Calgary

The Secret To The Joe Rogan Podcast

Joe Rogan may not have a University degree, but he has ingested far more information than he would have otherwise received with even a Master’s degree. When you can read, and you have an open mind, it’s amazing how much you can learn. Of all the books Joe has read, I’m willing to bet he’s spent some time with Dale Carnegie’s, “How to Win Friends, and Influence People”. Being well-read though is only one part of what has made The Joe Rogan Experience Podcast, the most successful podcast on earth. Joe has a larger audience than any show on Fox, CNN, MSNBC, CBS, or any other major network. Joe doesn’t just have the largest Podcast, he has the largest audience…period.

Inspired at least in part by Joe Rogan, myself and millions of other people have been trying to emulate his success by starting our own Podcasts. It doesn’t matter what the topic, somewhere there is a Podcast talking about it. Whether you’re interested in ceramic figurines, ten pin bowling, astronomy, or quilting, there is a Podcast for you…and it’s usually FREE!

Much to the disappointment of many Joe Rogan emulators, their Podcasts usually fall far short of their expectations. Instead of amassing an audience of millions, they discover that they are lucky to have an audience of dozens. Due to these unfavourable results, the vast majority of podcast hosts give up, fold up their tent, sell their gear on kijiji, and pretend their failure never happened. Most who fail never fully understand WHY they failed, or how to fix it. Here are some considerations for you, if you wish to either start your own podcast or re-launch a stagnant one.

First, let’s be honest…Joe had a head start. It’s a lot easier to succeed at a Podcast if you already have a following who is interested in your opinions. Gaining a following is the toughest part, so if you’re going to make it, you’re going to have to earn your audience…it won’t just happen on its own, nor will it happen by accident. Although pre-existing notoriety is a significant bonus, it’s only part of the recipe. Numerous late-night hosts have started their own podcasts, only to discover that their late-show talent doesn’t translate to their podcast talent. Despite their running start, these celebrities have not been successful in transitioning their existing audience to the podcast format. Here’s what they’re missing.

People hang out with people they like and trust. When you tune in to the Joe Rogan Experience (JRE) you don’t feel like you’re being force-fed a contrived narrative, instead, you feel like you’re chatting with a good friend. Listening to the JRE is like having a virtual coffee shop chat with the most interesting people on the planet, who have interesting ideas. In contrast, listening to the news feels like we’re being told what to think, and how to behave. A newscast pretends to be the unsullied purveyor of truth, though in recent years the credibility of this claim has been eroded worse than the wheel wells of a 1973 Chevy truck. We don’t trust the news, because they have proven themselves to be untrustworthy.

Joe doesn’t tuck us into the fold by proclaiming that he is the holder of the truth. Instead, Joe takes us on a journey of curiosity and shows us how to ask meaningful questions about interesting topics. Mr. Rogan models what it is to set your ego aside, and be open to the truth, whatever that may be. Being proven wrong is a Freddy Kruger level nightmare for many people, and they’ll fight to be right till their last breath. Joe shows us a different way, the way of courageous curiosity.

The skeptic is forever looking through the lens of “What’s wrong with this picture?” A person who chooses curiosity over skepticism looks through the lens of “What’s the truth of this picture?” Joe’s rare ability to disconnect from the outcome, and just follow the evidence is part of his magnetic charm. He earns our trust, by being willing to admit when he is wrong, and by rarely stating his opinions as facts. Joe doesn’t actually “know” much, but he is aware of much. He follows the Socratic philosophy of, “the only true wisdom, is in knowing you know nothing”. On most topics, Joe’s just guessing, as are the rest of us and he doesn’t try to hide it.

All of the above culminates to: Rule#1. Dig for the truth, not for validation that you are right.

Rule #2. Prioritize substance over bling.

A client of mine is a sales rep for Bacardi. He once told me that with enough money thrown into a marketing campaign, you can sell a whole lot of any liquid, but only for a short time. If it tastes like skunk piss, the marketing campaign will only yield short term success. For long term success, there must be quality in the substance of your message, not just clickbait.

Having celebrities on your show doesn’t hurt, …but it’s not as important as the topics you discuss. If you’re not going to say anything original, then at least convey your thoughts in an original way. Ride the waves or relevance by being quick to discuss trending topics, but ensure to pose meaningful questions, and get beyond the surface of a story.

Rule #3. Respect your audience

Respecting your audience, means being a professional. Being a professional, means being prepared. Provide your audience with decent quality audio for starters. If you don’t have a good quality microphone, you better have exceptional skills as an orator and be extremely likable for the audience to overlook your audio shortcomings. If you are interviewing a guest, have a plan. Make sure your launch straight into an engaging first question. The first question sets the tone, and the pace for the rest of the interview. If you get off to a slow start, it’s tough to recover.

Rule #4. Be 100% honest and transparent.

Like selling piss in a bottle, if you put out clickbait, your success will be short-lived. It’s difficult to gain the trust of an audience, but it’s very easy to lose that trust. You won’t get more than a second chance at best, so resist the temptation to B.S. your audience.

***disclaimer*** parody doesn’t count, as long as your work is clearly a parody. EG: My recent “Trump” interview was a parody done with a professional impersonator, but some people thought it was real. The show notes have all the contact information for the impersonator, to ensure I’m not accused of violating Rule #4.

Mark Meincke

Redline Real Estate

403-463-4313

Buy the Home Seller’s Bible by clicking HERE

Buy “Why not Me?” HERE

For more stories, visit Todayville Calgary

Alberta

Calgary mayor should retain ‘blanket rezoning’ for sake of Calgarian families

From the Fraser Institute

By Tegan Hill and Austin Thompson

Calgary’s new mayor, Jeromy Farkas, has promised to scrap “blanket rezoning”—a policy enacted by the city in 2024 that allows homebuilders to construct duplexes, townhomes and fourplexes in most neighbourhoods without first seeking the blessing of city hall. In other words, amid an affordability crunch, Mayor Farkas plans to eliminate a policy that made homebuilding easier and cheaper—which risks reducing housing choices and increasing housing costs for Calgarian families.

Blanket rezoning was always contentious. Debate over the policy back in spring 2024 sparked the longest public hearing in Calgary’s history, with many Calgarians airing concerns about potential impacts on local infrastructure, parking availability and park space—all important issues.

Farkas argues that blanket rezoning amounts to “ignoring the community” and that Calgarians should not be forced to choose between a “City Hall that either stops building, or stops listening.” But in reality, it’s virtually impossible to promise more community input on housing decisions and build more homes faster.

If Farkas is serious about giving residents a “real say” in shaping their neighbourhood’s future, that means empowering them to alter—or even block—housing proposals that would otherwise be allowed under blanket rezoning. Greater public consultation tends to give an outsized voice to development opponents including individuals and groups that oppose higher density and social housing projects.

Alternatively, if the mayor and council reform the process to invite more public feedback, but still ultimately approve most higher-density projects (as was the case before blanket rezoning), the consultation process would be largely symbolic.

Either way, homebuilders would face longer costlier approval processes—and pass those costs on to Calgarian renters and homebuyers.

It’s not only the number of homes that matters, but also where they’re allowed to be built. Under blanket rezoning, builders can respond directly to the preferences of Calgarians. When buyers want duplexes in established neighbourhoods or renters want townhomes closer to work, homebuilders can respond without having to ask city hall for permission.

According to Mayor Farkas, higher-density housing should instead be concentrated near transit, schools and job centres, with the aim of “reducing pressure on established neighbourhoods.” At first glance, that may sound like a sensible compromise. But it rests on the flawed assumption that politicians and planners should decide where Calgarians are allowed to live, rather than letting Calgarians make those choices for themselves. With blanket rezoning, new homes are being built in areas in response to buyer and renter demand, rather than the dictates of city hall. The mayor also seems to suggest that city hall should thwart some redevelopment in established neighbourhoods, limiting housing options in places many Calgarians want to live.

The stakes are high. Calgary is not immune to Canada’s housing crisis, though it has so far weathered it better than most other major cities. That success partly reflects municipal policies—including blanket rezoning—that make homebuilding relatively quick and inexpensive.

A motion to repeal blanket rezoning is expected to be presented to Calgary’s municipal executive committee on Nov. 17. If it passes, which is likely, the policy will be put to a vote during a council meeting on Dec. 15. As the new mayor and council weigh changes to zoning rules, they should recognize the trade-offs. Empowering “the community” may sound appealing, but it may limit the housing choices available to families in those communities. Any reforms should preserve the best elements of blanket rezoning—its consistency, predictability and responsiveness to the housing preferences of Calgarians—and avoid erecting zoning barriers that have exacerbated the housing crisis in other cities.

Austin Thompson

Alberta

Gondek’s exit as mayor marks a turning point for Calgary

This article supplied by Troy Media.

The mayor’s controversial term is over, but a divided conservative base may struggle to take the city in a new direction

Calgary’s mayoral election went to a recount. Independent candidate Jeromy Farkas won with 91,112 votes (26.1 per cent). Communities First candidate Sonya Sharp was a very close second with 90,496 votes (26 per cent) and controversial incumbent mayor Jyoti Gondek finished third with 71,502 votes (20.5 per cent).

Gondek’s embarrassing tenure as mayor is finally over.

Gondek’s list of political and economic failures in just a single four-year term could easily fill a few book chapters—and most likely will at some point. She declared a climate emergency on her first day as Calgary’s mayor that virtually no one in the city asked for. She supported a four per cent tax increase during the COVID-19 pandemic, when many individuals and families were struggling to make ends meet. She snubbed the Dec. 2023 menorah lighting during Hanukkah because speakers were going to voice support for Israel a mere two months after the country was attacked by the bloodthirsty terrorist organization Hamas. The

Calgary Party even accused her last month of spending over $112,000 in taxpayers’ money for an “image makeover and brand redevelopment” that could have benefited her re-election campaign.

How did Gondek get elected mayor of Calgary with 176,344 votes in 2021, which is over 45 per cent of the electorate?

“Calgary may be a historically right-of-centre city,” I wrote in a recent National Post column, “but it’s experienced some unusual voting behaviour when it comes to mayoral elections. Its last three mayors, Dave Bronconnier, Naheed Nenshi and Gondek, have all been Liberal or left-leaning. There have also been an assortment of other Liberal mayors in recent decades like Al Duerr and, before he had a political epiphany, Ralph Klein.”

In fairness, many Canadians used to support the concept of balancing their votes in federal, provincial and municipal politics. I knew of some colleagues, friends and family members, including my father, who used to vote for the federal Liberals and Ontario PCs. There were a couple who supported the federal PCs and Ontario Liberals in several instances. In the case of one of my late

grandfathers, he gave a stray vote for Brian Mulroney’s federal PCs, the NDP and even its predecessor, the Co-operative Commonwealth Federation.

That’s not the case any longer. The more typical voting pattern in modern Canada is one of ideological consistency. Conservatives vote for Conservative candidates, Liberals vote for Liberal candidates, and so forth. There are some rare exceptions in municipal politics, such as the late Toronto mayor Rob Ford’s populistconservative agenda winning over a very Liberal city in 2010. It doesn’t happen very often these days, however.

I’ve always been a proponent of ideological consistency. It’s a more logical way of voting instead of throwing away one vote (so to speak) for some perceived model of political balance. There will always be people who straddle the political fence and vote for different parties and candidates during an election. That’s their right in a democratic society, but it often creates a type of ideological inconsistency that doesn’t benefit voters, parties or the political process in general.

Calgary goes against the grain in municipal politics. The city’s political dynamics are very different today due to migration, immigration and the like. Support for fiscal and social conservatism may still exist in Alberta, but the urban-rural split has become more profound and meaningful than the historic left-right divide. This makes the task of winning Calgary in elections more difficult for today’s provincial and federal Conservatives, as well as right-leaning mayoral candidates.

That’s what we witnessed during the Oct. 20 municipal election. Some Calgary Conservatives believed that Farkas was a more progressive-oriented conservative or centrist with a less fiscally conservative plan and outlook for the city. They viewed Sharp, the leader of a right-leaning municipal party founded last December, as a small “c” conservative and much closer to their ideology. Conversely, some Calgary Conservatives felt that Farkas, and not Sharp, would be a better Conservative option for mayor because he seemed less ideological in his outlook.

When you put it all together, Conservatives in what used to be one of the most right-leaning cities in a historically right-leaning province couldn’t decide who was the best political option available to replace the left-wing incumbent mayor. Time will tell if they chose wisely.

Fortunately, the razor-thin vote split didn’t save Gondek’s political hide. Maybe ideological consistency will finally win the day in Calgary municipal politics once the recount has ended and the city’s next mayor has been certified.

Michael Taube is a political commentator, Troy Media syndicated columnist and former speechwriter for Prime Minister Stephen Harper. He holds a master’s degree in comparative politics from the London School of Economics, lending academic rigour to his political insights.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

National1 day ago

National1 day agoCanada’s free speech record is cracking under pressure

-

Energy15 hours ago

Energy15 hours agoTanker ban politics leading to a reckoning for B.C.

-

Energy15 hours ago

Energy15 hours agoMeet REEF — the massive new export engine Canadians have never heard of

-

Business1 day ago

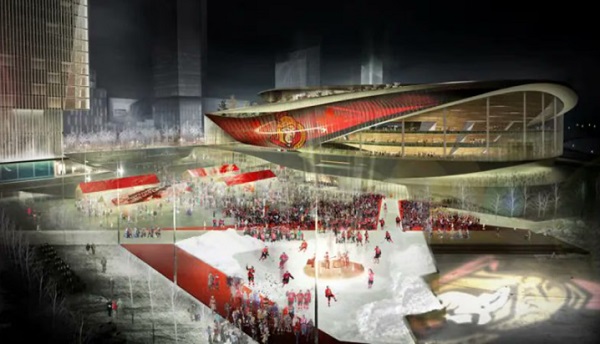

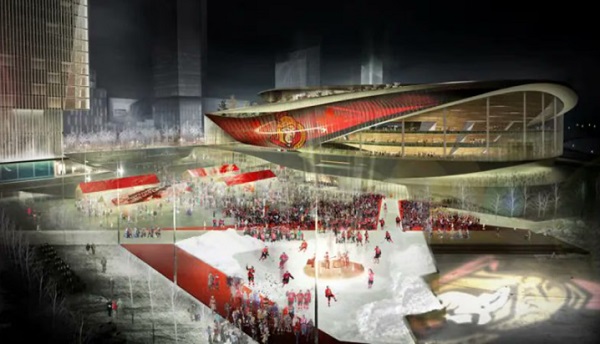

Business1 day agoTaxpayers Federation calls on politicians to reject funding for new Ottawa Senators arena

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoOttawa’s New Hate Law Goes Too Far

-

Business15 hours ago

Business15 hours agoToo nice to fight, Canada’s vulnerability in the age of authoritarian coercion

-

Fraser Institute16 hours ago

Fraser Institute16 hours agoClaims about ‘unmarked graves’ don’t withstand scrutiny

-

Business1 day ago

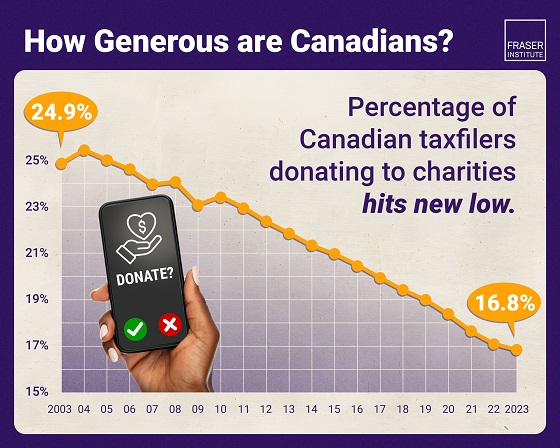

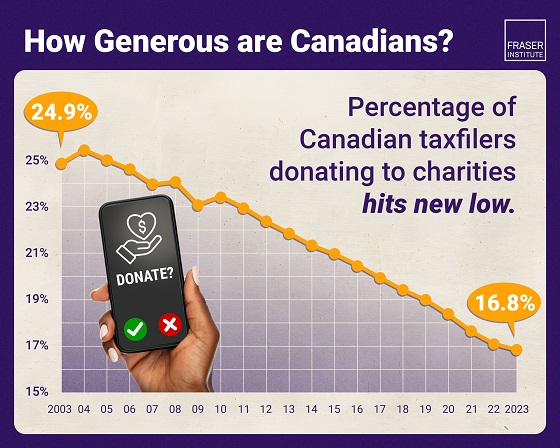

Business1 day agoAlbertans give most on average but Canadian generosity hits lowest point in 20 years