Economy

FLOP28 – Climate proposals would devastate economy

From the Frontier Centre for Public Policy

By Ian Madsen

” Most CO2 comes from natural sources like forest fires, volcanoes and ocean evaporation – not your SUV or natural gas furnace. The human portion of this tiny amount is the equivalent of 6 pennies in a jar of 10,000. “

Politicians, academics, celebrities, self-appointed activists, protesters, and green energy industry lobbyists recently gathered in Dubai at their annual Climate Crisis jamboree (COP28). Their central belief, from their computer models, is that human-generated global warming will lead to a rise in average global temperatures of two degrees Celsius, ‘2 C’ or even more frighteningly, as much as 3 C to 4 C by 2100. They claim that this will cause widespread health, environmental, and economic devastation.

From this hypothesis comes their solution: drastic reductions in so-called greenhouse gas emissions, principally carbon dioxide, ‘CO2’, and rapidly so. To their minds, this would require widespread adoption of their preferred solutions – ending fossil fuels in favour of wind and solar power; pervasive and intensive electrification of the world economy, including the mandated adoption of electric vehicles, ‘EVs’, and batteries, everywhere.

They insist that slashing CO2 levels will not only benefit the world, but also the economy – as these new industries would provide jobs and other benefits.

The hard reality is that CO2, is a life-giving gas that is crucial for photosynthesis and thus the flourishing of all life on Earth. It is a trace gas – making up only .04% of our atmosphere. Most CO2 comes from natural sources like forest fires, volcanoes and ocean evaporation – not your SUV or natural gas furnace. The human portion of this tiny amount is the equivalent of 6 pennies in a jar of 10,000. Very awkwardly, CO2 levels in the atmosphere are uncorrelated with temperatures. It may look so in government computer models, but remember those catastrophically wrong Covid models that gave us devastating lockdowns, failed vaccines and exploding debt and inflation?

Even if we assume that CO2 is “pollution that is warming the planet” their wild proposals’ math doesn’t work out.

Professor Richard Tol of the University of Sussex, United Kingdom, wrote in a special issue of Climate Economics a sobering assessment of the ‘bad deal’ climate crusaders are trying to sell to the world, including Canada. He estimates their proposed climate policies’ costs to be 3.8 to 5.6% of GDP in 2100 compared to benefits of 2.8% to 3.2% of GDP – or excess costs of $900 billion to $1.98 trillion in today’s $90 trillion world economy.

The prohibitively large subsidies required fail the cost benefit test. To summarize: Tol suggests that the whole Green Transition ‘enterprise’ would lose money – in vast amounts. His view is not even the worst assessment of such radical disruptive policies.

Another expert who engages the “CO2 is pollution” bubble and has done the math is Bjorn Lomborg, president of the Copenhagen Consensus think tank and a Hoover Institution Senior Fellow.

He assesses MIT researchers’ studies of the costs of attaining Net Zero (no net GHG emissions) by 2050, in the same journal, Climate Economics, and observes that these Paris policies would cost 8% to 18% of annual GDP by 2050 and 11% to 13% annually by 2100…. Averaged across the century, these promises would create benefits worth $4.5 trillion (in 2023 dollars) annually: “dramatically smaller than the $27 trillion annual cost that Paris promises would incur, as derived from averaging the three cost estimates from the two Climate Change Economics papers through 2100.”

To remove any doubt, these forecast costs would exceed total global annual capital investment of all kinds, and would crowd out everything else, impoverishing all humanity. Expensive, destructive ‘solutions’, for a dubious, unproven catastrophe.

The Dubai COP28 flopped as all others have.

We need to stop the madness.

Ian Madsen is the Senior Policy Analyst at the Frontier Centre for Public Policy

Business

Mark Carney’s Fiscal Fantasy Will Bankrupt Canada

By Gwyn Morgan

Mark Carney was supposed to be the adult in the room. After nearly a decade of runaway spending under Justin Trudeau, the former central banker was presented to Canadians as a steady hand – someone who could responsibly manage the economy and restore fiscal discipline.

Instead, Carney has taken Trudeau’s recklessness and dialled it up. His government’s recently released spending plan shows an increase of 8.5 percent this fiscal year to $437.8 billion. Add in “non-budgetary spending” such as EI payouts, plus at least $49 billion just to service the burgeoning national debt and total spending in Carney’s first year in office will hit $554.5 billion.

Even if tax revenues were to remain level with last year – and they almost certainly won’t given the tariff wars ravaging Canadian industry – we are hurtling toward a deficit that could easily exceed 3 percent of GDP, and thus dwarf our meagre annual economic growth. It will only get worse. The Parliamentary Budget Officer estimates debt interest alone will consume $70 billion annually by 2029. Fitch Ratings recently warned of Canada’s “rapid and steep fiscal deterioration”, noting that if the Liberal program is implemented total federal, provincial and local debt would rise to 90 percent of GDP.

