Energy

The Real Threat to Banks Isn’t From Climate Change. It’s From Bankers.

Over the last two years, some of the world’s most powerful and influential bankers and investors have argued that climate change poses a grave threat to financial markets and that nations must switch urgently from using fossil fuels to using renewables.

In 2019, the Federal Reserve Bank of San Francisco warned that climate change could cause banks to stop lending, towns to lose tax revenue, and home values to decline. Last year, 36 pension fund managers representing $1 trillion in assets said climate change “poses a systemic threat to financial markets and the real economy.”

And upon taking office, President Joe Biden warned government agencies that climate change disasters threatened retirement funds, home prices, and the very stability of the financial system.

But a major new staff report from the New York Federal Reserve Bank throws cold water on the over-heated rhetoric coming from activist investors, bankers, and politicians. “How Bad Are Weather Disasters for Banks?” asks the title of the report by three economists. “Not very,” they answer in the first sentence of the abstract.

The reason is because “weather disasters over the last quarter century had insignificant or small effects on U.S. banks’ performance.” The study looked at FEMA-level disasters between 1995 and 2018, at county-level property damage estimates, and the impact on banking revenue.

The New York Fed’s authors only looked at how banks have dealt with disasters in the past, and what they wrote isn’t likely to be the final word on the matter. The United Nations Intergovernmental Panel on Climate Change and most other scientific bodies predict that many weather events, including hurricanes and floods, which cause the greatest financial damage, are likely to become more extreme in the future, due to climate change.

And in February, The New York Times quoted one of six United States Federal Reserve governors saying, “Financial institutions that do not put in place frameworks to measure, monitor and manage climate-related risks could face outsized losses on climate-sensitive assets caused by environmental shifts.”

But the Fed economists looked separately at the most extreme 10 percent of all disasters and found that banks impacted not only didn’t suffer, “their income increases significantly with exposure,” and that the improved financial performance of banks hit by disasters wasn’t explained by increased federal disaster (FEMA) aid.

In other words, disasters are actually good for banks, since they increase demand for loans. The larger a bank’s exposure to natural disasters, the larger its profits.

Happily, the profits made by banks are trivial compared to rising societal resilience to disasters, which can be seen by the fact that the share of GDP spent on natural disasters has actually declined over the last 30 years.

While scientists expect hurricanes to become five percent more extreme they also expect them to become 25 percent less frequent, and now, new data showglobal carbon emissions actually declined over the last decade, and thus there is no longer any serious risk of a significant rise in global temperatures.

Banking Against Growth

Biden nominee Saule Omarova said she wants to bankrupt energy companies

The real risk to banks and the global economy comes from climate policy, not climate change, particularly efforts to make energy more expensive and less reliable through the greater use of renewables, new taxes, and new regulations.

“For policymakers,” warned the three economists writing for the New York Fed, “our findings suggest that potential transition risks from climate change warrant more attention than physical disaster risks.”

While they may seem like outliers, they are far from alone in expressing their concern. The second half of the quote by the Fed governor about climate change, which was hyped by The New York Times, warned that banks “could face outsized losses” from the “transition to a low-carbon economy.” (My emphasis.)

And, now concern is growing among members of Congress about the dangers of over-relying on weather-dependent energy, with some members citing the New York Fed’s report after The Wall Street Journal editorialized about it last week .

Proof of the threat to the economy from climate policy is the worst global energy crisis in 50 years. Shareholder activists played a significant role in creating it, according to analysts at Goldman Sachs, Bloomberg, and The Financial Times, by reducing investment in oil and gas production, and causing nations to over-invest in unreliable solar and wind energies, which has driven up energy prices, and contributed significantly to inflation.

And yet a crucial Biden Administration nominee for bank regulation has openly said she would like to bankrupt firms that produce oil and gas, the two fuels whose scarcity is causing the global energy crisis. Progressive academic, Saule Omarova, nominated by Biden, said recently that “we want [oil and gas firms] to go bankrupt” and that “the way we basically get rid of these carbon financiers is we starve them of their source of capital.

Omarova is not an outlier. The Biden Administration’s Financial Stability Oversight Council (FSOC) is advocating 30 new climate regulations that should be imposed on banking. Many analysts believe the US Securities and Exchange Commission will require new regulations. The goal is to radically alter how America’s banks lend money, the energy sector, and the economy as a whole.

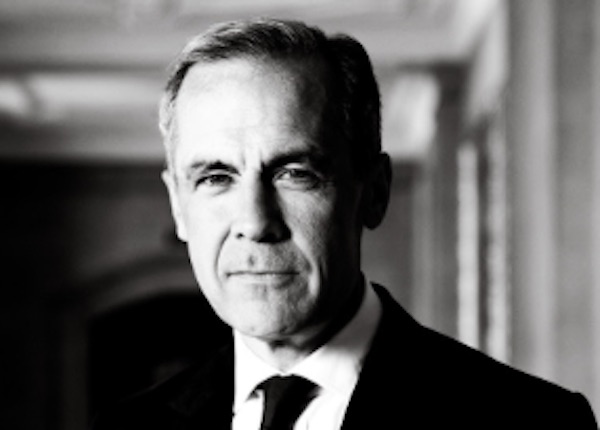

And former Bank of England chief, Mark Carney, co-chair of the Glasgow Financial Alliance for Net Zero, has organized $130 trillion in investment and said recently that his investors should expect to make higher, not lower, returns than the market. How? In the exact same way Omarova predicted: by bankrupting some companies, and financing other ones, through government regulations and subsidies.

Carney created the Glasgow Financial Alliance, or GFANZ, with Michael Bloomberg, and they did so under the official seal of the United Nations. “Carney said the alliance will put global finance on a trajectory that ultimately leaves high-carbon assets facing a much bleaker future,” wrote a reporter with Bloomberg. “He also said investors in such products will see the value of their holdings sink.”

What’s going on, exactly? How is it that some of the world’s most powerful bankers, and the politicians they finance, came to support policies that threaten the stability of electrical grids, energy supplies, and thus the global economy itself?

Donate to Environmental Progress

The Unseen Order

Tom Steyer, Michael Bloomberg, and George Soros

Three of the largest donors to climate change causes are billionaire financial titans Michael Bloomberg, George Soros, and Tom Steyer, all of whom have significant investments in both renewables and fossil fuels.

Soros is worth $8 billion and recently made large investments in natural gas firms (EQT) and electric vehicles (Fisker), Bloomberg has a net worth of around $70 billion and has large investments in natural gas and renewables, and much of Steyer’s wealth derives from investments in all three main fossil fuels—coal, oil, and natural gas — as well as renewables.

All three men finance climate activists and politicians, including President Biden, who then seek policies — from $500 billion for renewables and electric vehicles over the next decade to federal control over state energy systems to banking regulations to bankrupt oil and gas companies — which would benefit each of them personally.

Bloomberg gave over $100 million to Sierra Club to lobby to shut down coal plants after he had taken a large stake in its replacement, natural gas, and operates one of the largest news media companies in the world, which publishes articles and sends emails nearly every day reporting that climate change threatens the economy, and that solar panels and wind turbines are the only cost-effective solution.

Soros donates heavily to Center for American Progress, whose founder, John Podesta, was chief of staff to Bill Clinton, campaign chairman for Hillary Clinton’s presidential campaign, and who currently runs policy at the Biden White House. So too does Steyer, who funds the climate activist organization founded by New Yorker author Bill McKibben, 350.org, which reported revenues of nearly $20 million in 2018.

The most influential environmental organization among Democrats and the Biden Administration is the Natural Resources Defense Council, NRDC, which advocated for federal control of state energy markets, the $500 billion for electric cars and renewables, and international carbon markets that would be controlled by the bankers and financiers who also donate to it.

In the 1990s, NRDC helped energy trading company Enron to distribute hundreds of thousands of dollars to environmental groups. “On environmental stewardship, our experience is that you can trust Enron,” said NRDC’s Ralph Cavanagh in 1997, even though Enron executives at the time were defrauding investors of billions of dollars in an epic criminal conspiracy, which in 2001 bankrupted the company.

From 2009 to 2011, NRDC advocated for and helped write complex cap-and-trade climate legislation that would have created and allowed some of their donors to take advantage of a carbon-trading market worth upwards of $1 trillion.

NRDC created and invested $66 million of its own money in a BlackRock stock fund that invested heavily in natural gas companies, and in 2014 disclosed that it had millions invested in renewable funds.

Former NRDC head, Gina McCarthey, now heads up Biden’s climate policy team, and Biden’s top economic advisor, Brian Deese, last worked at BlackRock, and almost certainly will return at the end of the Biden Administration.

Money buys influence. In 2019, McKibben called Steyer a “climate champ” when Steyer announced he was running for president, adding that Steyer’s “just-released climate policy is damned good!” And in 2020, McKibben wrote an article called, “How Banks Could Bail Us Out of the Climate Crisis,” for The New Yorker, which repeated the claim that extreme weather created by climate change threatens financial interests, and that the way to prevent it is to divert public and private money away from reliable energy sources toward weather-dependent ones.

