Alberta

The Votes Tell the Story

The Votes Tell the Story

On this amazing day for hockey fans, especially in Alberta, it’s a personal joy to realize two men I have known and appreciated for decades are now members of the Hockey Hall of Fame.

As much satisfaction as supporters are sure to feel for Jarome Iginla and his selection in his first year of HHOF eligibility, the same level of pleasure is sure to be shared by Kevin Lowe, who has waited many years for his combination of steadiness, competitive fire and team intelligence to be recognized at the highest possible of the game both he and Iginla have loved since childhood.

It’s a bonus for Edmontonians, and for all in sports, that Ken Holland was welcomed as a builder. He deserves the accolade as much as anyone can and the fact that he achieved most of his front-office success before he was hired as the Edmonton Oilers general manager before the start of last season. It’s still a shock to recall how many dedicated Oilers lovers objected in words and in print to the thought that he would be hired after being escorted away from Joe Louis Arena in Detroit.

You want another shock? Iginla came much closer to being potentially a career Oiler than media wretches were allowed to know.

He was drafted 11th overall in 1995. Steve Kelly became a mistaken sixth-overall choice in the same year. He was picked as Number 6 — one spot ahead of Shane Doan despite loud demands for the Oilers to go for Doan with their first pick of the graduate draft.

Barry Fraser, Edmonton’s head scout, told me before the draft that Iginla “is going to be a good pick for somebody.” He also Iginla as a potential first-rounder, a clear sign that he would become part of the mid-90s Oilers if rival selections made it possible.

Doan, like Lowe, was a productive but not brilliant offensive player. If his character and leadership are taken into account in a future year, he will also become a more promising candidate for Hall of Fame membership.

Dealing with Lowe during the Oilers’ Stanley Cup run was always a pleasure. When he sensed a criticism, and if he missed some of the credit headed his team’s way, he was likely to be edgy. It was impossible to do a pre-game Sportstalk segment and still find time for a moment to talk. Then I learned that he sharpened his skates very early on game night. That meant he would be available for brief conversation.

Somehow, it evolved that we would speak before the first home game of every series. I still remember the intensity of his preparation.

Iginla’s brilliant junior record and his lifelong connection with Edmonton and St. Albert made it obvious that we would meet during the 1995 junior draft countdown. He and several other top prospects were made available for live appearances for about week.

Iginla was not a logical choice to talk: he did not blow his own horn. Others seemed more interested than he was at the thought of speaking for 30 minutes on radio. After about three days, someone asked about giving Jarome some time on the microphone. Said I: “It doesn’t look like he’s interested” but his supporter suggested that I approach the quiet young man. He agreed to join the chow and was a sensational guest, showing a confident streak that was well-balanced with modesty.

One question was a natural for presentation to any young athlete: “Do you think the NHL will be a good fit for you?” His answer, as I learned gradually over time, was typical for him.

“I know I’ve got a lot to learn,” he said. “I have to improve my skating quite a bit. If I do that, I can probably do all right.”

As they say: Now we know the rest of the story.

Alberta

Alberta Sports Hall of Fame Announces Class of 2026 Inductees

The Alberta Sports Hall of Fame is proud to announce its Class of 2026 inductees, celebrating outstanding athletes, builders, and contributors who have made a lasting impact on Alberta’s sporting community. From motorsport to rugby, rowing, and basketball, this year’s class represents excellence, dedication, and passion for sport across the province.

The Induction Ceremony will take place on Saturday, June 6, 2026, at the Red Deer Resort & Casino. Ticket information will be announced at a later date.

“Each year, the Alberta Sports Hall of Fame has the honour of recognizing remarkable individuals who have shaped sport in our province. The Class of 2026 is no exception,” said Alberta Sports Hall of Fame Board Chair Murray Cunningham. “This group includes Olympians, record breakers, and dedicated sport builders whose impact reaches far beyond competition. We are proud to celebrate their achievements and preserve their stories for future generations.”

Class of 2026 Inductees:

Jen Kish — Rugby Athlete

Jen Kish emerged as a standout talent early, earning her spot on the national team at just 17. Over the next 13 years, she became one of the country’s most influential rugby players, ultimately serving as captain of Canada’s Women’s Rugby Sevens team during its rise onto the world stage. Under her leadership, Canada achieved a series of historic results: silver at the 2013 Rugby World Cup Sevens, gold at the 2015 Pan American Games, and a bronze medal at the 2016 Rio Olympics—the first Olympic tournament for women’s rugby sevens. Her work ethic, competitive intensity, and ability to build trust and resilience became defining elements of the team’s culture. Beyond competition, Kish continued to break ground as an advocate for inclusion, representation, and mental health awareness. She has mentored young athletes at camps, schools, and community events across Alberta, helping broaden the sport’s reach and support future generations. Recognized as an inductee of both the Rugby Canada Hall of Fame and the Edmonton Sports Hall of Fame, Jen remains a powerful voice and mentor within Canadian rugby, solidifying her legacy as a world-class competitor and leader on and off the field.

Shannon Kleibrink — Curling Athlete

Shannon Kleibrink has been a major force in Canadian curling for more than two decades. She began competing at the national level in the early 1990s and went on to become a five-time Alberta Women’s Champion and four-time Alberta Mixed Champion. In 2004, she made history as the only woman to skip a team to a Canadian Mixed Curling Championship title. Kleibrink’s success continued on the world stage. She won an Olympic bronze medal at the 2006 Winter Games and competed in five Scotties, earning multiple national and Grand Slam titles. She also secured three medals at the Canadian Olympic Trials during her competitive career, which spanned from 1993 to 2018 before returning at the senior level in 2023. Beyond competition, Shannon has significantly shaped the sport through coaching and development. As Curling Alberta’s Director of Community Curling Centre Development, she has strengthened rural clubs, expanded post-secondary curling programs, and supported grassroots growth across the province.

James Steacy — Hammer Throw Athlete

James Steacy launched his athletic career at the University of Lethbridge, where he became a five-time CIS weight throw champion and set a national university record that still stands today. His success propelled him onto the international stage, beginning a 17-year career representing Canada. Steacy captured gold at the 2007 Pan American Games and made history at the 2008 Beijing Olympics as the first Canadian in 84 years to reach the hammer throw final. He continued to lead Canadian throwing through the next decade, serving as captain of Canada’s track and field team at the 2012 London Olympics and winning Commonwealth Games gold in 2014. Along the way, Steacy claimed 11 national titles and set a Canadian hammer throw record of 79.13 metres, which remained unbroken for 15 years. After retiring from competition, Steacy remains committed to his community, mentoring young athletes and supporting the Lethbridge sports community.

Kasia Gruchalla-Wesierski — Rowing Athlete

Kasia Gruchalla-Wesierski began her athletic career as an alpine skier before shifting to rowing in 2014 with the Calgary Rowing Club. Her rapid rise in the sport led to her joining the Canadian senior national team in 2018, marking the start of her impact on the world stage. She became a key member of Canada’s women’s eight, contributing to multiple World Cup podiums and earning a bronze medal at the 2022 World Rowing Championships. One of the defining moments of her career came at the Tokyo 2020 Olympic Games. Just weeks before competition, she suffered a severe cycling accident—breaking her collarbone, bruising her hip, and requiring 56 stitches. Her five-week comeback to reclaim her seat culminated in winning Olympic gold with the W8+, one of the most celebrated stories of the Games. Kasia continued to excel, capturing silver in the women’s eight at Paris 2024 and winning gold at the 2024 World Cup in Lucerne. Beyond competition, she remains deeply involved in the rowing community as a coach in Calgary and will serve as an Athlete Services Officer with the Canadian Olympic Committee at the 2026 Milano Cortina Winter Olympics.