This was already a fiscal powder keg. But then Carney casually tossed in a lit match. At June’s NATO summit, he pledged to raise defence spending to 2 percent of GDP this fiscal year – to roughly $62 billion. Days later, he stunned even his own caucus by promising to match NATO’s new 5 percent target. If he and his Liberal colleagues follow through, Canada’s defence spending will balloon to the current annual equivalent of $155 billion per year. There is no plan to pay for this. It will all go on the national credit card.

This is not “responsible government.” It is economic madness.

And it’s happening amid broader economic decline. Business investment per worker – a key driver of productivity and living standards – has been shrinking since 2015. The C.D. Howe Institute warns that Canadian workers are increasingly “underequipped compared to their peers abroad,” making us less competitive and less prosperous.

The problem isn’t a lack of money; it’s a lack of discipline and vision. We’ve created a business climate that punishes investment: high taxes, sluggish regulatory processes, and politically motivated uncertainty. Carney has done nothing to reverse this. If anything, he’s making the situation worse.

Recall the 2008 global financial meltdown. Carney loves to highlight his role as Bank of Canada Governor during that time but the true credit for steering the country through the crisis belongs to then-prime minister Stephen Harper and his finance minister, Jim Flaherty. Facing the pressures of a minority Parliament, they made the tough decisions that safeguarded Canada’s fiscal foundation. Their disciplined governance is something Carney would do well to emulate.

Instead, he’s tearing down that legacy. His recent $4.3 billion aid pledge to Ukraine, made without parliamentary approval, exemplifies his careless approach. And his self-proclaimed image as the experienced technocrat who could go eyeball-to-eyeball against Trump is starting to crack. Instead of respecting Carney, Trump is almost toying with him, announcing in June, for example that the U.S. would pull out of the much-ballyhooed bilateral trade talks launched at the G7 Summit less than two weeks earlier.

Ordinary Canadians will foot the bill for Carney’s fiscal mess. The dollar has weakened. Young Canadians – already priced out of the housing market – will inherit a mountain of debt. This is not stewardship. It’s generational theft.

Some still believe Carney will pivot – that he will eventually govern sensibly. But nothing in his actions supports that hope. A leader serious about economic renewal would cancel wasteful Trudeau-era programs, streamline approvals for energy and resource projects, and offer incentives for capital investment. Instead, we’re getting more borrowing and ideological showmanship.

It’s no longer credible to say Carney is better than Trudeau. He’s worse. Trudeau at least pretended deficits were temporary. Carney has made them permanent – and more dangerous.

This is a betrayal of the fiscal stability Canadians were promised. If we care about our credit rating, our standard of living, or the future we are leaving our children, we must change course.

That begins by removing a government unwilling – or unable – to do the job.

Canada once set an economic example for others. Those days are gone. The warning signs – soaring debt, declining productivity, and diminished global standing – are everywhere. Carney’s defenders may still hope he can grow into the job. Canada cannot afford to wait and find out.

The original, full-length version of this article was recently published in C2C Journal.

Gwyn Morgan is a retired business leader who was a director of five global corporations.

Business

Carney government should apply lessons from 1990s in spending review

From the Fraser Institute

By Jake Fuss and Grady Munro

For the summer leading up to the 2025 fall budget, the Carney government has launched a federal spending review aimed at finding savings that will help pay for recent major policy announcements. While this appears to be a step in the right direction, lessons from the past suggest the government must be more ambitious in its review to overcome the fiscal challenges facing Canada.

In two letters sent to federal cabinet ministers, Finance Minister François-Philippe Champagne outlined plans for a “Comprehensive Expenditure Review” that will see ministers evaluate spending programs in each of their portfolios based on the following: whether they are “meeting their objectives” are “core to the federal mandate” and “complement vs. duplicate what is offered elsewhere by the federal government or by other levels of government.” Ultimately, as a result of this review, ministers are expected to find savings of 7.5 per cent in 2026/27, rising to 10 per cent the following year, and reaching 15 per cent by 2028/29.

This news comes after the federal government has recently made several major policy announcements that will significantly impact the bottom line. Most notably, the government added an additional $9.3 billion to the defence budget for this fiscal year, and committed to more than double the annual defence budget by 2035. Without any policies to offset the fiscal impact of this higher defence spending (along with other recent changes), this year’s budget deficit (which the Liberal’s election platform initially pegged at $62.3 billion) will likely surpass $70.0 billion, and potentially may reach as high as $92.2 billion.

A spending review is long overdue. Recent research suggests that each year the federal government spends billions towards programs that are inefficient and/or ineffective, and which should be eliminated to find savings. Moreover, past governments (both federal and provincial) have proven that fiscal adjustments based on spending reviews can be very successful—just look at the Chrétien government’s 1995 Program Review.

In its 1995 budget, the federal Chrétien government launched a comprehensive review of all federal spending that—along with several minor tax increases—ultimately balanced the federal budget in two years and helped Canada avert a fiscal crisis. Two aspects of this review were critical to its success: it reviewed all federal spending initiatives with no exceptions, and it was based on clear criteria that not only tested whether spending was efficient, but which also reassessed the federal government’s role in delivering programs and services to Canadians. Unfortunately, the Carney government’s review is missing these two critical aspects.

