Economy

If Canadian families spent and borrowed like the federal government, they would be $427,759 in debt

From the Fraser Institute

By Grady Munro and Jake Fuss

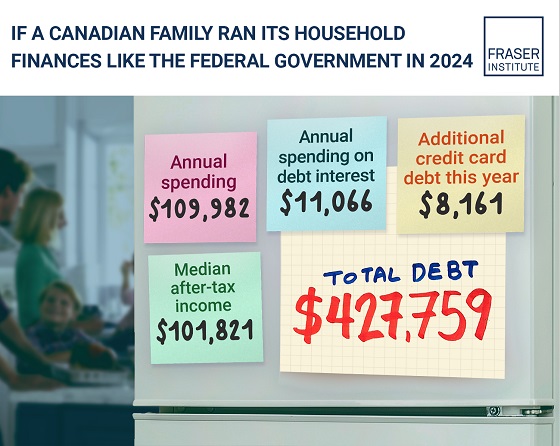

If the median Canadian family spent and borrowed like the federal government, they would already be $427,759 in debt and continuing to borrow, finds a new study published today by the Fraser Institute.

“If the median family in Canada spent and borrowed like the federal government, they would be in serious financial trouble,” said Grady Munro, a Fraser Institute policy analyst and co-author of Understanding the Scale of Canada’s Federal Deficit.

The $39.8 billion deficit expected by Ottawa in 2024/25 represents the 17th consecutive annual federal deficit, with continued deficits expected into the foreseeable future, eventually resulting in higher taxes for Canadians.

Continuous annual borrowing by Ottawa to finance increased spending has driven federal total debt from 53.0 per cent of the economy ($1.1 trillion) in 2014/15 up to an expected 69.8 per cent ($2.1 trillion) in 2024/25.

To put this into perspective, the study’s analysis offers an example of what a median family’s household finances would look like if they were to spend and borrow like the federal government in 2024.

The study found that the median Canadian family in 2024 would spend $109,982 while only earning $101,821, meaning that it would borrow $8,161 just to pay for its normal spending. This $8,000-plus in additional debt is on top of the $427,759 in existing debt the family would already hold based on previous borrowing.

Illustrative of the burden of debt, $11,066 of the family’s income, representing almost 11 per cent, would be spent on just the interest costs of existing debt.

“Unlike most households, where debt is often offset by assets such as a home or investments, the federal government has little in the way of assets to offset its enormous debt,” said Jake Fuss, director of fiscal policy at the Fraser Institute and coauthor. “And it’s important to note that this government debt burden on Canadian families does not include the burden of provincial and municipal government debt, which depending on one’s location, can be significant.”

- For many years the federal government’s approach to government finances has relied on spending-driven deficits and a growing debt burden, causing a deterioration in the state of federal finances.

- While deficits can sometimes be justified in certain circumstances, perpetual spending-driven deficits have become the norm rather than a temporary exception for the federal government. The $39.8 billion deficit expected in 2024/25 is the 17th consecutive annual deficit, and deficits are expected to continue into the foreseeable future.

- Deficits have helped drive federal gross debt from 53.0% of the economy ($1.1 trillion) in 2014/15 up to an expected 69.8% ($2.1 trillion) in 2024/25.

- This increase in the level of federal debt comes with costs and will result in higher taxes on Canadians.

- It may be hard to comprehend the scale of the deficits and debt, so to contextualize the current state of federal finances this bulletin provides an example of what a median family’s household budget would look like in 2024 if it managed its finances the way the federal government does.

- The median family earning $101,821 in 2024 would be spending $109,982 if it spent the way the federal government does. To cover the difference, it would put $8,161 on a credit card, despite already being $427,759 in debt.

- Of the total amount spent, $11,066 would go towards interest on the debt his year. Simply put, a Canadian family that chose to spend like the federal government would be in financial trouble.

Authors:

Business

Socialism vs. Capitalism

People criticize capitalism. A recent Axios-Generation poll says, “College students prefer socialism to capitalism.”

Why?

Because they believe absurd myths. Like the claim that the Soviet Union “wasn’t real socialism.”

Socialism guru Noam Chomsky tells students that. He says the Soviet Union “was about as remote from socialism as you could imagine.”

Give me a break.

The Soviets made private business illegal.

If that’s not socialism, I’m not sure what is.

“Socialism means abolishing private property and … replacing it with some form of collective ownership,” explains economist Ben Powell. “The Soviet Union had an abundance of that.”

Socialism always fails. Look at Venezuela, the richest country in Latin America about 40 years ago. Now people there face food shortages, poverty, misery and election outcomes the regime ignores.

But Al Jazeera claims Venezuela’s failure has “little to do with socialism, and a lot to do with poor governance … economic policies have failed to adjust to reality.”

“That’s the nature of socialism!” exclaims Powell. “Economic policies fail to adjust to reality. Economic reality evolves every day. Millions of decentralized entrepreneurs and consumers make fine tuning adjustments.”

Political leaders can’t keep up with that.

Still, pundits and politicians tell people, socialism does work — in Scandinavia.

“Mad Money’s Jim Cramer calls Norway “as socialist as they come!”

This too is nonsense.

“Sweden isn’t socialist,” says Powell. “Volvo is a private company. Restaurants, hotels, they’re privately owned.”

Norway, Denmark and Sweden are all free market economies.

Denmark’s former prime minister was so annoyed with economically ignorant Americans like Bernie Sanders calling Scandanavia “socialist,” he came to America to tell Harvard students that his country “is far from a socialist planned economy. Denmark is a market economy.”

Powell says young people “hear the preaching of socialism, about equality, but they don’t look on what it actually delivers: poverty, starvation, early death.”

For thousands of years, the world had almost no wealth creation. Then, some countries tried capitalism. That changed everything.

“In the last 20 years, we’ve seen more humans escape extreme poverty than any other time in human history, and that’s because of markets,” says Powell.

Capitalism makes poor people richer.

Former Rep. Jamaal Bowman (D-N.Y.) calls capitalism “slavery by another name.”

Rep. Alexandria Ocasio-Cortez (D-N.Y.) claims, “No one ever makes a billion dollars. You take a billion dollars.”

That’s another myth.

People think there’s a fixed amount of money. So when someone gets rich, others lose.

But it’s not true. In a free market, the only way entrepreneurs can get rich is by creating new wealth.

Yes, Steve Jobs pocketed billions, but by creating Apple, he gave the rest of us even more. He invented technology that makes all of us better off.

“I hope that we get 100 new super billionaires,” says economist Dan Mitchell, “because that means 100 new people figured out ways to make the rest of our lives better off.”

Former Labor Secretary Robert Reich advocates the opposite: “Let’s abolish billionaires,” he says.

He misses the most important fact about capitalism: it’s voluntary.

“I’m not giving Jeff Bezos any money unless he’s selling me something that I value more than that money,” says Mitchell.

It’s why under capitalism, the poor and middle class get richer, too.

“The economic pie grows,” says Mitchell. “We are much richer than our grandparents.”

When the media say the “middle class is in decline,” they’re technically right, but they don’t understand why it’s shrinking.

“It’s shrinking because more and more people are moving into upper income quintiles,” says Mitchell. “The rich get richer in a capitalist society. But guess what? The rest of us get richer as well.”

I cover more myths about socialism and capitalism in my new video.

Business

Residents in economically free states reap the rewards

From the Fraser Institute

A report published by the Fraser Institute reaffirms just how much more economically free some states are compared with others. These are places where citizens are allowed to make more of their economic choices. Their taxes are lighter, and their regulatory burdens are easier. The benefits for workers, consumers and businesses have been clear for a long time.

There’s another group of states to watch: “movers” that have become much freer in recent decades. These are states that may not be the freest, but they have been cutting taxes and red tape enough to make a big difference.

How do they fare?

I recently explored this question using 22 years of data from the same Economic Freedom of North America index. The index uses 10 variables encompassing government spending, taxation and labour regulation to assess the degree of economic freedom in each of the 50 states.

Some states, such as New Hampshire, have long topped the list. It’s been in the top five for three decades. With little room to grow, the Granite State’s level of economic freedom hasn’t budged much lately. Others, such as Alaska, have significantly improved economic freedom over the last two decades. Because it started so low, it remains relatively unfree at 43rd out of 50.

Three states—North Carolina, North Dakota and Idaho—have managed to markedly increase and rank highly on economic freedom.

In 2000, North Carolina was the 19th most economically free state in the union. Though its labour market was relatively unhindered by the state’s government, its top marginal income tax rate was America’s ninth-highest, and it spent more money than most states.

From 2013 to 2022, North Carolina reduced its top marginal income tax rate from 7.75 per cent to 4.99 per cent, reduced government employment and allowed the minimum wage to fall relative to per-capita income. By 2022, it had the second-freest labour market in the country and was ninth in overall economic freedom.

North Dakota took a similar path, reducing its 5.54 per cent top income tax rate to 2.9 per cent, scaling back government employment, and lowering its minimum wage to better reflect local incomes. It went from the 27th most economically free state in the union in 2000 to the 10th freest by 2022.

Idaho saw the most significant improvement. The Gem State has steadily improved spending, taxing and labour market freedom, allowing it to rise from the 28th most economically free state in 2000 to the eighth freest in 2022.

We can contrast these three states with a group that has achieved equal and opposite distinction: California, Delaware, New Jersey and Maryland have managed to decrease economic freedom and end up among the least free overall.

What was the result?

The economies of the three liberating states have enjoyed almost twice as much economic growth. Controlling for inflation, North Carolina, North Dakota and Idaho grew an average of 41 per cent since 2010. The four repressors grew by just 24 per cent.

Among liberators, statewide personal income grew 47 per cent from 2010 to 2022. Among repressors, it grew just 26 per cent.

In fact, when it comes to income growth per person, increases in economic freedom seem to matter even more than a state’s overall, long-term level of freedom. Meanwhile, when it comes to population growth, placing highly over longer periods of time matters more.

The liberators are not unique. There’s now a large body of international evidence documenting the freedom-prosperity connection. At the state level, high and growing levels of economic freedom go hand-in-hand with higher levels of income, entrepreneurship, in-migration and income mobility. In economically free states, incomes tend to grow faster at the top and bottom of the income ladder.

These states suffer less poverty, homelessness and food insecurity and may even have marginally happier, more philanthropic and more tolerant populations.

In short, liberation works. Repression doesn’t.

-

Haultain Research3 hours ago

Haultain Research3 hours agoSweden Fixed What Canada Won’t Even Name

-

Business1 day ago

Business1 day agoLargest fraud in US history? Independent Journalist visits numerous daycare centres with no children, revealing massive scam

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoUS Under Secretary of State Slams UK and EU Over Online Speech Regulation, Announces Release of Files on Past Censorship Efforts

-

Business1 day ago

Business1 day ago“Magnitude cannot be overstated”: Minnesota aid scam may reach $9 billion

-

Business2 days ago

Business2 days agoSocialism vs. Capitalism

-

Business3 hours ago

Business3 hours agoWhat Do Loyalty Rewards Programs Cost Us?

-

Energy2 days ago

Energy2 days agoCanada’s debate on energy levelled up in 2025

-

Daily Caller2 days ago

Daily Caller2 days agoIs Ukraine Peace Deal Doomed Before Zelenskyy And Trump Even Meet At Mar-A-Lago?