Business

USPS suspends inbound packages from China, Hong Kong

Quick Hit:

The U.S. Postal Service has suspended the acceptance of inbound packages from China and Hong Kong, citing security and policy concerns. The move comes as President Donald Trump enforces new tariffs to curb the flow of synthetic opioids into the United States.

Key Details:

- The suspension affects international parcels but does not impact letters or flat mail from China and Hong Kong.

- Trump signed an executive order on Feb. 1st, imposing a 10% tariff on imports linked to China’s synthetic opioid supply chain.

- In response, China has announced retaliatory tariffs and launched an anti-monopoly investigation into U.S. tech firms.

Diving Deeper:

The United States Postal Service (USPS) has announced the immediate suspension of inbound package acceptance from China and Hong Kong, a move aligned with President Donald Trump’s recent efforts to crack down on illicit drug trafficking. While the suspension blocks parcels from entering the country, it does not impact letters or flat mail, according to the USPS statement.

The decision comes as Trump signed an executive order on Feb. 1st, imposing a 10% tariff targeting Chinese chemical companies accused of fueling the fentanyl crisis in America. The order alleges that the Chinese Communist Party (CCP) has subsidized firms exporting fentanyl precursors, which are frequently used to manufacture synthetic opioids that have contributed to tens of thousands of American deaths.

“These companies exploit international trade loopholes, using fraudulent invoices, deceptive packaging, and re-shippers to evade detection,” Trump stated. The administration argues that these tactics enable the smuggling of lethal drugs into the U.S. under the guise of legitimate commerce.

China has responded swiftly to the escalating trade measures, announcing countertariffs on key U.S. exports, including coal, liquefied natural gas, crude oil, and agricultural equipment. Additionally, the Chinese government has initiated an anti-monopoly probe into Alphabet Inc.’s Google while adding U.S. companies PVH Corp. and Illumina to its “unreliable entities list.” Beijing has also imposed export restrictions on rare earth metals essential to high-tech industries.

The USPS suspension, combined with the new tariffs, signals a renewed push by Trump to hold China accountable for its role in the opioid crisis while reinforcing his America First trade agenda. With tensions mounting between the two global powers, further economic retaliation from Beijing remains a possibility.

Business

Pension and Severance Estimate for 110 MP’s Who Resigned or Were Defeated in 2025 Federal Election

By Franco Terrazzano

By Franco Terrazzano

Taxpayers Federation releases pension and severance figures for 2025 federal election

The Canadian Taxpayers Federation released its calculations of estimated pension and severance payments paid to the 110 members of Parliament who were either defeated in the federal election or did not seek re-election.

“Taxpayers shouldn’t feel too bad for the politicians who lost the election because they’ll be cashing big severance or pension cheques,” said Franco Terrazzano, CTF Federal Director. “Thanks to past pension reforms, taxpayers will not have to shoulder as much of the burden as they used to. But there’s more work to do to make politician pay affordable for taxpayers.”

Defeated or retiring MPs will collect about $5 million in annual pension payments, reaching a cumulative total of about $187 million by age 90. In addition, about $6.6 million in severance cheques will be issued to some former MPs.

Former prime minister Justin Trudeau will collect two taxpayer-funded pensions in retirement. Combined, those pensions total $8.4 million, according to CTF estimates. Trudeau is also taking a $104,900 severance payout because he did not run again as an MP.

The payouts for Trudeau’s MP pension will begin at $141,000 per year when he turns 55 years old. It will total an estimated $6.5 million should he live to the age of 90. The payouts for Trudeau’s prime minister pension will begin at $73,000 per year when he turns 67 years old. It will total an estimated $1.9 million should he live to the age of 90.

“Taxpayers need to see leadership at the top and that means reforming pensions and ending the pay raises MPs take every year,” Terrazzano said. “A prime minister already takes millions through their first pension, they shouldn’t be billing taxpayers more for their second pension.

“The government must end the second pension for all future prime ministers.”

There are 13 former MPs that will collect more than $100,000-plus a year in pension income. The pension and severance calculations for each defeated or retired MP can be found here.

Some notable severance / pensions

Name Party Years as MP Severance Annual Starting Pension Pension to Age 90

Bergeron, Stéphane BQ 17.6 $ 99,000.00 $ 4,440,000.00

Boissonnault, Randy LPC 7.6 $ 44,200.00 $ 53,000.00 $ 2,775,000.00

Dreeshen, Earl CPC 16.6 $ $ 95,000.00 $ 1,938,000.00

Mendicino, Marco * LPC 9.4 $ 66,000.00 $ 3,586,000.00

O’Regan, Seamus LPC 9.5 $ 104,900.00 $ 75,000.00 $ 3,927,000.00

Poilievre, Pierre ** CPC 20.8 $ 136,000.00 $ 7,087,000.00

Singh, Jagmeet NDP 6.2 $ 140,300.00 $ 45,000.00 $ 2,694,000.00

Trudeau, Justin *** LPC 16.6 $ 104,900.00 $ 141,000.00 $ 8,400,000.00

* Marco Mendicino resigned as an MP on March 14th, 2025

** Pierre Poilievre announced that he would not take a severance

*** The Pension to Age 90 includes Trudeau’s MP pension and his secondary Prime Minister’s pension

Business

New fiscal approach necessary to reduce Ottawa’s mountain of debt

From the Fraser Institute

By Jake Fuss and Grady Munro

Apparently, despite a few days of conflicting statements from the government, the Carney government now plans to table a budget in the fall. If the new prime minister wants to reduce Ottawa’s massive debt burden, which Canadians ultimately bear, he must begin to work now to reduce spending.

According to the federal government’s latest projections, from 2014/15 to 2024/25 total federal debt is expected to double from $1.1 trillion to a projected $2.2 trillion. That means $13,699 in new federal debt for every Canadian (after adjusting for inflation). In addition, from 2020 to 2023, the Trudeau government recorded the four highest years of total federal debt per person (inflation-adjusted) in Canadian history.

How did this happen?

From 2018 to 2023, the government recorded the six highest levels of program spending (inflation-adjusted, on a per-person basis) in Canadian history—even after excluding emergency spending during COVID. Consequently, in 2024/25 Ottawa will run its tenth consecutive budget deficit since 2014/15.

Of course, Canadians bear the burden of this free-spending approach. For example, over the last several years federal debt interest payments have more than doubled to an expected $53.7 billion this year. That’s more than the government plans to spend on health-care transfers to the provinces. And it’s money unavailable for programs including social services.

In the longer term, government debt accumulation can limit economic growth by pushing up interest rates. Why? Because governments compete with individuals, families and businesses for the savings available for borrowing, and this competition puts upward pressure on interest rates. Higher interest rates deter private investment in the Canadian economy—a necessary ingredient for economic growth—and hurt Canadian living standards.

Given these costs, the Carney government should take a new approach to fiscal policy and begin reducing Ottawa’s mountain of debt.

According to both history and research, the most effective and least economically harmful way to achieve this is to reduce government spending and balance the budget, as opposed to raising taxes. While this approach requires tough decisions, which may be politically unpopular in some quarters, worthwhile goals are rarely easy and the long-term gain will exceed the short-term pain. Indeed, a recent study by Canadian economist Bev Dahlby found the long-term economic benefits of a 12-percentage point reduction in debt (as a share of GDP) substantially outweighs the short-term costs.

Unfortunately, while Canadians must wait until the fall for a federal budget, the Carney government’s election platform promises to add—not subtract—from Ottawa’s mountain of debt and from 2025/26 to 2028/29 run annual deficits every year of at least $47.8 billion. In total, these planned deficits represent $224.8 billion in new government debt over the next four years, and there’s currently no plan to balance the budget. This represents a continuation of the Trudeau government’s approach to rack up debt and behave irresponsibly with federal finances.

With a new government on Parliament Hill, now is the time for federal policymakers to pursue the long-ignored imperative of reducing government debt. Clearly, if the Carney government wants to prioritize debt reduction, it must rethink its fiscal plan and avoid repeating the same mistakes of its predecessor.

-

Economy1 day ago

Economy1 day agoCanada as an energy superpower would empower thousands of families for generations

-

Alberta2 days ago

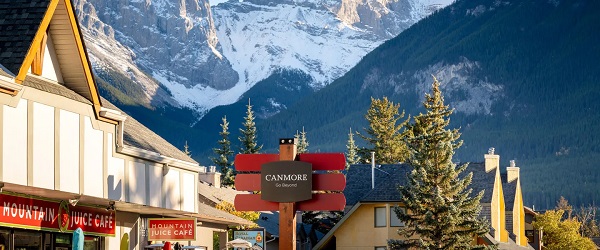

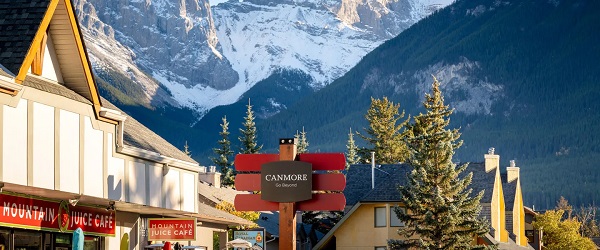

Alberta2 days agoCanmore attempting to tax its way out of housing crisis

-

Addictions1 day ago

Addictions1 day agoNews For Those Who Think Drug Criminalization Is Racist. Minorities Disagree

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoLiberals edge closer to majority as judicial recount flips another Ontario seat

-

Business2 days ago

Business2 days agoThe Oracle of Omaha Calls it a Career

-

Health1 day ago

Health1 day agoWHO assembly adopts ‘pandemic agreement’ binding countries to unified response

-

Alberta1 day ago

Alberta1 day agoBoreal forests could hold the key to achieving Canada’s climate goals

-

Business1 day ago

Business1 day agoCarney’s cabinet likely means more of the same on energy and climate