Fraser Institute

Government meddling contributes to doctor exodus in Quebec

From the Fraser Institute

By Bacchus Barua and Yanick Labrie

They have not left Quebec’s health-care system but rather have opted out of the province’s publicly-financed framework to provide care to their patients privately.

Quebec’s health minister recently came under fire after reports revealed a record number of physicians left the province’s public system to practise privately. Less discussed are the reasons why physicians made this choice.

Indeed, it turns out that ill-conceived attempts to protect publicly-funded health care by the Trudeau government and successive provincial governments may have contributed to the increasing numbers of physicians opting-out.

To be clear, the 780 physicians in question account for about four per cent of physicians in the province. However, this represents a 22 per cent increase in the number of physicians leaving the public system compared to the previous year—and is part of a growing trend. More importantly, they have not left Quebec’s health-care system but rather have opted out of the province’s publicly-financed framework to provide care to their patients privately.

Why?

One reason, is because governments have forced them to do so.

Until recently, physicians in Quebec (including those who practiced in the public sector) were allowed to charge patients so-called “accessory-fees” in certain instances—for example, if the service was either not covered or insufficiently reimbursed by the government’s fee schedule.

However, the federal Canada Health Act (CHA) clearly states that “extra-billing” of this nature, when charged by physicians who also bill the public system, must result in dollar-for-dollar deductions in federal health-care transfer payments to the province. In other words, the CHA encourages provincial efforts to effectively force doctors to choose between the public and private system if any out-of-pocket expenses are involved.

And so, under financial threat by the Trudeau government, Quebec eventually clamped down on such fees charged by physicians who worked in the public system.

Consequently, physicians who relied on these payments to cover a portion of their operating costs faced an unfortunate choice—stay in the public system at the risk of financial ruin or opt-out entirely and practise exclusively in the private sector.

For many, the choice was obvious. One study found that by 2019 “an additional 69 specialist physicians opted out after the 2017 clampdown on double billing [sic] than previous trends would have predicted.” Several clinics offering endoscopy and colonoscopy services simply closed their doors. Quebecers also ended up with a less convenient health-care experience following this clamp down, as evidenced by the reduction in clinic-provided services that followed.

This attitude to extra-billing stands in stark contrast to the situation in other universal health-care countries such as Australia where consultations with specialists are usually only partially (85 per cent) covered by the universal plan. In fact, physicians (family doctors and specialists) can generally set fees above the government’s fee schedule so long as they forgo the convenience of directly billing the government (i.e. patients claim reimbursement after the fact). Notably, Australia’s health-care system costs less than Canada’s in total (including these private payments) yet delivers more rapid access to health-care services with a greater availability of medical professionals, hospital beds, and diagnostic and surgical technologies.

More generally, a recent study found 22 of 28 universal health-care countries require patients to share a portion of the cost of treatment (with generous protections for vulnerable groups). These include deductibles (an amount individuals must pay before insurance coverage kicks in), co-insurance payments (the patient pays a certain percentage of treatment cost) and copayments (the patient pays a fixed amount per treatment). Crucially, many of these countries including Australia, Germany, the Netherlands and Switzerland also have shorter wait times than we endure.

In these countries, physicians are also generally allowed to practise both in publicly-funded universal settings and private settings (a policy known as “dual practice”) rather than having their activities restricted to one setting only. In other words, Canada’s federal restrictions on cost-sharing and extra-billing (such as Quebec’s accessory fees) and provincial barriers to dual-practice place our universal system in the minority of a small cohort of countries that are not particularly known for stellar performance.

The looming threat of further reductions in federal cash transfers, under the CHA, has led to provinces such as Quebec imposing increasingly restrictive conditions on physicians in the public system. And in response, physicians—by opting-out—are indicating that they’ve had enough.

It’s ironic that the very groups intent on supposedly “protecting public health care” by forcing physicians to choose between the public and private systems have enforced policies that may very well lead to the public system’s continued demise.

Authors:

Business

Massive government child-care plan wreaking havoc across Ontario

From the Fraser Institute

By Matthew Lau

It’s now more than four years since the federal Liberal government pledged $30 billion in spending over five years for $10-per-day national child care, and more than three years since Ontario’s Progressive Conservative government signed a $13.2 billion deal with the federal government to deliver this child-care plan.

Not surprisingly, with massive government funding came massive government control. While demand for child care has increased due to the government subsidies and lower out-of-pocket costs for parents, the plan significantly restricts how child-care centres operate (including what items participating centres may purchase), and crucially, caps the proportion of government funds available to private for-profit providers.

What have families and taxpayers got for this enormous government effort? Widespread child-care shortages across Ontario.

For example, according to the City of Ottawa, the number of children (aged 0 to 5 years) on child-care waitlists has ballooned by more than 300 per cent since 2019, there are significant disparities in affordable child-care access “with nearly half of neighbourhoods underserved, and limited access in suburban and rural areas,” and families face “significantly higher” costs for before-and-after-school care for school-age children.

In addition, Ottawa families find the system “complex and difficult to navigate” and “fewer child care options exist for children with special needs.” And while 42 per cent of surveyed parents need flexible child care (weekends, evenings, part-time care), only one per cent of child-care centres offer these flexible options. These are clearly not encouraging statistics, and show that a government-knows-best approach does not properly anticipate the diverse needs of diverse families.

Moreover, according to the Peel Region’s 2025 pre-budget submission to the federal government (essentially, a list of asks and recommendations), it “has maximized its for-profit allocation, leaving 1,460 for-profit spaces on a waitlist.” In other words, families can’t access $10-per-day child care—the central promise of the plan—because the government has capped the number of for-profit centres.

Similarly, according to Halton Region’s pre-budget submission to the provincial government, “no additional families can be supported with affordable child care” because, under current provincial rules, government funding can only be used to reduce child-care fees for families already in the program.

