Business

The Strange Case of the Disappearing Public Accounts Report

A few days ago, Public Services and Procurement Canada tabled their audited consolidated financial statements of the Government of Canada for 2024. This is the official and complete report on the state of government finances. When I say “complete”, I mean the report’s half million words stretch across three volumes and total more than 1,300 pages.

Together, these volumes provide the most comprehensive and authoritative view of the federal government’s financial management and accountability for the fiscal year ending March 31, 2024. The tragedy is that no one has the time and energy needed to read and properly understand all that data. But the report identifies problems serious enough to deserve the attention of all Canadians – and especially policy makers.

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Following the approach of my Parliamentary Briefings series, I uploaded all three volumes of the report to my AI research assistant and asked for its thoughts. Each one of the observations that came out the other end is significant and, in calmer and more rational times, could easily have driven a week’s worth of news coverage. But given the craziness of the past few weeks and months, they’re being largely ignored.

With that in mind, I’ve made this special edition of the Parliamentary Briefings series fully accessible to all subscribers.

We begin with a summary of the purpose and scope of the three uploaded volumes of the Public Accounts of Canada for 2023–2024:

Volume I: Summary Report and Consolidated Financial Statements

- Purpose: Provides a high-level overview of the federal government’s financial performance, presenting the consolidated financial statements audited by the Auditor General. It serves as the primary accountability report.

- Scope:

- Audited financial statements.

- Analysis of revenues, expenses, and the accumulated deficit.

- Overview of assets, liabilities, and financial position.

- Discussion of economic context, risks, uncertainties, and ten-year comparative financial data.

Volume II: Details of Expenses and Revenues

- Purpose: Presents the financial operations of the government, broken down by ministries and agencies, for detailed accountability.

- Scope:

- Financial transactions segregated by ministry.

- Details of appropriations, revenues, and transfer payments.

- Summary tables on ministerial expenditures by type, object, and other dimensions.

- Appendices providing additional details on budgetary authorities and their sources.

Volume III: Additional Information and Analyses

- Purpose: Offers supplementary analyses and financial data beyond what is included in the first two volumes, focusing on revolving funds, professional services, and shared-cost programs.

- Scope:

- Financial statements of revolving funds (e.g., Passport Canada, Canadian Grain Commission).

- Expenditure details on acquisitions, transfer payments, and public debt charges.

- Analyses of federal-provincial shared-cost programs and claims against the Crown.

- Miscellaneous financial and operational data for broader transparency.

The Audit: Based on these documents, could you identify the most serious threats to Canada’s economic stability?

From the Public Accounts of Canada 2023–2024, several serious threats to Canada’s economic security can be identified. These threats emerge from the broader fiscal and economic analyses, contingent liabilities, and uncertainties highlighted in the documents.

1. Growing Public Debt and Debt Servicing Costs

- Observation: Canada’s public debt charges increased significantly in 2024, rising by 35.2% year-over-year, largely due to higher interest rates on debt. The total accumulated federal debt stood at $1.24 trillion, representing 42.1% of GDP, up from 41.1% the previous year.

- Risk: Rising debt servicing costs reduce fiscal space for critical public investments, making the economy vulnerable to future economic shocks or downturns.

2. Contingent Liabilities and Indigenous Claims

- Observation: The government recorded $16.4 billion in contingent liabilities related to Indigenous claims in 2024, reflecting ongoing efforts to address past injustices. These liabilities have been increasing at an average annual growth rate of 30% since 2016.

- Risk: The unpredictable nature and scale of these liabilities could create significant financial pressures if settlements or court decisions require substantial payouts.

3. Legacy Costs from the COVID-19 Pandemic

- Observation: The government recorded $4.7 billion in pandemic-related expenses for 2024, including write-offs for expired vaccines and provisions for unrecovered loans and benefits.

- Risk: These costs highlight vulnerabilities in emergency financial planning and expose the government to further financial risks if similar large-scale public health crises occur.

4. Economic Pressures from High Inflation and Interest Rates

- Observation: Inflation returned to the Bank of Canada’s 2% target by mid-2024 after 41 consecutive months above this threshold. However, elevated interest rates (peaking at 5%) contributed to a softening economy.

