Alberta

Calgary Beer is Back! Calgary Craft Brewer reimagines one of Alberta’s most iconic brands

From technology, to communication, all the way to beer, our world is changing more rapidly every day. Who could have imagined how the brewing industry would be turned upside down by craftsmen and entreupreneurs who risk it all for their passion to create a better product right in their community?

In a world that used to be very predictable, everyday another new craft beer hits the market. It’s hard to keep up, though many of us are doing our best. Despite all the excitement around the new tastes and all the clever marketing needed to get those beers into our hands, we all know a few people who are ‘holding out’. Maybe they don’t like change. Maybe they don’t know where to start. Maybe they’re perfectly fine with the same safe brew they’ve been tasting for their entire adult lives. Maybe they should know one of Alberta’s finest craft brewers is bringing back a familiar brand, offering a ton of comfort and enjoyment, one sip at a time.

The renowned brand “Calgary Beer” is back! And of all the craft brewers in Southern Alberta, Village Brewery is the natural choice to have taken on this “reimagined” project. Village Brewery was established by seven veterans of the brewing business, all with an equal passion for beer, and for their community. It made perfect sense for this group to recognize their roots by recreating some local history in the town they love so much. Just in case you didn’t know, Village Brewery turns 10% of their profits, back to the Calgary community.

When Village Brewery Re-launched Calgary Beer they were nice enough to make their Head Brewer Jeremy McLaughlin available for a few questions.

Here’s Jeremy McLaughlin.

1) Why are you bringing “Calgary” back?

The Calgary Beer brand is an important part of beer history in Calgary. It dates back to 1892 and the brand imagery is iconic and represents the origins of beer in Calgary. At Village Brewery, we have always been about supporting the community and bringing people together around beer. The idea of being able to produce something under this brand just fits so well with what we stand for at Village. It’s special to us because we were given an awesome opportunity to modernize both the label and the recipe for today’s craft beer fans.

2) Is this the exact same “Calgary” I drank many years ago?

Since the core ideology of this was to modernize the brand, we were not going to be using the same Export Lager style or name and decided to go with “Craft Lager”. We felt this would reach the audience that Village reaches already. The main distinction, in terms of ingredients, is a significant hop character (from Ella, Sabro and Enigma), which make up the flavour profiles of a lot of craft beer.

3) Talk about the “craft” version. The can looks fantastic by the way. Curious about that and the beer itself.

The beer is really something that we as a brewery were looking to explore, a Craft Lager or dry-hopped lager is very much in the realm of beer profiles that can be interesting to new craft drinkers but something that experienced craft connoisseur would find interesting as well. A breakdown on ingredients and vital stats should get the conversation started here:

-ABV is 5.00%

-IBU: 15

-Colour: Light Gold

-Clarity: Light/Moderate Haze -Malt: Rahr 2-Row

-Yeast: Escarpment’s Krispy Kveik

-Hops: Ella, Sabro and Enigma (all mainly used as a dry-hop). These are symbolic to the ideology of the project (modernization and reimagining, while paying respect). These hops are developed through breeding programs, which modernized historical varieties of hops.

The can design was by Jackson and includes 4 versions

-A vintage throw-back to the original design

-A modernized vintage design featuring design concepts that are popular in craft breweries today (line art)

-A more high design variation that is black with the bull image wrapping the can

-A minimalistic version featuring a red backdrop and a white horseshoe, focusing on clean and crisp presentation

All Alberta residents can purchase this limited edition lager by clicking this link.

Alberta

COWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

Fr0m Energy Now

As Calgarians take a break from the incessant news of tariff threat deadlines and global economic challenges to celebrate the annual Stampede, Conservative party leader Pierre Poilievre gave them even more to celebrate.

Poilievre returned to Calgary, his hometown, to outline his plan to amplify the legitimate demands of Western Canada and not only fight for oil and gas, but also fight for the interests of farmers, for low taxes, for decentralization, a stronger military and a smaller federal government.

Speaking at the annual Conservative party BBQ at Heritage Park in Calgary (a place Poilievre often visited on school trips growing up), he was reminded of the challenges his family experienced during the years when Trudeau senior was Prime Minister and the disastrous effect of his economic policies.

“I was born in ’79,” Poilievre said. “and only a few years later, Pierre Elliott Trudeau would attack our province with the National Energy Program. There are still a few that remember it. At the same time, he hammered the entire country with money printing deficits that gave us the worst inflation and interest rates in our history. Our family actually lost our home, and we had to scrimp and save and get help from extended family in order to get our little place in Shaughnessy, which my mother still lives in.”

This very personal story resonated with many in the crowd who are now experiencing an affordability crisis that leaves families struggling and young adults unable to afford their first house or condo. Poilievre said that the experience was a powerful motivator for his entry into politics. He wasted no time in proposing a solution – build alliances with other provinces with mutual interests, and he emphasized the importance of advocating for provincial needs.

“Let’s build an alliance with British Columbians who want to ship liquefied natural gas out of the Pacific Coast to Asia, and with Saskatchewanians, Newfoundlanders and Labradorians who want to develop their oil and gas and aren’t interested in having anyone in Ottawa cap how much they can produce. Let’s build alliances with Manitobans who want to ship oil in the port of Churchill… with Quebec and other provinces that want to decentralize our country and get Ottawa out of our business so that provinces and people can make their own decisions.”

Poilievre heavily criticized the federal government’s spending and policies of the last decade, including the increase in government costs, and he highlighted the negative impact of those policies on economic stability and warned of the dangers of high inflation and debt. He advocated strongly for a free-market economy, advocating for less government intervention, where businesses compete to impress customers rather than impress politicians. He also addressed the decade-long practice of blocking and then subsidizing certain industries. Poilievre referred to a famous quote from Ronald Reagan as the modus operandi of the current federal regime.

“The Government’s view of the economy could be summed up in a few short phrases. If anything moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

The practice of blocking and then subsidizing is merely a ploy to grab power, according to Poilievre, making industry far too reliant on government control.

“By blocking you from doing something and then making you ask the government to help you do it, it makes you reliant. It puts them at the center of all power, and that is their mission…a full government takeover of our economy. There’s a core difference between an economy controlled by the government and one controlled by the free market. Businesses have to clamour to please politicians and bureaucrats. In a free market (which we favour), businesses clamour to impress customers. The idea is to put people in charge of their economic lives by letting them have free exchange of work for wages, product for payment and investment for interest.”

Poilievre also said he plans to oppose any ban on gas-powered vehicles, saying, “You should be in the driver’s seat and have the freedom to decide.” This is in reference to the Trudeau-era plan to ban the sale of gas-powered cars by 2035, which the Carney government has said they have no intention to change, even though automakers are indicating that the targets cannot be met. He also intends to oppose the Industrial Carbon tax, Bill C-69 the Impact Assessment Act, Bill C-48 the Oil tanker ban, the proposed emissions cap which will cap energy production, as well as the single-use plastics ban and Bill C-11, also known as the Online Streaming Act and the proposed “Online Harms Act,” also known as Bill C-63. Poilievre closed with rallying thoughts that had a distinctive Western flavour.

“Fighting for these values is never easy. Change, as we’ve seen, is not easy. Nothing worth doing is easy… Making Alberta was hard. Making Canada, the country we love, was even harder. But we don’t back down, and we don’t run away. When things get hard, we dust ourselves off, we get back in the saddle, and we gallop forward to the fight.”

Cowboy up, Mr. Poilievre.

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

Alberta

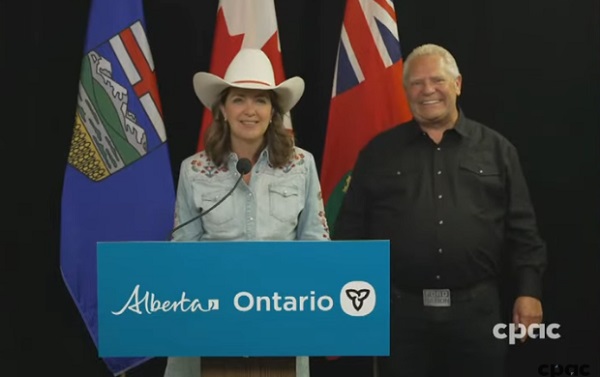

Alberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

Alberta-Ontario MOUs fuel more pipelines and trade

Alberta Premier Danielle Smith and Ontario Premier Doug Ford have signed two memorandums of understanding (MOUs) during Premier Ford’s visit to the Calgary Stampede, outlining their commitment to strengthen interprovincial trade, drive major infrastructure development, and grow Canada’s global competitiveness by building new pipelines, rail lines and other energy and trade infrastructure.

