Alberta

Alberta population growth highest in over 40 years!

Third-quarter population growth: Joint statement

President of Treasury Board and Minister of Finance Travis Toews and Minister of Jobs, Economy and Northern Development Brian Jean issued the following statement on Alberta’s third-quarter population growth:

“Alberta’s economy has momentum and we remain focused on investment attraction, job creation and diversification as we continue to be the economic engine of Canada.

“According to population estimates released by Statistics Canada, we just recorded our highest single-quarter population growth rate in more than 40 years. Between the beginning of July and the end of September, Alberta added 58,203 residents.

“This is a great testament to the economic climate here in Alberta.

“Compared to the rest of Canada, we have a lower cost of living, affordable housing market, higher earnings and lower taxes.

“We are committed to building up our young, educated workforce and putting Alberta in the best position possible to withstand future volatility.”

“The Renewed Alberta Advantage is real and the numbers prove it. Our government’s strong, business-friendly policies make us a top choice to grow a business, raise a family and build a career.

“This past quarter, Alberta saw massive gains in interprovincial migration. This means almost 20,000 more Canadians chose to make Alberta their home. This is, in part, thanks to our government’s strong, business-friendly, Alberta-first policies. Canadians and newcomers are rushing to Alberta to take advantage of our growing economy, our lower cost of living and our abundant opportunities.

“They’re coming to our province to get a first-class education, to find a well-paying job and to buy a home at some of the most affordable prices in the country. Our highly skilled workforce continues to diversify and grow our economy.

“Alberta is calling. Our doors are open to anyone who wants to keep more of what they earn while taking part in a prosperous Alberta.”

Alberta

IEA peak-oil reversal gives Alberta long-term leverage

This article supplied by Troy Media.

The peak-oil narrative has collapsed, and the IEA’s U-turn marks a major strategic win for Alberta

After years of confidently predicting that global oil demand was on the verge of collapsing, the International Energy Agency (IEA) has now reversed course—a stunning retreat that shatters the peak-oil narrative and rewrites the outlook for oil-producing regions such as Alberta.

For years, analysts warned that an oil glut was coming. Suddenly, the tide has turned. The Paris-based IEA, the world’s most influential energy forecasting body, is stepping back from its long-held view that peak oil demand is just around the corner.

The IEA reversal is a strategic boost for Alberta and a political complication for Ottawa, which now has to reconcile its climate commitments with a global outlook that no longer supports a rapid decline in fossil fuel use or the doomsday narrative Ottawa has relied on to advance its climate agenda.

Alberta’s economy remains tied to long-term global demand for reliable, conventional energy. The province produces roughly 80 per cent of Canada’s oil and depends on resource revenues to fund a significant share of its provincial budget. The sector also plays a central role in the national economy, supporting hundreds of thousands of jobs and contributing close to 10 per cent of Canada’s GDP when related industries are included.

That reality stands in sharp contrast to Ottawa. Prime Minister Mark Carney has long championed net-zero timelines, ESG frameworks and tighter climate policy, and has repeatedly signalled that expanding long-term oil production is not part of his economic vision. The new IEA outlook bolsters Alberta’s position far more than it aligns with his government’s preferred direction.

Globally, the shift is even clearer. The IEA’s latest World Energy Outlook, released on Nov. 12, makes the reversal unmistakable. Under existing policies and regulations, global demand for oil and natural gas will continue to rise well past this decade and could keep climbing until 2050. Demand reaches 105 million barrels per day in 2035 and 113 million barrels per day in 2050, up from 100 million barrels per day last year, a direct contradiction of years of claims that the world was on the cusp of phasing out fossil fuels.

A key factor is the slowing pace of electric vehicle adoption, driven by weakening policy support outside China and Europe. The IEA now expects the share of electric vehicles in global car sales to plateau after 2035. In many countries, subsidies are being reduced, purchase incentives are ending and charging-infrastructure goals are slipping. Without coercive policy intervention, electric vehicle adoption will not accelerate fast enough to meaningfully cut oil demand.

The IEA’s own outlook now shows it wasn’t merely off in its forecasts; it repeatedly projected that oil demand was in rapid decline, despite evidence to the contrary. Just last year, IEA executive director Fatih Birol told the Financial Times that we were witnessing “the beginning of the end of the fossil fuel era.” The new outlook directly contradicts that claim.

The political landscape also matters. U.S. President Donald Trump’s return to the White House shifted global expectations. The United States withdrew from the Paris Agreement, reversed Biden-era climate measures and embraced an expansion of domestic oil and gas production. As the world’s largest economy and the IEA’s largest contributor, the U.S. carries significant weight, and other countries, including Canada and the United Kingdom, have taken steps to shore up energy security by keeping existing fossil-fuel capacity online while navigating their longer-term transition plans.

The IEA also warns that the world is likely to miss its goal of limiting temperature increases to 1.5 °C over pre-industrial levels. During the Biden years, the IAE maintained that reaching net-zero by mid-century required ending investment in new oil, gas and coal projects. That stance has now faded. Its updated position concedes that demand will not fall quickly enough to meet those targets.

Investment banks are also adjusting. A Bloomberg report citing Goldman Sachs analysts projects global oil demand could rise to 113 million barrels per day by 2040, compared with 103.5 million barrels per day in 2024, Irina Slav wrote for Oilprice.com. Goldman cites slow progress on net-zero policies, infrastructure challenges for wind and solar and weaker electric vehicle adoption.

“We do not assume major breakthroughs in low-carbon technology,” Sachs’ analysts wrote. “Even for peaking road oil demand, we expect a long plateau after 2030.” That implies a stable, not shrinking, market for oil.

OPEC, long insisting that peak demand is nowhere in sight, feels vindicated. “We hope … we have passed the peak in the misguided notion of ‘peak oil’,” the organization said last Wednesday after the outlook’s release.

Oil is set to remain at the centre of global energy demand for years to come, and for Alberta, Canada’s energy capital, the IEA’s course correction offers renewed certainty in a world that had been prematurely writing off its future.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Alberta

READ IT HERE – Canada-Alberta Memorandum of Understanding – From the Prime Minister’s Office

-

Alberta5 hours ago

Alberta5 hours agoFrom Underdog to Top Broodmare

-

Banks2 days ago

Banks2 days agoThe Bill Designed to Kill Canada’s Fossil Fuel Sector

-

armed forces2 days ago

armed forces2 days ago2025 Federal Budget: Veterans Are Bleeding for This Budget

-

Alberta1 day ago

Alberta1 day agoAlberta and Ottawa ink landmark energy agreement

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoTrump’s New AI Focused ‘Manhattan Project’ Adds Pressure To Grid

-

International1 day ago

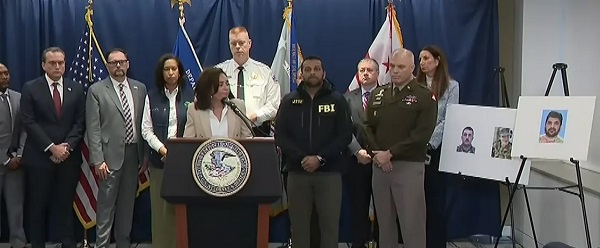

International1 day agoAfghan Ex–CIA Partner Accused in D.C. National Guard Ambush

-

Carbon Tax1 day ago

Carbon Tax1 day agoCanadian energy policies undermine a century of North American integration

-

International1 day ago

International1 day agoIdentities of wounded Guardsmen, each newly sworn in