Forms filed to the Internal Revenue Service by Steyer’s philanthropic organization, the TomKat Charitable Trust, show that it gave McKibben’s climate activist group, 350.org, $250,000 in 2012, 2014, and 2015, and may have given money to 350.org in 2013, 2016, 2017, 2018, 2019, and 2020, as well, because 350.org thanked either Steyer’s philanthropy, TomKat Foundation, or his organization, NextGen America, in each of its annual reports since 2013.

At the same time, McKibben’s motivations are plainly spiritual. He claims that various natural disasters are caused by humans, that climate change literally threatens life on Earth, and is thus “greatest challenge humans have ever faced,” a statement so unhinged from reality, considering declining deaths from disasters, declining carbon emissions, and the total absence of any science for such a claim, that it must be considered religious.

McKibben first book about climate change, The End of Nature, explicitly expressed his spiritual views, arguing that, through capitalist industrialization, humankind had lost its connection to nature. “We can no longer imagine that we are part of something larger than ourselves,” he wrote in The End of Nature. “That is what this all boils down to.” Indeed, for William James, the belief in “an unseen order” that we must adjust ourselves to, in order to avoid future punishment, is a defining feature of religion.

Climate change is punishment for our sins against nature — that’s the basic narrative pushed by journalists, climate activists, and their banker sponsors, for 30 years. It has a supernatural element: the belief that natural disasters are getting worse, killing millions, and threatening the economy, when in reality they are getting better, killing fewer, and costing less. And it offers redemption: to avoid punishment we must align our behavior with the unseen order, namely, a new economy controlled by the U.N., bankers, and climate activists. Unfortunately, as is increasingly obvious, the unseen order is parasitical and destructive.

When Nuclear Leads, the Bankers Will Follow

Former German Chancellor Angela Merkel, French President Emanuel Macron, and U.S. Energy Secretary Jennifer Granholm

The unseen order of bankers, climate activists, and the news media is so powerful that it is difficult to imagine how it could ever be challenged.

The financial might of the climate lobby covers the wealth not only of billionaires Soros, Steyer, and Bloomberg, but also $130 trillion in investment funds, including many of the world’s largest pension funds, such as the one belonging to California public employees. The climate lobby’s political power is equally awesome, covering the entirety of the Democratic Party and a significant portion of the Republican Party, and most center-Left parties in Europe.

And all of that is sustained by cultural power, which has led many elites to view climate change as the world’s number one issue, has convinced half of all humans that climate change will make our species extinct, and has served as the apocalyptic foundation for Woke religion.

But serious cracks in the foundation are growing. The global energy crisis has revealed for many around the world the limits of unreliable renewables, with European governments having to subsidize energy to avoid public backlash, President Biden and other heads of state opening up emergency petroleum reserves, and all nations begging OPEC to produce more energy.

The blackouts and rising unreliability of electricity in California, along with the work of the pro-nuclear movement over the last 6 years, has resulted in a growing number of Democrats supporting nuclear energy. Energy Secretary Jennifer Granholm last week publicly urged California Governor Gavin Newsom not to close California’s Diablo Canyon nuclear plant, the signature nuclear plant Environmental Progress has been trying to save since 2016. Democratic support in particular for nuclear is growing.

And alternative media including Substack, podcasts, and social media platforms are increasingly providing a counterweight to the mainstream news media, exposing a huge number of issues that the media got wrong in recent years, and amplifying alternative voices.

Nowhere is the change occurring faster than in Europe, where energy shortages are affecting heating, cooking, and electricity supplies in ways that undermine the legitimacy of the banker-led climate efforts. In Britain, private energy companies have gone bankrupt, forcing the government to bail them out. For-profit energy companies, like banks, ultimately depend on taxpayers, who are also voters.

Outgoing German Chancellor Angela Merkel, who led her nation’s exit from nuclear energy, acknowledged that Germany had been defeated in its anti-nuclear energy advocacy at the European Union level, and that nuclear would finally be recognized as low-carbon.

Donate to Environmental Progress

And French president Emanuel Macron, under pressure from the political right as voters look to elections next year, gave a passionate speech in favor of nuclear energy last month, announcing $35 billion for new reactors.

As the world returns to nuclear, policymakers, media elites, and climate advocates will be increasingly confronted with the question of why consumers and taxpayers will benefit from a global carbon trading scheme and more weather-dependent renewables, particularly at a time of declining global emissions from the continuing transition from coal to natural gas, reduced deforestation, and increased reforestation.

Simply building more nuclear power plants means there is no climate change justification for weather-dependent renewables, which actually require greater use of natural gas, in order to deal with the high amount of unreliability.

Nuclear power goes with slow and patient capital. The obvious funders of a nuclear expansion in the West would be the pension funds, which need the secure return on investment that major construction and infrastructure projects provide, and which unreliable renewables, as the energy crisis shows, do not.

And though the news media is currently ignoring the New York Fed’s report, reporters will not be able to continue spreading misinformation about climate change indefinitely. Increasingly, they, and thus policymakers and the public, will be forced to confront facts inconvenient to their narrative, including that humans are adapting remarkably well to climate change, that renewables make energy unreliable and expensive, and that only nuclear can achieve sustainability goals of reduced emissions, material throughput, and land use.

As people ask, “How Bad Are Weather Disasters?”, not just for banks, but for all of us, the answer will increasingly come back, “Not very.”

Energy

Liberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

From Energy Now

By Margareta Dovgal

Playing politics with pipelines is a time-honored Canadian tradition. Recent events in the House of Commons offered a delightful twist on the genre.

The Conservatives introduced a motion quoting the Liberals’ own pipeline promises laid out in the Memorandum of Understanding (MOU) with Alberta, nearly verbatim. The Liberals, true to form, killed it 196–139 with enthusiastic help from the NDP, Bloc, and Greens.

We all knew how this would end. Opposition motions like this never pass; no government, especially not one led by Mark Carney, is going to let the opposition dictate the agenda. There’s not much use feigning outrage that the Liberals voted it down. The more entertaining angle has been watching closely as Liberal MPs twist themselves into pretzels explaining why they had to vote “no” on a motion that cheers on a project they claim to support in principle.

Liberal MP Corey Hogan dismissed the motion as “game-playing” designed to “poke at people”.

And he’s absolutely right to call it a “trap” for the Liberals. But traps only work when you walk into them.

Indigenous Services Minister Mandy Gull-Masty deemed the motion an “immature waste of parliamentary time” and “clearly an insult towards Indigenous Peoples” because it didn’t include every clause of the original agreement. Energy Minister Tim Hodgson decried it as a “cynical ploy to divide us” that “cherry-picked” the MOU.

Yet the prize for the most tortured metaphor goes to the prime minister himself. Defending his vote against his own pipeline promise, Carney lectured the House that “you have to eat the entire meal, not just the appetizer.”

It’s a clever line, and it also reveals the problem. The “meal” Carney is serving is stuffed with conditions. Environmental targets or meaningful engagement with Indigenous communities aren’t unrealistic asks. A crippling industrial carbon price as a precondition might be though.

But the prime minister has already said the quiet part out loud.

Speaking in the House a few weeks ago, Carney admitted that the agreement creates “necessary conditions, but not sufficient conditions,” before explicitly stating: “We believe the government of British Columbia has to agree.”

There is the poison pill. Handing a de facto veto to a provincial government that has spent years fighting oil infrastructure is neither constitutionally required nor politically likely. Elevating B.C.’s “agreement” to a condition, which is something the MOU text itself carefully avoids doing, means that Carney has made his own “meal” effectively inedible.

Hodgson’s repeated emphasis that the Liberal caucus supports “the entire MOU, the entire MOU” only reinforces this theory.

This entire episode forces us to ask whether the MOU is a real plan to build a pipeline, or just a national unity play designed to cool down the separatist temperature in Alberta. My sense is that Ottawa knew they had to throw a bone to Premier Danielle Smith because the threat of the sovereignty movement is gaining real traction. But you can’t just create the pretense of negotiation to buy time.

With the MOU getting Smith boo’ed at her own party’s convention by the separatists, it’s debatable whether that bone was even an effective one to throw.

There is a way. The federal government has the jurisdiction. If they really wanted to, they could just do it, provided the duty to consult with and accommodate Indigenous peoples was satisfied. Keep in mind: no reasonable interpretation equates Section 35 of the Charter to a veto.

Instead, the MOU is baked with so many conditions that the Liberals have effectively laid the groundwork for how they’re going to fail.

With overly-hedged, rather cryptic messaging, Liberals have themselves given considerable weight to a cynical theory, that the MOU is a stalling tactic, not a foundation to get more Canadian oil to the markets it’s needed in. Maybe Hodgson is telling the truth, and caucus is unified because the radicals are satisfied that “the entire MOU” ensures that a new oil pipeline will never reach tidewater through BC.

