Opinion

Why Everything We Thought About Drugs Was Wrong

Michael Schellenberger is a leading environmentalist and progressive activist who has become disillusioned with the movements he used to help lead.

His passion for the environment and progressive issues remains, but his approach is unique and valuable.

Michael Shellenberger is author of the best-selling “Apocalypse Never”

This newsletter was sent out to Michael Schellenberger’s subscribers on Substack

The road to hell was paved with victimology

In the late 1990s and early 2000s, I worked with a group of friends and colleagues to advocate drug decriminalization, harm reduction, and criminal justice reform. I helped progressive Congressperson Maxine Waters organize civil rights leaders to advocate for needle exchange so that heroin users wouldn’t get HIV-AIDS. I fought for the treatment of drug addiction as a public health problem not a criminal justice one. And we demanded that housing be given to the homeless without regard for their own struggles with drugs.

Our intentions were good. We thought it was irrational to criminalize the distribution of clean needles to drug users when doing so had proven to save lives. We were upset about mass incarceration, particularly of African Americans and Latinos, for nonviolent drug offenses. And we believed that the approach European nations like the Netherlands and Portugal had taken to decriminalize drugs, and expand drug treatment, was the right one.

But it’s obvious now that we were wrong. Over the last 20 years the U.S. liberalized drug laws. During that time, deaths from illicit drugs rose from 17,000 to 93,000. Three three times more people die from illicit drug use than from car accidents; five times more die from drugs than homicide. Many of those people are homeless and die alone in the hotel rooms and apartment units given away as part of the harm reduction-based “Housing First” approach to homelessness. Others are children found dead by their parents on the floors of their rooms.

Many progressives today say the problem is that we didn’t go far enough, and to some extent they are right. A big factor behind rising drug deaths has been the contamination of cocaine, heroin, and counterfeit prescription opioids with fentanyl. Others say that concerns over rising drug deaths are misplaced, and that alcohol and tobacco kill more people than illicit drugs.

But drug deaths were rising in the U.S. long before the arrival of fentanyl, and most of the people who die from tobacco and alcohol do so in old age, not instantly, like they do when they are poisoned or overdose. Of the nearly 90,000 people in the U.S. who die of alcohol-related causes annually, just 2,200 die immediately from acute alcohol poisoning.

What about mass incarceration? It’s true that nearly half of the people in federal prisons are there for nonviolent drug offenses. But there are eight times more people in state prisons than federal prisons, and just 14 percent of people in state prisons are there for nonviolent drug offenses and just 4 percent for nonviolent possession. Half of state prisoners are there for murder, rape, robbery and other violent offenses.

While it’s true that both Netherlands and Portugal reduced criminal penalties, both nations still ban drug dealing, arrest drug users, and sentence dealers and users to prison or rehabilitation. “If somebody in Portugal started injecting heroin in public,” I asked the head of drug policy in that country, “what would happen to them?” He said, without hesitation, “They would be arrested.”

And being arrested is sometimes what addicts need. “I am a big fan of mandated stuff,” said Victoria Westbrook. “I don’t recommend it as a way to get your life together, but getting indicted by the Feds worked for me. I wouldn’t have done this without them.” Today Victoria is working for the San Francisco city government to integrate ex-convicts back into society.

But people in progressive cities are today shouted down for even suggesting a role for law enforcement. “Anytime a person says, ‘Maybe the police and the health care system could work together?’ or, ‘Maybe we could try some probation or low-level arrests,’ there’s an enormous outcry,” said Stanford addiction specialist Keith Humphreys. “‘No! That’s the war on drugs! The police have no role in this! Let’s open up some more services and people will come in and use them voluntarily!’”

Why is that? Why, in the midst of the worst drug death crisis in world history, and the examples of Portugal and Netherlands, are progressives still opposed to shutting down the street fentanyl markets in places like San Francisco that are killing people?

We Care A Lot

The City of San Francisco opened this homeless encampment virtually on the front steps of city hall.

There are many financial interests that make money from the drug crisis and so it’s reasonable to ask whether progressive inaction stems from political donations from addiction, homelessness, and service providers. California spends more on mental health than any other state but saw its homeless population rise 31 percent even as it declined 18 percent in the rest of the U.S. San Francisco spends significantly more on cash welfare and housing for the homeless than other cities but has one of the worst homeless and drug death crises, per capita.

