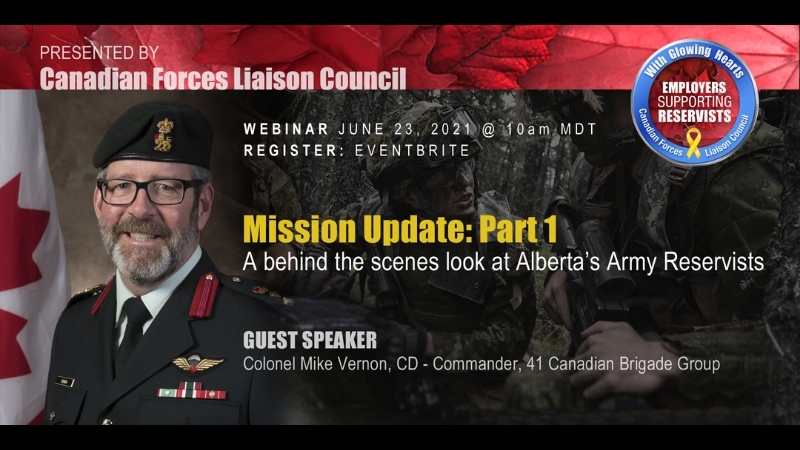

Alberta

Mission Update: A behind the scenes look at Alberta’s Army Reservists

Submitted by: Canadian Forces Liaison Council

Join us for an informative webinar on June 23rd with guest speaker Colonel Mike Vernon, CD/Commander of 41 Canadian Brigade Group.

A behind the scenes look at who reservists are, what they do, and how the Alberta Reserve is preparing and training to support our communities and country when we need them most.

Numerous Alberta businesses employ individuals who are members of the Reserve Force. When Alberta faces a disaster – the Covid-19 Pandemic, fires, floods – reservists are asked to respond to the call and assist in the survival and support of our communities. Responding to these calls often pulls reservists away from their regular employment.

Reservists are skilled and talented people who are part-time “citizen soldiers”, sailors and airmen/airwomen. In addition to their military responsibilities, they also work full time in the civilian workforce. They enhance corporate culture, small and large businesses, with the experience they have attained in the military. As a candidate for a position they have a well-earned skill set that goes above and beyond another candidate for the same role. If you already employ a Reservist, you know the benefits they bring to the workplace with both hard and soft skills.

The Canadian Armed Forces provide Reservists with world class training to develop key skills which form not only the foundations of an valuable Reservist but also a highly qualified employee. Employers benefit from their core skills and abilities such as leadership, teamwork, discipline, initiative, determination, problem solving, and the ability to work under pressure.

When you employ a Reservist, they bring their learnings from the military to your organization. In turn, they also contribute their workplace expertise when serving in the military. It’s a win-win for both the organization and the Canadian Armed Forces. Reservists who serve help to provide a safe environment for businesses to thrive and is one of the very reasons many people are proud of our serving members.

The Basics

Reservists are members of the Canadian Armed Forces (CAF) who train and serve with the CAF on a part-time basis. They typically serve on weekday evenings and weekends. From time to time Reservists attend military courses and training that lasts one or two weeks and occasionally longer durations. Reservists have the opportunity to volunteer to serve on domestic and international operations on a full-time basis augmenting the regular component of the CAF. Through floods, fires or ice storms, Reservists are there to help and to keep communities and businesses operating. Their training provides both domestic response and international support – when you employ a Reservist, you in turn, are serving your country.

What is the With Glowing Hearts Initiative?

The With Glowing Hearts – Reservist Support Initiative is an HR program to attract and retain talented employees. The Canadian Armed Forces has trained over 25,000 Reservists who bring exceptional qualifications to an organization or business. Consider the Reserves as a talent pool to source potential employees to support company goals and initiatives. The initiative provides guidance and tools to support both Employers and Reservists and the good work they do together. Employing a Reservist is good for business and it makes your work, and workplace, better – With Glowing Hearts, we stand together supporting our community and country.

How does the program work?

It’s simple – like any other HR initiative, the program becomes an offering to attract employees. For example, a company may already have a maternity leave policy in place, growth programs for leadership, or even policies for internships. The With Glowing Hearts – Reservist Support Initiative creates a “reserve-friendly” culture for an organization to attract, and keep, experienced and valued employees. The turnkey program assets can be used to create awareness through communication channels of choice.

What does the program include?

The program consists of the following elements:

- Reservists 101: What Reservists offer Employers

- “With Glowing Hearts” Reservist support customized certificate for Employers

- “With Glowing Hearts” Employer/Reservist Recognition stickers

- “With Glowing Hearts” Customized employer support icon (online use)

- HR & FAQS: Q&A for employing Reservists

- Military Leave Policy (MLP): Examples of MLP for small and large businesses

What’s next?

- Register for the program or for more information: cflcwithglowinghearts.ca

How can I find out more information for my business?

Employers Supporting Reservists – Canadian Forces Liaison Council

Visit the website: https://www.canada.ca/en/department-national-defence/services/benefits-military/supporting-reservists-employers.html

Agriculture

Lacombe meat processor scores $1.2 million dollar provincial tax credit to help expansion

Alberta’s government continues to attract investment and grow the provincial economy.

The province’s inviting and tax-friendly business environment, and abundant agricultural resources, make it one of North America’s best places to do business. In addition, the Agri-Processing Investment Tax Credit helps attract investment that will further diversify Alberta’s agriculture industry.

Beretta Farms is the most recent company to qualify for the tax credit by expanding its existing facility with the potential to significantly increase production capacity. It invested more than $10.9 million in the project that is expected to increase the plant’s processing capacity from 29,583 to 44,688 head of cattle per year. Eleven new employees were hired after the expansion and the company plans to hire ten more. Through the Agri-Processing Investment Tax Credit, Alberta’s government has issued Beretta Farms a tax credit of $1,228,735.

“The Agri-Processing Investment Tax Credit is building on Alberta’s existing competitive advantages for agri-food companies and the primary producers that supply them. This facility expansion will allow Beretta Farms to increase production capacity, which means more Alberta beef across the country, and around the world.”

“This expansion by Beretta Farms is great news for Lacombe and central Alberta. It not only supports local job creation and economic growth but also strengthens Alberta’s global reputation for producing high-quality meat products. I’m proud to see our government supporting agricultural innovation and investment right here in our community.”

The tax credit provides a 12 per cent non-refundable, non-transferable tax credit when businesses invest $10 million or more in a project to build or expand a value-added agri-processing facility in Alberta. The program is open to any food manufacturers and bio processors that add value to commodities like grains or meat or turn agricultural byproducts into new consumer or industrial goods.

Beretta Farms’ facility in Lacombe is a federally registered, European Union-approved harvesting and meat processing facility specializing in the slaughter, processing, packaging and distribution of Canadian and United States cattle and bison meat products to 87 countries worldwide.

“Our recent plant expansion project at our facility in Lacombe has allowed us to increase our processing capacities and add more job opportunities in the central Alberta area. With the support and recognition from the Government of Alberta’s tax credit program, we feel we are in a better position to continue our success and have the confidence to grow our meat brands into the future.”

Alberta’s agri-processing sector is the second-largest manufacturing industry in the province and meat processing plays an important role in the sector, generating millions in annual economic impact and creating thousands of jobs. Alberta continues to be an attractive place for agricultural investment due to its agricultural resources, one of the lowest tax rates in North America, a business-friendly environment and a robust transportation network to connect with international markets.

Quick facts

- Since 2023, there are 16 applicants to the Agri-Processing Investment Tax Credit for projects worth about $1.6 billion total in new investment in Alberta’s agri-processing sector.

- To date, 13 projects have received conditional approval under the program.

- Each applicant must submit progress reports, then apply for a tax credit certificate when the project is complete.

- Beretta Farms has expanded the Lacombe facility by 10,000 square feet to include new warehousing, cooler space and an office building.

- This project has the potential to increase production capacity by 50 per cent, thereby facilitating entry into more European markets.

Related information

Alberta

Alberta Next: Alberta Pension Plan

From Premier Danielle Smith and Alberta.ca/Next

Let’s talk about an Alberta Pension Plan for a minute.

With our young Alberta workforce paying billions more into the CPP each year than our seniors get back in benefits, it’s time to ask whether we stay with the status quo or create our own Alberta Pension Plan that would guarantee as good or better benefits for seniors and lower premiums for workers.

I want to hear your perspective on this idea and please check out the video. Get the facts. Join the conversation.

Visit Alberta.ca/next

-

Energy1 day ago

Energy1 day agoB.C. Residents File Competition Bureau Complaint Against David Suzuki Foundation for Use of False Imagery in Anti-Energy Campaigns

-

Alberta2 days ago

Alberta2 days agoAlberta uncorks new rules for liquor and cannabis

-

COVID-191 day ago

COVID-191 day agoCourt compels RCMP and TD Bank to hand over records related to freezing of peaceful protestor’s bank accounts

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

C2C Journal1 day ago

C2C Journal1 day agoCanada Desperately Needs a Baby Bump

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Alberta Pension Plan

-

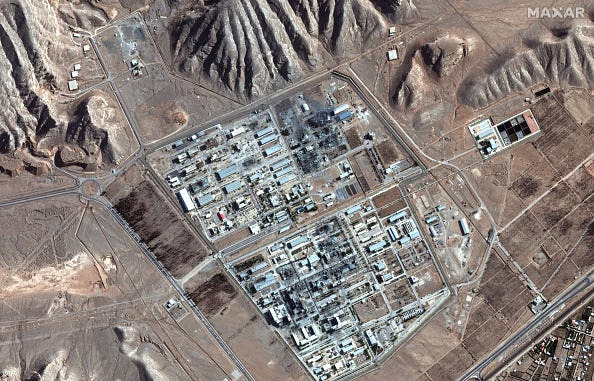

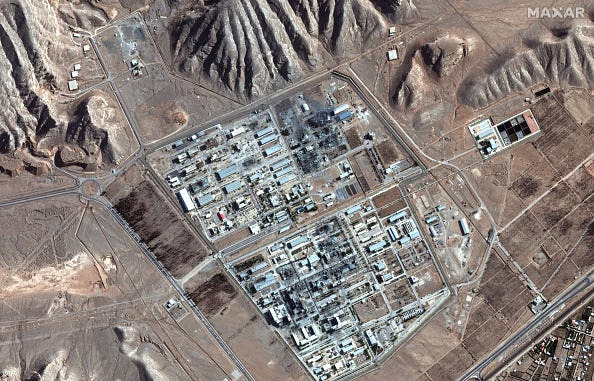

conflict16 hours ago

conflict16 hours agoUS airstrike on Iran’s nuclear facilities. Was it obliteration?