Banks

Canada is preparing to launch ‘open banking.’ Here’s what that means

From LifeSiteNews

By David James

The experience with open banking so far suggests that the benefits are mostly exaggerated and that, while it does not necessarily increase the risk of fraud, it does not eliminate it either. It just shifts the dangers elsewhere.

The Canadian government is setting the stage to bring in what is termed “open banking.”

It is described as a “secure way” for customers to share their financial data with financial technology companies (fintechs or fintech apps). The holders of the account do not have to provide their online banking usernames and passwords. Instead, the data is shared by the customer’s bank with the fintech company, or app, through an online channel.

Open banking is often contrasted with what is called screen scraping, which is when the third party is provided with the online banking username and password, enabling them to log in directly to the bank account as if they were the customer.

Open banking has been adopted by 68 countries, including the United Kingdom and Australia. The U.S. Congress passed the necessary legislation to set it up in 2010, but it was not until last October that the Consumer Financial Protection Bureau (CFPB) issued a proposed rule necessary for implementation.

The experience with open banking so far suggests that the benefits are mostly exaggerated and that, while it does not necessarily increase the risk of fraud, it does not eliminate it either. It just shifts the dangers elsewhere.

The greatest peril is fraudulent account linking: unauthorized connections between customer accounts and third-party applications. This can be done by linking the victim’s financial account to an app controlled by the fraudster, allowing unauthorized access to the person’s funds. Or, the fraudster’s financial account can be linked to a victim’s third-party app, allowing scammers to transfer funds into their account. Substantial sums of money can be stolen before the victim becomes aware of the breach.

Such risks are commonplace in the digital banking environment. For instance, in Australia, according to the Australian Bureau of Statistics, credit card fraud affected 8.7 per cent of the population in 2022-23. The average amount stolen, however, was only $A200 and only 18 per cent had more than $A1000 taken. With open banking, if there is a breach, any sums stolen are likely to be much larger.

Neither is there any reason to think open banking is completely secure just because customers do not reveal their username and password. The Australian Banking Association warned that, after cyberattacks on the government medical insurer Medibank and telco Optus, “the engagement of a third party standing in the shoes of the customer … introduces a range of new risks for which banks may need to develop specific scam, fraud and cyber mitigation tools.”

According to research by financial advisory company Konsentus, the adoption of open banking has been strongest in Asia. In the U.S., customers have a strong attraction to credit cards and the rewards on offer. That is expected to represent a big barrier to take up. In Britain participation has “plateaued,” according to The Open Banking Impact Report (OBI report).

What are the advantages of open banking? According to the OBI report open banking has become a “critical component of cloud accounting” in Britain, which is helping smaller businesses track their financial positions more accurately. It is claimed that giving more entities access to customers’ financial data also increases competition.

Open banking is supposedly more efficient. The fintech company Gocardless contends that: “bank-to-bank payments are fully integrated and use a digital pull-based mechanism, where the merchant requests payment. In contrast, manual bank payments or card payments require the customer to send the payment to the business. Bank-to-bank payments tend to have lower failure rates compared to credit/debit card methods. Thus, businesses spend less time chasing missed payments.”

Another more doubtful claim is that open banking will make things easier for lenders. Abhigyan Shrivastava, leader in banking and technology transformation for Bendigo and Adelaide Bank writes that open banking is: “set to have a significant impact on lending transformation in Australia… with increased competition, personalized lending products, and more efficient lending processes.”

There is little reason, however, to think that better exposure to borrowers’ data will make any difference to lending practices. It will still be a matter of borrowers being able to provide enough collateral to qualify for a loan and to demonstrate they have sufficient income to pay the interest. In other words, banking as usual.

What is most likely is that the benefits of the initiative will primarily go to the banks and financial technology companies. That these entities argue, unconvincingly, that open banking is more “customer-centric” rouses the suspicion that ordinary customers will ultimately gain little.

Banks

To increase competition in Canadian banking, mandate and mindset of bank regulators must change

From the Fraser Institute

By Lawrence L. Schembri and Andrew Spence

Canada’s weak productivity performance is directly related to the lack of competition across many concentrated industries. The high cost of financial services is a key contributor to our lagging living standards because services, such as payments, are essential input to the rest of our economy.

It’s well known that Canada’s banks are expensive and the services that they provide are outdated, especially compared to the banking systems of the United Kingdom and Australia that have better balanced the objectives of stability, competition and efficiency.

