Economy

Trudeau accused of lacking leadership after refusing to meet with premiers about carbon tax

From LifeSiteNews

Ontario Premier Doug Ford called the prime minister’s answer ‘snarky.’

Prime Minister Justin Trudeau’s refusal to meet with five Canadian premiers, who have demanded a meeting with him to discuss the ever-escalating carbon tax that shot up 23 percent on April 1, shows he lacks any true “leadership,” quipped Saskatchewan Premier Scott Moe.

Last Thursday during an interview with the CBC’s Matt Galloway for an episode that aired-on April 4, Trudeau said he already “had” a meeting with the premiers in 2016 and will “continue to talk with premiers” about the carbon tax but will not meet with them soon.

Moe said Trudeau’s refusal to meet with the premiers is “not leadership.”

“Premiers have respectfully asked the Prime Minister for a meeting to discuss the carbon tax. Here is the snarky answer that we got,” Moe wrote Monday on X, with a link to a CBC report regarding Trudeau dismissing a full-out meeting with the premiers.

“That’s not leadership,” he added.

Shortly after the Trudeau government raised the carbon tax by 23 percent on April 1, the premiers of Alberta, Saskatchewan, Ontario, and New Brunswick all wrote letters to Trudeau asking him to convene an emergency first ministers meeting, to discuss the carbon tax’s detrimental effect on Canadians finances.

The first premier to write to Trudeau was Newfoundland and Labrador’s Andrew Furey, who wrote to him before April 1 demanding a meeting.

Last Thursday, Alberta Premier Danielle Smith in her letter to Trudeau wrote, “Albertans and Canadians are facing a cost-of-living crisis not seen in decades.”

“In March, natural gas was selling at less than $1.80 a gigajoule. Now that the carbon tax has increased to $4.09 per gigajoule, the tax alone is more than double what it costs Albertans to heat their homes. This is not just reckless, it is immoral and inhumane,” she wrote.

Ontario Premier Doug Ford in his letter to Trudeau said, “This carbon tax has to go, or in a year and a half, the prime minister’s going. It’s as simple as that. He will be going. I’ll guarantee you.”

Last Friday at a press conference, Ford said, “Taxing people doesn’t reduce emissions, and that’s what they’re doing. They’re hurting the economy. They’re hurting people. Unacceptable.”

Protests against Trudeau have been increasing in recent months due to the unpopularity of higher carbon taxes as well as other governmental policies.

LifeSiteNews reported last week that protesters let Trudeau know their true feelings about his tanking in the polls by heckling him with loud drum beats and screams during a press conference.

On April 1, Canada’s carbon tax, which was introduced by the government of Prime Minister Justin Trudeau in 2019, increased from $65 to $85 per tonne despite seven of 10 provincial premiers objecting to the increase and 70% of Canadians saying they are against it.

Trudeau has remained adamant that he will not pause the hikes.

As it stands, Canadians living in provinces under the federal carbon pricing scheme pay $65 per tonne, but the Trudeau government wants to increase this to $170 per tonne by 2030.

Recent polls show that the scandal-plagued government has sent the Liberals into a nosedive with no end in sight. Per a recent LifeSiteNews report, according to polls, in a Canadian federal election held today, Conservatives under leader Pierre Poilievre would win a majority in the House of Commons over Trudeau’s Liberals.

Trudeau’s government is trying to force net-zero regulations on all Canadian provinces, notably on electricity generation, as early as 2035. The provinces of Alberta and Saskatchewan are adamantly opposed to Trudeau’s 2035 goals.

The Trudeau government’s current environmental goals, which are in lockstep with the United Nations’ 2030 Agenda for Sustainable Development, include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of the use of so-called “fossil fuels” and a transition to unreliable “green” energy has been pushed by the World Economic Forum (WEF) – the globalist group behind the socialist “Great Reset” agenda in which Trudeau and some of his cabinet are involved.

