Energy

Canada Embracing Carbon Capture and Storage (CCS) to Reduce Emissions and Sustain Energy Industry

From EnergyNow.ca

Alberta has firmly led the Canadian charge on CCS. It has more CO2 storage capacity than Norway, Korea, India, and double the entire Middle East, according to the Global CCS Institute.

Back in 2007, the Alberta and federal governments established a task force on carbon capture and storage (CCS) as a way of reducing emissions from oil, gas, and energy operations. That led to a report in 2008 that said: “CCS is seen as a technological solution that allows Canada to continue to increase its energy production while reducing (carbon dioxide) emissions from these activities. . . .

“CCS is strategically important to Canada for several reasons. First and foremost, Canada is endowed with an abundance of fossil fuels (including an unparalleled oil sands resource).”

The task force noted that public support for CCS was high, with 64% of the public being open to the idea of government financial support for CCS. All that happened under the Conservative Stephen Harper government, which, in 2015, lost power to the Justin Trudeau Liberals.

Trudeau himself went on to say in 2017 these memorable words: “No country would find 173 billion barrels of oil in the ground and leave them there.”

That’s not a message repeated since, and certainly not by his relentless minister of environment and climate change, Steven Guilbeault. On CCS, Guilbeault maintains that while carbon capture and storage “is happening in Canada,” it is not the “be-all and end-all.”

Much more positively, we now have Jonathan Wilkinson, Canada’s energy and natural resources minister, saying he expects 20 to 25 commercial-scale CCS projects to break ground in Canada within the next decade.

And we finally have what Ottawa first promised in 2021: a system of tax credits for investments in carbon capture — which industry sees as a way to get those 20 to 25 carbon-capture projects built.

The tax incentive covers up to 50 per cent of the capital cost of CCS and CCUS carbon-capture projects. Although energy company Enbridge points out that tax incentives in the U.S. are more attractive than what Canada is offering.

“CCUS” is one of the carbon-capture models. It stands for Carbon Capture Use and Storage or Carbon Capture Utilization and Sequestration. Under CCUS, captured carbon dioxide can be used elsewhere (for example, to increase the flow from an oilfield, or locked into concrete). Or it can be permanently stored underground, held there by rock formations or in deep saltwater reservoirs.

Canada’s climate plan includes this: “Increased use of CCUS features in the mix of every credible path to achieving net zero by 2050.”

As well, the feds have supported a couple of smaller CCS projects through the Canada Growth Fund and its “carbon contract for difference” approach.

To date, Alberta has firmly led the Canadian charge on CCS. It has more CO2 storage capacity than Norway, Korea, India, and double the entire Middle East, according to the Global CCS Institute.

From the Alberta government’s Canadian Energy Centre

From the Alberta government’s Canadian Energy Centre

In the most recent move in Alberta, Shell Canada announced it is going ahead with its Polaris carbon capture project in Alberta. It is designed to capture up to 650,000 tonnes of carbon dioxide annually from Shell’s Scotford refinery and chemicals complex near Edmonton.

That works out to approximately 40 per cent of Scotford’s direct CO2 emissions from the refinery and 22 per cent of its emissions from the chemicals complex.

Shell’s announcement sparked this from Wilkinson: “The Shell Polaris announcement last week was a direct result of the investment tax credit.”

Also in Alberta, the Alberta government notes: “The Alberta government has invested billions of dollars into carbon capture, utilization and storage (CCUS) projects and programs. . . . The Alberta government is investing $1.24 billion for up to 15 years in the Quest and Alberta Carbon Trunk Line (ACTL) projects.”

Quest is Shell’s earlier Scotford project. “The project is capturing CO2 from oil sands upgrading and transporting it 65 km north for permanent storage approximately 2 km below the earth’s surface. Since commercial operations began in 2015, the Quest Project has captured and stored over 8 million tonnes of CO2.”

The Alberta Carbon Trunk Line is a 240-km pipeline that carries CO2 captured from the Sturgeon Refinery and the Nutrien Redwater fertilizer plant to enhanced oil recovery projects in central Alberta. Since commercial operations began in 2020, the ACTL Project has captured and sequestered over 3.5 million tonnes of CO2.

Shell and partner ATCO EnPower now plan a new CCS project at Scotford. And, on a smaller scale, Entropy Inc. will add a second phase of CCS at its Glacier gas plant near Grande Prairie.

