic benefits.

“You have all of the construction staff associated; electricians, engineers, plumbers, and HVAC people for all the cooling tech that are continuously working on a multi-year time horizon. In the construction phase there’s a lot of spend, and that is just generally good for the ecosystem,” said Kearl.

Investment in local power infrastructure also has long-term job implications for maintenance and upgrades, he said.

“Alberta is a really exciting place when it comes to building data centers,” said Beacon AI CEO Josh Schertzer on a recent ARC Energy Ideas podcast.

“It has really great access to natural gas, it does have some excess grid capacity that can be used in the short term, it’s got a great workforce, and it’s very business-friendly.”

The unaltered reproduction of this content is free of charge with attribution to the Canadian Energy Centre.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Business1 day ago

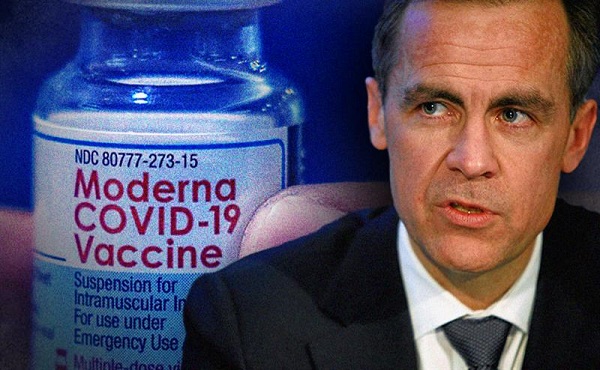

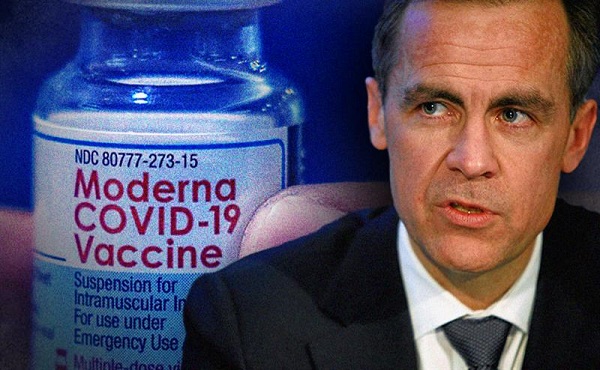

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Red Deer1 day ago

Red Deer1 day agoWesterner Days Attraction pass and New Experiences!

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again