Canadian Energy Centre

Trans Mountain completion shows victory of good faith Indigenous consultation

Photo courtesy Trans Mountain Corporation

From the Canadian Energy Centre

‘Now that the Trans Mountain expansion is finally completed, it will provide trans-generational benefits to First Nations involved’

While many are celebrating the completion of the Trans Mountain pipeline expansion project for its benefit of delivering better prices for Canadian energy to international markets, it’s important to reflect on how the project demonstrates successful economic reconciliation with Indigenous communities.

It’s easy to forget how we got here.

The history of Trans Mountain has been fraught with obstacles and delays that could have killed the project, but it survived. This stands in contrast to other pipelines such as Energy East and Keystone XL.

Starting in 2012, proponent Kinder Morgan Canada engaged in consultation with multiple parties – including many First Nation and Métis communities – on potential project impacts.

According to Trans Mountain, there have been 73,000 points of contact with Indigenous communities throughout Alberta and British Columbia as the expansion was developed and constructed. The new federal government owners of the pipeline committed to ongoing consultation during early construction and operations phase.

Beyond formal Indigenous engagement, the project proponent conducted numerous environmental and engineering field studies. These included studies drawing on deep Indigenous input, such as traditional ecological knowledge studies, traditional land use studies, and traditional marine land use studies.

At each stage of consultation, the proponent had to take into consideration this input, and if necessary – which occurred regularly – adjust the pipeline route or change an approach.

With such a large undertaking, Kinder Morgan and later Trans Mountain Corporation as a government entity had to maintain relationships with many Indigenous parties and make sure they got it right.

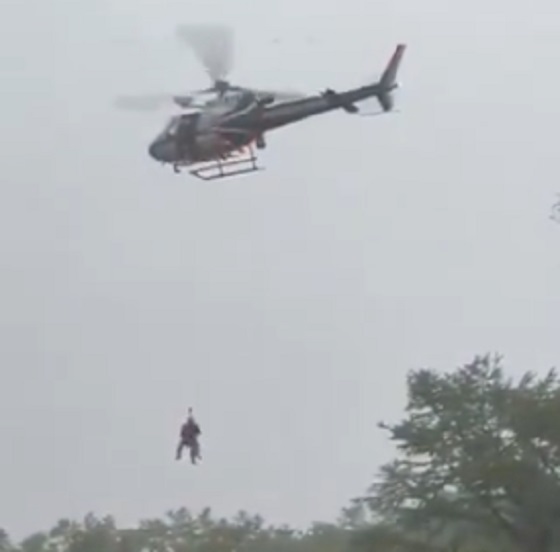

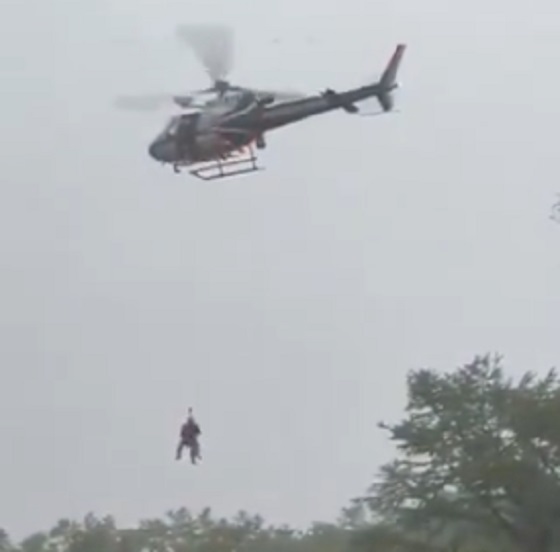

Trans Mountain participates in a cultural ceremony with the Shxw’ōwhámél First Nation near Hope, B.C. Photograph courtesy Trans Mountain

Trans Mountain participates in a cultural ceremony with the Shxw’ōwhámél First Nation near Hope, B.C. Photograph courtesy Trans Mountain

It was the opposite of the superficial “checklist” form of consultation that companies had long been criticized for.

