Also Interesting

How Canada’s Top Companies Protect Against Fraud

Fraud, both cyber and otherwise, is an affliction on the body of Canada’s business community. Every year, thieves, and sophisticated scam artists bilk billions of dollars from owners in the

form of ransom. Another way the activity hurts corporations and smaller organizations is

through hacking of customer files and theft of proprietary information. Most owners never

even get a chance to pay ransom to evil doers; they discover that they’ve been hacked or

violated in some way, and that’s the end of it.

What can savvy and diligent owners and managers do to minimize their risk of falling victim to a

theft, hacking event, or other cybercrime? Luckily, there are numerous preventive measures

that can get the job done and keep devices and their precious data files safe from scams,

frauds, and hacks. The first principle is to realize the potential of the threat. Being in denial puts

you at risk and does nothing more than offer a false sense of security. Other strategies include

using certified ELD compliance systems if you operate a commercial fleet, reporting all

suspicious incidents to authorities, enabling two-factor authentication for all company

computers, and more. Here are the relevant details about the top ways Canadian owners can

avoid fraud.

Don’t Be in Denial

The one factor that leads to the widespread affliction of commercial fraud is denial by potential

and former victims. The problem is particularly pernicious among new and smaller entities,

many of whose owners assume that scammers only target major corporations and wealthy

Canadian companies. The truth is that talented scam artists and cyber criminals do the

opposite: they focus their sights on startups, small companies, and medium-sized organizations

precisely because many of those businesses don’t have the resources to detect attacks.

Use Certified ELD Compliance Systems

Canada’s leading transport firms take a proactive approach to fraudulent threats. That’s just

one of the many reasons they give serious attention to ELD (electronic logging device)

compliance issues. Today’s fleet managers in Canada attempt to maximize compliance within

their own borders and when carrying cargo to or through the US. The fleet supervisors use ELD

units that are fully certified by third parties as well as the nation’s CCMTA (Canadian Council of

Motor Transport Administrators) and the US-based FMCSA (Federal Motor Carrier Safety

Administration). For the ultimate in ELD-related compliance at the commercial level, fleet

managers use a connected operations cloud-based approach to guarantee meeting the federal

standards in both countries.

Report Your Suspicions

Never assume that someone who attempts to scam your company or hack its databases will go

away and not return later. One of the worst things a business owner can do is dodge a scam or

hacking attempt and neglect to report the incident to law enforcement authorities. In nearly every case, computer fraud and similar crimes are attempts to steal goods, data, or services

from businesses.

Get Sophisticated Timeclock Software & Devices

It only takes one disgruntled worker or a small group to sabotage a timeclock system and

perpetrate fraud schemes that can cost a company dearly. The best defense is a solid offense,

namely installing the latest digital timeclocks that leverage the power of biometric

identification methods to minimize or eradicate fraud.

Enable TFA (Two-Factor Authentication) on All Work Devices

Enabling all your work-connected devices for TFA is one of the simplest and least costly ways to

avoid becoming a victim of scams and fraudulent schemes of all types. The arrangement serves

as a kind of cyber padlock on every computer the company uses. Most consumers in Canada

and the US are aware of how the authentication process works. Step one involves entering a

standard password or pass phrase. The second factor is of an interactive nature and requires

the user to receive and enter a digital code sent via email or text.

Also Interesting

KYC in Casino Gaming

KYC, which means “Know Your Customer,” has become one of the most important systems in casino gaming today. In the early days of online gambling, players could simply sign up, deposit money, and start playing without giving much personal information. But as online casinos grew, so did the need to confirm who was playing, how they were paying, and where their funds came from.

This change was not sudden. It came through years of regulation, fraud cases, and technological improvement. Even $3 minimum deposit casinos now use KYC to make sure their players are verified and protected.

How KYC Began in Casino Gaming

In the late 1990s the internet was still in its early days, and online casinos came into the picture with hardly any rules regarding identity verification. Security was not a primary concern for gambling platforms, which were mainly occupied with game development and player attraction.

