Alberta

Second presumptive COVID-19 case reported in Alberta

Alberta’s chief medical officer of health has confirmed the province’s second presumptive case of novel coronavirus, officially known as COVID-19.

The individual is a male in his forties who lives in the Edmonton zone. The case is travel-related and he is recovering in isolation at home with support from public health officials.

“While I know some Albertans may be concerned by a second case, this is not unexpected. The risk to Albertans is still considered low. We have already isolated this individual and are taking swift action to implement immediate precautions to prevent the infection from spreading.”

“I have full confidence that our front-line health-care workers are ready and able to handle this challenge. Thanks to Alberta’s focused preparations, this case has been quickly identified and all the immediate first steps required to protect the public and our front-line health-care staff are being taken.”

The affected individual recently returned from travel in the United States. He had visited Michigan, Illinois, and Ohio, before returning to Alberta on Feb 28. He is currently in isolation at home.

The case was detected on March 6. Health officials are currently identifying close contacts of this individual and will be asking them to self-isolate at home, away from the public. They will be closely monitored by public health officials. If they do develop symptoms, health officials will coordinate getting them into care immediately while ensuring that the public and health-care workers are not exposed.

Effective immediately, Alberta will be expanding its testing protocols. All travellers returning from outside of Canada are advised to monitor their symptoms. If they experience flu-related symptoms, such as a fever or a cough, they should self-isolate and call Health Link at 811 to arrange followup testing. Returning travellers should not visit emergency departments or urgent care centres for testing. Calling 811 is the best way to get quick assessment and testing.

This applies only to returning travellers who are symptomatic with fever, or cough.

The risk of exposure is still considered low in Alberta, however this may change over the coming weeks, and if it does, we will communicate this to Albertans.

Alberta Health and Alberta Health Services will continue to closely monitor the situation, conduct surveillance and appropriate laboratory testing, and provide public health and infection control guidance.

Quick facts

- The most important measures that Albertans can take to prevent respiratory illnesses, including COVID-19, is to practise good hygiene.

- This includes cleaning your hands regularly, avoiding touching your face, coughing or sneezing into your elbow or sleeve, disposing of tissues appropriately, and staying home and away from others if you are sick.

- Anyone who has health concerns or is experiencing symptoms of COVID-19 should contact Health Link 811 to see if followup testing is required.

- For recommendations on protecting yourself and your community, visit alberta.ca/COVID19.

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

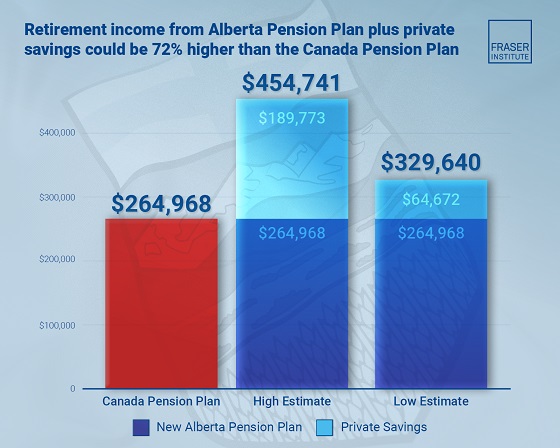

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Energy21 hours ago

Energy21 hours agoActivists using the courts in attempt to hijack energy policy

-

National14 hours ago

National14 hours agoCanada’s immigration office admits it failed to check suspected terrorists’ background

-

conflict14 hours ago

conflict14 hours agoTrump’s done waiting: 50-day ultimatum for Putin to end Ukraine war