So, hats off to the legislative affairs strategists in the Conservative caucus. The real test of Carney’s political power continues: can he force a caucus that prefers fantasy economics into a mold of economic literacy to deliver on the vision Canadians signed off on? Or will he be hamstrung trying to appease the radicals from within?

Margareta Dovgal is managing director of Resource Works Society.

Daily Caller

Paris Climate Deal Now Decade-Old Disaster

From the Daily Caller News Foundation

By Steve Milloy

The Paris Climate Accord was adopted 10 years ago this week. It’s been a decade of disaster that President Donald Trump is rightly trying again to end.

The stated purpose of the agreement was for countries to voluntarily cut emissions to avoid the average global temperature exceeding the (guessed at) pre-industrial temperature by 3.6°F (2°C) and preferably 2.7°F (1.5°C).

Since December 2015, the world spent an estimated $10 trillion trying to achieve the Paris goals. What has been accomplished? Instead of reducing global emissions, they have increased about 12 percent. While the increase in emissions is actually a good thing for the environment and humanity, spending $10 trillion in a failed effort to cut emissions just underscores the agreement’s waste, fraud and abuse.

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

But wasting $10 trillion is only the tip of the iceberg.

The effort to cut emissions was largely based on forcing industrial countries to replace their tried-and-true fossil fuel-based energy systems with not-ready-for-prime-time wind, solar and battery-based systems. This forced transition has driven up energy costs and made energy systems less reliable. The result of that has been economy-crippling deindustrialization in former powerhouses of Germany and Britain.

And it gets worse.

European nations imagined they could reduce their carbon footprint by outsourcing their coal and natural gas needs to Russia. That outsourcing enriched Russia and made the European economy dependent on Russia for energy. That vulnerability, in turn, and a weak President Joe Biden encouraged Vladimir Putin to invade Ukraine.

The result of that has been more than one million killed and wounded, the mass destruction of Ukraine worth more than $500 billion so far and the inestimable cost of global destabilization. Europe will have to spend hundreds of billions more on defense, and U.S. taxpayers have been forced to spend hundreds of billions on arms for Ukraine. Putin has even raised the specter of using nuclear weapons.

President Barack Obama unconstitutionally tried to impose the Paris agreement on the U.S. as an Executive agreement rather than a treaty ratified by the U.S. Senate. Although Trump terminated the Executive agreement during his first administration, President Joe Biden rejoined the agreement soon after taking office, pledging to double Obama’s emissions cuts pledge to 50 percent below 2005 levels by 2030.

Biden’s emissions pledge was an impetus for the 2022 Inflation Reduction Act that allocated $1.2 trillion in spending for what Trump labeled as the Green New Scam. Although Trump’s One Big Beautiful Bill Act reduced that spending by about $500 billion and he is trying to reduce it further through Executive action, much of that money was used in an effort to buy the 2024 election for Democrats. The rest has been and will be used to wreck our electricity grid with dangerous, national security-compromising wind, solar and battery equipment from Communists China.

Then there’s this. At the Paris climate conference in 2015, U.S. Secretary of State John Kerry stated quite clearly that emissions cuts by the U.S. and other industrial countries were meaningless and would accomplish nothing since the developing world’s emissions would be increasing.

Finally, there is the climate realism aspect to all this. After the Paris agreement was signed and despite the increase in emissions, the average global temperature declined during the years from 2016 to 2022, per NOAA data.

The super El Nino experienced during 2023-2024 caused a temporary temperature spike. La Nina conditions have now returned the average global temperature to below the 2015-2016 level, per NASA satellite data. The overarching point is that any “global warming” that occurred over the past 40 years is actually associated with the natural El Nino-La Nina cycle, not emissions.

The Paris agreement has been all pain and no gain. Moreover, there was never any need for the agreement in the first place. A big thanks to President Trump for pulling us out again.

Steve Milloy is a biostatistician and lawyer. He posts on X at @JunkScience.

-

Business1 day ago

Business1 day agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

Daily Caller2 days ago

Daily Caller2 days agoParis Climate Deal Now Decade-Old Disaster

-

Energy1 day ago

Energy1 day agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

Indigenous2 days ago

Indigenous2 days agoResidential school burials controversy continues to fuel wave of church arsons, new data suggests

-

Alberta2 days ago

Alberta2 days agoAlberta’s huge oil sands reserves dwarf U.S. shale

-

International2 days ago

International2 days agoFBI didn’t think it had cause to raid Trump but DOJ did it anyway

-

Daily Caller2 days ago

Daily Caller2 days agoHegseth Planning Huge Shakeup Of Top Military Command: REPORT