- Risk: Prolonged periods of high interest rates could suppress household and business spending, slowing economic growth and increasing the likelihood of a recession.

5. Climate Change and Environmental Commitments

- Observation: Significant spending is allocated to addressing climate change, with over $1 billion dedicated to environmental programs in 2024, including pollution pricing proceeds and clean energy initiatives.

- Risk: Canada’s reliance on resource-intensive industries and increasing costs to meet climate targets create economic vulnerabilities, particularly in regions heavily reliant on fossil fuels.

6. Global Economic Instability

- Observation: Global supply chain disruptions, energy price volatility, and geopolitical events (e.g., Russia’s invasion of Ukraine) significantly impacted Canada’s economy, with slower GDP growth (1.5% in 2023) and reduced trade.

- Risk: External shocks could exacerbate domestic economic challenges, such as rising import costs or reduced demand for Canadian exports.

7. Labor Market and Productivity Challenges

- Observation: While job creation remained positive, population growth outpaced employment gains, leading to an increase in the unemployment rate to 6.5% by October 2024. Productivity improvements have been uneven.

- Risk: Labor shortages in key sectors and declining workforce participation among certain demographics (e.g., aging population) could undermine economic resilience.

8. Dependence on Resource Revenues

- Observation: Volatile global commodity prices impacted nominal GDP growth, with gains slowing to 2.9% in 2023 after double-digit growth in prior years.

- Risk: Fluctuations in resource revenues leave Canada exposed to external shocks, particularly in provinces like Alberta and Saskatchewan, heavily reliant on oil and gas.

These challenges underscore the need for proactive fiscal and policy measures to safeguard economic stability, manage liabilities, and address emerging risks.

The Audit: What would you recommend as the three most urgent areas to address to avoid deepening the economic crisis?

1. Manage Rising Public Debt and Debt Servicing Costs

- Why It’s Urgent: The rapid increase in public debt charges (35.2% in 2024) is crowding out fiscal space for essential programs. The federal debt, at 42.1% of GDP, has become a significant liability, with interest rate fluctuations posing an ongoing threat.

- Recommendations:

- Introduce stricter fiscal discipline by prioritizing expenditures that yield long-term economic benefits (e.g., infrastructure, innovation).

- Develop a comprehensive debt reduction strategy to stabilize the debt-to-GDP ratio in the medium term.

- Explore debt refinancing strategies to lock in lower interest rates where feasible.

- Impact: Reducing debt servicing pressures will free up resources for critical investments and improve Canada’s fiscal resilience.

2. Mitigate the Economic Impact of Contingent Liabilities

- Why It’s Urgent: Contingent liabilities related to Indigenous claims have grown exponentially (30% annually since 2016), creating fiscal unpredictability and potentially overwhelming future budgets.

- Recommendations:

- Accelerate settlement negotiations to limit litigation costs and interest on outstanding claims.

- Establish a transparent reserve fund specifically for contingent liabilities, ensuring predictable future payouts.

- Increase collaboration with Indigenous communities to address systemic issues and prevent further claims.

- Impact: Resolving liabilities promptly will reduce fiscal uncertainty and demonstrate Canada’s commitment to reconciliation.

3. Address Structural Labor Market and Productivity Challenges

- Why It’s Urgent: Despite job creation, rising unemployment (6.5% in late 2024) and productivity stagnation threaten long-term economic growth. Labor shortages in critical sectors further exacerbate vulnerabilities.

- Recommendations:

- Expand skilled immigration programs to address labor shortages in healthcare, technology, and green industries.

- Increase investment in workforce retraining programs, particularly for sectors undergoing automation or transition due to climate policies.

- Promote workplace flexibility and childcare access to increase labor force participation, particularly among women and aging workers.

- Impact: Enhancing workforce productivity and participation will strengthen the economic foundation and support GDP growth.

Rationale for Prioritization

These areas represent the most immediate threats to economic security and fiscal stability. Addressing them proactively can reduce vulnerabilities and position Canada for sustainable growth.

The Audit: What are the most surprising and disturbing details in these documents?

1. Rapid Growth of Public Debt Charges

- Detail: Public debt charges increased by 35.2% year-over-year to $47.3 billion, representing one of the fastest-growing expense categories. This reflects a combination of higher interest rates and the significant size of Canada’s debt.

- Why Disturbing: Such a rapid increase in debt servicing costs could divert funds from essential public services and programs. It also signals limited fiscal flexibility in the event of future economic shocks.

2. Ballooning Contingent Liabilities

- Detail: The federal government recorded $16.4 billion in expenses for Indigenous contingent liabilities in 2024. This is part of an ongoing surge, with liabilities increasing by 30% annually since 2016.

- Why Disturbing: While reconciliation efforts are vital, the sheer scale and rapid growth of these liabilities are fiscally unsustainable without structural changes or dedicated funding mechanisms. The risk of further liabilities emerging adds to fiscal uncertainty.

3. Significant Write-offs and Provisions for Pandemic Programs

- Detail: The government wrote off $1.2 billion in expired COVID-19 vaccines and therapeutics and recorded $3.5 billion in provisions for unrecovered pandemic-era loans.

- Why Disturbing: These figures highlight inefficiencies in planning and administration during the pandemic response, leading to substantial financial losses. The scale of unrecovered funds also raises questions about accountability in the deployment of emergency programs.

4. Rising Unemployment Despite Job Creation

- Detail: While 475,000 jobs were created in 2023, the unemployment rate rose to 6.5% by late 2024 due to population growth outpacing employment gains.

- Why Surprising: Despite strong job creation, an inability to keep pace with population growth signals structural issues in labor force integration. This poses a risk to Canada’s economic competitiveness and social cohesion.

5. Declining Corporate Income Tax Revenues

- Detail: Corporate income tax revenues decreased by 0.7%, driven by reduced taxable income despite an overall increase in total revenues.

- Why Surprising: The decline in corporate tax revenues during a period of economic recovery raises concerns about potential tax avoidance, economic inequality, or over-reliance on other revenue streams, such as personal income taxes.

6. Substantial Environmental and Climate Spending

- Detail: Over $1 billion was allocated to environmental programs, including pollution pricing proceeds. However, the documents note Canada’s slow progress toward net-zero targets and risks to resource-dependent provinces.

- Why Disturbing: While necessary, this spending may be insufficient given the scale of the climate challenge. The mismatch between spending and measurable progress on climate goals risks long-term environmental and economic consequences.

7. Unanticipated Costs of Indigenous Reconciliation

- Detail: Beyond contingent liabilities, the government is facing unpredictable settlement costs due to increasing litigation and the complexity of claims. These have already exceeded $60 billion since 2016.

- Why Disturbing: The ongoing financial impact of these settlements reflects Canada’s historical neglect of Indigenous issues. Resolving these claims is essential, but the lack of predictability or dedicated funding highlights systemic shortcomings in reconciliation strategies.

8. Softened GDP Growth and Inflation Challenges

- Detail: Real GDP growth slowed to 1.5% in 2023, and inflation remained high throughout the year, only reaching the Bank of Canada’s 2% target by mid-2024.

- Why Disturbing: The prolonged inflationary period and sluggish growth signal a fragile recovery. These economic conditions could exacerbate income inequality and lead to further fiscal strain.

9. High Provisions for Unrecovered Loans

- Detail: Provisions of $3.5 billion were recorded for emergency loans provided during the pandemic. The government continues to face difficulties in recovering these funds.

- Why Disturbing: This provision raises serious questions about the efficiency of loan administration and the government’s ability to safeguard public funds during emergencies.

10. Heavy Dependence on Volatile Resource Revenues

- Detail: Nominal GDP growth slowed to 2.9% in 2023, largely due to easing commodity prices after a surge in 2022. Resource dependence remains a key economic vulnerability.

- Why Surprising: Despite global shifts toward renewable energy, Canada’s reliance on resource revenues remains high, posing long-term risks to economic diversification and stability.

Invite your friends and earn rewards

Business

Dallas mayor invites NYers to first ‘sanctuary city from socialism’

From The Center Square

By

After the self-described socialist Zohran Mamdani won the Democratic primary for mayor in New York, Dallas Mayor Eric Johnson invited New Yorkers and others to move to Dallas.

Mamdani has vowed to implement a wide range of tax increases on corporations and property and to “shift the tax burden” to “richer and whiter neighborhoods.”

