Banks

Canadian bankers ask gov’t to let them view private citizens’ tax returns

From LifeSiteNews

In addition to the Canadian Bankers Association, Mortgage Professionals Canada has also requested that it be allowed to view confidential tax records, saying a ‘digital income verification tool is an urgently required fraud prevention solution.’

The Canadian Bankers Association has asked Canada’s Senate banking committee to allow large banks to view people’s confidential federal personal tax returns via electronic access for what it claims is to verify one’s income to combat fraud.

According to Blacklock’s Reporter, the Association’s chief economist Alex Ciappara claims the measure would cut costs while allowing “banks to reduce mortgage fraud that serves to drive up costs for borrowers.”

While mortgage fraud does occur, according to a 2004 report from the Canada Mortgage and Housing Corporation, it is quite rare.

“Fraud in land conveyancing does not appear to have reached crisis proportions in Canada,” said the report.

Ciappara, failing to elaborate on just how this new privilege would reduce fraud, insisted that allowing banks to see one’s gross income would be a “technology-based solution to reduce mortgage fraud.”

While the banks claim that being allowed to view one’s personal tax returns would help prevent mortgage “fraud,” it is not clear what the federal government of Prime Minister Justin Trudeau will do in this matter.

In addition to the Bankers Association, Mortgage Professionals Canada has also requested that it be allowed to view one’s confidential tax records, saying a “digital income verification tool is an urgently required fraud prevention solution.”

Governments allowing banks to access personal tax records is concerning given how the current federal government has a history of intruding on one’s personal finances. An example of this was in 2022, when Finance Minister Chrystia Freeland took the unprecedented step of demanding that banks freeze the accounts of anyone involved in the Freedom Convoy protest in Ottawa, without a court order.

Of note is that similar infrastructure blocking protests have taken place in recent weeks in Canada, over the Israel-Hamas conflict, yet no extraordinary measures have been taken to stop protesters by the Trudeau government.

Should banks be allowed to access one’s personal tax returns, it might not stop at just being allowed to verify one’s income but could extend to making every single transaction searchable.

Freeland is a member of the Board of Trustees for the World Economic Forum (WEF), which is the group behind the now-infamous “Great Reset,” an agenda that critics say seeks to install a global system similar to that of China’s Social Credit System.

One of the WEF goals is to push governments to introduce a digital currency and ID system.

For the time being, it looks like Canada will not get a digital dollar.

The Bank of Canada (BOC) in August said that the creation of a central bank digital currency (CBDC) is not needed as many people rely on “cash” to pay for things, and that the introduction of a digital currency would only be feasible if consumers demanded its release.

However, the BOC did not fully rule out a digital dollar in the future.

As noted in a report from LifeSiteNews, experts warn that central bank digital currencies are a “control tool” of governments.

Conservative leader Pierre Poilievre promised that if he is elected prime minister, he would stop any implementation of a “digital currency” or a compulsory “digital ID” system.

Banks

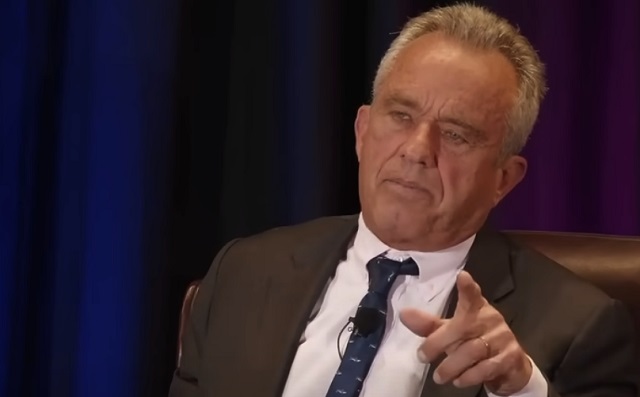

RFK Jr. warns Americans ‘will be slaves’ if central bank digital currency is established

From LifeSiteNews

The U.S. presidential candidate cited the Freedom Convoy trucker protests in Canada when the government ‘was able to destroy their lives’ by freezing bank accounts.

Democrat presidential candidate Robert F. Kennedy Jr. declared in no uncertain terms recently that establishing a Central Bank Digital Currency in the country will be “the end of freedom; we will be slaves if we allow that to happen.”

In a wide-ranging discussion at the University of Austin about freedom of speech and civil discourse, Kennedy said he didn’t “get” the connection between CBDCs and the loss of freedom of expression and other freedoms until he witnessed the Canadian trucker protest.