Business

Taxpayers criticize Trudeau and Ford for Honda deal

From the Canadian Taxpayers Federation

Author: Jay Goldberg

The Canadian Taxpayers Federation is criticizing the Trudeau and Ford governments to for giving $5 billion to the Honda Motor Company.

“The Trudeau and Ford governments are giving billions to yet another multinational corporation and leaving middle-class Canadians to pay for it,” said Jay Goldberg, CTF Ontario Director. “Prime Minister Justin Trudeau is sending small businesses bigger a bill with his capital gains tax hike and now he’s handing out billions more in corporate welfare to a huge multinational.

“This announcement is fundamentally unfair to taxpayers.”

The Trudeau government is giving Honda $2.5 billion. The Ford government announced an additional $2.5 billion subsidies for Honda.

The federal and provincial governments claim this new deal will create 1,000 new jobs, according to media reports. Even if that’s true, the handout will cost taxpayers $5 million per job. And according to Globe and Mail investigation, the government doesn’t even have a proper process in place to track whether promised jobs are actually created.

The Parliamentary Budget Officer has also called into question the government’s claims when it made similar multi-billion-dollar handouts to other multinational corporations.

“The break-even timeline for the $28.2 billion in production subsidies announced for Stellantis-LGES and Volkswagen is estimated to be 20 years, significantly longer than the government’s estimate of a payback within five years for Volkswagen,” wrote the Parliamentary Budget Officer said.

“If politicians want to grow the economy, they should cut taxes and red tape and cancel the corporate welfare,” said Franco Terrazzano, CTF Federal Director. “Just days ago, Trudeau said he wants the rich to pay more, so he should make rich multinational corporations pay for their own factories.”

Business

Maxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

From LifeSiteNews

If ‘the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.’

People’s Party of Canada leader Maxime Bernier has warned that the Liberal government’s push for World Economic Forum (WEF) “Global Tax” scheme should concern Canadians.

According to Canada’s 2024 Budget, Prime Minister Justin Trudeau is working to pass the WEF’s Global Minimum Tax Act which will mandate that multinational companies pay a minimum tax rate of 15 percent.

“Canadians should be very concerned, for several reasons,” People’s Party leader Maxime Bernier told LifeSiteNews, in response to the proposal.

“First, the WEF is a globalist institution that actively campaigns for the establishment of a world government and for the adoption of socialist, authoritarian, and reactionary anti-growth policies across the world,” he explained. “Any proposal they make is very likely not in the interest of Canadians.”

“Second, this minimum tax on multinationals is a way to insidiously build support for a global harmonized tax regime that will lower tax competition between countries, and therefore ensure that taxes can stay higher everywhere,” he continued.

“Canada reaffirms its commitment to Pillar One and will continue to work diligently to finalize a multilateral treaty and bring the new system into effect as soon as a critical mass of countries is willing,” the budget stated.

“However, in view of consecutive delays internationally in implementing the multilateral treaty, Canada cannot continue to wait before taking action,” it continued.

The Trudeau government also announced it would be implementing “Pillar Two,” which aims to establish a global minimum corporate tax rate.

“Pillar Two of the plan is a global minimum tax regime to ensure that large multinational corporations are subject to a minimum effective tax rate of 15 per cent on their profits wherever they do business,” the Liberals explained.

“The federal government is moving ahead with legislation to implement the regime in Canada, following consultations last summer on draft legislative proposals for the new Global Minimum Tax Act,” it continued.

According to the budget, Trudeau promised to introduce the new legislation in Parliament soon.

The global tax was first proposed by Secretary-General of Amnesty International at the WEF meeting in Davos this January.

“Let’s start taxing carbon…[but] not just carbon tax,” the head of Amnesty International, Agnes Callamard, said during a panel discussion.

According to the WEF, the tax, proposed by the Organization for Economic Co-operation and Development (OECD), “imposes a minimum effective rate of 15% on corporate profits.”

Following the meeting, 140 countries, including Canada, pledged to impose the tax.

While a tax on large corporations does not necessarily sound unethical, implementing a global tax appears to be just the first step in the WEF’s globalization plan by undermining the sovereignty of nations.