Fraud and underage gambling activities were rampant at that time. Stolen credit cards were being used by some players while others were using fake identities to get through age restrictions.

Regulators soon pointed out that a total lack of control could lead to bigger issues like money laundering and illegal transfers. So, new rules were imposed by the government and one of them was to get the casinos to collect the most basic player information including name, address, and date of birth.

These details, however, did not do much to prove that the players were actually human beings. Nevertheless, it was still very far from what KYC would later turn into.

The Rise of KYC Laws and Regulation

As online gaming spread across Europe and other regions, regulators made stricter laws. They wanted casinos to take responsibility for who was playing on their platforms.

Around the mid-2000s, KYC laws became mandatory for any casino that held a license. This meant players had to submit documents like passports or utility bills to prove their identity and location.

It was not always smooth. Many players disliked sending personal documents online, especially when the internet still had many privacy risks. Casinos also found it challenging to process thousands of verification requests.

But as technology improved, so did trust. Encryption became stronger, and online platforms became safer. This marked the true beginning of proper KYC systems in casino gaming.

Why KYC Became So Important

The goal of KYC is simple. It makes sure gambling stays safe, legal, and fair. With KYC, casinos can stop criminals from using their platforms to clean illegal money.

It also protects players by preventing identity theft and underage gaming. Over time, players began to understand that KYC was not just about restrictions. It was about protection.

A verified account means that a casino can return funds to the rightful owner if there is any problem. It also helps regulators ensure that every transaction is transparent and traceable.

In short, KYC built the bridge of trust between casinos and their players.

Technology Transformed the KYC Process

KYC was initially a hand-operated process. Players needed to upload their document’s scanned copies. The casino personnel then manually checked them. This process could last for days and even weeks sometimes.

However, technology has completely altered that scenario. Currently, most of the casinos make use of KYC automatic verification systems powered by AI.

These systems can read and verify an ID within seconds. The system checks its authenticity and even compares the image to a selfie taken by the player.

There are also some casinos that go for biometric verification as well. Players use their fingerprints or facial recognition to verify their identity.

Moreover, blockchain technology has started to play a role in KYC. The use of blockchain ensures safe storage of identity data. Players can provide it to the casinos without having to resend the same information over and over again.

This not only saves time but also keeps user data secure.

Challenges That Still Exist

Even though KYC has come a long way, it is not perfect. Some players still struggle with the verification process, especially in countries where official identification is hard to get.

Others worry about data security and how casinos store their personal information. Casinos face the challenge of balancing speed and safety.

They need to verify players quickly without making the process so strict that it drives them away. The rise of global players also means casinos must follow different KYC laws in different countries. This can be complex to manage.

The Future of KYC in Casino Gaming

The next stage of KYC looks even more advanced. Artificial intelligence will continue to play a huge role. It will help casinos detect fake IDs and spot suspicious activity automatically.

We may also see more global identity databases. They will make cross-border verification easier and safer.

In the future, players could control their own KYC data through secure digital wallets. They can choose which casino to share their identity with. This will keep privacy fully in their hands.

With this kind of progress, both players and casinos win.

How KYC Strengthens the Trust Between Players and Casino

KYC has undergone a radical transformation from being a mere requirement to being the mainstay of trust in online gambling. It is the one that assures clean money, fairness in games, and safety for players. Online gambling would otherwise be a scene of chaos, fraud, and continuous disputes.

KYC compliance and casinos having better verification systems are proving to be very active in promoting and maintaining the integrity and transparency of the industry. KYC has transitioned from being merely a concept to being a pillar, and it continues to regulate the gaming world.

The casino gaming universe is in a state of flux and the pace is quicker than ever. KYC is among the main reasons for this. It is the backbone of a safe, fair, and responsible gambling practice. It not only protects players but also the gaming platform, thus providing a trust-building environment for the online gaming industry to expand.