Canada’s banks are increasingly being called out by senior federal officials for not embracing new technology that would lower costs and improve productivity and living standards. Peter Rutledge, the Superintendent of Financial Institutions and senior officials at the Bank of Canada, notably Senior Deputy Governor Carolyn Rogers and Deputy Governor Nicolas Vincent, have called for measures to increase competition in the banking system to promote innovation, efficiency and lower prices for financial services.

The recent federal budget proposed several new measures to increase competition in the Canadian banking sector, which are long overdue. As a marker of how uncompetitive the market for financial services has become, the budget proposed direct interventions to reduce and even eliminate some bank service fees. In addition, the budget outlined a requirement to improve price and fee transparency for many transactions so consumers can make informed choices.

In an effort to reduce barriers to new entrants and to growth by smaller banks, the budget also proposed to ease the requirement that small banks include more public ownership in their capital structure.

At long last, the federal government signalled a commitment to (finally) introduce open banking by enacting the long-delayed Consumer Driven Banking Act. Open banking gives consumers full control over who they want to provide them with their financial services needs efficiently and safely. Consumers can then move beyond banks, utilizing technology to access cheaper and more efficient alternative financial service providers.

Open banking has been up and running in many countries around the world to great success. Canada lags far behind the U.K., Australia and Brazil where the presence of open banking has introduced lower prices, better service quality and faster transactions. It has also brought financing to small and medium-sized business who are often shut out of bank lending.

Realizing open banking and its gains requires a new payment mechanism called real time rail. This payment system delivers low-cost and immediate access to nonbank as well as bank financial service providers. Real time rail has been in the works in Canada for over a decade, but progress has been glacial and lags far behind the world’s leaders.

Despite the budget’s welcome backing for open banking, Canada should address the legislative mandates of its most important regulators, requiring them to weigh equally the twin objectives of financial system stability as well as competition and efficiency.

To better balance these objectives, Canada needs to reform its institutional framework to enhance the resilience of the overall banking system so it can absorb an individual bank failure at acceptable cost. This would encourage bank regulators to move away from a rigid “fear of failure” cultural mindset that suppresses competition and efficiency and has held back innovation and progress.

Canada should also reduce the compliance burden imposed on banks by the many and varied regulators to reduce barriers to entry and expansion by domestic and foreign banks. These agencies, including the Office of the Superintendent of Financial Institutions, Financial Consumer Agency of Canada, Financial Transactions and Reports Analysis Centre of Canada, the Canada Deposit Insurance Corporation plus several others, act in largely uncoordinated manner and their duplicative effort greatly increases compliance and reporting costs. While Canada’s large banks are able, because of their market power, to pass those costs through to their customers via higher prices and fees, they also benefit because the heavy compliance burden represents a significant barrier to entry that shelters them from competition.

More fundamental reforms are needed, beyond the measures included in the federal budget, to strengthen the institutional framework and change the regulatory mindset. Such reforms would meaningfully increase competition, efficiency and innovation in the Canadian banking system, simultaneously improving the quality and lowering the cost of financial services, and thus raising productivity and the living standards of Canadians.

Banks

From Energy Superpower to Financial Blacklist: The Bill Designed to Kill Canada’s Fossil Fuel Sector

From Energy Now

By Tammy Nemeth and Ron Wallace

REALITY: Senator Galvez’s BILL S-238 would force every federally regulated bank, insurer, pension fund and Crown financial corporation to treat the financing of oil, gas, and coal as an unacceptable systemic risk and phase it out through “decommissioning.”

Prime Minister Mark Carney has spent the past weeks proclaiming that Canada will become an “energy superpower” not just in renewables but in responsible conventional energy as well. The newly created Major Projects Office has been proposed to fast-track billions in LNG terminals, transmission lines, carbon-capture hubs, critical-mineral mines, and perhaps oil export pipelines. A rumored federal–Alberta Memorandum of Understanding is said to be imminent from signature, possibly clearing the way for a new million-barrel-per-day oil pipeline from Alberta to British Columbia’s north coast. The message from Ottawa is clear: Canada is open for energy business. Yet quietly moving through the Senate is legislation that would deliver the exact opposite outcome.

Senator Rosa Galvez’s reintroduction of her Climate-Aligned Finance Act, now Bill S-238, following the death of its predecessor Bill S-243 on the order paper, is being touted by supporters not only as a vital tool for an “orderly transition” to a low-carbon Canadian economy but also to be “simply inevitable.” This Bill does not simply ask financial institutions to “consider” climate risk it proposes to re-write their core mandate so that alignment with the Paris Agreement’s 1.5 °C target overrides every other duty. In fact, it would force every federally regulated bank, insurer, pension fund and Crown financial corporation to treat the financing of oil, gas, and coal as an unacceptable systemic risk and phase it out through “decommissioning.” For certainty this means to:

“(i) incentivize decommissioning emissions-intensive activities, diversifying energy sources, financing zero-emissions energy and infrastructure and developing and adopting change and innovation,

(ii) escalate climate concerns regarding emissions-intensive activities of financially facilitated entities and exclude entities that are unable or unwilling to align with climate commitments, and

(iii) minimize actions that have a climate change impact that is negative.”

As discussed here in May, the reach of the Climate Aligned Finance Act is vast, targeting emissions-intensive sectors like oil and gas with a regulatory overreach that borders on the draconian. Institutions must shun financing and support of emissions-intensive activities, which are defined as related to fossil fuel activities, and chart a course toward a “fossil-free future.” This would effectively starve Canada’s energy sector of capital, insurance, and investment. Moreover, Directors and Officers are explicitly required to exercise their powers in a manner that keeps their institution “in alignment with climate commitments.” The Bill effectively subordinates traditional financial fiduciary responsibility to climate ideology.

While the new iteration removes the explicit capital-risk weights of the original Bill (1,250% on debt for new fossil fuel projects and 150% or more for existing ones) it replaces those conditions with directives for the Office of the Superintendent of Financial Institutions (OSFI) to issue guidelines that “account for exposures and contributions to climate-related risks.” This shift offers little real relief because mandated guidelines would still require “increased capital-risk weights for financing exposed to acute transition risks,” and the “non-perpetuation and elimination of dependence on emissions-intensive activities, including planning for a fossil-fuel-free future.”

These provisions would grant OSFI broad discretion but steer it inexorably toward punitive outcomes. As the Canadian Bankers’ Association and OSFI warned in their 2023 Senate testimony on the original Bill, such mechanisms would likely compel Canadian lenders to curtail or abandon oil and gas financing.

In plain language, Ottawa would be directing the entire financial system to stop lending to, insuring or investing in the very industries that are central to Canada’s economic future. In addition to providing tens of billions in royalties and taxes to governments each year, the oil and gas sector contributes about 3–3.5% of Canada’s GDP, generates over $160 billion in annual revenue and accounts for roughly 25% of Canada’s total exports.

The governance provisions proposed in Bill S-238 are beyond the pale. Board members with any past or present connection to the fossil fuel industry would have to declare it annually, detail any associations or lobbying involving “organizations not in alignment with climate commitments,” recuse themselves from every discussion or vote involving investments in oil, gas or coal, and make these declarations within a Climate Commitments Alignment Report. While oil and gas expertise is not banned outright, it is nonetheless ‘quarantined’ in ways that create a de facto purity test in the boardroom. At the same time, every board must appoint at least one member with “climate expertise”. Contrary to long-established principles for financial management, while seasoned energy experts would not be banned outright from such deliberations, they would effectively be sidelined on the very investment files where their expertise would be most valued.

The contradictions posed by Bill S-238 are simply breathtaking. The Major Projects Office is promising 68,000 jobs and CAD$116 billion in new investment, much of it tied to natural gas and oil-related infrastructure. These new pipeline and LNG export projects will require material private capital investments. Yet under Bill S-238 any bank that provides the capital needed for the projects would face escalating, punitive capital requirements along with public disclosure of its “contribution” to climate risks that are to be declared annually in a “Climate Commitments Alignment Report.” No MoU, Indigenous loan guarantee or federal permit can conjure financing out of thin air once Canada’s banks and insurers have effectively been legally compelled to exit the fossil fuel energy sector.

Current actions constitute a clear warning about the potential legal consequences of Bill S-238. Canada’s largest pension fund is currently being sued by four young Canadians who claim the Canada Pension Plan Investment Board (CPPIB) is failing to properly manage climate-related financial risk. Alleged are breaches of fiduciary duty through fossil fuel investments that are claimed to exacerbate climate risks and threaten ‘intergenerational equity’ with the demand that the CPP divest from fossil fuels entirely. The case, filed in Ontario Superior Court, demonstrates how financial institutions may be challenged in their traditional roles as stewards of balanced economic growth and instead used as agents for enforced decarbonization. In short, such legislation enables regulatory laws to re-direct, if not disable, capital investment in the Canadian non-renewable energy sector.

