Fraser Institute

Yes, B.C.’s Land Act changes give First Nations veto over use of Crown Land

From the Fraser Institute

By Bruce Pardy

Nathan Cullen says there’s no veto. Cullen, British Columbia’s Minister of Water, Land, and Resource Stewardship, plans to give First Nations joint decision-making authority over Crown land. His NDP government recently opened consultations on its proposal to amend the B.C. Land Act, under which the minister grants leases, licences, permits, rights-of-way and land sales. The amendments will give legal effect to agreements with Indigenous governing bodies. Those agreements will share decision-making power “through joint or consent models” with some or all of B.C.’s more than 200 First Nations.

Yes, First Nations will have a veto.

Cullen denies it. “There is no veto in these amendments,” he told the Nanaimo News Bulletin last week. He accused critics of fearmongering and misinformation. “My worry is that for some of the political actors here on the right, this is an element of dog-whistle politics.”

But Cullen has a problem. Any activity that requires your consent is an activity over which you have a veto. If a contract requires approval of both parties before something can happen, “no” by one means “no” for both. The same is true in other areas of law such as sexual conduct, which requires consent. If you withhold your consent, you have vetoed the activity. “Joint decision-making,” “consent,” and “veto” come out to the same thing.

Land use decisions are subject to the same logic. The B.C. government will give First Nations joint decision-making power, when and where agreements are entered into. Its own consultation materials say so. This issue has blown up in the media, and the government has hastily amended its consultation webpage to soothe discontent (“The proposed amendments to the Land Act will not lead to broad, sweeping, or automatic changes (or) provide a ‘veto.’”) Nothing to see here folks. But its documentation continues to describe “shared decision-making through joint or consent models.”

These proposals should not surprise anyone. In 2019, the B.C. legislature passed Bill 41, the Declaration of the Rights of Indigenous Peoples Act (DRIPA). It requires the government to take “all measures necessary” to make the laws of British Columbia consistent with the United Nations Declaration on the Rights of Indigenous People (UNDRIP).

UNDRIP is a declaration of the U.N. General Assembly passed in 2007. It says that Indigenous people have “the right to the lands, territories and resources which they have traditionally owned, occupied or otherwise used or acquired… to own, use, develop and control.”

On its own, UNDRIP is non-binding and unenforceable. But DRIPA seeks to incorporate UNDRIP into B.C. law, obligating the government to achieve its aspirations. Mere consultation with First Nations, which Section 35 of the Constitution requires, won’t cut it under UNDRIP. Under Section 7 of DRIPA, agreements to be made with indigenous groups are to establish joint decision-making or to require consent of the Indigenous group. Either Cullen creates a First Nations veto or falls short of the goalposts in DRIPA. He is talking out of both sides of his mouth.

Some commentators warned against these dangers long ago. For example, shortly after DRIPA was passed in 2019, Vancouver lawyer Robin Junger wrote in the Vancouver Sun, “It will likely be impossible for government to live up to the expectations that Indigenous groups will now reasonably hold, without fundamentally affecting the rights and interests of third parties.” Unfortunately, few wanted to tackle that thorny question head on at the time. All three political parties in B.C. voted in favour of DRIPA, which passed unanimously.

For a taste of how Land Act changes could work, ask some B.C. residents who have private docks. In Pender Harbour, for instance, the shishalh Nation and the province have jointly developed a “Dock Management Plan” to try and impose various new and onerous rules on private property owners (including red “no go” zones and rules that will make many existing docks and boat houses non-compliant). Property owners with long-standing docks in full legal compliance will have no right to negotiate, to be consulted, or to be grandfathered. Land Act amendments may hardwire this plan into B.C. law.

Yet Cullen insists that no veto will exist since aggrieved parties can apply to a court for judicial review. “[An agreement] holds both parties—B.C. and whichever nation we enter into an agreement (with)—to the same standard of judicial review, administrative fairness, all the things that courts protect when someone is going through an application or a tendering process,” he told Business in Vancouver.

This is nonsense on stilts. By that standard, no government official has final authority under any statute. All statutory decisions are potentially subject to judicial review, including decisions of Cullen himself as the minister responsible for the Land Act. He doesn’t have a veto? Of course he does. Moreover, courts on judicial review generally defer to statutory decision-makers. And they don’t change decisions but merely send them back to be made again. The argument that First Nations won’t have a veto because their decisions can be challenged on judicial review is legal jibber jabber.