But we progressives who fought to change drug laws and attitudes were not primarily motivated by money. Sure, we needed George Soros and other wealthy individuals to support our work. But we could have made more money doing other things, and Soros and others have nothing to gain financially from drug decriminalization. The same goes for homelessness. The most influential Housing First advocates work in non-profits and universities.

Is it because so many progressives who fought for decriminalization themselves used drugs? Everybody I knew in that period, myself included, smoked marijuana, drank alcohol, and experimented with psychedelics and occasionally with harder drugs. Several of the donors who supported our work were known to smoke marijuana.

But I saw no evidence that advocates for drug decriminalization and harm reduction used illicit drugs at a higher rate than the rest of the population. Some used them less and showed far greater awareness of the harms of drugs, including addiction, than many other people I have met, likely due to their higher socio-economic status as much as their specific knowledge of the issue.

And the core motivation of the people I worked with was ideological. Many people, including many progressives, were libertarian, and fundamentally believed the government did not have a right to tell able-bodied adults what drugs they could and could not use. But many more, myself included, were upset by mass incarceration, and the ways in which incarceration destroys families, disproportionately African American and Latino ones.

Our views were too simplistic and wrong. Many things undermine families and communities, of all colors, well before anyone is incarcerated, including drugs and the crime and violence associated with them. And, violent communities attract the drug trade more than the drug trade makes communities violent, both scholars and journalists find.

But mostly we were too emotional. Progressives hold two moral values particularly deeply: caring and fairness. “Across many scales, surveys, and political controversies,” notes the psychologist Jonathan Haidt, “liberals turn out to be more disturbed by signs of violence and suffering, compared to conservatives, and especially to libertarians.”

The problem is that, in the process of valuing care so much, progressives abandon other important values, argue Haidt and other researchers in a field called Moral Foundations Theory. While progressives (“liberal” and “very liberal” people) hold the values of Caring, Fairness, and Liberty, they tend to reject the values of Sanctity, Authority, and Loyalty as wrong. Because these values are so deeply held, often subconsciously, Moral Foundations Theory explains well why so many progressives and conservatives today view each other as not merely uninformed but immoral.

The Victim God

California Governor Gavin Newsome has proposed a 12 Billion dollar plan to build homes for California’s entire homeless population.

The values of Sanctity and Authority appear to explain why conservatives and moderate Democrats more than progressives favor prohibitions on things like sleeping on sidewalks, public use of hard drugs, and other behaviors. In a more traditional morality, drug use is seen as violating the Sanctity of the body, and the importance of self-control. Sleeping on sidewalks is seen as violating the value of Authority of laws and thus Loyalty to America. Writes Haidt, “liberals are often willing to trade away fairness when it conflicts with compassion or their desire to fight oppression.”

But there is a twist. Progressives don’t trade away Fairness for victims, only for those they see as privileged. Progressives still value Fairness, but more for victims, and their progressive allies, than for everyone equally, and particularly not for people progressives view as the oppressors and victimizers.

Conservatives and moderates tend to define Fairness around equal treatment, including enforcement of the law. They tend to believe we should enforce the law against the homeless man who is sleeping and urinating on BART, our subway system, even if he is a victim. Progressives disagree. They demand we take into account that the man is a victim in deciding whether to arrest and how to sentence whole classes of people including the homeless, mentally ill, and addicts.

Progressives also value Liberty, or freedom, differently from conservatives. Many progressives reject the value of Liberty for Big Tobacco and cigarette smokers but embrace the value of Liberty for fentanyl dealers and users. Why? Because progressives view fentanyl dealers and users, who are disproportionately poor, sick, and nonwhite, as victims of a bad system.

Progressives also value Authority and Loyalty for victims above everyone else. San Francisco homelessness advocate Jennifer Friedenbach told me that we should “center unhoused people, primarily black and brown folks, that are experiencing homelessness, folks with disabilities. They’re the voices that should be centered.” She is not rejecting Authority or Loyalty. Rather, she is suggesting that we should have Loyalty to the victims, and that they, not governments, should have Authority.

Indeed, progressives insist on taking orders, supposedly without questioning them, from the homeless themselves. “Drug use is often the only thing that feels good for them, to oversimplify it,” said Kristen Marshall, who oversees San Francisco’s response to drug overdoses. “When you understand that, you stop caring about the drug use and ask people what they need.”

The San Francisco Coalition on Homelessness has similarly argued that the city must let homeless people sit and lie on sidewalks, and camp in public spaces including parks and sidewalks, if that’s what they would prefer, rather than require them to stay in shelters. Once you decide, in advance, to let victims determine their fates, then much else can be justified.

Many progressives do something similar with Sanctity, which is to value some things as sacred or pure. Monique Tula, the head of the Harm Reduction Coalition, argues for “bodily autonomy” against mandatory drug treatment for people who break the law to support their addiction. In so doing, she is insisting upon the Sanctity of the body, not rejecting it. The difference between her definition of Sanctity and the traditional view of Sanctity was what violated it. Where traditional morality views recreational injection drug use as a violation of the Sanctity of the body, Tula, like many libertarians, believes that the state coercing sobriety is.

All religions and moralities have light and dark sides, suggests Haidt. “Morality binds and blinds,” he writes. On the one hand, they bind us together in groups and societies, helping us realize our individual and social needs, and are thus very positive. But religions and moralities can also create giant blind spots preventing us from seeing our dark sides, and thus can be very negative.

Victimology takes the truth that it is wrong for people to be victimized and distorts it by going a step further. Victimology asserts that victims are inherently good because they have been victimized. It robs victims of their moral agency and creates double standards that frustrate any attempt to criticize their behavior, even if they’re behaving in self-destructive, antisocial ways like smoking fentanyl and living in a tent on the sidewalk. Such reasoning is obviously faulty. It purifies victims of all badness. But by appealing to emotion, victimology overrides reason and logic.

Victimology appears to be rising as traditional religions are declining. Unlike traditional religions, many nontraditional religions are largely invisible to the people who hold them most strongly. A secular religion like victimology is powerful because it meets the contemporary psychological, social, and spiritual needs of its believers, but also because it appears obvious, not ideological, to them. Advocates of “centering” victims, giving them special rights, and allowing them to behave in ways that undermine city life, don’t believe, in my experience, that they are adherents to a new religion, but rather that they are more compassionate and more moral than those who hold more traditional views.

A Bad Case of San Fransickness

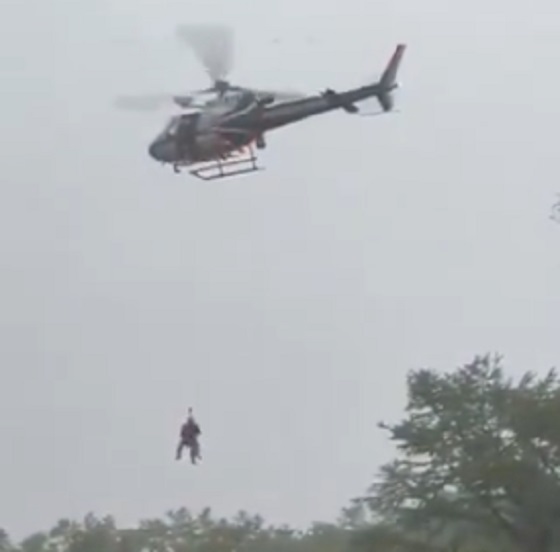

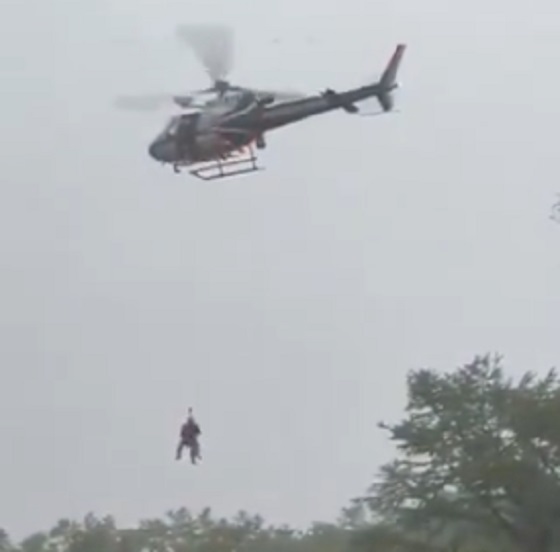

Case workers at San Francisco City Hall Homeless Encampment

“Safe Sleeping Sites” is the name San Francisco gives to parking lots of tents of homeless addicts shooting and smoking fentanyl and meth. They are expensive, costing the city $60,000 per tent to maintain. Some people say they look like a natural disaster, but with city-funded social workers providing services to the people in tents, they look to me more like a medical experiment, albeit one that no board of ethics would ever permit.

At the Sites the city isn’t providing drug treatment; it’s providing easy access to drugs. That includes cash in the form of welfare payments with which to purchase drugs, and the equipment with which to inject them. As such, progressives cities like San Francisco are directly financing the drug death crisis.

Is this Munchausen syndrome by proxy, which is when a parent deliberately makes their child sick so they can feel important? In San Fransicko, I consider this possibility, and ultimately conclude that while the progressive approach to drug addiction and homelessness can be fairly described as pathological altruism, it would be unfair to call it sadistic. Many of the drug-addicted and mentally ill homeless are, in fact, sick, and most progressives have good intentions.

But it is not unfair to point out that the city’s approach of playing the Rescuer is resulting in worsening addiction and rising drug deaths. Nor is it unfair to point out that we limit people’s potential for freedom by labeling them Victims and “centering” their trauma, rather than viewing victimization as an opportunity for heroism. Nor is it unfair to point out, as I have attempted to do by describing the history, that San Francisco’s political, business, and cultural leaders should all know better by now.

People suffering from addiction and living on the street are ill. To mix them up in speech and policy with people who are merely poor is deceptive. Leading scholars have for thirty years denounced the conflation of the merely poor with disaffiliated addicts. Yet progressive advocates for the homeless continue to engage in the same sleight of hand by using the single term “homeless,” tricking journalists, policy makers, and the public into mixing together groups of people who require different kinds of help.

Progressives justify their discourse and agenda in the name of preventing dehumanization, but the effect has been the opposite. In defending the humanity of addicts, progressives ended up defending the inhumane conditions of street addiction.

The morality of victimology contains a version of all six values identified in Moral Foundations Theory. The problem is that those values are oriented around those defined as Victims in a particular context, to the exclusion of everyone else. But not even the most devoted homeless activists could do whatever drug-addicted homeless people demand of them. The demand that we give Victims special political authority is thus really a demand to give special political authority to those who claim to represent the supposed Victims, namely homelessness advocates.

The power of victimology lies in its moralizing discourse more than in any single set of laws. I was struck in my research that progressive intellectuals and activists have had a far greater impact on public policy, and the reality on the streets, than countless progressive politicians.

It is notable that while academics and activists are the most influential individuals in shaping homeless policy in San Francisco and Los Angeles, they are also the least accountable. As the problem has worsened, their cultural and political power has grown, while voters understandably blame their local elected leaders for the crisis.

Progressive advocates and policy makers alike blame the drug war, mass incarceration, and drug prohibition for the addiction and overdose crisis, even though the crisis resulted from liberalized attitudes and drug laws, first toward pharmaceutical opioids, and then toward all drugs. This view is, on the one hand, a defensive and ideological reaction. But it is also an abdication of responsibility.

And so while we should hold our elected officials responsible, we must also ask hard questions of the intellectual architects of their policies, and of the citizens, donors, and voters who empower them. What kind of a civilization leaves its most vulnerable people to use deadly substances and die on the streets? What kind of city regulates ice cream stores more strictly than drug dealers who kill 713 of its citizens in a single year? And what kind of people moralize about their superior treatment of the poor, people of color, and addicts while enabling and subsidizing the conditions of their death?

Crime

Eyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

Peter Doocy asked directly, “What happened to the Epstein client list that the Attorney General said she had on her desk?” Here’s how Leavitt tried to explain it.

The Epstein client list was supposed to be SITTING on Pam Bondi’s desk for review.

But months later, the DOJ says no such list even exists.

Karoline Leavitt was just asked why there was such a reversal in so little time.

Her responses today are raising eyebrows.

On February 21st, Pam Bondi told the world the Epstein client list was “sitting on [her] desk right now to review,” explaining it was part of a directive ordered by President Trump.

Shortly afterward, she and Kash Patel pledged to end the Epstein cover-up, promising to fully disclose the Epstein files to the public, hold accountable any government officials who withheld key evidence, and investigate why critical documents had been hidden in the first place.

But ever since late February, it seems the cover-up wasn’t exposed but buried even deeper by those who promised transparency.

First, they handed out the so-called “Epstein files” to influencers like golden Willy Wanka tickets, only for everyone to discover that almost all of the contents inside were already public and contained no new revelations.

Fast-forward to May, and suddenly Kash Patel and Dan Bongino are declaring firmly that Epstein killed himself.

“I’ve seen the whole file. He killed himself,” Bongino stated bluntly to Fox News’s Maria Bartiromo.

Today, the Trump-appointed DOJ and FBI released a new report that’s turning heads and raising plenty of questions.

They concluded that Epstein had no clients, didn’t blackmail anyone, and definitely killed himself.