While most of the First Nation and Métis communities engaged in good faith with Kinder Morgan, and later the federal government, and wanted to maximize environmental protections and ensure they got the best deal for their communities, environmentalist opponents wanted to kill the project outright from the start.

After the government took over the incomplete expansion in 2018, green activists were transparent about using cost overruns as a tactic to scuttle and defeat the project. They tried to make Trans Mountain ground zero for their anti-energy divestment crusade, targeting investors.

It is an amazing testament to importance of Trans Mountain that it survived this bad faith onslaught.

In true eco-colonialist fashion, the non-Indigenous activist community did not care that the consultation process for Trans Mountain project was achieving economic reconciliation in front of their eyes. They were “fair weather friends” who supported Indigenous communities only when they opposed energy projects.

They missed the broad support for the Trans Mountain expansion. As of March 2023, the project had signed agreements with 81 Indigenous communities along the proposed route worth $657 million, and the project has created over $4.8 billion in contracts with Indigenous businesses.

Most importantly, Trans Mountain saw the maturing of Indigenous capital as Indigenous coalitions came together to seek equity stakes in the pipeline. Project Reconciliation, the Alberta-based Iron Coalition and B.C.’s Western Indigenous Pipeline Group all presented detailed proposals to assume ownership.

Although these equity proposals have not yet resulted in a sale agreement, they involved taking that important first step. Trans Mountain showed what was possible for Indigenous ownership, and now with more growth and perhaps legislative help from provincial and federal governments, an Indigenous consortium will be eventually successful when the government looks to sell the project.

If an Indigenous partner ultimately acquires an equity stake in Trans Mountain, observers close to the negotiations are convinced it will be a sizeable stake, well beyond 10 per cent. It will be a transformative venture for many First Nations involved.

Now that the Trans Mountain expansion is finally completed, it will provide trans-generational benefits to First Nations involved, including lasting work for Indigenous companies. It will also demonstrate the victory of good faith Indigenous consultation over bad faith opposition.

Canadian Energy Centre

Alberta oil sands legacy tailings down 40 per cent since 2015

Wapisiw Lookout, reclaimed site of the oil sands industry’s first tailings pond, which started in 1967. The area was restored to a solid surface in 2010 and now functions as a 220-acre watershed. Photo courtesy Suncor Energy

From the Canadian Energy Centre

By CEC Research

Mines demonstrate significant strides through technological innovation

Tailings are a byproduct of mining operations around the world.

In Alberta’s oil sands, tailings are a fluid mixture of water, sand, silt, clay and residual bitumen generated during the extraction process.

Engineered basins or “tailings ponds” store the material and help oil sands mining projects recycle water, reducing the amount withdrawn from the Athabasca River.

In 2023, 79 per cent of the water used for oil sands mining was recycled, according to the latest data from the Alberta Energy Regulator (AER).

Decades of operations, rising production and federal regulations prohibiting the release of process-affected water have contributed to a significant accumulation of oil sands fluid tailings.

The Mining Association of Canada describes that:

“Like many other industrial processes, the oil sands mining process requires water.

However, while many other types of mines in Canada like copper, nickel, gold, iron ore and diamond mines are allowed to release water (effluent) to an aquatic environment provided that it meets stringent regulatory requirements, there are no such regulations for oil sands mines.

Instead, these mines have had to retain most of the water used in their processes, and significant amounts of accumulated precipitation, since the mines began operating.”

Despite this ongoing challenge, oil sands mining operators have made significant strides in reducing fluid tailings through technological innovation.

This is demonstrated by reductions in “legacy fluid tailings” since 2015.

Legacy Fluid Tailings vs. New Fluid Tailings

As part of implementing the Tailings Management Framework introduced in March 2015, the AER released Directive 085: Fluid Tailings Management for Oil Sands Mining Projects in July 2016.

Directive 085 introduced new criteria for the measurement and closure of “legacy fluid tailings” separate from those applied to “new fluid tailings.”