When the U.N. passed UNDRIP in 2007, people said they can’t be serious. When the B.C. legislature passed DRIPA in 2019, people said they can’t be serious. The B.C. government now proposes to give First Nations a veto over the use of Crown land. Don’t worry, they can’t be serious.

Author:

Automotive

Governments in Canada accelerate EV ‘investments’ as automakers reverse course

From the Fraser Institute

Evidence continues to accrue that many of these “investments,” which are ultimately of course taxpayer funded, are risky ventures indeed.

Even as the much-vaunted electric vehicle (EV) transition slams into stiff headwinds, the Trudeau government and Ontario’s Ford government will pour another $5 billion in subsidies into Honda, which plans to build an EV battery plant and manufacture EVs in Ontario.

This comes on top of a long list of other such “investments” including $15 billion for Stellantis and LG Energy Solution, $13 billion for Volkswagen (with a real cost to Ottawa of $16.3 billion, per the Parliamentary Budget Officer), a combined $4.24 billion (federal/Quebec split) to Northvolt, a Swedish battery maker, and a combined $644 million (federal/Quebec split) to Ford Motor Company to build a cathode manufacturing plant in Quebec.

All this government subsidizing is of course meant to help remake the automobile, with the Trudeau government mandating that 100 per cent of new passenger vehicles and light trucks sold in Canada be zero-emission by 2035. But evidence continues to accrue that many of these “investments,” which are ultimately of course taxpayer funded, are risky ventures indeed.

As the Wall Street Journal notes, Tesla, the biggest EV maker in the United States, has seen its share prices plummet (down 41 per cent this year) as the company struggles to sell its vehicles at the pace of previous years when first-adopters jumped into the EV market. Some would-be EV makers or users are postponing their own EV investments. Ford has killed it’s electric F-150 pickup truck, Hertz is dumping one-third of its fleet of EV rental vehicles, and Swedish EV company Polestar dropped 15 per cent of its global work force while Tesla is cutting 10 per cent of its global staff.

And in the U.S., a much larger potential market for EVs, a recent Gallup poll shows a market turning frosty. The percentage of Americans polled by Gallup who said they’re seriously considering buying an EV has been declining from 12 per cent in 2023 to 9 per cent in 2024. Even more troubling for would-be EV sellers is that only 35 per cent of poll respondents in 2024 said they “might consider” buying an EV in the future. That number is down from 43 per cent in 2023.

Overall, according to Gallup, “less than half of adults, 44 per cent, now say they are either seriously considering or might consider buying an EV in the future, down from 55 per cent in 2023, while the proportion not intending to buy one has increased from 41 per cent to 48 per cent.” In other words, in a future where government wants sellers to only sell EVs, almost half the U.S. public doesn’t want to buy one.

And yet, Canada’s governments are hitting the gas pedal on EVs, putting the hard-earned capital of Canadian taxpayers at significant risk. A smart government would have its finger in the wind and would slow down when faced with road bumps. It might even reset its GPS and change the course of its 2035 EV mandate for vehicles few motorists want to buy.

Author:

Business

Economic progress stalling for Canada and other G7 countries

From the Fraser Institute

By Jake Fuss

For decades, Canada and other countries in the G7 have been known as the economic powerhouses of the world. They generally have had the biggest economies and the most prosperous countries. But in recent years, poor government policy across the G7 has contributed to slowing economic growth and near-stagnant living standards.

Simply put, the Group of Seven countries—Canada, France, Germany, Italy, Japan, the United Kingdom and the United States—have become complacent. Rather than build off past economic success by employing small governments that are limited and efficient, these countries have largely pursued policies that increase or maintain high taxes on families and businesses, increase regulation and grow government spending.

Canada is a prime example. As multiple levels of government have turned on the spending taps to expand programs or implement new ones, the size of total government has surged ever higher. Unsurprisingly, Canada’s general government spending as a share of GDP has risen from 39.3 per cent in 2007 to 42.2 per cent in 2022.

At the same time, federal and provincial governments have increased taxes on professionals, businessowners and entrepreneurs to the point where the country’s top combined marginal tax rate is now the fifth-highest among OECD countries. New regulations such as Bill C-69, which instituted a complex and burdensome assessment process for major infrastructure projects and Bill C-48, which prohibits producers from shipping oil or natural gas from British Columbia’s northern coast, have also made it difficult to conduct business.

The results of poor government policy in Canada and other G7 countries have not been pretty.