And those are just two of Alberta’s coming CCS projects. That province is working on at least 11 more that could lead to over $20 billion in capital expenditures and reduce about 24 million tonnes of emissions annually — the equivalent of reducing Alberta’s annual industrial emissions by almost 10 per cent.

And then there’s the giant CCS project proposed by the Pathways Alliance, a partnership representing about 95% of Canada’s oil sands production.

“The project would see CO2 captured from more than 20 oil sands facilities and transported 400 kilometers by pipeline to a terminal in the Cold Lake area, where it will be stored underground in a joint carbon-storage hub. . . . A final investment decision is expected in 2025.”

Alberta alone has more CO2 storage capacity than Norway, Korea, India, and double the entire Middle East, according to the Global CCS Institute.

When Wilkinson spoke in favor of CCS, Capital Power had just backed away from building a carbon-capture facility at its Genesee power plant in Alberta. But Enbridge, which would have built the associated storage hub, is still “strongly interested.”

In Saskatchewan, which also offers government support for CCS, more than 5 million tonnes of CO2 have been captured at SaskPower’s Boundary Dam 3 power plant. “Someone would have to plant more than 69 million trees and let them grow for 10 years to match that.”

In B.C., natural gas company FortisBC offers small-scale carbon-capture technology to help businesses that use natural gas to save energy and decrease greenhouse gas emissions.

And the B.C. government says that, potentially, two to six large-scale CCS projects could be developed in northeast B.C. over the next decade.

“Small-scale operations currently exist in B.C. that inject a mixture of CO2 and H2S (hydrogen sulfide) deep into underground formations. This process, which is referred to as acid-gas disposal, already occurs at 12 sites.”

Elsewhere, CCS projects are operating or being developed around the world, including in Australia, Denmark, and the U.S. A CCS project in Norway has been in operation for 28 years.

It took a while to get the ball rolling in Canada, but CCS/CCUS is here to stay, reducing emissions and keeping industries alive to contribute to the economy.

Energy

B.C. Residents File Competition Bureau Complaint Against David Suzuki Foundation for Use of False Imagery in Anti-Energy Campaigns

From Energy Now and The Canadian Newswire

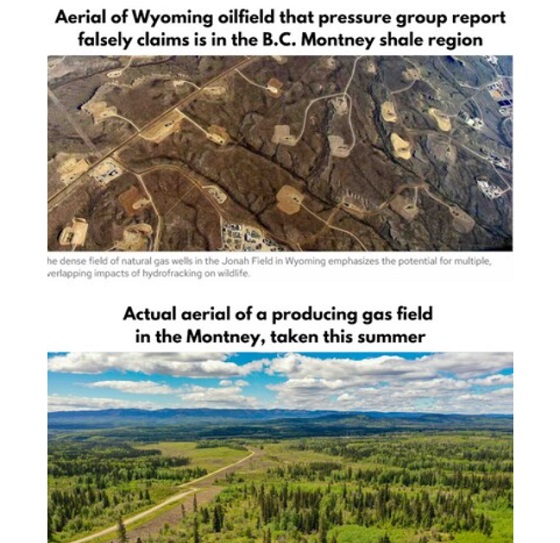

A group of eight residents of Northeast British Columbia have filed a formal application for inquiry with Canada’s Competition Bureau, calling for an investigation into the David Suzuki Foundation’s (the Foundation) use of false and misleading imagery in its anti-energy campaigns.

The complaint alleges that the Foundation has repeatedly used a two-decade-old aerial photograph of Wyoming gas wells to falsely depict modern natural gas development in B.C.’s Montney Formation. This area produces roughly half of Canada’s natural gas.

Key Facts:

- The misleading image has been used on the Foundation’s website, social media pages, reports and donation appeals.

- The Foundation has acknowledged the image’s true source (Wyoming) in some contexts but has continued to use it to represent B.C. development.

- The residents claim this materially misleads donors and the public, violating Section 74.01(1) of the Competition Act.

- The complaint is filed under Sections 9 and 10 of the Act, asking the Bureau to investigate and impose remedies including ceasing the conduct, publishing corrective notices, and returning proceeds.