The two provinces agree on the need for the federal government to address the underlying conditions that have harmed the energy industry in Canada. This includes significantly amending or repealing the Impact Assessment Act, as well as repealing the Oil Tanker Moratorium Act, Clean Electricity Regulations, the Oil and Gas Sector Greenhouse Gas Emissions Cap, and all other federal initiatives that discriminately impact the energy sector, as well as sectors such as mining and manufacturing. Taking action will ensure Alberta and Ontario can attract the investment and project partners needed to get shovels in the ground, grow industries and create jobs.

The first MOU focuses on developing strategic trade corridors and energy infrastructure to connect Alberta and Ontario’s oil, gas and critical minerals to global markets. This includes support for new oil and gas pipeline projects, enhanced rail and port infrastructure at sites in James Bay and southern Ontario, as well as end-to-end supply chain development for refining and processing of Alberta’s energy exports. The two provinces will also collaborate on nuclear energy development to help meet growing electricity demands while ensuring reliable and affordable power.

The second MOU outlines Alberta’s commitment to explore prioritizing made-in-Canada vehicle purchases for its government fleet. It also includes a joint commitment to reduce barriers and improve the interprovincial trade of liquor products.

“Alberta and Ontario are joining forces to get shovels in the ground and resources to market. These MOUs are about building pipelines and boosting trade that connects Canadian energy and products to the world, while advocating for the right conditions to get it done. Government must get out of the way, partner with industry and support the projects this country needs to grow. I look forward to working with Premier Doug Ford to unleash the full potential of our economy and build the future that people across Alberta and across the country have been waiting far too long for.”

“In the face of President Trump’s tariffs and ongoing economic uncertainty, Canadians need to work together to build the infrastructure that will diversify our trading partners and end our dependence on the United States. By building pipelines, rail lines and the energy and trade infrastructure that connects our country, we will build a more competitive, more resilient and more self-reliant economy and country. Together, we are building the infrastructure we need to protect Canada, our workers, businesses and communities. Let’s build Canada.”

These agreements build on Alberta and Ontario’s shared commitment to free enterprise, economic growth and nation-building. The provinces will continue engaging with Indigenous partners, industry and other governments to move key projects forward.

“Never before has it been more important for Canada to unite on developing energy infrastructure. Alberta’s oil, natural gas, and know-how will allow Canada to be an energy superpower and that will make all Canadians more prosperous. To do so, we need to continue these important energy infrastructure discussions and have more agreements like this one with Ontario.”

“These MOUs with Ontario build on the work Alberta has already done with Saskatchewan, Manitoba, Northwest Territories and the Port of Prince Rupert. We’re proving that by working together, we can get pipelines built, open new rail and port routes, and break down the barriers that hold back opportunities in Canada.”

“Canada’s economy has an opportunity to become stronger thanks to leadership and steps taken by provincial governments like Alberta and Ontario. Removing interprovincial trade barriers, increasing labour mobility and attracting investment are absolutely crucial to Canada’s future economic prosperity.”

Together, Alberta and Ontario are demonstrating the shared benefits and opportunities that result from collaborative partnerships, and what it takes to keep Canada competitive in a changing world.

Quick facts

- Steering committees with Alberta and Ontario government officials will be struck to facilitate work and cooperation under the agreements.

- Alberta and Ontario will work collaboratively to launch a preliminary joint feasibility study in 2025 to help move private sector led investments in rail, pipeline(s) and port(s) projects forward.

- These latest agreements follow an earlier MOU Premiers Danielle Smith and Doug Ford signed on June 1, 2025, to open up trade between the provinces and advance shared priorities within the Canadian federation.

Related information

-

Alberta2 days ago

Alberta2 days agoAlberta Next: Immigration

-

COVID-191 day ago

COVID-191 day agoFDA requires new warning on mRNA COVID shots due to heart damage in young men

-

Alberta Sports Hall of Fame and Museum2 days ago

Alberta Sports Hall of Fame and Museum2 days agoAlberta Sports Hall of Fame 2025 Inductee Profiles – Para Nordic Skiing – Brian and Robin McKeever

-

Crime1 day ago

Crime1 day agoNews Jeffrey Epstein did not have a client list, nor did he kill himself, Trump DOJ, FBI claim

-

Business1 day ago

Business1 day agoCarney’s new agenda faces old Canadian problems

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoEau Canada! Join Us In An Inclusive New National Anthem

-

International19 hours ago

International19 hours agoChicago suburb purchases childhood home of Pope Leo XIV

-

Daily Caller18 hours ago

Daily Caller18 hours agoBlackouts Coming If America Continues With Biden-Era Green Frenzy, Trump Admin Warns