Productivity, which is typically defined as economic output per hour of work, is a crucial determinant of overall economic growth and living standards in a country. Over the most recent 10-year period of available data (2013 to 2022), productivity growth has been meagre at best. Annual productivity growth equaled 0.9 per cent for the G7 on average over this period, which means the average rate of growth during the two previous decades (1.6 per cent) has essentially been chopped in half. For some countries such as Canada, productivity has grown even slower than the paltry G7 average.

Since productivity has grown at a snail’s pace, citizens are now experiencing stalled improvement in living standards. Gross domestic product (GDP) per person, a common indicator of living standards, grew annually (inflation-adjusted) by an anemic 0.7 per cent in Canada from 2013 to 2022 and only slightly better across the G7 at 1.3 per cent. This should raise alarm bells for policymakers.

A skeptic might suggest this is merely a global phenomenon. But other countries have fared much better. Two European countries, Ireland and Estonia, have seen a far more significant improvement than G7 countries in both productivity and per-person GDP.

From 2013 to 2022, Estonia’s annual productivity has grown more than twice as fast (1.9 per cent) as the G7 countries (0.9 per cent). Productivity in Ireland has grown at a rapid annual pace of 5.9 per cent, more than six times faster than the G7.

A similar story occurs when examining improvements in living standards. Estonians enjoyed average per-person GDP growth of 2.8 per cent from 2013 to 2022—more than double the G7. Meanwhile, Ireland’s per-person GDP has surged by 7.9 per cent annually over the 10-year period. To put this in perspective, living standards for the Irish grew 10 times faster than for Canadians.

But this should come as no surprise. Governments in Ireland and Estonia are smaller than the G7 average and impose lower taxes on individuals and businesses. In 2019, general government spending as a percentage of GDP averaged 44.0 per cent for G7 countries. Spending for governments in both Estonia and Ireland were well below this benchmark.

Moreover, the business tax rate averaged 27.2 per cent for G7 countries in 2023 compared to lower rates in Ireland (12.5 per cent) and Estonia (20.0 per cent). For personal income taxes, Estonia’s top marginal tax rate (20.0 per cent) is significantly below the G7 average of 49.7 per cent. Ireland’s top marginal tax rate is below the G7 average as well.

Economic progress has largely stalled for Canada and other G7 countries. The status quo of government policy is simply untenable.

Author:

-

Opinion2 days ago

Opinion2 days agoCanada’s fertility, marriage rates plummet to record lows: report

-

Alberta1 day ago

Alberta1 day agoRed Deer Hospital Lottery – Second Chance Early Bird Prize!!!

-

armed forces1 day ago

armed forces1 day agoTrudeau government has spent $10 million promoting DEI in the military as recruitment flounders

-

illegal immigration2 days ago

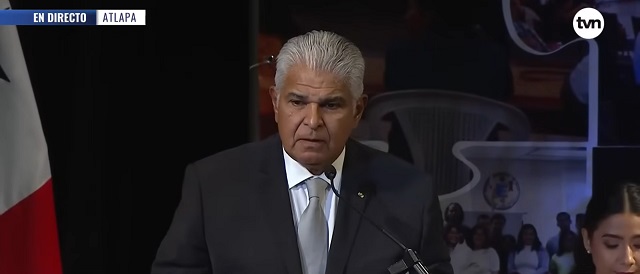

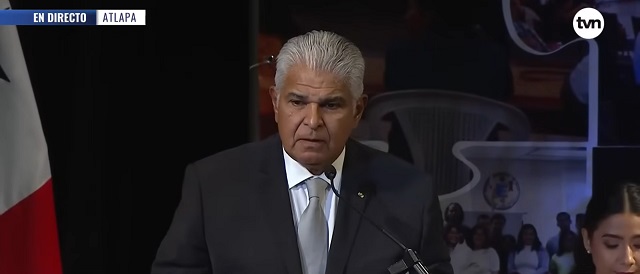

illegal immigration2 days agoPanama’s Incoming President Wants To Shut Down His Country’s Most Treacherous Route For Migrants — But Will It Work?

-

COVID-191 day ago

COVID-191 day agoMore victories for freedom as ArriveCAN charges dropped and fines reduced

-

City of Red Deer2 days ago

City of Red Deer2 days agoCity Council paving the way for more house suites, backyard suites, tiny homes, and duplexes

-

COVID-191 day ago

COVID-191 day agoTrudeau government only sought legal advice after Emergencies Act was invoked, records indicate

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoThe WHO’s Proposed Pandemic Agreements Worsen Public Health