Legacy fluid tailings are defined as those deposited in storage before January 1, 2015, while new fluid tailings are those deposited in storage after January 1, 2015.

The new rules specified that new fluid tailings must be ready to reclaim ten years after the end of a mine’s life, while legacy fluid tailings must be ready to reclaim by the end of a mine’s life.

Total Oil Sands Legacy Fluid Tailings

Alberta’s oil sands mining sector decreased total legacy fluid tailings by approximately 40 per cent between 2015 and 2024, according to the latest company reporting to the AER.

Total legacy fluid tailings in 2024 were approximately 623 million cubic metres, down from about one billion cubic metres in 2015.

The reductions are led by the sector’s longest-running projects: Suncor Energy’s Base Mine (opened in 1967), Syncrude’s Mildred Lake Mine (opened in 1978), and Syncrude’s Aurora North Mine (opened in 2001). All are now operated by Suncor Energy.

The Horizon Mine, operated by Canadian Natural Resources (opened in 2009) also reports a significant reduction in legacy fluid tailings.

The Muskeg River Mine (opened in 2002) and Jackpine Mine (opened in 2010) had modest changes in legacy fluid tailings over the period. Both are now operated by Canadian Natural Resources.

Imperial Oil’s Kearl Mine (opened in 2013) and Suncor Energy’s Fort Hills Mine (opened in 2018) have no reported legacy fluid tailings.

Suncor Energy Base Mine

Between 2015 and 2024, Suncor Energy’s Base Mine reduced legacy fluid tailings by approximately 98 per cent, from 293 million cubic metres to 6 million cubic metres.

Syncrude Mildred Lake Mine

Between 2015 and 2024, Syncrude’s Mildred Lake Mine reduced legacy fluid tailings by approximately 15 per cent, from 457 million cubic metres to 389 million cubic metres.

Syncrude Aurora North Mine

Between 2015 and 2024, Syncrude’s Aurora North Mine reduced legacy fluid tailings by approximately 25 per cent, from 102 million cubic metres to 77 million cubic metres.

Canadian Natural Resources Horizon Mine

Between 2015 and 2024, Canadian Natural Resources’ Horizon Mine reduced legacy fluid tailings by approximately 36 per cent, from 66 million cubic metres to 42 million cubic metres.

Total Oil Sands Fluid Tailings

Reducing legacy fluid tailings has helped slow the overall growth of fluid tailings across the oil sands sector.

Without efforts to reduce legacy fluid tailings, the total oil sands fluid tailings footprint today would be approximately 1.6 billion cubic metres.

The current fluid tailings volume stands at approximately 1.2 billion cubic metres, up from roughly 1.1 billion in 2015.

The unaltered reproduction of this content is free of charge with attribution to the Canadian Energy Centre.

Business

Why it’s time to repeal the oil tanker ban on B.C.’s north coast

The Port of Prince Rupert on the north coast of British Columbia. Photo courtesy Prince Rupert Port Authority

From the Canadian Energy Centre

By Will Gibson

Moratorium does little to improve marine safety while sending the wrong message to energy investors

In 2019, Martha Hall Findlay, then-CEO of the Canada West Foundation, penned a strongly worded op-ed in the Globe and Mail calling the federal ban of oil tankers on B.C.’s northern coast “un-Canadian.”

Six years later, her opinion hasn’t changed.

“It was bad legislation and the government should get rid of it,” said Hall Findlay, now director of the University of Calgary’s School of Public Policy.

The moratorium, known as Bill C-48, banned vessels carrying more than 12,500 tonnes of oil from accessing northern B.C. ports.

Targeting products from one sector in one area does little to achieve the goal of overall improved marine transport safety, she said.

“There are risks associated with any kind of transportation with any goods, and not all of them are with oil tankers. All that singling out one part of one coast did was prevent more oil and gas from being produced that could be shipped off that coast,” she said.

Hall Findlay is a former Liberal MP who served as Suncor Energy’s chief sustainability officer before taking on her role at the University of Calgary.

She sees an opportunity to remove the tanker moratorium in light of changing attitudes about resource development across Canada and a new federal government that has publicly committed to delivering nation-building energy projects.

“There’s a greater recognition in large portions of the public across the country, not just Alberta and Saskatchewan, that Canada is too dependent on the United States as the only customer for our energy products,” she said.

“There are better alternatives to C-48, such as setting aside what are called Particularly Sensitive Sea Areas, which have been established in areas such as the Great Barrier Reef and the Galapagos Islands.”

The Business Council of British Columbia, which represents more than 200 companies, post-secondary institutions and industry associations, echoes Hall Findlay’s call for the tanker ban to be repealed.

“Comparable shipments face no such restrictions on the East Coast,” said Denise Mullen, the council’s director of environment, sustainability and Indigenous relations.

“This unfair treatment reinforces Canada’s over-reliance on the U.S. market, where Canadian oil is sold at a discount, by restricting access to Asia-Pacific markets.

“This results in billions in lost government revenues and reduced private investment at a time when our economy can least afford it.”

The ban on tanker traffic specifically in northern B.C. doesn’t make sense given Canada already has strong marine safety regulations in place, Mullen said.

Notably, completion of the Trans Mountain Pipeline expansion in 2024 also doubled marine spill response capacity on Canada’s West Coast. A $170 million investment added new equipment, personnel and response bases in the Salish Sea.

“The [C-48] moratorium adds little real protection while sending a damaging message to global investors,” she said.

“This undermines the confidence needed for long-term investment in critical trade-enabling infrastructure.”

Indigenous Resource Network executive director John Desjarlais senses there’s an openness to revisiting the issue for Indigenous communities.

“Sentiment has changed and evolved in the past six years,” he said.

“There are still concerns and trust that needs to be built. But there’s also a recognition that in addition to environmental impacts, [there are] consequences of not doing it in terms of an economic impact as well as the cascading socio-economic impacts.”

The ban effectively killed the proposed $16-billion Eagle Spirit project, an Indigenous-led pipeline that would have shipped oil from northern Alberta to a tidewater export terminal at Prince Rupert, B.C.

“When you have Indigenous participants who want to advance these projects, the moratorium needs to be revisited,” Desjarlais said.

He notes that in the six years since the tanker ban went into effect, there are growing partnerships between B.C. First Nations and the energy industry, including the Haisla Nation’s Cedar LNG project and the Nisga’a Nation’s Ksi Lisims LNG project.

This has deepened the trust that projects can mitigate risks while providing economic reconciliation and benefits to communities, Dejarlais said.

“Industry has come leaps and bounds in terms of working with First Nations,” he said.

“They are treating the rights of the communities they work with appropriately in terms of project risk and returns.”

Hall Findlay is cautiously optimistic that the tanker ban will be replaced by more appropriate legislation.

“I’m hoping that we see the revival of a federal government that brings pragmatism to governing the country,” she said.

“Repealing C-48 would be a sign of that happening.”

-

Carbon Tax2 days ago

Carbon Tax2 days agoCanada’s Carbon Tax Is A Disaster For Our Economy And Oil Industry

-

Disaster2 days ago

Disaster2 days agoTexas flood kills 43 including children at Christian camp

-

Daily Caller2 days ago

Daily Caller2 days agoTrump’s One Big Beautiful Bill Resets The Energy Policy Playing Field

-

Business1 day ago

Business1 day agoThe Digital Services Tax Q&A: “It was going to be complicated and messy”

-

Alberta18 hours ago

Alberta18 hours agoAlberta Next: Immigration

-

International1 day ago

International1 day agoElon Musk forms America Party after split with Trump

-

Crime6 hours ago

Crime6 hours agoNews Jeffrey Epstein did not have a client list, nor did he kill himself, Trump DOJ, FBI claim

-

COVID-194 hours ago

COVID-194 hours agoFDA requires new warning on mRNA COVID shots due to heart damage in young men