Robert F. Kennedy Jr on Why He Opposes Central Bank Digital Currencies

“That is part of the path to getting us where China is today. That’s where they started…It’s the end of freedom. We will be slaves if we allow that to happen.”@RobertKennedyJr pic.twitter.com/DSD6ZD0Bkk

— Chief Nerd (@TheChiefNerd) March 24, 2024

“The truckers in Canada were protesting the COVID mandates, the lockdowns, masking mandates, vaccination mandates, and others,” Kennedy began. “They started in Alberta. They picked up thousands of trucks as they drove across Canada to Ottawa.”

When they got to Ottawa — they were trying to petition Prime Minister Trudeau — and they were exercising a right that we all take for granted in this country: the right to assemble, the right to protest, the right to petition their government, and the government instead condemned them as right-wing fascists and racists, which if you look at the videos, they’re the opposite. Looks like Woodstock. They were delivering bottled water, they were cooking food for the poor, they were picking up garbage. There were musicians on every block.

It was really a beautiful thing.

However, the Trudeau government perceived the protesters to be an existential threat.

“The government used facial recognition systems and other intrusive technologies to identify the participants,” he recounted, and weaponized that information against them to freeze their bank accounts so they couldn’t purchase diesel for their trucks, buy food for their kids, or pay their mortgages or rents.

A pivotal moment for Kennedy occurred when one of the truckers told him that because of the government’s action, he was going to go to jail because he couldn’t pay his alimony.

He said that transactional freedom is as important as freedom of the press, or freedom of speech, “because if you have freedom of speech in the First Amendment and yet when you exercise that speech — if the government doesn’t like it — they can starve you to death. They can throw you out of your home.”

He explained that in China:

They keep a social credit score on you so that if (for instance) you’ve got your mask off below your nose, or if you’re not social distancing properly, or if you violate some other social norm, you get penalties taken off your social (credit) score and at some point they punish you.

Penalized persons are then limited to buying groceries from “stores that are within a certain radius of your house. You can’t buy gas. You can’t buy an airplane ticket. You can’t buy anything else, so you’re basically under home confinement.”

The truckers in Canada were never charged with a crime. They were certainly never convicted. It was just (that) they were doing something the government didn’t like.

So the government was able to destroy their lives, and that is a very dangerous power to give government. And that’s why I’m against Central Bank Digital Currencies because that is part of the path to getting us where China is today.

That’s where they started. That’s where all these other countries … with a Central Bank Digital Currency (started). And it’s the end of freedom. We will be slaves if we allow that to happen.

Kennedy is far from alone in his alarm over the prospect of a CBDC being introduced in the U.S. or Canada.

Although digital currency offers some attractive features, it also would grant the federal government unlimited opportunity to weaponize the technology against citizens, allowing it to both spy on the spending habits of everyday Americans and block access to the money in their personal bank accounts.

U.S. Sen. Ted Cruz introduced the CBDC Anti-Surveillance State Act last month to prohibit the Federal Reserve from issuing a central bank digital currency that Republican sponsors of the bill believe could turn the nation into a “surveillance state” by handing over control of personal finances to federal government agencies.

“The Biden administration salivates at the thought of infringing on our freedom and intruding on the privacy of citizens to surveil their personal spending habits, which is why Congress must clarify that the Federal Reserve has no authority to implement a CBDC,” Cruz said.

“While Americans across the country are being punished for thinking, speaking, and voting the ‘wrong’ way, the last thing we need is the government surveilling personal finances,” Heritage Action for America explained in a statement concerning the new legislation. “Anti-CBDC legislation is necessary to safeguard Americans’ financial privacy in the face of potential surveillance, control, and political intimidation.”

“CBDCs present major privacy concerns for everyday Americans, including granting the government the ability to collect intimate personal details on U.S. citizens, and potentially track and freeze funds for any reason,” the Blockchain Association noted.

“Big government has no business spying on Americans to control their personal finances and track their transactions,” said Republican U.S. Sen. Rick Scott of Florida, a co-sponsor of the bill.

“It is a massive overreach,” he warned.

Banks

Canada is preparing to launch ‘open banking.’ Here’s what that means

From LifeSiteNews

By David James

The experience with open banking so far suggests that the benefits are mostly exaggerated and that, while it does not necessarily increase the risk of fraud, it does not eliminate it either. It just shifts the dangers elsewhere.

The Canadian government is setting the stage to bring in what is termed “open banking.”

It is described as a “secure way” for customers to share their financial data with financial technology companies (fintechs or fintech apps). The holders of the account do not have to provide their online banking usernames and passwords. Instead, the data is shared by the customer’s bank with the fintech company, or app, through an online channel.

Open banking is often contrasted with what is called screen scraping, which is when the third party is provided with the online banking username and password, enabling them to log in directly to the bank account as if they were the customer.

Open banking has been adopted by 68 countries, including the United Kingdom and Australia. The U.S. Congress passed the necessary legislation to set it up in 2010, but it was not until last October that the Consumer Financial Protection Bureau (CFPB) issued a proposed rule necessary for implementation.

The experience with open banking so far suggests that the benefits are mostly exaggerated and that, while it does not necessarily increase the risk of fraud, it does not eliminate it either. It just shifts the dangers elsewhere.

The greatest peril is fraudulent account linking: unauthorized connections between customer accounts and third-party applications. This can be done by linking the victim’s financial account to an app controlled by the fraudster, allowing unauthorized access to the person’s funds. Or, the fraudster’s financial account can be linked to a victim’s third-party app, allowing scammers to transfer funds into their account. Substantial sums of money can be stolen before the victim becomes aware of the breach.

Such risks are commonplace in the digital banking environment. For instance, in Australia, according to the Australian Bureau of Statistics, credit card fraud affected 8.7 per cent of the population in 2022-23. The average amount stolen, however, was only $A200 and only 18 per cent had more than $A1000 taken. With open banking, if there is a breach, any sums stolen are likely to be much larger.

Neither is there any reason to think open banking is completely secure just because customers do not reveal their username and password. The Australian Banking Association warned that, after cyberattacks on the government medical insurer Medibank and telco Optus, “the engagement of a third party standing in the shoes of the customer … introduces a range of new risks for which banks may need to develop specific scam, fraud and cyber mitigation tools.”

According to research by financial advisory company Konsentus, the adoption of open banking has been strongest in Asia. In the U.S., customers have a strong attraction to credit cards and the rewards on offer. That is expected to represent a big barrier to take up. In Britain participation has “plateaued,” according to The Open Banking Impact Report (OBI report).

What are the advantages of open banking? According to the OBI report open banking has become a “critical component of cloud accounting” in Britain, which is helping smaller businesses track their financial positions more accurately. It is claimed that giving more entities access to customers’ financial data also increases competition.

Open banking is supposedly more efficient. The fintech company Gocardless contends that: “bank-to-bank payments are fully integrated and use a digital pull-based mechanism, where the merchant requests payment. In contrast, manual bank payments or card payments require the customer to send the payment to the business. Bank-to-bank payments tend to have lower failure rates compared to credit/debit card methods. Thus, businesses spend less time chasing missed payments.”

Another more doubtful claim is that open banking will make things easier for lenders. Abhigyan Shrivastava, leader in banking and technology transformation for Bendigo and Adelaide Bank writes that open banking is: “set to have a significant impact on lending transformation in Australia… with increased competition, personalized lending products, and more efficient lending processes.”

There is little reason, however, to think that better exposure to borrowers’ data will make any difference to lending practices. It will still be a matter of borrowers being able to provide enough collateral to qualify for a loan and to demonstrate they have sufficient income to pay the interest. In other words, banking as usual.

What is most likely is that the benefits of the initiative will primarily go to the banks and financial technology companies. That these entities argue, unconvincingly, that open banking is more “customer-centric” rouses the suspicion that ordinary customers will ultimately gain little.

-

Business1 day ago

Business1 day agoWEF panelist suggests COVID response accustomed people to the idea of CBDCs

-

conflict2 days ago

conflict2 days agoColumbia on Lockdown After pro-Palestinian Protesters Take Over Building, Hold Janitors Hostage

-

Canadian Energy Centre2 days ago

Canadian Energy Centre2 days agoNorth America LNG project cost competitiveness

-

International1 day ago

International1 day agoNYPD storms protest-occupied Columbia building, several arrested

-

Addictions5 hours ago

Addictions5 hours agoCity of Toronto asks Trudeau gov’t to decriminalize hard drugs despite policy’s failure in BC

-

Alberta1 day ago

Alberta1 day agoProtecting the right to vote for Canadian citizens: Minister McIver

-

Great Reset1 day ago

Great Reset1 day agoMiddle school girls who refused to compete against male banned from next track meet

-

illegal immigration1 day ago

illegal immigration1 day agoFlight Docs Reveal Which Cities Are Receiving Migrants Under Biden’s Parole Program