The Carney government already plans to exclude large swathes of the budget from its spending review. While it might be reasonable for the government to exclude defence spending given our recent commitments (though that doesn’t appear to be the plan), the Carney government has instead chosen to exclude all transfers to individuals (such as seniors’ benefits) and provinces (such as health-care spending) from any spending cuts. Based on the last official spending estimates for this year, these two areas alone represent a combined $254.6 billion—or more than half of total spending after excluding debt charges—that won’t be reviewed.

This is a major weakness in the government’s plan. Not only does this limit the dollar value of savings available, it also means a significant portion of the government’s budget is missing out on a reassessment that could lead to more effective delivery of services for Canadians.

For example, as part of the 1995 program review, the Chrétien government overhauled how it delivered welfare transfers to provincial governments. Specifically, the federal government replaced two previous programs with a new Canada Health and Social Transfer (CHST) that addressed some major flaws with how the government delivered welfare assistance. While the transition to the CHST did include a $4.6 billion reduction in spending on government transfers, the new structure gave the federal government better control over spending growth in the future and allowed provincial governments more flexibility to tailor social assistance programs to local needs and preferences.

In addition to considering all areas of spending, the Carney government’s spending review also needs to be more ambitious in its criteria. While the current criteria are an important start—for example, it’s critical the government identifies and eliminates spending programs that aren’t achieving their stated objectives or which are simply duplicating another program—the Carney government should take it one step further and explicitly reflect on the role of the federal government itself.

Among other criteria that focused on efficiency and affordability of programs, the 1995 program review also evaluated every spending program based on whether government intervention was even necessary, and whether or not the federal government specifically should be involved. As such, not only did the program review eliminate costly inefficiencies, it also included the privatization of government-owned entities such as Petro-Canada and Canadian National Railway—which generated considerable economic benefits for Canadians.

Today, the federal government devotes considerable amounts of spending each year towards areas that are outside of its jurisdiction and/or which government shouldn’t be involved in the first place—national pharmacare, national dental care, and national daycare all being prime examples. Ignoring the fact that many of these areas (including the three examples) are already excluded from the Carney government’s spending review, the government’s criteria makes no explicit effort to test whether a program is targeting an area that’s outside of the federal purview.

For instance, while the government will test whether or not a spending program fits within the federal mandate, that mandate will not actually ensure the government stays within its own jurisdictional lane. Instead, the mandate simply lays out the key priorities the Carney government intends to focus on—including vague goals including, “Bringing down costs for Canadians and helping them to get ahead” which could be used to justify considerable federal overreach. Similarly, the government’s other criterion to not duplicate programs offered by other levels of government provides little meaningful restriction on government spending that is outside of its jurisdiction so long as that spending can be viewed as “complementing” provincial efforts. In other words, this spending review is unlikely to meaningfully check the costly growth in the size of government that Canada has experienced over the last decade.

Simply put, the Carney government’s spending review, while a step in the right direction, is missing key elements that will limit its effectiveness. Applying key lessons from the Chrétien government’s spending review is crucial for success today.

Grady Munro

Policy Analyst, Fraser Institute

-

Uncategorized13 hours ago

Uncategorized13 hours agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

illegal immigration1 day ago

illegal immigration1 day agoICE raids California pot farm, uncovers illegal aliens and child labor

-

Energy1 day ago

Energy1 day agoLNG Export Marks Beginning Of Canadian Energy Independence

-

Business1 day ago

Business1 day agoCarney government should apply lessons from 1990s in spending review

-

Entertainment1 day ago

Entertainment1 day agoStudy finds 99% of late-night TV guests in 2025 have been liberal

-

Frontier Centre for Public Policy13 hours ago

Frontier Centre for Public Policy13 hours agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Opinion6 hours ago

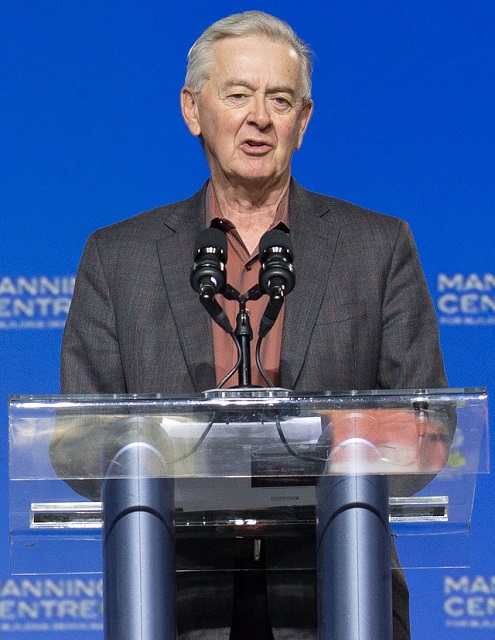

Opinion6 hours agoPreston Manning: Three Wise Men from the East, Again

-

Addictions5 hours ago

Addictions5 hours agoWhy B.C.’s new witnessed dosing guidelines are built to fail