Every episode of Power Struggle offers a different doorway into the global energy system. But every so often I speak with someone who doesn’t merely interpret the data — he dismantles the illusions around it. Energy economist Dr. Anas F. Alhajji is one of those rare voices.

For anyone who follows world oil markets, Anas requires little introduction. He is one of the most widely referenced analysts in global energy economics, managing partner at Energy Outlook Advisors, and a commentator whose views often diverge from the political narratives that dominate Western media. Our conversation, fast-paced and data-driven, reinforced a point I’ve been making for years: many assumptions about the energy transition are overdue for a hard reset.

And if you think the transition is unfolding as advertised, Anas has a simple message: look again.

Peak oil demand — or peak illusion?

We began with the recurring claim, made most notably by the International Energy Agency, that global oil demand is nearing a terminal peak. Anas has long challenged this analysis, but his breakdown was especially stark.

“In May 2025, they said they are revising up global oil demand… They’ve been wrong for 18 straight years. By how much? Two or three years. The total is about 350 million barrels.”

He added an even sharper example.

“In August, they revised up Mexico’s oil demand by a hundred thousand barrels a day — since 2020. With all of this, who is going to believe the IEA?”

If we are going to debate “peak oil demand,” Anas argued, we must start with accurate numbers. And reality, as he laid out, tells a very different story.

Oil demand is higher — not lower

The most striking fact he brought to the table was where global demand sits today.

“Current world demand for oil is 107 million barrels a day.”

That figure sits eight million barrels above 2019 levels, despite rapid growth in electric vehicle sales. And here is where the assumptions collide with the data.

“Right now we have about 55 million EVs… 35 million are in China. The replacement in terms of oil is only 1.3 million barrels a day. That’s it.”

EVs are increasing, yes — but the global vehicle fleet is expanding even faster, and so is mobility demand. A century’s worth of built energy systems does not pivot overnight.

Hybrids now dominate

This brought Anas to the point that may surprise the most people.

“The trend right now is very clear. We are going hybrid. Hybrid. The electric story is over.”

He emphasized that this is not ideological — it is practical. Hybrids outperform EVs on cost, convenience and grid impacts, and consumers are voting with their wallets.

“Hybrid sales have been going through the roof. And this is going to continue… The media reports EV sales all the time. But what matters is the number of EVs on the road.”

This distinction matters. Monthly sales data can create a false sense of momentum. What counts for emissions, infrastructure planning and oil displacement is the stock of vehicles actually in use.

Three ‘scams’ in EV sales reporting

Anas went further, arguing that even sales data does not always reflect real-world adoption. He described what he called three “scams” that inflate EV sales figures globally. He shared one example on air:

“There are many tens of thousands of them in parking lots that are not being sold… A manufacturer calls an official, says: I have 2,000 cars. I will sell them to you. You issue the license plates, you issue the insurance, you get all the subsidies, we split it. But the cars are still in the parking lot.”

On paper, these are “sales.” In reality, they are inventory.

The broader point is that EV market statistics need scrutiny — and policymakers who rely on headline numbers may be basing major decisions on flawed data.

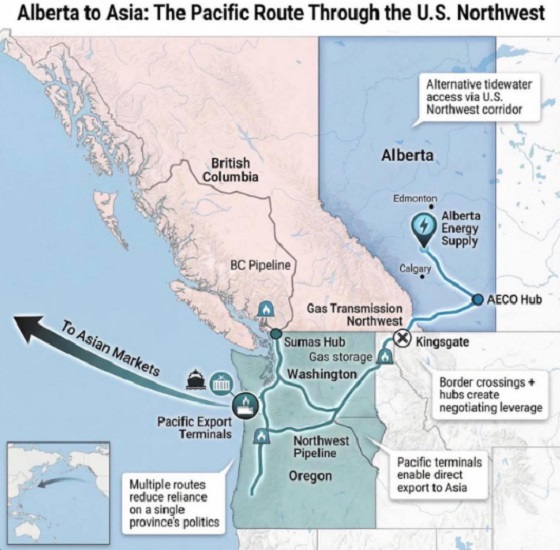

Why Canada still needs another pipeline

We then turned to Canada’s current debates about pipelines and whether the country still needs more tidewater access. Anas answered without hesitation.

“I can tell you without any reservation, we do need another pipeline, another Canadian pipeline to tidewater.”

His rationale was blunt.

“Energy demand globally is increasing at a very high rate in a way that we have never seen before.”

For Canada, this is about competitiveness. Without access to global markets, Canadian oil is priced at a discount — a problem solved only by pipelines reaching the coast.

On LNG: “Canada should go at full speed”

Anas was even more emphatic when discussing natural gas.

“That’s where Canada basically should go at full speed.”

He criticized the idea of a long-term LNG surplus.

“All those ideas about a surplus in LNG… it is nonsense.”

Asian LNG demand is projected to grow sharply, and Canada’s low-emissions LNG — powered by hydro — gives the country a unique competitive advantage.

Why voices like Anas matter

What I value most about conversations like this is the grounding they give us. In energy, narratives and evidence are drifting apart. You may not agree with every assertion, but you can’t dismiss the data. Whether discussing EVs, oil demand, LNG or Canada’s infrastructure, Anas reminds us that aspirations only matter when they intersect with reality.

This episode of Power Struggle is exactly the kind of dialogue we need: sober, data-based, and challenging enough to re-examine assumptions.

You can listen to the full conversation wherever you get your podcasts. If it unsettles a few comfortable stories — that’s the point.

Watch the video on Power Struggle

- Power Struggle audio and transcript

- Anas F. alhajji on LinkedIn

- Stewart Muir on X

- Stewart Muir on LinkedIn

Power Struggle on social media:

- Power Struggle on LinkedIn

- Power Struggle on Instagram

- Power Struggle on Facebook

- Power Struggle on X

Resource Works News