New York businesses and individuals have already been relocating to states like Texas, which has no corporate or personal income taxes.

Johnson, a Black mayor and former Democrat, switched parties to become a Republican in 2023 after opposing a city council tax hike, The Center Square reported.

“Dear Concerned New York City Resident or Business Owner: Don’t panic,” Johnson said. “Just move to Dallas, where we strongly support our police, value our partners in the business community, embrace free markets, shun excessive regulation, and protect the American Dream!”

Fortune 500 companies and others in recent years continue to relocate their headquarters to Dallas; it’s also home to the new Texas Stock Exchange (TXSE). The TXSE will provide an alternative to the New York Stock Exchange and Nasdaq and there are already more finance professionals in Texas than in New York, TXSE Group Inc. founder and CEO James Lee argues.

From 2020-2023, the Dallas-Fort Worth-Arlington MSA reported the greatest percentage of growth in the country of 34%, The Center Square reported.

Johnson on Thursday continued his invitation to New Yorkers and others living in “socialist” sanctuary cities, saying on social media, “If your city is (or is about to be) a sanctuary for criminals, mayhem, job-killing regulations, and failed socialist experiments, I have a modest invitation for you: MOVE TO DALLAS. You can call us the nation’s first official ‘Sanctuary City from Socialism.’”

“We value free enterprise, law and order, and our first responders. Common sense and the American Dream still reside here. We have all your big-city comforts and conveniences without the suffocating vice grip of government bureaucrats.”

As many Democratic-led cities joined a movement to defund their police departments, Johnson prioritized police funding and supporting law and order.

“Back in the 1800s, people moving to Texas for greater opportunities would etch ‘GTT’ for ‘Gone to Texas’ on their doors moving to the Mexican colony of Tejas,” Johnson continued, referring to Americans who moved to the Mexican colony of Tejas to acquire land grants from the Mexican government.

“If you’re a New Yorker heading to Dallas, maybe try ‘GTD’ to let fellow lovers of law and order know where you’ve gone,” Johnson said.

Modern-day GTT movers, including a large number of New Yorkers, cite high personal income taxes, high property taxes, high costs of living, high crime, and other factors as their reasons for leaving their states and moving to Texas, according to multiple reports over the last few years.

In response to Johnson’s invitation, Gov. Greg Abbott said, “Dallas is the first self-declared “Sanctuary City from Socialism. The State of Texas will provide whatever support is needed to fulfill that mission.”

The governor has already been doing this by signing pro-business bills into law and awarding Texas Enterprise Grants to businesses that relocate or expand operations in Texas, many of which are doing so in the Dallas area.

“Texas truly is the Best State for Business and stands as a model for the nation,” Abbott said. “Freedom is a magnet, and Texas offers entrepreneurs and hardworking Texans the freedom to succeed. When choosing where to relocate or expand their businesses, more innovative industry leaders recognize the competitive advantages found only in Texas. The nation’s leading CEOs continually cite our pro-growth economic policies – with no corporate income tax and no personal income tax – along with our young, skilled, diverse, and growing workforce, easy access to global markets, robust infrastructure, and predictable business-friendly regulations.”

Business

National dental program likely more costly than advertised

From the Fraser Institute

By Matthew Lau

At the beginning of June, the Canadian Dental Care Plan expanded to include all eligible adults. To be eligible, you must: not have access to dental insurance, have filed your 2024 tax return in Canada, have an adjusted family net income under $90,000, and be a Canadian resident for tax purposes.

As a result, millions more Canadians will be able to access certain dental services at reduced—or no—out-of-pocket costs, as government shoves the costs onto the backs of taxpayers. The first half of the proposition, accessing services at reduced or no out-of-pocket costs, is always popular; the second half, paying higher taxes, is less so.

A Leger poll conducted in 2022 found 72 per cent of Canadians supported a national dental program for Canadians with family incomes up to $90,000—but when asked whether they would support the program if it’s paid for by an increase in the sales tax, support fell to 42 per cent. The taxpayer burden is considerable; when first announced two years ago, the estimated price tag was $13 billion over five years, and then $4.4 billion ongoing.