Dennis Allen — Multisport Builder

Dennis Allen has spent a lifetime shaping sport in Alberta as both an athlete and a builder. His time with the 1963-1965 Lethbridge North Star Fastball teams earned him induction into the Softball Alberta Hall of Fame (2003) and the Lethbridge Sports Hall of Fame (2007). Allen’s work as a sport builder began in 1986 when he served as Chair of the Alberta Summer Games in Edson, earning Citizen of the Year for his leadership. That role launched nearly 30 years of service to the Alberta games, where he led marketing, operations, volunteer development, and facility upgrades that supported athlete pathways and contributed to the development of more than 50 future Olympians. He later played a key role in strengthening the Alberta Sports Hall of Fame, helping raise funds for the construction of its current facility and serving as both Director and Chairman of the Board. Known for his mentorship and forward-thinking approach, Allen championed youth engagement programs such as “Live Outside the Box” and secured funding that expanded sport opportunities across the province. His work has left a lasting impact on Alberta’s sport infrastructure, community development, and athlete success at every level.

Bernard “Bernie” Haley — Hockey Builder

Bernard “Bernie” Haley began his hockey career as an elite player, winning an NCAA national championship with the University of North Dakota before moving into senior hockey. He later shifted his focus to officiating, quickly rising through the ranks thanks to his exceptional skating, professionalism, and command of the game. Over his career, Haley officiated across multiple levels of Canadian hockey, including the WHA, national championships, Memorial Cup finals, and the Canada Winter Games, where he was consistently assigned medal rounds and championship games. His skill earned him international recognition as well—he represented Canada as its lone official at several IIHF World Championships and at the 1980 Winter Olympics, where his composure and authoritative presence drew widespread respect. Beyond the ice, Haley shaped the sport through more than 20 years as Hockey Alberta’s Zone 4 assignor, mentoring generations of officials, leading clinics, and instilling the values of preparation, discipline, and respect for the game. His contributions have been honoured through numerous awards, including his Level VI National High Performance Referee designation, the Alberta Achievement Award of Excellence, and the “Bernie Haley Award for Officiating,” named in his honour. Together, these achievements cement his legacy as one of Alberta’s and Canada’s most influential officials and builders in hockey.

Donna Rudakas — Basketball Builder

Donna Rudakas began shaping Alberta basketball in the early years of her coaching career, eventually joining the University of Calgary Dinos and leading the women’s program through a dominant 14-year run. Under her guidance, the Dinos made 13 playoff appearances, captured five Canada West titles, and delivered a historic undefeated 36-0 season in 1988–89—part of a remarkable 69-game winning streak, one of the longest in North American women’s basketball. Donna was known for her forward-thinking approach, pioneering offensive and defensive systems built around the newly introduced three-point line. Her leadership developed numerous national team players, All-Canadians, and athletes who went on to professional and high-profile careers. Off the court, she became a powerful advocate for women in sport. Rudakas delivered clinics, camps, and leadership programs across Alberta, promoting participation, academic success, and lifelong confidence through basketball. Her commitment to developing athletes and empowering young women earned her multiple coaching honours and deep respect across the Canadian basketball community. Widely regarded as a visionary builder, Rudakas’ influence continues to shape the game—and the players—who follow in her footsteps.

Dale Schulha — Multisport Builder

Dale Schulha began his athletic journey as a multi-sport standout at McNally Composite High School, competing on seven teams in his senior year. He went on to play defensive back for the University of Alberta Golden Bears from 1968 to 1972, serving as team captain during the 1971 and 1972 College Bowl Championship seasons. After completing his education, Schulha entered the Edmonton Public School system as a teacher and quickly moved into coaching. He guided teams at both the high school and junior football levels, coached at Medicine Hat College, and later became Head Coach of the Medicine Hat Rattlers in the Alberta Junior Football League. Schulha transitioned into senior sport administration, holding several leadership roles before serving two terms as the University of Alberta’s Director of Athletics. In that role, he oversaw 25 varsity teams, 80 staff, and more than 475 student-athletes, while helping shape the broader landscape of Canada West and Canadian Interuniversity Sport. He was also a key contributor to the 1983 World University Summer Games in Edmonton. In recognition of his impact, Schulha received the Austin-Matthew Award in 2014 for outstanding contributions to Canadian University sport.