FBI Concludes Epstein Had No Clients, Didn’t Blackmail Anyone, and Definitely Killed Himself

This article originally appeared on Infowars and was republished with permission.

They also released surveillance footage and claimed it showed no one entered Epstein’s cell area, supporting the suicide ruling.

But people aren’t convinced. Some allege the video cuts off, with a minute of footage missing between 11:59 PM and midnight.

Monday, White House Press Secretary Karoline Leavitt responded to questions about the Epstein client list in light of these new DOJ and FBI statements.

A reporter asked, “Karoline, the DOJ and FBI have now concluded there was no Jeffrey Epstein client list. What do you tell MAGA supporters who say they want anyone involved in Epstein’s alleged crimes held accountable?”

Leavitt replied, “This administration wants anyone who has ever committed a crime to be accountable, and I would argue this administration has done more to lock up bad guys than certainly the previous administration.”

She continued, “The Trump administration is committed to truth and transparency. That’s why the Attorney General and the FBI Director pledged, at the president’s direction, to do an exhaustive review of all the files related to Jeffrey Epstein’s crimes and his death. They put out a memo in conclusion of that review.”

“There was material they did not release because frankly it was incredibly graphic and contained child pornography, which is not something that is appropriate for public consumption,” she added.

“But they committed to an exhaustive investigation. That’s what they did and they provided the results of that.”

“That’s transparency,” Leavitt said.

Leavitt was also pressed about Attorney General Pam Bondi’s comments in February when she claimed she had the Epstein list “on [her] desk.”

Peter Doocy asked, “Okay, so the FBI looks at the circumstances surrounding the death of Jeffrey Epstein. According to the report, this systematic review revealed no incriminating client list. So what happened to the Epstein client list that the Attorney General said she had on her desk?”

Leavitt responded, “I think if you go back and look at what the Attorney General said in that interview, which was on your network, on Fox News—”

Doocy pushed back, “I have the quote. John Roberts said: ‘DOJ may release the list of Jeffrey Epstein’s clients, will that really happen?’ And she said, ‘It’s sitting on my desk right now to review.’”

Leavitt explained, “Yes. She was saying the entirety of all of the paperwork, all of the paper in relation to Jeffrey Epstein’s crimes, that’s what the Attorney General was referring to. And I will let her speak for that.”

“But when it comes to the FBI and the Department of Justice, they are more than committed to ensuring that bad people are put behind bars.”

So, after months of patiently waiting, the American people get a nothing burger that simply repeats the same old claims we heard under Bill Barr.

Even worse, it’s purported that this is what “transparency” and “accountability” look like.

The story went from saying the Epstein client list was “on my desk” to “actually, there is no client list.”

And the newly released video footage raises questions and, in the age of AI, proves nothing.

If there’s really nothing to hide, why does it still feel like they’re hiding everything?

And most importantly—who’s still being protected?

Thanks for reading to the end. I hope you found this timeline of events and recap helpful.

Subscribe to The Vigilant Fox

Bruce Dowbiggin

Eau Canada! Join Us In An Inclusive New National Anthem

This past week has seen (some) Canadians celebrating their heritage— now that Mike Myers has officially reinterpreted Canadian culture as a hockey sweater and Mr. Dressup. This quick-change was so popular that Canadian voters even forgot an entire decade of Justin Trudeau.

In the United States, the people who elected Donald Trump– and not Andrew Coyne– to run their nation celebrated Independence Day with stirring renditions off The Star Spangled Banner, although few could surpass the brilliant performance of the song by the late Whitney Houston at the 1991 Super Bowl.

The CDN equivalent is some flavour of the month changing the words to O Canada at the Grey Cup game. Canada’s national anthem has always been open to interpretation by people who may or may not have Canada in their hearts. At the 2023 NBA All Star Game Canadian chanteuse Jully Black became the latest singer to attempt a manicure to the English lyrics of O Canada, penned for the 1880 Saint-Jean-Baptiste Day ceremony ( Calixa Lavallée composed the music, after which words were written by the poet and judge Sir Adolphe-Basile Routhier. The English lyrics have “evolved” over the years, just like the dress code for the CDN PM..)

Black amended the first line from “our home and native land” to our home ON native land”. Because something-something. But this creative license is nothing new. Unlike Chris Stapleton, Marvin Gaye or Whitney Houston with the Star Spangled Banner, interpreters of O Canada have seen fit to amend the lyrics to their sensibilities. Roger Doucet, famed anthem singer of the Montreal Canadiens in the 1970-80s, tried to add the words “we stand on guard for truth and liberty” in place of the first “we stand on guard for thee”.