Already, there are signs the final cost to taxpayers will far exceed these estimates. Dr. Maneesh Jain, the immediate past-president of the Ontario Dental Association, has pointed out that according to Health Canada the average patient saved more than $850 in out-of-pocket costs in the program’s first year. However, the Trudeau government’s initial projections in the 2023 federal budget amounted to $280 per eligible Canadian per year.

Not all eligible Canadians will necessarily access dental services every year, but the massive gap between $850 and $280 suggests the initial price tag may well have understated taxpayer costs—a habit of the federal government, which over the past decade has routinely spent above its initial projections and consistently revises its spending estimates higher with each fiscal update.

To make matters worse there are also significant administrative costs. According to a story in Canadian Affairs, “Dental associations across Canada are flagging concerns with the plan’s structure and sustainability. They say the Canadian Dental Care Plan imposes significant administrative burdens on dentists, and that the majority of eligible patients are being denied care for complex dental treatments.”

Determining eligibility and coverage is a huge burden. Canadians must first apply through the government portal, then wait weeks for Sun Life (the insurer selected by the federal government) to confirm their eligibility and coverage. Unless dentists refuse to provide treatment until they have that confirmation, they or their staff must sometimes chase down patients after the fact for any co-pay or fees not covered.

Moreover, family income determines coverage eligibility, but even if patients are enrolled in the government program, dentists may not be able to access this information quickly. This leaves dentists in what Dr. Hans Herchen, president of the Alberta Dental Association, describes as the “very awkward spot” of having to verify their patients’ family income.

Dentists must also try to explain the program, which features high rejection rates, to patients. According to Dr. Anita Gartner, president of the British Columbia Dental Association, more than half of applications for complex treatment are rejected without explanation. This reduces trust in the government program.

Finally, the program creates “moral hazard” where people are encouraged to take riskier behaviour because they do not bear the full costs. For example, while we can significantly curtail tooth decay by diligent toothbrushing and flossing, people might be encouraged to neglect these activities if their dental services are paid by taxpayers instead of out-of-pocket. It’s a principle of basic economics that socializing costs will encourage people to incur higher costs than is really appropriate (see Canada’s health-care system).

At a projected ongoing cost of $4.4 billion to taxpayers, the newly expanded national dental program is already not cheap. Alas, not only may the true taxpayer cost be much higher than this initial projection, but like many other government initiatives, the dental program already seems to be more costly than initially advertised.

-

Agriculture2 days ago

Agriculture2 days agoCanada’s supply management system is failing consumers

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

armed forces23 hours ago

armed forces23 hours agoCanada’s Military Can’t Be Fixed With Cash Alone

-

Alberta23 hours ago

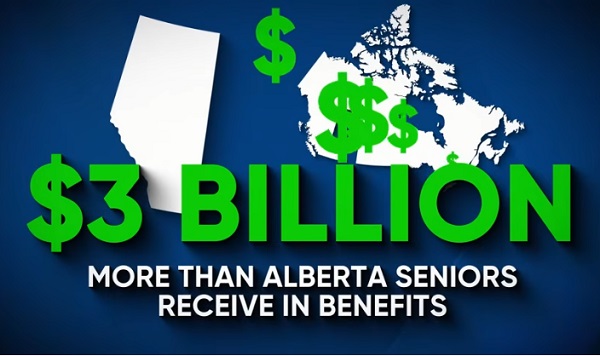

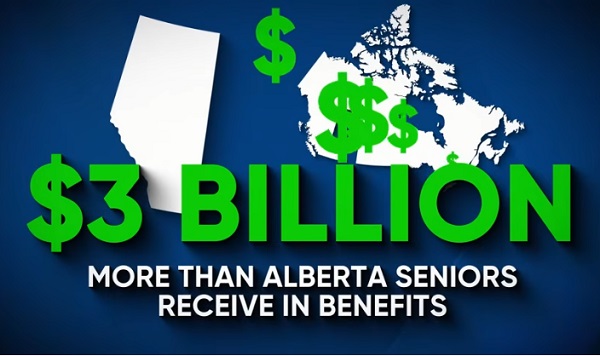

Alberta23 hours agoAlberta Next: Alberta Pension Plan

-

Economy2 days ago

Economy2 days agoTrump opens door to Iranian oil exports

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry