Economy

UN climate elites call for money from the West, issue warning about the ‘transition’

From the Fraser Institute

By: Kenneth P. Green

” the Agreement will be implemented to reflect equity and the principle of common but differentiated responsibilities and respective capabilities, in the light of different national circumstances.” This is a long-winded way of saying the West is going to pay for all this stuff, and transfer a lot of its wealth to the UN’s designated less-developed countries “

The world’s climate policy elites have wrapped up their Conference of the Parties (COP28) in the United Arab Emirates, hopped back onto their private jets and headed home (spewing carbon emissions all the way). But not before issuing their latest manifesto on global climate change policy for our holiday reading. What do the world’s climate elites have in store for us?

First and foremost, one needs to understand that the United Nations climate agenda is about global wealth redistribution, and the usual political agenda of the UN. The very first paragraph of the manifesto makes the social justice agenda explicit: “Parties should, when taking action to address climate change, respect, promote and consider their respective obligations on human rights, the right to a clean, healthy and sustainable environment, the right to health, the rights of Indigenous Peoples, local communities, migrants, children, persons with disabilities and people in vulnerable situations and the right to development, as well as gender equality, empowerment of women and intergenerational equity.”

The second paragraph reaffirms that global wealth redistribution is at the heart of things. “Also recalling Article 2, paragraph 2, of the Paris Agreement, which provides that the Agreement will be implemented to reflect equity and the principle of common but differentiated responsibilities and respective capabilities, in the light of different national circumstances.” This is a long-winded way of saying the West is going to pay for all this stuff, and transfer a lot of its wealth to the UN’s designated less-developed countries. Specifically, this year’s manifesto repeats the call for the world’s developed countries to pony up US$100 billion per year to fund various UN initiatives such as the “green climate fund,” the “adaptation fund,” the “special climate change fund” and the “least-developed countries” fund.

On the actual nuts and bolts of climate policy, they have stayed with their arbitrary target of limiting global average temperature change to 1.5 degrees Celsius from the pre-industrial average, and their overarching agenda of achieving “net-zero” greenhouse gas emissions by 2050. And they issued various specific steps toward these goals, such as tripling renewable energy globally by 2030, accelerating the use of “unabated” coal power, accelerating the transition to zero-emission (electric) vehicles, accelerating the deployment of low- and zero-greenhouse gas emitting forms of electrical generation (including, amazingly enough, nuclear power), and so on.

And for the first time, they explicitly called for, via the UN secretary general, the “transition away from fossil fuels—after many years in which the discussion of this issue was blocked.” And issued a warning. “To those who opposed a clear reference to a phase out of fossil fuels in the COP28 text, I want to say that a fossil fuel phase out is inevitable whether they like it or not. Let’s hope it doesn’t come too late,” adding that the “era of fossil fuels must end—and it must end with justice and equity.”

The UN’s latest climate manifesto is pretty much business as usual. Same arbitrary target of limiting warming to 1.5 °C, net-zero emissions by 2050, same boosting of a “renewables” transition, transport electrification, and so on. The new explicit call for moving away from fossil fuels will likely be the biggest theme in coming years, with increasing vilification and penalization of oil and gas producers (in the West) who have now been put on the species to become rendered extinct list. This will be happy holiday music to the ears of Prime Minister Trudeau and Environment Minister Guilbeault, but not likely a popular tune in the Prairies.

CBDC Central Bank Digital Currency

A Fed-Controlled Digital Dollar Could Mean The End Of Freedom

From the Daily Caller News Foundation

From the Daily Caller News Foundation

Central bank digital currencies (CBDC) are a threat to liberty.

Sixty-eight countries, including communist China, are exploring the possibility of issuing a CBDC. CBDCs are essentially government-sponsored cryptocurrencies pegged to the value of a national currency that allow for real-time payments.

The European Union has a digital euro CBDC pilot program, and all BRICS nations (Brazil, Russia, India, China and South Africa) are working to stand up CBDCs. China’s CBDC pilot, the largest in the world, is being used by 260 million individuals.

While faster payments are a positive for markets and economic growth, CBDCs present major risks. They would allow governments to meticulously monitor transactions made by their citizens, and CBDCs open the door for government planners to limit the types of transactions made.

Power corrupts, and no government should have that level of control. No wonder China and other authoritarian regimes around the globe are eager to implement a CBDC.

Governments that issue CBDCs could prohibit the sale or purchase of certain goods or services and more easily freeze and seize assets. But that would never happen in the U.S, right? Don’t be so certain.

Take a look at recent events in our neighbor to the north. The government of Canada shut down bank accounts and froze assets of Canadian citizens protesting the COVID-19 vaccination in Ottawa during the winter of 2022. With a CBDC, authoritarian actions of this kind would be even easier to execute.

To make matters worse, the issuance of a CBDC by the Federal Reserve, the U.S.’s central bank, has the potential to undermine the existing banking system. The exact ramifications of what a CBDC would mean to the banking sector are unclear, but such a development could position the Fed to offer banking services directly to American businesses and citizens, undercutting the community banks, credit unions, and other financial institutions that currently serve main street effectively.

The Fed needs to stay out of the banking business – it’s having a hard enough time achieving its core mission of getting inflation under control. A CBDC would open the door for the Fed to compete with the private sector, undercutting economic growth, innovation, and financial access in the process.

Fed Chair Jerome Powell has testified before Congress that America’s central bank would not issue a CBDC without express approval from Congress, but the Fed has studied CBDCs extensively.

For consumers who want the ability to make real-time payments internationally, CBDCs are not the answer. Stablecoins offer a commonsense private sector solution to this market demand.

Stablecoins are a type of cryptocurrency pegged to the value of a certain asset, such as the U.S. dollar. If Congress gets its act together and creates a regulatory framework for stablecoins, many banks, cryptocurrency firms, and other innovative private sector entities would issue dollar-pegged stablecoins. These financial instruments would allow for instantaneous cross-border payments for market participants who find that service of value.

Stablecoins are the free market response to CBDCs. They offer the benefits associated with the technology without the privacy risk, and they would likely enhance, not disrupt, the existing banking sector.

Representatives Patrick McHenry (R-N.C.) and French Hill (R-Ark.) have done yeoman’s work advancing quality, commonsense stablecoin legislation in the House of Representatives, and the Senate needs to move forward on this issue.

Inaction by Congress will force innovators overseas and put the U.S. at a competitive disadvantage. It would also help the Fed boost the case for a CBDC that will undermine liberty and open the door to government oppression.

Tommy Tuberville is a Republican from Alabama serving in the United States Senate. He is a member of the Senate Agriculture Committee, which plays a key role in overseeing emerging digital assets markets.

Business

Taxpayers criticize Trudeau and Ford for Honda deal

From the Canadian Taxpayers Federation

Author: Jay Goldberg

The Canadian Taxpayers Federation is criticizing the Trudeau and Ford governments to for giving $5 billion to the Honda Motor Company.

“The Trudeau and Ford governments are giving billions to yet another multinational corporation and leaving middle-class Canadians to pay for it,” said Jay Goldberg, CTF Ontario Director. “Prime Minister Justin Trudeau is sending small businesses bigger a bill with his capital gains tax hike and now he’s handing out billions more in corporate welfare to a huge multinational.

“This announcement is fundamentally unfair to taxpayers.”

The Trudeau government is giving Honda $2.5 billion. The Ford government announced an additional $2.5 billion subsidies for Honda.

The federal and provincial governments claim this new deal will create 1,000 new jobs, according to media reports. Even if that’s true, the handout will cost taxpayers $5 million per job. And according to Globe and Mail investigation, the government doesn’t even have a proper process in place to track whether promised jobs are actually created.

The Parliamentary Budget Officer has also called into question the government’s claims when it made similar multi-billion-dollar handouts to other multinational corporations.

“The break-even timeline for the $28.2 billion in production subsidies announced for Stellantis-LGES and Volkswagen is estimated to be 20 years, significantly longer than the government’s estimate of a payback within five years for Volkswagen,” wrote the Parliamentary Budget Officer said.

“If politicians want to grow the economy, they should cut taxes and red tape and cancel the corporate welfare,” said Franco Terrazzano, CTF Federal Director. “Just days ago, Trudeau said he wants the rich to pay more, so he should make rich multinational corporations pay for their own factories.”

-

Business2 days ago

Business2 days agoHonda deal latest episode of corporate welfare in Ontario

-

espionage2 days ago

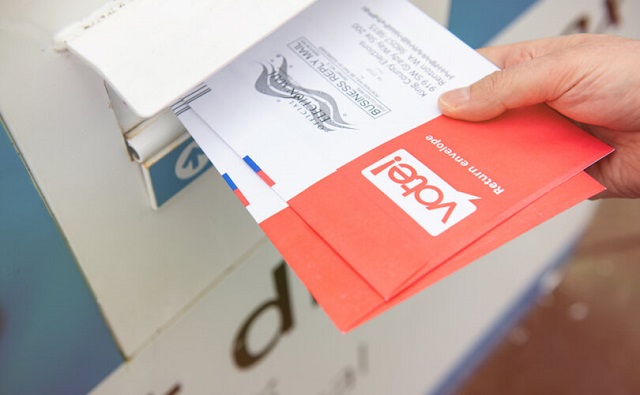

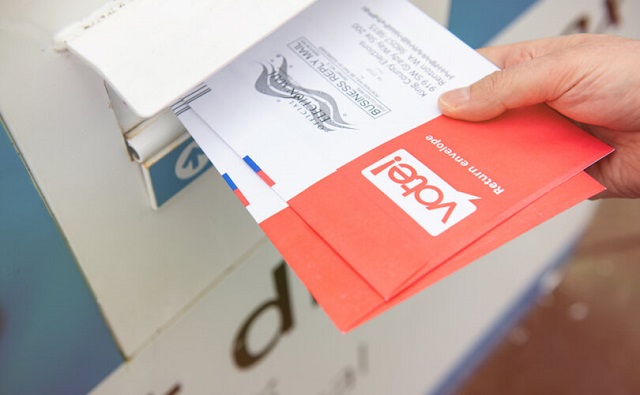

espionage2 days agoOne in five mail-in voters admitted to committing voter fraud during 2020 election: Rasmussen poll

-

Automotive1 day ago

Automotive1 day agoThe EV ‘Bloodbath’ Arrives Early

-

CBDC Central Bank Digital Currency1 day ago

CBDC Central Bank Digital Currency1 day agoA Fed-Controlled Digital Dollar Could Mean The End Of Freedom

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoThe Numbers Favour Our Side

-

Frontier Centre for Public Policy21 hours ago

Frontier Centre for Public Policy21 hours agoHow much do today’s immigrants help Canada?