While Bernier explained that multinationals should pay taxes, he argued it is the role of each country to determine what those taxes are.

“The logic of pressuring countries with low taxes to raise them is that it lessens fiscal competition and makes it then less costly and easier for countries with higher taxes to keep them high,” he said.

Bernier pointed out that competition is good since it “forces everyone to get better and more efficient.”

“In the end, we all end up paying for taxes, even those paid by multinationals, as it causes them to raise prices and transfer the cost of taxes to consumers,” he warned.

Bernier further explained that the new tax could be a first step “toward the implementation of global taxes by the United Nations or some of its agencies, with the cooperation of globalist governments like Trudeau’s willing to cede our sovereignty to these international organizations.”

“Just like ‘temporary taxes’ (like the income tax adopted during WWI) tend to become permanent, ‘minimum taxes’ tend to be raised,” he warned. “And if the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.”

Trudeau’s involvement in the WEF’s plan should not be surprising considering his current environmental goals – which are in lockstep with the United Nations’ 2030 Agenda for Sustainable Development – which include the phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum – the aforementioned group famous for its socialist “Great Reset” agenda – in which Trudeau and some of his cabinet are involved.

-

Alberta22 hours ago

Alberta22 hours agoRed Deer Doctor critical of Alberta’s COVID response to submit report to Danielle Smith this May

-

Business5 hours ago

Business5 hours agoDon’t be fooled by high-speed rail

-

Alberta5 hours ago

Alberta5 hours agoActivity-Based Hospital Funding in Alberta: Insights from Quebec and Australia

-

Business2 days ago

Business2 days agoFederal government’s ‘fudget budget’ relies on fanciful assumptions of productivity growth

-

International1 day ago

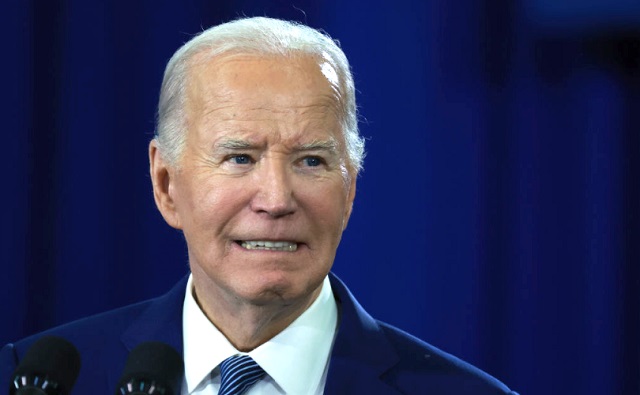

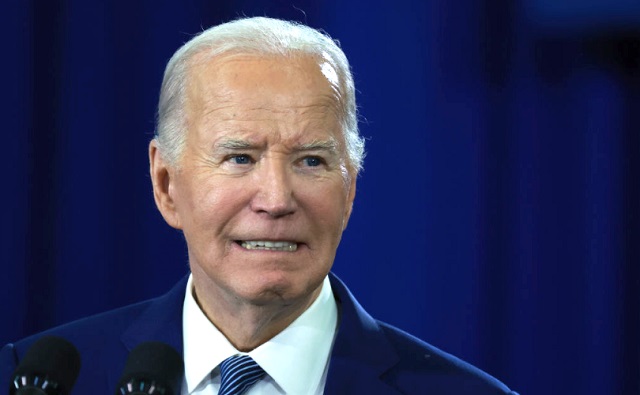

International1 day agoBiden admin expands Title IX to include ‘gender identity,’ sparking conservative backlash

-

Censorship Industrial Complex24 hours ago

Censorship Industrial Complex24 hours agoNow We Are Supposed to Cheer Government Surveillance?

-

Fraser Institute23 hours ago

Fraser Institute23 hours agoBill Maher is right about Canadian health care

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoDesperate Liberals move to stop MPs from calling Trudeau ‘corrupt’