Bud Steen — Football Builder

Bud Steen is regarded as one of Canadian football’s most influential officials and builders. His career began in the late 1970s and grew into more than 30 years on the field, working over 500 CFL games and receiving seven Grey Cup referee assignments—one of the league’s highest honours for an official. Known for his calm presence, professionalism, and command of the rulebook, Steen helped elevate the role of officiating across Canada. In the late 1990s, he founded the Canadian Professional Football Officials Association and served as its first president for 12 years. Under his leadership, the association secured the CFL’s first formal employment agreement for officials, introduced comprehensive insurance coverage, and improved working conditions and professional standards across the league. Steen’s impact extended far beyond game days. He has mentored officials at every level, led decades of film and rules clinics, created Alberta’s Junior Officials Program, and helped implement league-wide evaluation and grading systems that strengthened training and accountability within the CFL. After retiring from on-field officiating in 2010, he continued to serve the league as a game supervisor, evaluator, and rules coach, earning respect from officials, coaches, and players alike. His leadership has been recognized through the CFL Commissioner’s Award and numerous honours for mentorship and professionalism.

1995 Calgary Canucks — Hockey Team

The 1995 Calgary Canucks stand as one of Alberta’s greatest junior hockey teams, built entirely from local Hockey Calgary talent. After finishing second in the regular season, the Canucks powered through the AJHL playoffs to win the league title and then captured the Doyle Cup, earning their spot at the Centennial Cup in Ottawa. Their national championship run became one of the most memorable in tournament history. In the final, the Canucks forced overtime with a goal in the last minute of regulation before Jason Abramoff scored the winner, securing Calgary’s first national title and the final championship contested under the Centennial Cup name before it became the Royal Bank Cup. The team’s success showcased the strength of Calgary’s grassroots development system and reinforced the city’s status as a junior hockey powerhouse. Defined by resilience, leadership, and a deep commitment to team play, the 1995 Calgary Canucks left a legacy that continues to influence junior hockey in Alberta and across Canada.

David Moir —Bell Memorial

David Moir has built a remarkable career in Canadian sports broadcasting after an accomplished athletic youth. Growing up in Calgary, he excelled in football, basketball, hockey, and track and field—earning city championships, All-Star honours, and setting junior football records with the Calgary Colts. He transitioned into sports media in the early 1980s and quickly became a trusted statistician and graphics coordinator for Calgary Flames broadcasts and CFL coverage. Over more than 40 years, Moir has contributed to 37 Grey Cups, 21 Stanley Cup Finals, 8 Olympic Games—including the iconic 2010 Vancouver Olympic hockey gold medal game—and numerous world championship events. He is widely respected for his precision, professionalism, and ability to anticipate broadcaster needs in high-pressure environments. Known for elevating the quality of live sports coverage, Moir has worked alongside many of Canada’s leading media personalities and is regarded as “at the top of his craft.” His decades of service have strengthened sports broadcasting nationwide and reflect a lifelong commitment to Alberta athletics and storytelling.

Allen Berg — Motorsport Achievement

Allen Berg is one of Alberta’s most accomplished motorsport athletes and remains the only Albertan to compete in Formula 1. Raised in Calgary, he began karting in the late 1970s and quickly rose through the ranks, winning back-to-back Alberta championships. He advanced into Formula Ford and Formula F, earning multiple Rookie of the Year awards and Canadian Driver of the Year honours before moving onto the international stage. Berg competed in British Formula 3, finishing second overall in 1984. His success earned him a Formula 1 contract with Osella, and in 1986 he competed in nine Grand Prix events against some of the sport’s greatest drivers. He later transitioned into endurance racing, taking part in major events such as the 24 Hours of Le Mans and the IMSA Daytona 24 Hours. After retiring from professional competition, Berg turned his focus to mentorship and driver development. He founded the Allen Berg Racing School, where he has trained more than 10,000 drivers across Canada, the United States, Mexico, and Europe, advancing driver safety and high-performance training worldwide. Inducted into the Canadian Motorsport Hall of Fame in 2019, Berg’s career reflects international success, a dedication to education, and a lasting impact on motorsport in Alberta and beyond.

Dr. Bob Bratton — Volleyball Pioneer

Dr. Bob Bratton is a trailblazer who helped turn volleyball in Alberta from a casual pastime into a powerhouse sport.He discovered the game at 20 while in graduate school in Chicago, earning a silver medal at the U.S. collegiate championship before bringing his passion north. Over the next several decades, Bratton became one of the sport’s strongest architects—serving more than 20 years as President of the Alberta Volleyball Association and later as Vice-President of Volleyball Canada, where he advanced player development, coaching standards, and officiating programs nationwide. As head coach of the University of Calgary men’s team from 1962 to 1976, he led Canada’s first university volleyball tour of Europe, opening doors for international competition. Alberta’s first National Referee, Bratton also created the Masters Officials Program—still a benchmark for training officials at every level. He authored coaching manuals, hosted clinics and camps across the province, and played a key role in bringing the Canadian Men’s National Team to Calgary. Inducted into both the Volleyball Canada Hall of Fame (2003) and Volleyball Alberta Hall of Fame (2005), Bratton’s impact is lasting. His vision and leadership helped establish Alberta as one of the country’s strongest centres for volleyball—nationally and internationally.

“As we embark on the induction journey, our team is genuinely excited to connect with and learn more about each member of the Class of 2026. Every inductee carries an inspiring story shaped by passion, resilience, and achievement. It is a privilege for us to help share these stories with Albertans, and we look forward to celebrating this exceptional group throughout the year,” said Executive Director Tracey Kinsella.

The Alberta Sports Hall of Fame continues to celebrate and preserve the rich sporting heritage of Alberta. Join us in recognizing these incredible contributors at the 2026 Induction Ceremony.

Alberta

Carney’s pipeline deal hits a wall in B.C.

This article supplied by Troy Media.

Carney’s attempt to ease Canada’s dependence on the U.S. stirs a backlash in B.C., raises Indigenous concerns and rattles his own party

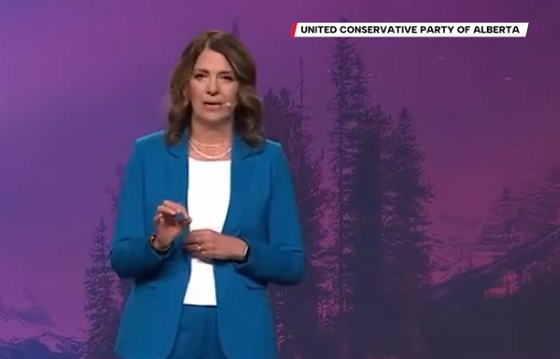

The Memorandum of Understanding (MOU) between Prime Minister Mark Carney and Alberta Premier Danielle Smith has opened a political hornet’s nest, exposing deep divisions within the Liberal Party and forcing a national debate that has been avoided for years.

Carney was under mounting pressure to respond to U.S. tariffs that threaten to carve billions out of Canada’s economy. The United States buys more than 95 per cent of Canada’s oil exports, leaving the country highly exposed to U.S. policy decisions. That pressure is now driving his push for a route to the Pacific, a project that could change Canada’s economic future but also destabilize his already fragile minority government.