And according to a March 2025 Oxford County report, the municipality is experiencing a shortage of child-care staff and access challenges for low-income families and children with special needs. The report includes a grim bureaucratic predication that “provincial expansion targets do not reflect anticipated child care demand.”

Child-care access is also a problem provincewide. In Stratford, which has a population of roughly 33,000, the municipal government reports that more than 1,000 children are on a child-care waitlist. Similarly in Port Colborne (population 20,000), the city’s chief administrative officer told city council in April 2025 there were almost 500 children on daycare waitlists at the beginning of the school term. As of the end of last year, Guelph and Wellington County reportedly had a total of 2,569 full-day child-care spaces for children up to age four, versus a waitlist of 4,559 children—in other words, nearly two times as many children on a waitlist compared to the number of child-care spaces.

More examples. In Prince Edward County, population around 26,000, there are more than 400 children waitlisted for licensed daycare. In Kawartha Lakes and Haliburton County, the child-care waitlist is about 1,500 children long and the average wait time is four years. And in St. Mary’s, there are more than 600 children waitlisted for child care, but in recent years town staff have only been able to move 25 to 30 children off the wait list annually.

The numbers speak for themselves. Massive government spending and control over child care has created havoc for Ontario families and made child-care access worse. This cannot be a surprise. Quebec’s child-care system has been largely government controlled for decades, with poor results. Why would Ontario be any different? And how long will Premier Ford allow this debacle to continue before he asks the new prime minister to rethink the child-care policy of his predecessor?

Business

Municipal government per-person spending in Canada hit near record levels

From the Fraser Institute

Municipal government spending in Canada hit near record levels in recent years, finds a new study by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“In light of record-high spending in municipalities across Canada, residents should consider whether or not crime, homelessness, public transit and other services have actually improved,” said Austin Thompson, senior policy analyst at the Fraser Institute and author of The Expanding Finances of Local Governments in Canada.

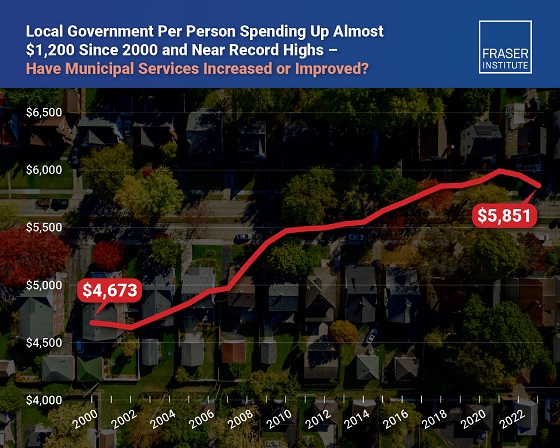

From 2000 to 2023, per-person spending (inflation-adjusted) increased by 25.2 per cent, reaching a record-high $5,974 per person in 2021 before declining slightly to $5,851 in 2023, the latest year of available data.

During that same period, municipal government revenue—generated from property taxes and transfers from other levels of government—increased by 33.7 per cent per person (inflation-adjusted).

And yet, among all three levels of government including federal and provincial, municipal government spending (adjusted for inflation) has actually experienced the slowest rate of growth over the last 10 years, underscoring the large spikes in spending at all government levels across Canada.

“Despite claims from municipal policymakers about their dire financial positions, Canadians should understand the true state of finances at city hall so they can decide whether they’re getting good value for their money,” said Jake Fuss, director of fiscal studies at the Fraser Institute.

The Expanding Finances of Local Governments in Canada, 1990–2023

- Canada’s local governments have experienced substantial fiscal growth in recent decades.

- Revenue and expenditure by local governments—including municipal governments, school boards, and Indigenous governments—have increased faster than population growth and inflation combined. From 1990 to 2023, real per-capita revenue rose by 32.7%, and expenditure by 30.0%.

- Local governments represent a significant component of Canada’s broader public sector. In 2023, net of inter-governmental transfers, municipal governments and school boards accounted for 18.6% of total government expenditure and 11.1% of revenue.

- Despite this growth, local governments’ share of overall government revenue and expenditure has declined over time—especially since the COVID-19 pandemic—as federal and provincial budgets have expanded even more rapidly.

- Nevertheless, between 2008 and 2023 the inflation-adjusted per-capita revenue of municipal governments in-creased by 10.1% and their expenditure by 12.4% , on average across the provinces.

- Over the same period, municipal governments recorded above-inflation increases in their combined annual operating surpluses, which contributed to an 88.1% inflation-adjusted rise in their net worth—raising important questions about the allocation of accumulated resources.

- In 2023, Ontario recorded the highest per-capita municipal revenue among the provinces ($4,156), while Alberta had the highest per-capita expenditure ($3,750). Prince Edward Island reported the lowest per-capita municipal revenue ($1,635) and expenditure ($1,186).

- Wide variation in per-capita municipal revenue and expenditure across the provinces reflects differences in the responsibilities provinces assign to municipalities, as well as possible disparities in the efficiency of service delivery—issues that warrant further scrutiny.

Click Here To Read The Full Study

-

Alberta1 day ago

Alberta1 day agoAlberta judge sides with LGBT activists, allows ‘gender transitions’ for kids to continue

-

Crime16 hours ago

Crime16 hours agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Business1 day ago

Business1 day agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Crime1 day ago

Crime1 day agoSuspected ambush leaves two firefighters dead in Idaho

-

Business1 day ago

Business1 day agoMassive government child-care plan wreaking havoc across Ontario

-

Alberta1 day ago

Alberta1 day agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Health15 hours ago

Health15 hours agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Business4 hours ago

Business4 hours agoElon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party