Energy

Strong domestic supply chain an advantage as Canada moves ahead with new nuclear

From the MacDonald Laurier Institute

By Sasha Istvan

Canada has two major advantages. We produce uranium and we have an established supply chain.

The pledge from 22 countries, including Canada, to collectively triple nuclear capacity by 2050 drew cheers and raised eyebrows at the United Nations Climate Change Conference last fall in Dubai. Climate commitments are no stranger to bold claims. So, the question remains, can it be done?

In Canada, we are well on our way with successful and ongoing refurbishments of Ontario’s existing nuclear fleet and planning for the development of small modular reactors, or SMRs, in Ontario, New Brunswick, Saskatchewan and most recently Alberta.

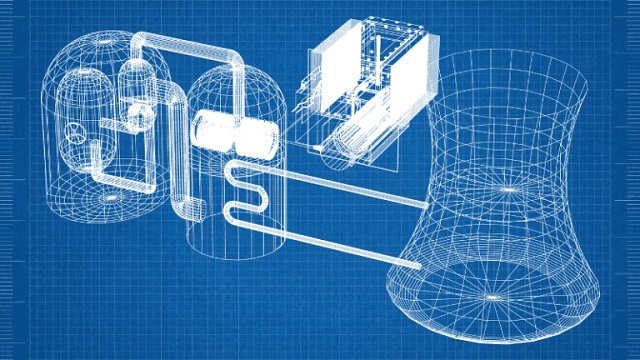

The infrastructure required to generate nuclear energy is significant. You not only need engineers and technicians working at a plant, but the supply chain to support it.

Over five decades worth of nuclear generation has allowed Canada to build a world class supply chain. Thus far it has focused on servicing CANDU reactors, but now we have the potential to expand into SMRs.

I first became interested in the CANDU reactor after working as a manufacturing engineer for one of the major fuel and tooling suppliers of Ontario Power Generation and Bruce Power. I witnessed firsthand the sophistication and quality of the nuclear supply chain in Ontario, being particularly impressed by the technical expertise and skilled workers in the industry.

The CANDU reactor is the unsung hero of the Canadian energy industry: one of the world’s safest nuclear reactors, exported around the world, and producing around 60 per cent of Ontario’s electricity, as well as 40 per cent of New Brunswick’s.

Having visited machine shops across Ontario, it’s evident that Canadians should take pride that the expertise and technology required for the safe generation of nuclear energy is available here in Canada.

As Canada looks to grow its nuclear output to achieve net-zero goals, its well-established engineering and manufacturing capabilities can make it a leader in the global expansion of nuclear energy as other nations work to make their COP28 declaration a reality.

Canada has two major advantages. The first is that it is a globally significant producer of uranium. We already export uranium from our incredible reserves in northern Saskatchewan and fabricate unenriched uranium fuel for CANDU. Canadian uranium will be an important ingredient in the success and sustainability of a nuclear renaissance, especially for our allies.

The second is that we have an established and active supply chain. While new nuclear builds have slowed dramatically in the western world — a result of the fallout from Chernobyl and Fukushima, as well as competition from cheap natural gas — Bruce Power and OPG are in the midst of major refurbishments to extend their operations until 2064 and 2055, respectively.

Bruce Power has successfully completed the first unit refurbishment on schedule and within budget, with ongoing work on the second unit. OPG has accomplished refurbishments for two out of its four units at Darlington, with the latest unit completed ahead of schedule and under budget. These multibillion-dollar refurbishments have actually grown our nuclear supply chain and demonstrate that it’s firing on all cylinders.

SMRs are the next phase of nuclear technology. Their size and design make them well suited for high production and modular construction. Investing in the supply chain for SMRs now positions Canada for significant economic gains.

OPG plans to build four GE-Hitachi BWRX-300 reactors, with the first slated for service as early as 2028. This first-of-a-kind investment will help identify and overcome design challenges and develop its own supply chain. That will benefit not only their project but those that follow suit.

SaskPower is planning to proceed with the same SMR design, as well as the first pilot globally of the Westinghouse eVinci microreactor; New Brunswick is moving ahead with the ARC-100, both for its existing nuclear site at Point Lepreau as well as in the Port of Belledune; and OPG and Capital Power recently announced a partnership to explore a nuclear reactor in Alberta, including the potential for the BWRX-300.

While the bulk of the nuclear supply chain is currently located in Ontario, other provinces have already been investing in the development of local capacity.

All this activity sets Canada up to leverage first-mover advantage and become a significant global provider of BWRX-300 components. Canada will not only see the economic benefits during initial construction but also through sustained demand for replacement parts in the future.

Nuclear energy has already made a significant contribution to the Canadian economy. In 2019, a study commissioned by the Canadian Nuclear Association and the Organization of Canadian Nuclear Industries showed that the nuclear industry accounted for $17 billion of Canada’s annual GDP annually and has created over 76,000 jobs.

Notably, 89 per cent of these positions were classified as high-skilled, and over 40 per cent of the workforce was under 40. This study, conducted before the announcement of SMR plans, was followed by a more recent report from the Conference Board of Canada on the economic impact of OPG’s SMR initiatives. The study found that the construction of just four SMRs at OPG could boost the Canadian GDP by $15.3 billion (2019 dollars) over 65 years and sustain approximately 2,000 jobs annually during that period.

Public perception of nuclear is improving. In 2023, the percentage of Canadians wanting to see further development of nuclear power generation in Canada grew to 57 per cent compared with 51 per cent in 2021.

As well, the Business Council of Canada has voiced its support for nuclear expansion, emphasizing Canada’s strategic advantages: political and public backing across the spectrum, coupled with a rich history of nuclear expertise.

Nuclear energy is dispatchable, sustainable and a proven technology. As nations move to achieve their climate goals, it has one other major benefit: a supply chain that is wholly western and in Canada’s case almost totally domestic.

While the critical minerals and manufactured goods required for batteries, wind and solar energy rely heavily on China and other politically unstable or authoritarian countries, nuclear provides energy independence. Canada is well positioned to help our allies improve their energy security with our strong, competitive nuclear supply chain.

Sasha Istvan is an engineer based in Calgary, with experience in both the nuclear supply chain and the oil and gas sector.

Alberta

Game changer: Trans Mountain pipeline expansion complete and starting to flow Canada’s oil to the world

Workers complete the “golden weld” of the Trans Mountain pipeline expansion on April 11, 2024 in the Fraser Valley between Hope and Chilliwack, B.C. The project saw mechanical completion on April 30, 2024. Photo courtesy Trans Mountain Corporation

From the Canadian Energy Centre

By Will Gibson

‘We’re going to be moving into a market where buyers are going to be competing to buy Canadian oil’

It is a game changer for Canada that will have ripple effects around the world.

The Trans Mountain pipeline expansion is now complete. And for the first time, global customers can access large volumes of Canadian oil, with the benefits flowing to Canada’s economy and Indigenous communities.

“We’re going to be moving into a market where buyers are going to be competing to buy Canadian oil,” BMO Capital Markets director Randy Ollenberger said recently, adding this is expected to result in a better price for Canadian oil relative to other global benchmarks.

The long-awaited expansion nearly triples capacity on the Trans Mountain system from Edmonton to the West Coast to approximately 890,000 barrels per day. Customers for the first shipments include refiners in China, California and India, according to media reports.

Shippers include all six members of the Pathways Alliance, a group of companies representing 95 per cent of oil sands production that together plan to reduce emissions from operations by 22 megatonnes by 2030 on the way to net zero by 2050.

The first tanker shipment from Trans Mountain’s expanded Westridge Marine Terminal is expected later in May.

Photo courtesy Trans Mountain Corporation

Photo courtesy Trans Mountain Corporation

The new capacity on the Trans Mountain system comes as demand for Canadian oil from markets outside the United States is on the rise.

According to the Canada Energy Regulator, exports to destinations beyond the U.S. have averaged a record 267,000 barrels per day so far this year, up from about 130,000 barrels per day in 2020 and 33,000 barrels per day in 2017.

“Oil demand globally continues to go up,” said Phil Skolnick, New York-based oil market analyst with Eight Capital.

“Both India and China are looking to add millions of barrels a day of refining capacity through 2030.”

In India, refining demand will increase mainly for so-called medium and heavy oil like what is produced in Canada, he said.

“That’s where TMX is the opportunity for Canada, because that’s the route to get to India.”

Led by India and China, oil demand in the Asia-Pacific region is projected to increase from 36 million barrels per day in 2022 to 52 million barrels per day in 2050, according to the U.S. Energy Information Administration.

More oil coming from Canada will shake up markets for similar world oil streams including from Russia, Ecuador, and Iraq, according to analysts with Rystad Energy and Argus Media.

Expanded exports are expected to improve pricing for Canadian heavy oil, which “have been depressed for many years” in part due to pipeline shortages, according to TD Economics.

Photo courtesy Trans Mountain Corporation

Photo courtesy Trans Mountain Corporation

In recent years, the price for oil benchmark Western Canadian Select (WCS) has hovered between $18-$20 lower than West Texas Intermediate (WTI) “to reflect these hurdles,” analyst Marc Ercolao wrote in March.

“That spread should narrow as a result of the Trans Mountain completion,” he wrote.

“Looking forward, WCS prices could conservatively close the spread by $3–4/barrel later this year, which will incentivize production and support industry profitability.”

Canada’s Parliamentary Budget Office has said that an increase of US$5 per barrel for Canadian heavy oil would add $6 billion to Canada’s economy over the course of one year.

The Trans Mountain Expansion will leave a lasting economic legacy, according to an impact assessment conducted by Ernst & Young in March 2023.

In addition to $4.9 billion in contracts with Indigenous businesses during construction, the project leaves behind more than $650 million in benefit agreements and $1.2 billion in skills training with Indigenous communities.

Ernst & Young found that between 2024 and 2043, the expanded Trans Mountain system will pay $3.7 billion in wages, generate $9.2 billion in GDP, and pay $2.8 billion in government taxes.

Energy

Market Realities Are Throwing Wrench In Biden’s Green Energy Dreams

From the Daily Caller News Foundation

From the Daily Caller News Foundation

For two years now, I and others have been pointing out the reality that there is no real “energy transition” happening around the world. Two new items of information came to light this week that irrevocably prove the point.

It is true that governments across the western world appear to be working to bankrupt their countries by pouring trillions of debt-funded dollars, Euros and British pounds into central planning efforts to subsidize renewables and electric vehicles into existence. That reality cannot be denied. The trouble is that no amount of debt money can turn the markets and the markets aren’t cooperating.

Despite all the government largesse that has spurred major additions of wind and solar generation capacity, those weather-reliant energy sources can’t even keep up with the pace of rising demand for electricity. As a result, the markets dictated that the world consumed record levels of coal, natural gas, oil and even wood during 2023. Yes, we are still burning vast amounts of wood for electricity, despite an alleged “transition” from wood to coal which began 500 years ago.

That is reality, dictated by the markets.

Two new bits of data came to light this week that pound the final nails into the coffin of the narrative around the energy transition. A report in the Financial Times, citing data compiled by Grid Strategies, reveals that the buildout of new high-voltage transmission lines in the United States slowed to a trickle in 2023, with just 55.5 additional miles installed. That collapse comes despite the Biden government’s recognition that a massive expansion of this type of transmission lines must happen to accommodate the demands of any true “transition” to renewables.

The Financial Times quotes a 2023 assessment by the Department of Energy that found that “regional transmission must more than double and interregional transmission must grow more than fivefold by 2035 to meet decarbonization targets.” DOE admits such a pace would add more than 50,000 miles of new transmission in just 11 years, which is almost 1,000 times the pace of adds during 2023. Yikes.

A crucial aspect of that DOE study to understand is that it was conducted before we began to understand the true magnitude of additional power demands that will result from the explosive growth of AI technology just now starting to come to full bloom. It was just this past January, at the WEF Forum in Davos, where OpenAI CEO Sam Altman told the audience he believes generation capacity on the grid will have to double over the next decade just to fill the AI demands alone. That is what is needed in addition to the rising demands for EV charging, industrial growth, population growth and economic growth.

The second piece of compelling data arising this week comes from a Bloomberg story headlined, “Data Centers Now Need a Reactor’s Worth of Power, Dominion Says.” The key thing to understand about this story is that the piece is only referencing the needs of planned new data centers being built in Northern Virginia to feed AI development in that tiny sliver of the United States.

This key excerpt from the story says it all: “Over the past five years, Dominion has connected 94 data centers that, together, consume about four gigawatts of electricity, Blue said. That means that just two or three of the data center campuses now being planned could require as much electricity as all the centers Dominion hooked up since about 2019.”

That is not just rapid growth, it is exponential growth in power demand from a single developing technology.

Demand growth needs such as this aren’t going to be filled by unpredictable, unreliable, weather-dependent generation like windmills and solar arrays. And let’s face it: The United States is not going to be able to continue expanding renewables without finding some way to create a massive expansion of transmission. Why build the generation if you can’t move the electricity?

What it all means is that all the grand Biden Green New Deal plans to shut down America’s remaining coal fleet and much of its natural gas generation fleet are going to have to wait, because the market will not allow them. That’s reality, and reality does not care about anyone’s green transition dreams.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

-

conflict1 day ago

conflict1 day agoOver 200 Days Into War, Family Of American Hostage in Gaza Strives For Deal To Bring Son Home

-

Energy2 days ago

Energy2 days agoMarket Realities Are Throwing Wrench In Biden’s Green Energy Dreams

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoBook Burning Goes Digital

-

Brownstone Institute16 hours ago

Brownstone Institute16 hours agoThe Predictable Wastes of Covid Relief

-

Alberta8 hours ago

Alberta8 hours agoGame changer: Trans Mountain pipeline expansion complete and starting to flow Canada’s oil to the world

-

Addictions7 hours ago

Addictions7 hours agoCanada’s ‘safer supply’ patients are receiving staggering amounts of narcotics

-

Community5 hours ago

Community5 hours agoLast Day: What would you do with $20,000 Early Bird Prize?

-

conflict3 hours ago

conflict3 hours agoImmigration Experts Warn Possible Biden Plan To Import Gazan Refugees Would Be ‘National Security Disaster’