Also Interesting

How Digital Platforms Are Changing Culture, Creativity, and Everyday Life

Being connected has become a way of life. From the moment we reach for our phones in the morning to evenings spent streaming our favourite shows or playlists, digital platforms shape how we communicate, learn, and relax. What began as simple tools for entertainment have evolved into dynamic ecosystems that influence culture, creativity, and social interaction. Looking ahead, this evolution will only deepen, the line between digital and physical life will continue to blur, weaving online experiences into nearly every aspect of daily living. This transformation is not just technological but cultural, reflecting how people choose to connect, learn, and share meaning in a constantly moving world. The digital lifestyle has become part of who we are, shaping how we live, think, and experience the world around us.

A new kind of lifestyle

The idea of a digital lifestyle goes beyond technology itself. It represents the culture that surrounds how people use it. Across Canada, the way people experience leisure, work, and social connection has changed dramatically in the past decade. Streaming platforms, gaming communities, and social networks are no longer separate spaces but extensions of everyday reality.

It is no longer only about watching or consuming content. People now act as curators and participants, shaping what they see and share. Through short-form videos, online communities, and live streams, users are not only consuming culture but helping to create it. This participatory model has produced a more inclusive and expressive entertainment landscape that reflects shared interests and creativity.

The cultural shift behind entertainment

Digital media has opened the door to creativity for everyone. Anyone with a smartphone and an idea can share their perspective with a global audience. This accessibility has changed what it means to be a creator or a commentator. Online platforms have become modern stages where cultural trends emerge, evolve, and spread.

Gaming communities now attract audiences comparable to traditional sports, while music and visual storytelling have merged through digital platforms. The result is a culture that values immediacy, diversity, and collaboration. A recent report on technological innovation in digital entertainment highlights how streaming and social media are merging to create new hybrid ecosystems. This evolution encourages direct engagement between creators and audiences and pushes industries to rethink how content is produced and shared.

Life in Canada’s expanding digital landscape

In Canada, the digital shift is clear in how people interact with entertainment and information. Remote work, online learning, and digital leisure have become part of

everyday life. Platforms that once served niche audiences now represent mainstream culture, shaping how people spend their free time and connect with others.

Within this wider transformation, platforms such as speedz.com illustrate how digital entertainment continues to evolve. This online entertainment operator applies a modern “Pay’n Play” model that focuses on accessibility and speed. This approach reflects a broader cultural shift toward seamless, on-demand digital experiences, where interaction and convenience shape how users engage with content. While its foundation lies in entertainment, the platform embodies how technology-driven design now defines user expectations across all digital spaces.

As global discussions explore the merging of online and offline experiences, Canada’s digital lifestyle continues to evolve through entertainment, innovation, and community connection. People are becoming more mindful of how they use technology, balancing their online engagement with offline experiences to maintain a sense of connection and perspective.

The benefits and boundaries of the digital lifestyle

Living digitally offers new ways to connect, collaborate, and express ideas. People can work remotely, explore new interests, or join communities that share their passions. Access to diverse content has become easier and faster, and cultural exchange is now a daily experience.

However, this lifestyle also requires balance. Many Canadians are choosing to set limits on screen time or focus on quality interactions rather than quantity. As technology continues to evolve, awareness and self-regulation will remain important skills for maintaining a fulfilling digital life.

-

Courageous Discourse1 day ago

Courageous Discourse1 day agoNo Exit Wound – EITHER there was a very public “miracle” OR Charlie Kirk’s murder is not as it appears

-

Business1 day ago

Business1 day agoEmission regulations harm Canadians in exchange for no environmental benefit

-

Alberta1 day ago

Alberta1 day agoPetition threatens independent school funding in Alberta

-

Business1 day ago

Business1 day agoQuebecers want feds to focus on illegal gun smuggling not gun confiscation

-

National1 day ago

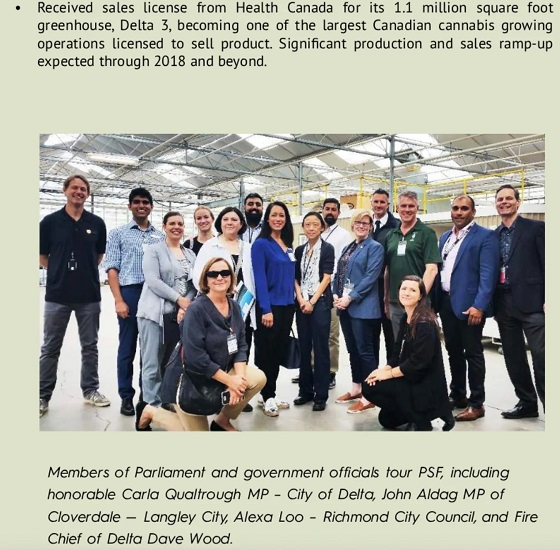

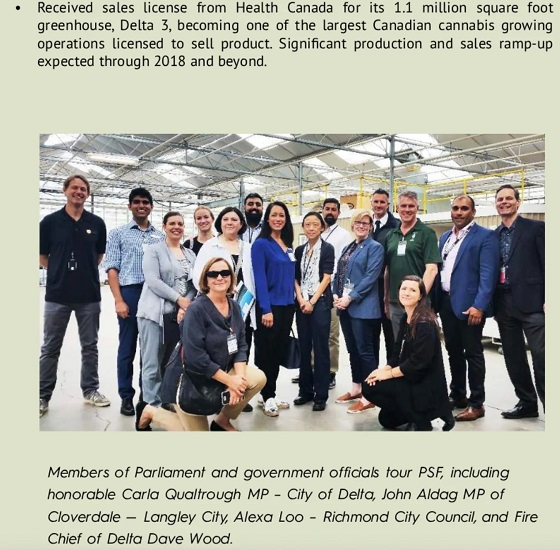

National1 day agoPolitically Connected Canadian Weed Sellers Push Back in B.C. Court, Seek Distance from Convicted Heroin Trafficker

-

Business1 day ago

Business1 day agoCanada Revenue Agency found a way to hit “Worse Than Rock Bottom”

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoWho tries to silence free speech? Apparently who ever is in power.

-

Business1 day ago

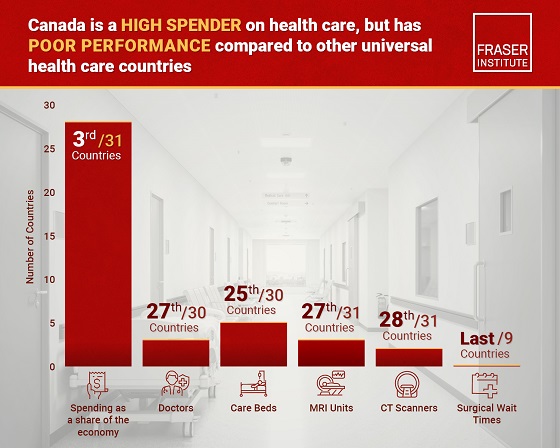

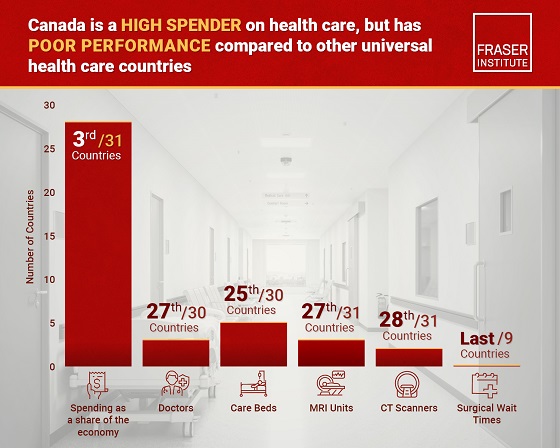

Business1 day agoCanada has fewer doctors, hospital beds, MRI machines—and longer wait times—than most other countries with universal health care