Quote from Deena Del Giusto, Spokesperson:

“This is about fairness and truth. The people of Northeast B.C. are proud of the work they do to produce energy for Canada and the world. They deserve honest debate, not scare tactics and misleading imagery used to raise millions in donations. We’re asking the Competition Bureau to hold the David Suzuki Foundation to the same standard businesses face: tell the truth.”

Background:

Natural gas development in the Montney Formation supports thousands of jobs and fuels economic activity across the region. Accurate public information is vital to informed debate, especially as many Canadians live far from production sites.

SOURCE Deena Del Giusto

Economy

Trump opens door to Iranian oil exports

This article supplied by Troy Media.

U.S. President Donald Trump’s chaotic foreign policy is unravelling years of pressure on Iran and fuelling a surge of Iranian oil into global markets. His recent pivot to allow China to buy Iranian crude, despite previously trying to crush those exports, marks a sharp shift from strategic pressure to transactional diplomacy.

This unpredictability isn’t just confusing allies—it’s transforming global oil flows. One day, Trump vetoes an Israeli plan to assassinate Iran’s supreme leader, Ayatollah Khamenei. Days later, he calls for Iran’s unconditional surrender. After announcing a ceasefire between Iran, Israel and the United States, Trump praises both sides then lashes out at them the next day.

The biggest shock came when Trump posted on Truth Social that “China can now continue to purchase Oil from Iran. Hopefully, they will be purchasing plenty from the U.S., also.” The statement reversed the “maximum pressure” campaign he reinstated in February, which aimed to drive Iran’s oil exports to zero. The campaign reimposes sanctions on Tehran, threatening penalties on any country or company buying Iranian crude,

with the goal of crippling Iran’s economy and nuclear ambitions.

This wasn’t foreign policy—it was deal-making. Trump is brokering calm in the Middle East not for strategy, but to boost American oil sales to China. And in the process, he’s giving Iran room to move.

The effects of this shift in U.S. policy are already visible in trade data. Chinese imports of Iranian crude hit record levels in June. Ship-tracking firm Vortexa reported more than 1.8 million barrels per day imported between June 1 and 20. Kpler data, covering June 1 to 27, showed a 1.46 million bpd average, nearly 500,000 more than in May.

Much of the supply came from discounted May loadings destined for China’s independent refineries—the so-called “teapots”—stocking up ahead of peak summer demand. After hostilities broke out between Iran and Israel on June 12, Iran ramped up exports even further, increasing daily crude shipments by 44 per cent within a week.

Iran is under heavy U.S. sanctions, and its oil is typically sold at a discount, especially to China, the world’s largest oil importer. These discounted barrels undercut other exporters, including U.S. allies and global producers like Canada, reducing global prices and shifting power dynamics in the energy market.

All of this happened with full knowledge of the U.S. administration. Analysts now expect Iranian crude to continue flowing freely, as long as Trump sees strategic or economic value in it—though that position could reverse without warning.

Complicating matters is progress toward a U.S.-China trade deal. Commerce Secretary Howard Lutnick told reporters that an agreement reached in May has now been finalized. China later confirmed the understanding. Trump’s oil concession may be part of that broader détente, but it comes at the cost of any consistent pressure on Iran.

Meanwhile, despite Trump’s claims of obliterating Iran’s nuclear program, early reports suggest U.S. strikes merely delayed Tehran’s capabilities by a few months. The public posture of strength contrasts with a quieter reality: Iranian oil is once again flooding global markets.

With OPEC+ also boosting output monthly, there is no shortage of crude on the horizon. In fact, oversupply may once again define the market—and Trump’s erratic diplomacy is helping drive it.

For Canadian producers, especially in Alberta, the return of cheap Iranian oil can mean downward pressure on global prices and stiffer competition in key markets. And with global energy supply increasingly shaped by impulsive political decisions, Canada’s energy sector remains vulnerable to forces far beyond its borders.

This is the new reality: unpredictability at the top is shaping the oil market more than any cartel or conflict. And for now, Iran is winning.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Agriculture2 days ago

Agriculture2 days agoCanada’s supply management system is failing consumers

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry

-

armed forces24 hours ago

armed forces24 hours agoCanada’s Military Can’t Be Fixed With Cash Alone

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

Alberta23 hours ago

Alberta23 hours agoAlberta Next: Alberta Pension Plan

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate

-

Crime1 day ago

Crime1 day agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel