Calgary

“Calgary is Stepping Up” – City Support for Food Bank Continues in the Face of COVID-19

Since its launch in 1982, the Calgary Food Bank has played an essential role in combating hunger in our city and providing Calgarians in need with access to food.

From humble beginnings as a small not-for-profit charity in the basement of a local church, the Calgary Food Bank has since grown into a million dollar charitable organization. Dedicated to rescuing and distributing millions of pounds of food, CFB impacts the lives of over 150,000 Calgarians annually.

Faced with the difficult task of aiding citizens most in need, staff at the Food Bank rely on one another as well as community collaboration and support to be successful. On a daily basis, workers and volunteers navigate the many complex situations that bring clients to the doors of their organization in search of a helping hand.

Challenges include collecting and organization donations, effectively distributing supplies, and keeping products and programs in compliance with the changing guidelines of the Canada Food Guide. All services are designed to build resiliency and increase quality of life for clients while sharing the best of what CFB has to offer. For such an essential community service, 2020 has brought with it a series of new and unprecedented challenges, namely the arrival of the novel Coronavirus. However, in the face of COVID-19, the Calgary Food Bank has been working tirelessly to persevere.

Having joined the Calgary Food Bank in 2013 during the height of the tragic Calgary floods, Communications and Media Relations Supervisor Shawna Ogston has seen the resiliency of CFB first hand. She is confident in the organization and takes pride in its ability to adapt and continue to look after Calgarians during times of crisis. When COVID-19 reached Calgary, staff at the Food Bank knew things were going to change quickly, and they needed to be prepared.

“The basic needs of the community don’t change just because the world as we know it does,” says Ogston, “food is a human right, not a privilege. We still need to get people fed.”

With no option to close, the Calgary Food Bank shut its doors for just two days in mid-March to organize and put a pandemic plan into place. This would allow the organization to continue to operate safely within the new state of emergency guidelines mandated by the Alberta Government. Changes included adjusting hamper sizes, reducing the workforce, implementing a new cyclic volunteer schedule and transitioning to drive-thru pick-up methods.

As new updates are continually released and things seem to change by the hour, the importance of community support for the Food Bank cannot be overstated. The impact of the virus on grocery store attendance and operation has led to an understandable decline in food donations to in-store food bank bins, according to Ogston. However, inventory is still holding fast at the same level it was pre-pandemic. “Calgary is stepping up,” she says, “people are responding to social media calls, countless new volunteers have come forward, and financial donations are coming in like mad.” Shawna is realistic about the lasting implications of COVID-19, but feels inspired by Calgary’s sense of community, and remains optimistic moving forward. “Remember,” she says, “we’re all in this together.”

Community owned and supported, the Calgary Food bank sincerely thanks all who have and continue to donate food, funds and time to their organization. Currently, their most-needed products include canned fruit, dry soup and single serve oatmeal. To learn more about volunteer opportunities and supporting the Calgary Food Bank, visit https://www.calgaryfoodbank.com.

For more stories, visit Todayville Calgary

Alberta

Calgary’s High Property Taxes Run Counter to the ‘Alberta Advantage’

By David Hunt and Jeff Park

Of major cities, none compare to Calgary’s nearly 50 percent property tax burden increase between censuses.

Alberta once again leads the country in taking in more new residents than it loses to other provinces and territories. But if Canadians move to Calgary seeking greater affordability, are they in for a nasty surprise?

In light of declining home values and falling household incomes amidst rising property taxes, Calgary’s overall property tax burden has skyrocketed 47 percent between the last two national censuses, according to a new study by the Aristotle Foundation for Public Policy.

Between 2016 and 2021 (the latest year of available data), Calgary’s property tax burden increased about twice as fast as second-place Saskatoon and three-and-a-half times faster than Vancouver.

The average Calgary homeowner paid $3,496 in property taxes at the last census, compared to $2,736 five years prior (using constant 2020 dollars; i.e., adjusting for inflation). By contrast, the average Edmonton homeowner paid $2,600 in 2021 compared to $2,384 in 2016 (in constant dollars). In other words, Calgary’s annual property tax bill rose three-and-a-half times more than Edmonton’s.

This is because Edmonton’s effective property tax rate remained relatively flat, while Calgary’s rose steeply. The effective rate is property tax as a share of the market value of a home. For Edmontonians, it rose from 0.56 percent to 0.62 percent—after rounding, a steady 0.6 percent across the two most recent censuses. For Calgarians? Falling home prices collided with rising taxes so that property taxes as a share of (market) home value rose from below 0.5 percent to nearly 0.7 percent.

Plug into the equation sliding household incomes, and we see that Calgary’s property tax burden ballooned nearly 50 percent between censuses.

This matters for at least three reasons. First, property tax is an essential source of revenue for municipalities across Canada. City councils set their property tax rate and the payments made by homeowners are the backbone of municipal finances.

Property taxes are also an essential source of revenue for schools. The province has historically required municipalities to directly transfer 33 percent of the total education budget via property taxes, but in the period under consideration that proportion fell (ultimately, to 28 percent).

Second, a home purchase is the largest expense most Canadians will ever make. Local taxes play a major role in how affordable life is from one city to another. When municipalities unexpectedly raise property taxes, it can push homeownership out of reach for many families. Thus, homeoowners (or prospective homeowners) naturally consider property tax rates and other local costs when choosing where to live and what home to buy.

And third, municipalities can fall into a vicious spiral if they’re not careful. When incomes decline and residential property values fall, as Calgary experienced during the period we studied, municipalities must either trim their budgets or increase property taxes. For many governments, it’s easier to raise taxes than cut spending.

But rising property tax burdens could lead to the city becoming a less desirable place to live. This could mean weaker residential property values, weaker population growth, and weaker growth in the number of residential properties. The municipality then again faces the choice of trimming budgets or raising taxes. And on and on it goes.

Cities fall into these downward spirals because they fall victim to a central planner’s bias. While $853 million for a new arena for the Calgary Flames or $11 million for Calgary Economic Development—how City Hall prefers to attract new business to Calgary—invite ribbon-cuttings, it’s the decisions about Calgary’s half a million private dwellings that really drive the city’s finances.

Yet, a virtuous spiral remains in reach. Municipalities tend to see the advantage of “affordable housing” when it’s centrally planned and taxpayer-funded but miss the easiest way to generate more affordable housing: simply charge city residents less—in taxes—for their housing.

When you reduce property taxes, you make housing more affordable to more people and make the city a more desirable place to live. This could mean stronger residential property values, stronger population growth, and stronger growth in the number of residential properties. Then, the municipality again faces a choice of making the city even more attractive by increasing services or further cutting taxes. And on and on it goes.

The economy is not a series of levers in the mayor’s office; it’s all of the million individual decisions that all of us, collectively, make. Calgary city council should reduce property taxes and leave more money for people to make the big decisions in life.

Jeff Park is a visiting fellow with the Aristotle Foundation for Public Policy and father of four who left Calgary for better affordability. David Hunt is the research director at the Calgary-based Aristotle Foundation for Public Policy. They are co-authors of the new study, Taxing our way to unaffordable housing: A brief comparison of municipal property taxes.

Alberta

Calgary taxpayers forced to pay for art project that telephones the Bow River

From the Canadian Taxpayers Federation

The Canadian Taxpayers Federation is calling on the City of Calgary to scrap the Calgary Arts Development Authority after it spent $65,000 on a telephone line to the Bow River.

“If someone wants to listen to a river, they can go sit next to one, but the City of Calgary should not force taxpayers to pay for this,” said Kris Sims, CTF Alberta Director. “If phoning a river floats your boat, you do you, but don’t force your neighbour to pay for your art choices.”

The City of Calgary spent $65,194 of taxpayers’ money for an art project dubbed “Reconnecting to the Bow” to set up a telephone line so people could call the Bow River and listen to the sound of water.

The project is running between September 2024 and December 2025, according to documents obtained by the CTF.

The art installation is a rerun of a previous version set up back in 2014.

Emails obtained by the CTF show the bureaucrats responsible for the newest version of the project wanted a new local 403 area code phone number instead of an 1-855 number to “give the authority back to the Bow,” because “the original number highlighted a proprietary and commercial relationship with the river.”

Further correspondence obtained by the CTF shows the city did not want its logo included in the displays, stating the “City of Calgary (does NOT want to have its logo on the artworks or advertisements).”

Taxpayers pay about $19 million per year for the Calgary Arts Development Authority. That’s equivalent to the total property tax bill for about 7,000 households.

Calgary bureaucrats also expressed concern the project “may not be received well, perceived as a waste of money or simply foolish.”

“That city hall employee was pointing out the obvious: This is a foolish waste of taxpayers’ money and this slush fund should be scrapped,” said Sims. “Artists should work with willing donors for their projects instead of mooching off city hall and forcing taxpayers to pay for it.”

-

Automotive1 day ago

Automotive1 day agoParliament Forces Liberals to Release Stellantis Contracts After $15-Billion Gamble Blows Up In Taxpayer Faces

-

National1 day ago

National1 day agoPolitically Connected Canadian Weed Sellers Push Back in B.C. Court, Seek Distance from Convicted Heroin Trafficker

-

Alberta1 day ago

Alberta1 day agoPetition threatens independent school funding in Alberta

-

Business1 day ago

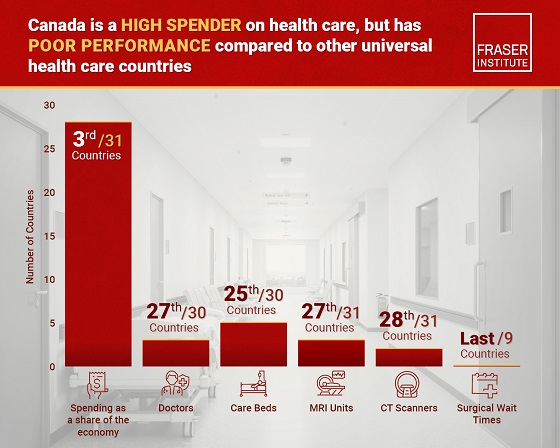

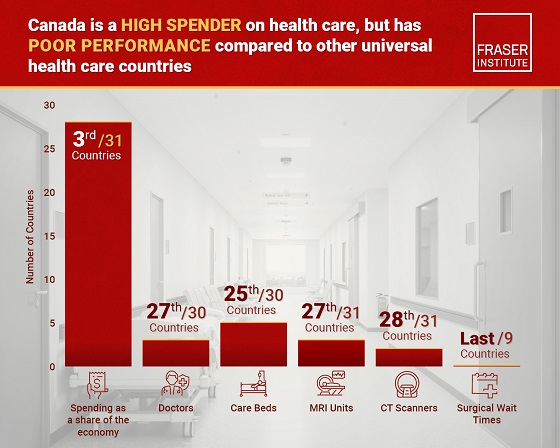

Business1 day agoCanada has fewer doctors, hospital beds, MRI machines—and longer wait times—than most other countries with universal health care

-

MAiD16 hours ago

MAiD16 hours agoDisabled Canadians increasingly under pressure to opt for euthanasia during routine doctor visits

-

Courageous Discourse1 day ago

Courageous Discourse1 day agoNo Exit Wound – EITHER there was a very public “miracle” OR Charlie Kirk’s murder is not as it appears

-

Business1 day ago

Business1 day agoQuebecers want feds to focus on illegal gun smuggling not gun confiscation

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoWho tries to silence free speech? Apparently who ever is in power.