In May 2024, Mark Carney, then Chair of Brookfield Asset Management Inc. and head of Transition Investing, appeared at a Senate Committee hearing. He lauded the original Bill, calling key elements “achievable and actually essential” to champion “climate-related financial disclosures.” He noted that: “Finance cannot drive this transition on its own. Finance is an enabler, a catalyst that will speed what governments and companies initiate.” However, the new revised Bill S-238 goes far beyond disclosure. Like its previous iteration, it remains punitive, discriminatory and economically shortsighted, jeopardizing the very economic resilience that Carney has pledged to fortify. It is engineered debanking dressed up as prudential regulation.

This is at a time in which Richard Ciano described Canada as a land of “investment chaos”:

“While investment risk in the United States is often political, external, and transactional, the risk in Canada is systemic, legal, and structural. For long-term, capital-intensive projects, this deep, internal rot is fundamentally more toxic and unmanageable than the headline-driven volatility of a U.S. administration.

If the “rule of law” in Canada is meant to provide the certainty and predictability that capital demands, it is failing spectacularly. Investors seek clear title and dependable contracts. Canada is increasingly delivering the opposite. Investors don’t witness stability — they witness a fractured federation, a weaponized bureaucracy, and a legal system that injects profound uncertainty into the most basic elements of capitalism, like property rights.”

Bill S-238 is yet another example of how Canada is imposing unrealistic laws and regulations that contribute to investment uncertainty and that directly contradict policies proposed to accelerate projects in the national interest. While the Carney government trumpets Canada as a future energy superpower that produces and exports LNG, responsibly produced “decarbonized” oil and critical minerals, Bill S-238 would effectively limit, if not negate, the crucial financial backing and investments that would be required to accomplish this policy objective.

Rhetoric about nation-building projects is cheap. Access to capital is what turns promises into steel in the ground. This Bill would ensure that one hand of government will be quietly strangling what the other hand is proposing to do in the national interest.

Tammy Nemeth is a U.K.-based energy analyst. Ron Wallace is a Calgary-based energy analyst and former Member of the National Energy Board.

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Energy2 days ago

Energy2 days agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Daily Caller22 hours ago

Daily Caller22 hours agoParis Climate Deal Now Decade-Old Disaster

-

Bruce Dowbiggin2 days ago

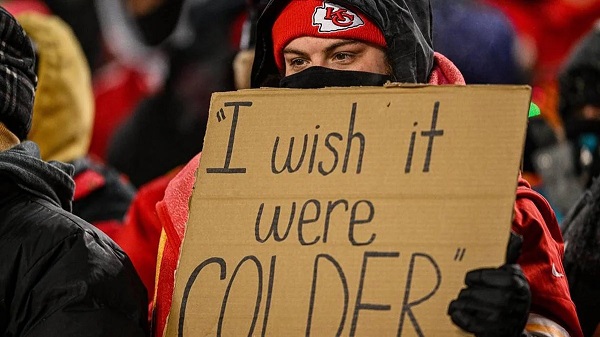

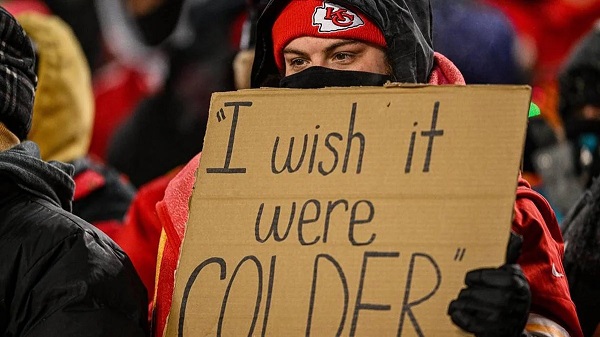

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria

-

Energy2 days ago

Energy2 days agoCan we not be hysterical about AI and energy usage?

-

Alberta22 hours ago

Alberta22 hours agoAlberta’s huge oil sands reserves dwarf U.S. shale

-

Energy2 days ago

Energy2 days agoEnergy security matters more than political rhetoric

-

Business12 hours ago

Business12 hours agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau