Economy

Trudeau punishing Canadians for surviving cold winter

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

Millions of Canadians are keeping an anxious eye on their thermostats, praying the power stays on and bracing for carbon-taxed heat bills to arrive.

A frigid winter cold snap delivered daytime temperatures in the minus thirties with overnight windchills of more than minus 50 in parts of Canada. Natural gas furnaces are running around the clock, keeping families from freezing and water pipes from bursting.

The situation got scary Saturday when an Alberta-wide alarm blared across smartphones, TVs and radios. The province warned the power grid was maxing out and rolling blackouts were about to hit.

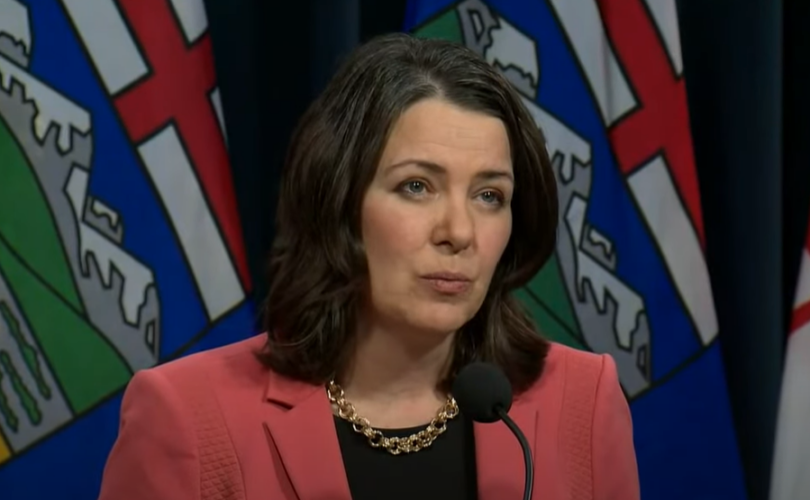

Alberta Premier Danielle Smith took to social media imploring Albertans to turn off their lights, stop using appliances and hunker down to save the power grid from blacking out. Saskatchewan Premier Scott Moe tagged in, announcing his province was sending 153 megawatts to Alberta.

When it’s minus 40, running the furnace isn’t a luxury, it’s a necessity. And yet, Prime Minister Justin Trudeau is punishing Canadians with a carbon tax for the sin of staying warm and staying alive in winter.

The federal carbon tax is currently set at $65 per tonne, costing 12 cents per cubic meter of natural gas and 10 cents per litre of propane. An average Canadian home uses about 2,385 cubic metres of natural gas per year, so the carbon tax will cost them about $300 extra to heat their home.

Even after the rebates, average families will be out hundreds of dollars this year because of the higher heating bills, gas prices, inflation and the economic damage that comes with the carbon tax, according to the Parliamentary Budget Officer.

But the Trudeau government isn’t done. On April 1, the carbon tax is going up to $80 per tonne. That will cost 15 cents per cubic metre of natural gas.

In fact, Trudeau plans to crank up his carbon tax every year. Over the next three years, Trudeau’s carbon tax will cost the average family $1,100 on natural gas alone.

Canada is a cold place. Keeping the heat on isn’t a luxury, it’s a necessity. And Trudeau’s carbon tax punishes families who need to stay warm during the winter months. Even worse, Trudeau knows the carbon tax makes it more expensive for families to stay warm.

“We are putting more money back in your pocket and making it easier for you to find affordable, long-term solutions to heat your home,” Trudeau said, when he removed the carbon tax from home heating oil for three years.

This was an admission of an obvious reality: the carbon tax makes life more expensive. Otherwise, why would Trudeau take the carbon tax off a form of heating energy?

Trudeau’s carbon tax-carve out was a political ploy to keep his Atlantic MPs from revolting while support for the Liberals plummeted in their typical stronghold.

While many Atlantic Canadians use heating oil, 97 per cent of Canadian families use other forms of energy, like natural gas or propane, and won’t get any relief from the feds this winter.

Even in Atlantic Canada, 77 per cent of people in the region want carbon tax relief for all Canadians this winter, according to a Leger poll commission by the Canadian Taxpayers Federation. Provincial politicians of all stripes have demanded the feds take the carbon tax off everyone’s heating bill.

That’s because staying warm isn’t a partisan issue. All Canadians need to heat their home. And we shouldn’t be punished with a tax just to survive the winter.

Trudeau should completely scrap his carbon tax. But at the very least he should extend the same relief he provided to Atlantic Canadians and take the carbon tax off everyone’s home heating bill.

Economy

‘Gambling With The Grid’: New Data Highlights Achilles’ Heel Of One Of Biden’s Favorite Green Power Sources

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By NICK POPE

New government data shows that wind power generation fell in 2023 despite the addition of new capacity, a fact that energy sector experts told the Daily Caller News Foundation demonstrates its inherent flaw.

Wind generation fell by about 2.1% in 2023 relative to 2022 generation, despite the 6 gigawatts (GW) of wind power capacity that came online last year, according to data published Tuesday by the U.S. Energy Information Administration (EIA). That wind power output dropped despite new capacity coming online and the availability of government subsidies highlights its intermittency and the problems wind power could pose for grid reliability, energy sector experts told the DCNF.

The decrease in wind generation is the first drop on record with the EIA since the 1990s; the drop was not evenly distributed across all regions of the U.S., and slower wind speeds last year also contributed to the decline, according to EIA. The Biden administration wants to have the American power sector reach carbon neutrality by 2035, a goal that will require a significant shift away from natural gas- and coal-fired power toward wind, solar and other green sources.

A table depicting the decrease of wind power generation in 2023 relative to 2022. (Screenshot via U.S. Energy Information Administration)

“Relying on wind power to meet your peak electricity demands is gambling with the grid,” Isaac Orr, a policy fellow at the Center of the American Experiment who specializes in power grid-related analysis, told the DCNF. “Will the wind blow, or won’t it? This should be a moment where policymakers step back and consider the wisdom of heavily subsidizing intermittent generators and punishing reliable coal and gas plants with onerous regulations.”

Between 2016 and 2022, the wind industry received an estimated $18.6 billion worth of subsidies, about 10% of the total amount of subsidies extended to the energy sector by the U.S. government, according to an August 2023 EIA report. Wind power received more assistance from the government than nuclear power, coal or natural gas over the same period of time.

“This isn’t subsidies per kilowatt hour of generation. It’s raw subsidies. If it were per kilowatt hour of generation, the numbers would be even more extreme,” Paige Lambermont, a research fellow at the Competitive Enterprise Institute, told the DCNF. “This is a massive amount of money. It’s enough to dramatically alter energy investment decisions for the worse. We’re much more heavily subsidizing the sources that don’t provide a significant portion of our electricity than those that do.”

“Policy that just focuses on installed capacity, rather than the reliability of that capacity, fails to understand the real needs of the electrical grid,” Lambermont added. “This recent disparity illustra

Wind power’s performance was especially lackluster in the upper midwest, but Texas saw more wind generation in 2023 than it did in 2022, according to EIA. Wind generation in the first half of 2023 was about 14% lower than it was through the first six months of 2022, but generation was higher toward the end of 2023 than it was during the same period in 2022.

In 2023, about 60% of all electricity generated in the U.S. came from fossil fuels, while 10% came from wind power, according to EIA data. Beyond generous subsidies for preferred green energy sources, the Biden administration has also aggressively regulated fossil fuels and American power plants to advance its broad climate agenda.

Biden’s Climate Bill Boosted An Offshore Wind Giant, But His Economy Brought It To The Brink https://t.co/AF7SPT2FNu

— Daily Caller (@DailyCaller) November 3, 2023

The Environmental Protection Agency’s (EPA) landmark power plant rules finalized this month will threaten grid reliability if enacted, partially because the regulations are likely to incentivize operators to close plants rather than adopt the costly measures required for compliance, grid experts previously told the DCNF. At the same time that the Biden administration is effectively trying to shift power generation away from fossil fuels, it is also pursuing goals — such as substantially boosting electric vehicle adoption over the next decade and incentivizing construction of energy-intensive computer chip factories — that are driving up projected electricity demand in the future.

“The EIA data proves what we’ve always known about wind power: It is intermittent, unpredictable and unreliable,” David Blackmon, a 40-year veteran of the oil and gas industry who now writes and consults on the energy sector, told the DCNF. “Any power generation source whose output is wholly dependent on equally unpredictable weather conditions should never be presented by power companies and grid managers as safe replacements for abundant, cheap, dispatchable generation fueled with natural gas, coal or nuclear. This is a simple reality that people in charge of our power grids too often forget. Saying that no doubt hurts some people’s feelings, but nature really does not care about our feelings.”

Blackmon also pointed out that, aside from its intermittency, sluggish build-out of the transmission lines and related infrastructure poses a major problem for wind power.

“Wind power is worthless without accompanying transmission, yet the Biden administration continues to pour billions into unreliable wind while ignoring the growing crisis in the transmission sector,” Blackmon told the DCNF.

Another long-term issue that wind power, as well as solar power, faces is the need for a massive expansion in the amount of battery storage available to store and dispatch energy from intermittent sources as market conditions dictate. By some estimates, the U.S. will need about 85 times as much battery storage by 2050 relative to November 2023 in order to fully decarbonize the power grid, according to Alsym Energy, a battery company.

The White House and the Department of Energy did not respond to requests for comment.

Alberta

Alberta government should eliminate corporate welfare to generate benefits for Albertans

From the Fraser Institute

By Spencer Gudewill and Tegan Hill

Last November, Premier Danielle Smith announced that her government will give up to $1.8 billion in subsidies to Dow Chemicals, which plans to expand a petrochemical project northeast of Edmonton. In other words, $1.8 billion in corporate welfare.

And this is just one example of corporate welfare paid for by Albertans.

According to a recent study published by the Fraser Institute, from 2007 to 2021, the latest year of available data, the Alberta government spent $31.0 billion (inflation-adjusted) on subsidies (a.k.a. corporate welfare) to select firms and businesses, purportedly to help Albertans. And this number excludes other forms of government handouts such as loan guarantees, direct investment and regulatory or tax privileges for particular firms and industries. So the total cost of corporate welfare in Alberta is likely much higher.

Why should Albertans care?

First off, there’s little evidence that corporate welfare generates widespread economic growth or jobs. In fact, evidence suggests the contrary—that subsidies result in a net loss to the economy by shifting resources to less productive sectors or locations (what economists call the “substitution effect”) and/or by keeping businesses alive that are otherwise economically unviable (i.e. “zombie companies”). This misallocation of resources leads to a less efficient, less productive and less prosperous Alberta.

And there are other costs to corporate welfare.

For example, between 2007 and 2019 (the latest year of pre-COVID data), every year on average the Alberta government spent 35 cents (out of every dollar of business income tax revenue it collected) on corporate welfare. Given that workers bear the burden of more than half of any business income tax indirectly through lower wages, if the government reduced business income taxes rather than spend money on corporate welfare, workers could benefit.

Moreover, Premier Smith failed in last month’s provincial budget to provide promised personal income tax relief and create a lower tax bracket for incomes below $60,000 to provide $760 in annual savings for Albertans (on average). But in 2019, after adjusting for inflation, the Alberta government spent $2.4 billion on corporate welfare—equivalent to $1,034 per tax filer. Clearly, instead of subsidizing select businesses, the Smith government could have kept its promise to lower personal income taxes.

Finally, there’s the Heritage Fund, which the Alberta government created almost 50 years ago to save a share of the province’s resource wealth for the future.

In her 2024 budget, Premier Smith earmarked $2.0 billion for the Heritage Fund this fiscal year—almost the exact amount spent on corporate welfare each year (on average) between 2007 and 2019. Put another way, the Alberta government could save twice as much in the Heritage Fund in 2024/25 if it ended corporate welfare, which would help Premier Smith keep her promise to build up the Heritage Fund to between $250 billion and $400 billion by 2050.

By eliminating corporate welfare, the Smith government can create fiscal room to reduce personal and business income taxes, or save more in the Heritage Fund. Any of these options will benefit Albertans far more than wasteful billion-dollar subsidies to favoured firms.

Authors:

-

illegal immigration1 day ago

illegal immigration1 day agoBiden’s DOJ Threatens To Sue Another State For Enforcing Immigration Law

-

Economy1 day ago

Economy1 day ago‘Gambling With The Grid’: New Data Highlights Achilles’ Heel Of One Of Biden’s Favorite Green Power Sources

-

Opinion2 days ago

Opinion2 days agoMisleading polls may produce more damaging federal policies

-

International2 days ago

International2 days agoTrump campaign says he will pardon Jan. 6 prisoners on ‘case-by-case basis’ if re-elected

-

conflict2 days ago

conflict2 days agoNYPD says protesters had weapons, gas masks and ‘Death to America!’ pamphlets

-

illegal immigration1 day ago

illegal immigration1 day agoMore Chinese Illegal Migrants Apprehended At Southern Border In Two Days Than In All Of 2021: REPORT

-

ESG1 day ago

ESG1 day agoTennessee Taking Lead In Protecting Civil Rights And Free Enterprise—And Stopping Political Debanking

-

Energy23 hours ago

Energy23 hours agoMarket Realities Are Throwing Wrench In Biden’s Green Energy Dreams