Carney knows the political risk. His government could fall at any time, which only raises the stakes. Even so, he has pressed ahead. The agreement with Alberta lays early groundwork for a new pipeline to the Pacific. It would expand the oil sands, ease some environmental obligations and revive a proposal industry leaders have pushed for years.

The route is far from settled, but it is expected to run to B.C.’s northern coast and open access to Asian buyers. A Pacific route would finally give Canada a direct path into Asian energy markets, where demand remains strong and prices are often higher than in the United States.

If Carney expected broad support, he did not get it, especially in British Columbia. Because B.C. is the only province with a deep-water port capable of handling large crude carriers, it is the only path a west-coast pipeline can take. The province is now the central battleground, and whether the project succeeds will depend on what happens there.

B.C. Premier David Eby criticized the lack of consultation. “It would have been good for B.C. to be at the table,” he said, warning that the project risks undermining Indigenous support for the province’s liquefied natural gas plans. He also noted that the pipeline has no private backer and no commitments from First Nations, two obstacles that have tripped up projects before.

The backlash quickly spread to Ottawa. Steven Guilbeault, the former environment minister and the most prominent environmentalist ever to serve in a federal cabinet, resigned from cabinet in direct response to the MOU. He said the proposed pipeline “would have major environmental impacts”. Green Party Leader Elizabeth May said his departure “dashes the last hope that Mark Carney is going to have a good climate record ever.”

Several B.C. Liberal MPs echoed concerns about the political cost. CBC News reported anger inside the caucus, with some MPs “seething” over the agreement and worried about losing climate-focused voters.

The voters those MPs fear may not be as opposed as they think. An October Angus Reid Institute survey found that a solid majority of Canadians support a pipeline from northern Alberta to the northwest B.C. coast. In British Columbia, support outweighs opposition by a wide margin. That challenges Eby’s claim that the project lacks public backing. Carney may have more room to manoeuvre than his critics admit.

The most significant challenge, however, comes from Indigenous leaders. British Columbia is the only province that has formally adopted the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) into law, giving First Nations a stronger legal position in major project decisions. Court rulings over the past two decades have affirmed a duty to consult and, in some cases, accommodate Indigenous communities, giving them major influence over large projects.

A group representing Coastal First Nations in B.C. said the pipeline “will never happen”. The Union of B.C. Indian Chiefs said it is “loudly objecting” to the MOU, arguing it was drafted without involvement from coastal First Nations and does not meet consultation standards outlined in UNDRIP. “The answer is still no and always will be,” said UBCIC Grand Chief Stewart Phillip. He also said lifting the crude oil tanker ban would amount to bulldozing First Nation rights. Without Indigenous consent, the project cannot proceed, and Carney knows this is the single largest barrier he faces.

Carney’s reasoning is straightforward. The long-term danger of relying on one market outweighs the short-term turbulence created by the pipeline fight. The MOU suggests Ottawa is prepared to reconsider projects once thought politically impossible in order to protect Canada’s economic future. He is betting that doing nothing is the bigger risk.

Whether this pipeline moves forward is uncertain, and the obstacles are real. One fact, however, remains clear. Canada cannot keep betting its stability on a single market.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

National2 days ago

National2 days agoCanada Needs an Alternative to Carney’s One Man Show

-

Alberta1 day ago

Alberta1 day agoThis new Canada–Alberta pipeline agreement will cost you more than you think

-

Daily Caller2 days ago

Daily Caller2 days agoTech Mogul Gives $6 Billion To 25 Million Kids To Boost Trump Investment Accounts

-

Business2 days ago

Business2 days agoRecent price declines don’t solve Toronto’s housing affordability crisis

-

Automotive1 day ago

Automotive1 day agoPower Struggle: Governments start quietly backing away from EV mandates

-

Energy1 day ago

Energy1 day agoUnceded is uncertain

-

Business2 days ago

Business2 days agoCanada’s future prosperity runs through the northwest coast

-

Business10 hours ago

Business10 hours agoCanada’s climate agenda hit business hard but barely cut emissions