Alberta

Zainul Mawji- passion and a track record in technology, entrepreneurship, and community

Zainul Mawji is President of TELUS Home Solutions. She is responsible for delivering valued products to customers, growing market share and improving the quality of life across Western Canada. Mawji is accountable for several lines of business including: the design and delivery of consumer products and content for our residential market; our small business segment; our security and automation business; and our consumer health product line.

Joining Telus in 2001 with her entrepreneurship and passion for technology she has held various positions at TELUS, including as an Investment Resource Manager, Corporate Strategy, Marketing, Business Transformation (IT) and Technology Operations, to bring TELUS PureFibre network to reality.

After completing her Master of Business Administration (MBA) degree at University of Western Ontario’s Richard Ivey School of Business Mawji worked in management consulting for PricewaterhouseCoopers and Accenture.

Mawji is very committed to give back to the community. She serves as Vice-Chair of the TELUS Edmonton Community Board which has donated 100’s of millions since 2000, she is a Trustee of the Edmonton Public Library Board, a board member of Alberta Science & Technology Foundation, national committee member with Aga Khan Foundation for Canada, she volunteers for Junior Achievement of Northern Alberta & NWT. In 2017 the Mawji family donated $1-million dollars to help launch The Mawji Centre for New Venture and Entrepreneurship.

Mawji has also held numerous consulting roles in her family’s Alberta-based hotel business. And most importantly, Zainul enjoys spending time with her husband, Ashif and their two sons.

Here are the members of the council. You’ll see more of Tom’s stories about this group as the week progresses.

- Jack Mintz, chair

- Clive Beddoe – former chair, president and CEO, WestJet

- Robert Blakely

- Brent Belzberg – founder and senior managing partner, TorQuest Partners

- Bob Dhillon – founder, president and CEO, Mainstreet Equity Corporation

- Chris Fowler – president and CEO, Canadian Western Bank

- Rt. Hon. Stephen Harper – Canada’s 22nd prime minister

- Peter Kiss – owner and president, Morgan Construction and Environmental

- Zainul Mawji – president, Telus Home Solutions

- Nancy Southern – chair and CEO, ATCO Ltd.

- Kevin Uebelein – CEO, AIMCo

- Mac Van Wielingen – founder, ARC Financial

Nancy Southern has the skills and experience to help Alberta find its way forward

Westjet Founder Clive Beddoe to help Alberta’s economy take flight

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

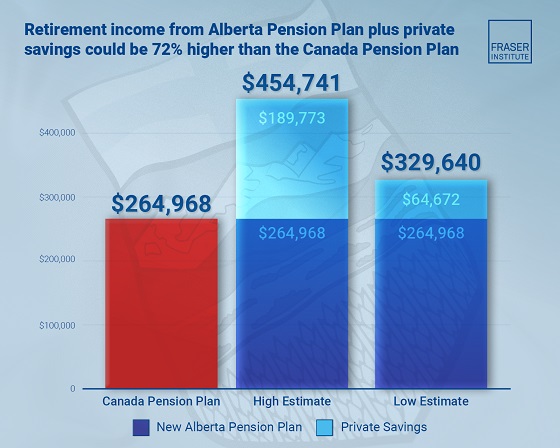

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Alberta1 day ago

Alberta1 day agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Daily Caller21 hours ago

Daily Caller21 hours ago‘Strange Confluence Of Variables’: Mike Benz Wants Transparency Task Force To Investigate What Happened in Butler, PA

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

COVID-191 day ago

COVID-191 day agoTrump DOJ dismisses charges against doctor who issued fake COVID passports