In 1990, having nothing better to do, Toronto City Council voted 12 to 7 in favour of recommending that the phrase “our home and native land” be changed to “our home and cherished land” and that “in all thy sons command” be partly reverted to “in all of us command”. (The latter was officially adapted.)

While those attempts had mixed outcomes it appears it’s just a matter of time till Ms. Black’s class-conscious culling of the words is accepted. Being generous we here at IDLM thought we’d short-circuit piecemeal attempts to create a throughly Woke version of the anthem that would last till the latest fad come along. Herewith our 2023 definitive O Canada that even— maybe only— Justin Trudeau could love:

“O Canada” (Ignores the French fact in our culture) Change to “Eau Canada”

“Our home on native land” (ignores indigenous land claims) Change to “Get off our land, settlers”

“True patriot love in all of us commands” (Only true patriot love? There were officially 78 kinds of relationships in Trudeaupia. And commanding love?) Change to “Love the one you’re with”.

“With glowing hearts we see thee rise” (rise suggests triumph of white triumphalist dogma) Change to “Non judgementally we oppose the crushing impacts of Euro-based autocracy”

“The true north strong and free” (How can anyone be strong or free when we support America’s killing fields?) Change to “Heteronormative thinking must be stamped out at our borders. If we even have borders anymore.”

“From far and wide” (Body shaming) Change to “Obesity is a disease that is not helped by putting it in the national anthem.”

“O Canada” (biased against A, B, AB blood types) change to “Science Must Be Believed”

“We stand on guard for thee” (Spreads hate against the non ableist community) Change to “Please remain seated.”

“God keep our land” (God? God? What is this, the Reformation) “Change to “It’s your thing”

”Glorious and free” (Glorious harkens to the bourgeois subjugation of Indigenous thought processes by white Christian priests) Change to “A genocidal state if there ever was one”.

“O Canada we stand on guard for thee/

O Canada we stand on guard for thee” The denial of trans rights is used twice here to emphasize the intolerable burdens faced by people of the LGBTQ2R community as they seek respect and compensation for the evils of the founding oppressors.) Change to “Eau Canada, after 6.5 hours of intensive lectures on the gender, race and dissociative application of class war on your citizens you may someday come to understand that this song is a manifestation of your bigotry and exploitation of minorities— and why rhyming lines like “thee and free” is the work of the devil or J.K. Rowling, whomever comes to mind first.”

There. That wasn’t so tough, was it? Flows trippingly off the tongue like Mark Carney refusing a special inquiry into China buying the electoral process. Or perhaps we should simply accept a literal translation of the original French lyrics:

“O Canada!

Land of our ancestors

Glorious deeds circle your brow

For your arm knows how to wield the sword

Your arm knows how to carry the cross;

Your history is an epic

Of brilliant deeds

And your valour steeped in faith

Will protect our homes and our rights.”

Yikes. That’s downright fascistic. But it’s Quebec, and we have to allow them their peccadilloes. So circle your brow with glorious deeds, grab a cross and a sword and valour steeped in faith. And remember we must be adaptable in the new era.

Unless it’s Alberta using the adapting to fuel its CO2-belching machines. In which case it’s man the battlements and follow Mike Myers into the fight.

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, his new book Deal With It: The Trades That Stunned The NHL And Changed hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org . His 2004 book Money Players was voted sixth best on the same list, and is available via brucedowbigginbooks.ca.

-

Disaster2 days ago

Disaster2 days agoTexas flood kills 43 including children at Christian camp

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Immigration

-

Business2 days ago

Business2 days agoThe Digital Services Tax Q&A: “It was going to be complicated and messy”

-

International2 days ago

International2 days agoElon Musk forms America Party after split with Trump

-

Crime15 hours ago

Crime15 hours agoNews Jeffrey Epstein did not have a client list, nor did he kill himself, Trump DOJ, FBI claim

-

COVID-1912 hours ago

COVID-1912 hours agoFDA requires new warning on mRNA COVID shots due to heart damage in young men

-

Alberta Sports Hall of Fame and Museum23 hours ago

Alberta Sports Hall of Fame and Museum23 hours agoAlberta Sports Hall of Fame 2025 Inductee Profiles – Para Nordic Skiing – Brian and Robin McKeever

-

Indigenous10 hours ago

Indigenous10 hours agoInternal emails show Canadian gov’t doubted ‘mass graves’ narrative but went along with it