Automotive

Trudeau’s new vehicle ban is a non starter

From the Canadian Taxpayers Federation

Author: Kris Sims

The Trudeau government’s ban on new gas and diesel vehicles is a nonstarter for three powerful reasons.

First, Canadians want to drive gas-powered minivans and diesel pickups.

Second, Canada does not have the electrical power to fuel these battery-powered cars.

Third, Canadians do not have the money to build the power-generating stations that would be needed to power these government-mandated vehicles.

Let’s start on the showroom floor.

The Trudeau government is banning the sale of new gasoline and diesel-powered vehicles by 2035.

In about 10 years’ time, Canadians will not be allowed to buy a new vehicle powered by an internal combustion engine because the government will forbid it.

Canadians disagree with this.

The Canadian Taxpayers Federation released Leger polling showing 59 per cent of Canadians oppose the federal government’s ban on new gas and diesel vehicles.

Among those who are decided on the issue, 67 per cent of Canadians, and majorities in every demographic, oppose the Trudeau government’s ban.

Now let’s look under the hood.

Canada does not have the electricity to charge these battery-powered cars. The government hasn’t presented any plan to pay for the power plants, transmission lines and charging stations for these government-mandated vehicles.

That leaves a big question: How much will this cost taxpayers?

Canada’s vehicle transition could cost up to $300 billion by 2040 to expand the electrical grid, according to a report for Natural Resources Canada.

Let’s look at why this will cost so much.

The average Canadian household uses about 10,861 kWh in electricity per year. The average electric car uses about 4,500 kWh of energy per year.

The average household’s electricity use would jump by about 40 per cent if they bought one EV and charged it at home.

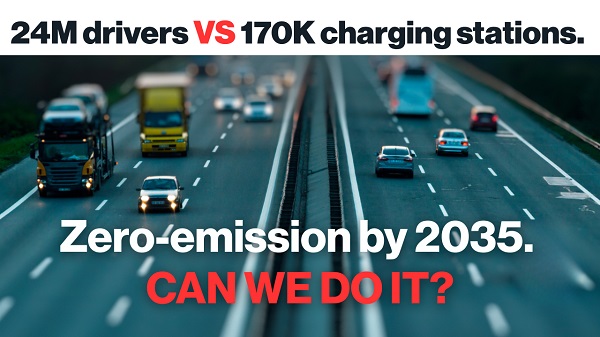

Canada is home to 24 million cars and light trucks that run on gasoline and diesel, according to Statistics Canada.

If all those vehicles were powered by electricity and batteries, that fleet would use about 108 million mWh of power every year.

For context, one large CANDU nuclear reactor at the Darlington nuclear plant in Ontario generates about 7,750,000 mWh of power per year.

Canada would require about 14 of these reactors to power all of those electric cars.

Building a large nuclear reactor costs about $12.5 billion.

That’s a price tag of about $175 billion just for all the power plants. The Natural Resources report estimates the transition to electric vehicles could cost up to $300 billion in total, when new charging stations and power lines are included.

Who would be paying that tab? Normal Canadians through higher taxes and power bills.

Canadians cannot afford the cost of these mandatory electric vehicles because they’re broke.

Canadians are broke largely because of high taxes and high inflation, both driven by the Trudeau government’s wasteful spending.

About half of Canadians say they are within $200 of not being able to make the minimum payments on their bills each month. That’s also known as barely scraping by.

Food banks are facing record demand, with a sharp increase in working families needing help. That means parents who are holding down jobs are still depending on donated jars of peanut butter to feed their kids.

Rubbing salt into the wound, the federal government also put taxpayers on the hook for about $30 billion to multinational corporations like Honda, Volkswagen, Stellantis and Northvolt to build EV battery factories.

The roadside sobriety test is complete, and the Trudeau government is blowing a fail on this policy.

Canadians are opposed to the Trudeau government banning the sale of new gasoline and diesel-powered vehicles.

Canada does not have the electricity to charge these battery-powered cars.

Canadians don’t have the money to build the new power plants, transmission lines and charging stations these vehicles would demand.

It’s time to tow this ban on new gas and diesel vehicles to the scrapyard.

Franco Terrazzano is the Federal Director and Kris Sims is the Alberta Director of the Canadian Taxpayers Federation

Automotive

Power Struggle: Electric vehicles and reality

From Resource Works

Tension grows between ambition and market truths

Host Stewart Muir talks on Power Struggle with Brian Maas, president of the California New Car Dealers Association, and Maas introduces us to a U.S. problem that Canada and B.C. also face right now. “The problem is there are mandates that apply in California and 11 other states that require, for the 2026 model year, 35% of all vehicles manufactured for sale in our state must be zero-emission, even though the market share right now is 20%. “So we’ve got a mandate that virtually none of the manufacturers our dealers represent are going to be able to meet.”

Maas adds: “We’re trying to communicate with policymakers that nobody’s opposed to the eventual goal of electrification. California’s obviously led that effort, but a mandate that nobody can comply with and one that California voters are opposed to deserves to be recalibrated.” Meanwhile, in Canada, the same objections apply to the federal government’s requirement, set in 2023, that 100% of new light-duty vehicles sold must be zero-emission vehicles, ZEVs (electric or plug-in hybrid) by 2035, with interim targets of 20 per cent by 2026 and 60 per cent by 2030. There are hefty penalties for dealers missing the targets.

Market researchers note that it now takes 55 days to sell an electric vehicle in Canada, up from 22 days in the first quarter of 2023. The researchers cite a lack of desirable models and high consumer prices despite government subsidies to buyers in six provinces that run as high as $7,000 in Quebec.

In the U.S. The Wall Street Journal reports that, on average, electric vehicles and plug-in hybrids sit in dealer lots longer than gasoline-powered cars and hybrids, despite government pressure to switch to electric. (The Biden administration ruled that two-thirds of new vehicles sold must be electric by 2032.) For Canada, the small-c conservative Fraser Institute reports: “The targets were wild to begin with. As Manhattan Institute senior fellow Mark P. Mills observed, bans on conventional vehicles and mandated switches to electric means, consumers will need to adopt EVs at a scale and velocity 10 times greater and faster than the introduction of any new model of car in history.”

When Ottawa scrapped federal consumer subsidies earlier this year, EV manufacturers and dealers in Canada called on the feds to scrap the sales mandates. “The federal government’s mandated ZEV sales targets are increasingly unrealistic and must end,” said Brian Kingston, CEO of the Canadian Vehicle Manufacturers’ Association. “Mandating Canadians to buy ZEVs without providing them the supports needed to switch to electric is a made-in-Canada policy failure.” And Tim Reuss, CEO of the Canadian Automobile Dealers Association, said: “The Liberal federal government has backed away from supporting the transition to electric vehicles and now we are left with a completely unrealistic plan at the federal level. “There is hypocrisy in imposing ambitious ZEV mandates and penalties on consumers when the government is showing a clear lack of motivation and support for their own policy goals.”

In B.C., sales growth of ZEVs has recently slowed, and the provincial government is considering easing its ZEV targets. “The Energy Ministry acknowledged that it will be ‘challenging’ to reach the target that 90 per cent of new vehicles be zero emission by 2030.” Nat Gosman, an assistant deputy minister in the B.C. energy ministry, cited reasons for the slowdown that include affordability concerns due to a pause in government rebates, supply chain disruptions caused by U.S. tariffs, and concerns about reliability of public charging sites.

Barry Penner, chair of the Energy Futures Institute and a former B.C. Liberal environment minister, said the problem is that the government has “put the cart before the horse” when it comes to incentivizing people to buy electric vehicles. “The government imposed these electric vehicle mandates before the public charging infrastructure is in place and before we’ve figured out how we’re going to make it easy for people to charge their vehicles in multi-family dwellings like apartment buildings.”

Penner went on to write an article for Resource Works that said: “Instead of accelerating into economically harmful mandates, both provincial and federal governments should recalibrate. We need to slow down, invest in required charging infrastructure, and support market-based innovation, not forced adoption through penalties. “A sustainable energy future for BC and Canada requires smart, pragmatic policy, not economic coercion. Let’s take our foot off the gas and realign our policies with reality, protect jobs, consumer affordability, and real environmental progress. Then we can have a successful transition to electric vehicles.”

Back to Power Struggle, and Brian Maas tells Stewart: “I think everybody understands that it’s great technology and I think a lot of Californians would like to have one. . . . The number one reason consumers cited for not making the transition to a zero-emission vehicle is the lack of public charging infrastructure. We’re woefully behind what would be required to move to 100% environment. “And if you live in a multifamily dwelling, an apartment building or something like that, you can’t charge at home, so you would have to rely on a public charger. Where do you go to get that charged?

“The state’s Energy Commission has said we need a million public chargers by 2030 and two million public chargers by 2035. We only have 178,000 now and we’re adding less than 50,000 public chargers a year. We’re just not going to get there fast enough to meet the mandate that’s on the books now.”

In Canada, Resource Works finds there now are more than 33,700 public charging ports, at 12,955 locations. But Ottawa says that to support its EV mandate, Canada will need about 679,000 public ports. “This will require the installation of, on average, 40,000 public ports each year between 2025 and 2040.”

And we remind readers of Penner’s serious call on governments to lighten the push on the accelerator when it comes to ZEV mandates: “Let’s take our foot off the gas and realign our policies with reality, protect jobs, consumer affordability, and real environmental progress. Then we can have a successful transition to electric vehicles.”

- Power Struggle YouTube video: https://ow.ly/8J4T50WhK5i

- Audio and full transcript: https://ow.ly/Np8550WhK5j

- Stewart Muir on LinkedIn: https://ow.ly/Smiq50UWpSB

- Brian Maas on LinkedIn: https://ow.ly/GuTh50WhK8h

- Power Struggle on LinkedIn: https://ow.ly/KX4r50UWpUa

- Power Struggle on Instagram: https://ow.ly/3VIM50UWpUg

- Power Struggle on Facebook: https://ow.ly/4znx50UWpUs

- Power Struggle on X: https://ow.ly/tU3R50UWpVu

Automotive

Electric vehicle sales are falling hard in BC, and it is time to recognize reality.

From Energy Now

By Barry Penner

Get the Latest Canadian Focused Energy News Delivered to You! It’s FREE: Quick Sign-Up Here

British Columbia’s electric vehicle (EV) sales mandates were created with good intentions, but the collision with reality is now obvious.

Although we are still in 2025, the 26 percent zero-emission vehicle sales mandate is already hitting our dealerships. That’s because it applies to the 2026 model year, and many of those models are starting to arrive across the province now.

While 26 percent sounds moderate compared to 90 percent by 2030, or 100 percent by 2035, as also required by BC law, the facts on the ground are grim.

According to S&P Global Mobility data, EV sales in BC have plummeted to around 15.4 percent as of June 2025, down from nearly 25 percent in mid-2024. This decline happened fast after both federal, up to $5,000, and provincial governments, up to $4,000 in BC, stopped funding their EV rebate programs earlier this year. So, the very incentives that made expensive electric vehicles accessible to middle-income buyers disappeared just when they were needed most.

Government polling shows 60 percent of British Columbians say cost is their biggest barrier to buying electric vehicles. And yet, both levels of government pulled the financial support while maintaining the sales mandates, with penalties of up to $20,000 per non-compliant vehicle. This is not just bad policy, it’s economic punishment for our auto sector.

Flavio Volpe, president of the Automotive Parts Manufacturers’ Association, pointed out the severe consequences for automakers. Federally, failing to meet the EV sales targets could mean astronomical penalties. A company selling 300,000 vehicles a year that misses its target by 10 percent could face a $600 million fine. These are not theoretical risks; they are real and could mean manufacturers reduce their Canadian presence, potentially costing thousands of auto jobs.

And powering an all-electric vehicle fleet is no small task. The organization of which I am chair, the Energy Futures Institute, modelled BC’s electricity needs under the 2035 mandate scenario and found full implementation would require an extra two Site C dams’ worth of electricity. We’ve already been importing 20 to 25 percent of our electricity annually for the past few years, often from fossil fuels, which contradicts our clean energy goals.

Electric vehicles represent an important technological advance, but the path matters. With governments forcing unattainable mandates, they are creating resentment amongst potential buyers and a political backlash against EVs themselves.

Energy Futures recently learned that the BC government is undertaking a technical review of the Zero-Emission Vehicle Act, quietly acknowledging that sales targets are increasingly seen as next to impossible. Under consideration is a change to the targets themselves, along with adjustments to compliance ratios and eligibility rules for plug-in hybrids.

The market shift to regular hybrids, which you don’t plug in, is not supported by rebates, but is happening nevertheless. However, these vehicles, such as the Toyota Prius, are not considered “clean” enough under BC legislation and could attract a penalty of $20,000 each.

This only makes things worse for consumers who are already stretched. Punitive mandates create market distortions, restrict consumer choice, and drive up vehicle prices for everyone, especially lower-income families who rely on affordable used cars.

Instead of accelerating into economically harmful mandates, both provincial and federal governments should recalibrate. Ottawa’s Environment Minister Julie Dabrusin’s statement earlier this month to renew consumer rebates is a good start, if the government is determined to interfere with the marketplace. But rebates alone won’t be enough. We need to slow down, invest in required charging infrastructure, and support market-based innovation, not forced adoption through penalties.

A sustainable energy future for BC and Canada requires smart, pragmatic policy, not economic coercion. Let’s take our foot off the gas and realign our policies with reality, protect jobs, consumer affordability, and real environmental progress. Then we can have a successful transition to electric vehicles.

Barry Penner is chair of the Energy Futures Institute, former president of the Pacific Northwest Economic Region and former four-term B.C. MLA and cabinet minister.

-

armed forces1 day ago

armed forces1 day agoCanada’s Military Can’t Be Fixed With Cash Alone

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate

-

Alberta1 day ago

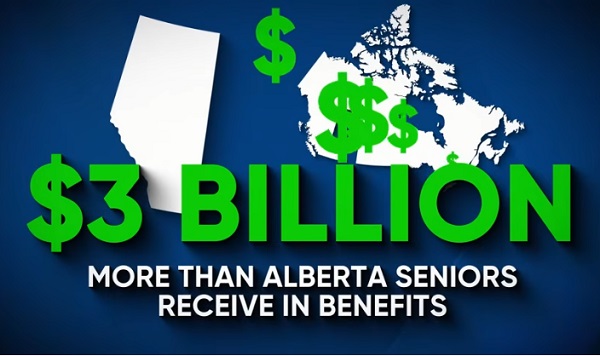

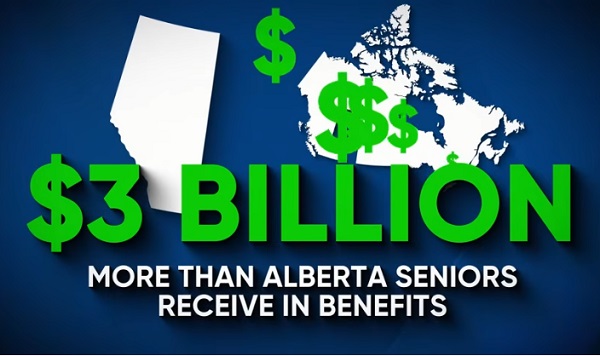

Alberta1 day agoAlberta Next: Alberta Pension Plan

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

C2C Journal23 hours ago

C2C Journal23 hours agoCanada Desperately Needs a Baby Bump