Energy

Why Canada should get carbon credits for LNG exports

From the MacDonald Laurier Institute

By Jerome Gessaroli

Generating carbon credits from LNG exports is potentially a cost-effective way to reduce GHGs globally while helping to meet our carbon reduction goals

It stands to reason that Canada should get carbon credits for replacing dirty coal-fired energy sources in Asia with our cleaner natural gas, preventing the release of many megatonnes of greenhouse gas emissions. But as the issue currently stands, we won’t.

However, there’s hope for reason.

A recent paper I wrote for the Macdonald-Laurier Institute sheds light on the confusion surrounding this matter. Based on the 2015 Paris Agreement, specifically Article 6, and the subsequently developed guidelines for the sharing of carbon reduction credits, liquid natural gas exports should be eligible to generate such credits for Canada — just not in a way envisioned by provincial leaders.

Former B.C. premier Christy Clark and successive premiers have argued since 2013 that LNG exports alone should be counted toward carbon credits for Canada and its provinces. Researchers estimate that if Asian countries replace coal with natural gas in their power plants, emissions would fall by 34 to 62 per cent.

However, each time this argument resurfaces, it faces criticism from various quarters.

The confusion over sharing carbon credits arises from the disconnect between the idea’s simplicity and its complex implementation.

Carbon credit eligibility is based on the principle that only emission reduction projects that would not have proceeded without access to carbon credits meet a so-called “additionality” criterion. While there are other criteria, the additionality criterion is the heart of credits sharing regime.

A straightforward LNG export contract with an Asian utility that substitutes gas for coal would probably not be eligible to generate any carbon credits for the Canadian side. While the deal does lower GHG emissions, those reductions are not “additional” and the deal would go ahead with or without the availability of emissions credits.

However, there is another scenario that would likely qualify to receive carbon credits. In this scenario, in addition to selling LNG, the Canadian company helps the Asian utility convert its coal-fuelled plant to a natural gas plant. In this case, the utility’s motivation is to avoid prematurely shuttering its power plant and losing its investment due to stricter emission standards.

On the Canadian side, support may involve providing technical services, financing or other assistance. While more costly for Canada, those extra expenses could be more than offset by the value of carbon credits transferred by the Asian side. Canada would win by accruing revenue from the sale of LNG, providing additional Canadian-based services, and receiving valuable carbon credits to help meet our emissions targets. This deal is “additional” – its feasibility is contingent on its eligibility for carbon credits.

Critics warn that selling LNG abroad will “lock in” fossil fuel use and delay the transition to renewables. The reality is that the average age of Asian coal-fuelled power plants is only 13 years (with a lifespan of up to 40 years) and that over 1,000 new coal plants have been announced, permitted or are currently under construction.

These are the facts, whether we like them or not. This reminds me of the quote often attributed to John Maynard Keynes, “As the facts change, I change my mind. What do you do, sir?” What we can do is assist in switching some of these plants from burning coal to LNG, which will substantially reduce GHG emissions over the short and medium term; not to mention help energy workers keep their jobs.

Critics also assert that producing LNG in British Columbia creates emissions which could prevent the province from meeting its own emission reduction targets. Yet studies estimate that using just over half of LNG Canada’s annual Phase 1 production capacity to replace coal could reduce international GHG emissions by 14 to 34 Mt while increasing yearly emissions in B.C. by less than two megatonnes.

Creating the infrastructure to transfer carbon credits under the Paris Agreement is a complex and relatively new endeavour. Earning carbon credits is also a non-trivial task. It will require the federal government to initiate bilateral agreements and negotiate common policies and practices with any partnering country for calculating, verifying, allocating and transferring credits. Alberta and B.C. are already co-operating.

Generating carbon credits from LNG exports is potentially a cost-effective way to reduce GHGs globally while helping to meet our carbon reduction goals.

Jerome Gessaroli is a senior fellow at the Macdonald-Laurier Institute and leads The Sound Economic Policy Project at the British Columbia Institute of Technology

Energy

Liberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

From Energy Now

By Margareta Dovgal

Playing politics with pipelines is a time-honored Canadian tradition. Recent events in the House of Commons offered a delightful twist on the genre.

The Conservatives introduced a motion quoting the Liberals’ own pipeline promises laid out in the Memorandum of Understanding (MOU) with Alberta, nearly verbatim. The Liberals, true to form, killed it 196–139 with enthusiastic help from the NDP, Bloc, and Greens.

We all knew how this would end. Opposition motions like this never pass; no government, especially not one led by Mark Carney, is going to let the opposition dictate the agenda. There’s not much use feigning outrage that the Liberals voted it down. The more entertaining angle has been watching closely as Liberal MPs twist themselves into pretzels explaining why they had to vote “no” on a motion that cheers on a project they claim to support in principle.

Liberal MP Corey Hogan dismissed the motion as “game-playing” designed to “poke at people”.

And he’s absolutely right to call it a “trap” for the Liberals. But traps only work when you walk into them.

Indigenous Services Minister Mandy Gull-Masty deemed the motion an “immature waste of parliamentary time” and “clearly an insult towards Indigenous Peoples” because it didn’t include every clause of the original agreement. Energy Minister Tim Hodgson decried it as a “cynical ploy to divide us” that “cherry-picked” the MOU.

Yet the prize for the most tortured metaphor goes to the prime minister himself. Defending his vote against his own pipeline promise, Carney lectured the House that “you have to eat the entire meal, not just the appetizer.”

It’s a clever line, and it also reveals the problem. The “meal” Carney is serving is stuffed with conditions. Environmental targets or meaningful engagement with Indigenous communities aren’t unrealistic asks. A crippling industrial carbon price as a precondition might be though.

But the prime minister has already said the quiet part out loud.

Speaking in the House a few weeks ago, Carney admitted that the agreement creates “necessary conditions, but not sufficient conditions,” before explicitly stating: “We believe the government of British Columbia has to agree.”

There is the poison pill. Handing a de facto veto to a provincial government that has spent years fighting oil infrastructure is neither constitutionally required nor politically likely. Elevating B.C.’s “agreement” to a condition, which is something the MOU text itself carefully avoids doing, means that Carney has made his own “meal” effectively inedible.

Hodgson’s repeated emphasis that the Liberal caucus supports “the entire MOU, the entire MOU” only reinforces this theory.

This entire episode forces us to ask whether the MOU is a real plan to build a pipeline, or just a national unity play designed to cool down the separatist temperature in Alberta. My sense is that Ottawa knew they had to throw a bone to Premier Danielle Smith because the threat of the sovereignty movement is gaining real traction. But you can’t just create the pretense of negotiation to buy time.

With the MOU getting Smith boo’ed at her own party’s convention by the separatists, it’s debatable whether that bone was even an effective one to throw.

There is a way. The federal government has the jurisdiction. If they really wanted to, they could just do it, provided the duty to consult with and accommodate Indigenous peoples was satisfied. Keep in mind: no reasonable interpretation equates Section 35 of the Charter to a veto.

Instead, the MOU is baked with so many conditions that the Liberals have effectively laid the groundwork for how they’re going to fail.

With overly-hedged, rather cryptic messaging, Liberals have themselves given considerable weight to a cynical theory, that the MOU is a stalling tactic, not a foundation to get more Canadian oil to the markets it’s needed in. Maybe Hodgson is telling the truth, and caucus is unified because the radicals are satisfied that “the entire MOU” ensures that a new oil pipeline will never reach tidewater through BC.

So, hats off to the legislative affairs strategists in the Conservative caucus. The real test of Carney’s political power continues: can he force a caucus that prefers fantasy economics into a mold of economic literacy to deliver on the vision Canadians signed off on? Or will he be hamstrung trying to appease the radicals from within?

Margareta Dovgal is managing director of Resource Works Society.

Daily Caller

Paris Climate Deal Now Decade-Old Disaster

From the Daily Caller News Foundation

By Steve Milloy

The Paris Climate Accord was adopted 10 years ago this week. It’s been a decade of disaster that President Donald Trump is rightly trying again to end.

The stated purpose of the agreement was for countries to voluntarily cut emissions to avoid the average global temperature exceeding the (guessed at) pre-industrial temperature by 3.6°F (2°C) and preferably 2.7°F (1.5°C).

Since December 2015, the world spent an estimated $10 trillion trying to achieve the Paris goals. What has been accomplished? Instead of reducing global emissions, they have increased about 12 percent. While the increase in emissions is actually a good thing for the environment and humanity, spending $10 trillion in a failed effort to cut emissions just underscores the agreement’s waste, fraud and abuse.

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

But wasting $10 trillion is only the tip of the iceberg.

The effort to cut emissions was largely based on forcing industrial countries to replace their tried-and-true fossil fuel-based energy systems with not-ready-for-prime-time wind, solar and battery-based systems. This forced transition has driven up energy costs and made energy systems less reliable. The result of that has been economy-crippling deindustrialization in former powerhouses of Germany and Britain.

And it gets worse.

European nations imagined they could reduce their carbon footprint by outsourcing their coal and natural gas needs to Russia. That outsourcing enriched Russia and made the European economy dependent on Russia for energy. That vulnerability, in turn, and a weak President Joe Biden encouraged Vladimir Putin to invade Ukraine.

The result of that has been more than one million killed and wounded, the mass destruction of Ukraine worth more than $500 billion so far and the inestimable cost of global destabilization. Europe will have to spend hundreds of billions more on defense, and U.S. taxpayers have been forced to spend hundreds of billions on arms for Ukraine. Putin has even raised the specter of using nuclear weapons.

President Barack Obama unconstitutionally tried to impose the Paris agreement on the U.S. as an Executive agreement rather than a treaty ratified by the U.S. Senate. Although Trump terminated the Executive agreement during his first administration, President Joe Biden rejoined the agreement soon after taking office, pledging to double Obama’s emissions cuts pledge to 50 percent below 2005 levels by 2030.

Biden’s emissions pledge was an impetus for the 2022 Inflation Reduction Act that allocated $1.2 trillion in spending for what Trump labeled as the Green New Scam. Although Trump’s One Big Beautiful Bill Act reduced that spending by about $500 billion and he is trying to reduce it further through Executive action, much of that money was used in an effort to buy the 2024 election for Democrats. The rest has been and will be used to wreck our electricity grid with dangerous, national security-compromising wind, solar and battery equipment from Communists China.

Then there’s this. At the Paris climate conference in 2015, U.S. Secretary of State John Kerry stated quite clearly that emissions cuts by the U.S. and other industrial countries were meaningless and would accomplish nothing since the developing world’s emissions would be increasing.

Finally, there is the climate realism aspect to all this. After the Paris agreement was signed and despite the increase in emissions, the average global temperature declined during the years from 2016 to 2022, per NOAA data.

The super El Nino experienced during 2023-2024 caused a temporary temperature spike. La Nina conditions have now returned the average global temperature to below the 2015-2016 level, per NASA satellite data. The overarching point is that any “global warming” that occurred over the past 40 years is actually associated with the natural El Nino-La Nina cycle, not emissions.

The Paris agreement has been all pain and no gain. Moreover, there was never any need for the agreement in the first place. A big thanks to President Trump for pulling us out again.

Steve Milloy is a biostatistician and lawyer. He posts on X at @JunkScience.

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Bruce Dowbiggin2 days ago

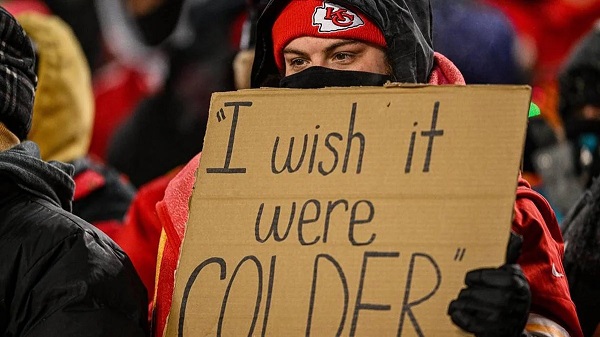

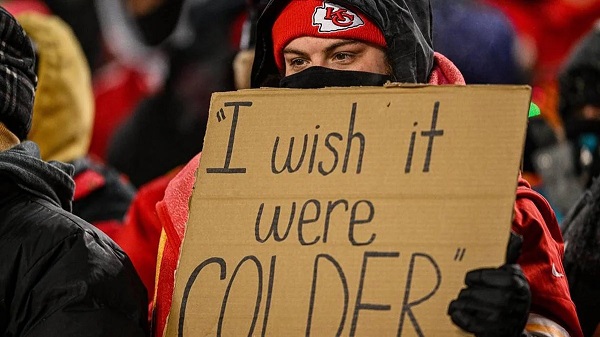

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria

-

Energy2 days ago

Energy2 days agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Daily Caller22 hours ago

Daily Caller22 hours agoParis Climate Deal Now Decade-Old Disaster

-

Business12 hours ago

Business12 hours agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

armed forces1 day ago

armed forces1 day agoOttawa’s Newly Released Defence Plan Crosses a Dangerous Line

-

Energy12 hours ago

Energy12 hours agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Censorship Industrial Complex9 hours ago

Censorship Industrial Complex9 hours agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info