Business

The Mortgage Maelstrom: Navigating the Impending Financial Tempest in Canada

From The Opposition with Dan Knight substack

As renewal rates surge and interest rates soar, Canadian households stand on the precipice of a fiscal fallout that could redefine the nation’s economic landscape

As we wade through the current economic climate, it’s becoming increasingly clear that a storm is brewing on the Canadian horizon, one that could sweep away the financial stability of countless households. The heart of this looming tempest? The mortgage market—specifically, the shock awaiting about 60% of mortgage holders in the next three years as their terms come up for renewal.

RBC has crunched the numbers and the forecast is grim. More than $186 billion in mortgages is set to renew in 2024 alone, and if today’s interest rates hold, homeowners could see their payments leap by a staggering 32%. And that’s just the beginning. The following year, $315 billion worth of mortgages are on the renewal chopping block, many of which are variable-rate mortgages, potentially pushing the payment shock to 33%.

What’s the root cause? It’s the interest rates—sitting at a 5% benchmark, the highest we’ve seen since the turn of the millennium. If there’s no significant decrease, we’re looking at a tidal wave of credit losses come 2025. And let’s not forget the elephant in the room: those with variable-rate mortgages could face a payment shock as high as 84% by 2026 if the rates stay put.

Here’s the scoop, folks. Bank of Canada Governor Tiff Macklem laid out a cold hard truth: fiscal and monetary policy are at loggerheads. While the central bank is straining every sinew to wrestle down inflation with rate hikes, the federal and provincial governments are lighting the fuse with their spending, fueling the very inflation the Bank of Canada is trying to stamp out.

In the red corner, we’ve got the Bank of Canada, gloves on, ready to slug inflation down to its target by 2025. In the blue corner, Trudeau’s government, doling out dollars like there’s no tomorrow. What does this mean for John and Jane Doe on Main Street? As their mortgage renewals roll in, they’re staring down the barrel of a 32% to a mind-boggling 84% payment shock.

Folks, let’s cut to the chase. This economic quagmire we’re sinking into? It’s got Trudeau’s fingerprints all over it. The fabric of Canadian society is getting shredded not by accident, but by a government playing fast and loose with fiscal policy. The Bank of Canada is scrambling to counteract with rate hikes, but Trudeau’s Liberals seem hell-bent on doling out dollars like candy on Halloween, inflaming inflation and leaving families to foot the bill.

As for Trudeau, he’s steering the ship with a blindfold on, and the polls? They’re reading like an obituary for the Liberals’ prospects. Come the next federal election, if these mortgage hikes hit as hard as predicted, Trudeau’s so-called economic strategy could be the very thing that buries his political future. We’re not just talking about a swing in the voting booths; we’re talking about a full-scale revolt from a populace that’s had enough of being ignored in the face of an economic abyss.

As Canadians navigate the turbulent waters of an economy where the dream of homeownership slips through their fingers and the basic necessity of putting food on the table becomes a herculean task, the political pageantry of promised dental plans rings hollow. When the ballots are drawn, the echo of dissatisfaction will thunder across the voting booths. Yes, my dear readers, as the national mood simmers with the desire for change, there’s a palpable sense that a political reckoning looms on the horizon — a red wedding in the electoral sense, where the old guard may be unseated in a dramatic upheaval.

Subscribe to The Opposition with Dan Knight.

For the full experience, upgrade your subscription.

Dan Knight

Business

PRC Money Laundering Probes Secured Beijing Influence Case Into New York Governors Office

Salted Ducks, Supercars, and State Access: How FBI Agents Say Beijing Bought Influence in the Heart of New York Government

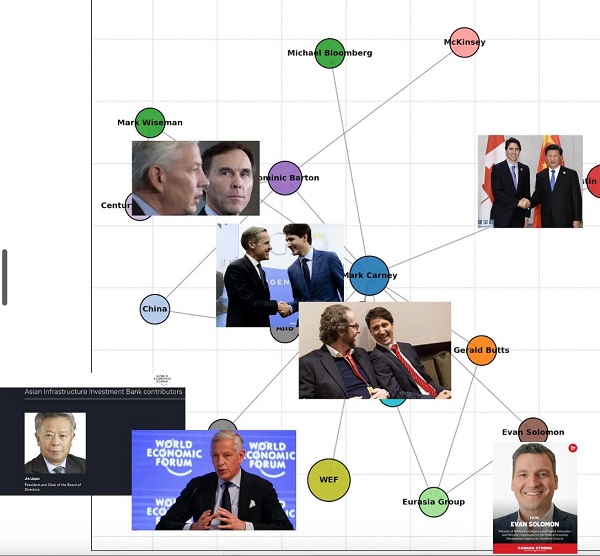

The upcoming trial of Linda Sun — also known as Wen Sun — may prove to be the most sophisticated and high-level political infiltration operation in the United States publicly tied to Beijing’s United Front system. A youthful, naturalized immigrant from China, Sun rose through New York State’s bureaucracy to become a senior diversity official. Now, she stands accused of secretly manipulating two Democratic governors — effectively scripting Andrew Cuomo’s praise of Chinese pandemic mask shipments, while blocking Governor Kathy Hochul from meeting Taiwanese officials and ensuring her silence on the Chinese Communist Party’s mass detention of Uyghurs.

According to a sweeping superseding indictment filed in June 2025, Sun and her husband Chris Hu began enriching themselves through large-scale money laundering and corruption as early as March 2020, just weeks into the COVID-19 emergency. Prosecutors allege that Sun exploited her insider position to steer over $34 million in pandemic-era PPE contracts to companies tied to her husband and relatives — all while concealing her financial interests. In exchange, Sun and Hu allegedly received more than $8 million in kickbacks, routed through a constellation of opaque bank accounts and disguised as legitimate business revenue.

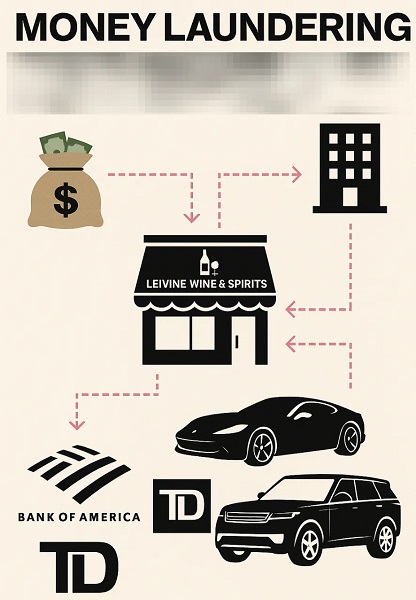

Luxury perks included gifts of Nanjing ducks and high-end travel to China, including a stay in a Beijing hotel suite previously used by former First Lady Michelle Obama. According to federal agents, much of the couple’s illicit income was funneled from China through underground banking and masked wire transfers into Leivine Wine & Spirits, a high-end boutique liquor store in Flushing that allegedly operated as a laundering front for Chinese-backed capital.

A criminal trial for Sun, 41, and Hu, 40, is scheduled for November.

The government further alleges that Sun’s influence reached into the core of New York’s executive branch. Under then-Governor Cuomo, Sun allegedly coordinated with senior officials from the Chinese Consulate in New York to orchestrate public expressions of gratitude toward Beijing during the early COVID-19 crisis. This culminated in Cuomo’s April 4, 2020 tweet: “We finally got some good news today. The Chinese government helped facilitate a donation of 1,000 ventilators that are coming in today. We thank @ConsulGeneralNY and the Chinese government.” According to FBI agents, this statement was not spontaneous — it was part of a covert diplomatic effort Sun was tasked with securing, even as she and her husband were allegedly profiting from tens of millions of dollars in pandemic-era contracts awarded to entities secretly tied to them.

Sun and Hu deny all allegations. Their attorneys have mounted a vigorous defense, filing numerous motions to dismiss the charges and suppress evidence obtained through federal search warrants. The most recent failed motion, filed a week ago, asked the government “to retract and delete its June 26, 2025 press release” regarding the new PPE-fraud and money-laundering allegations, and accused FBI Director Kash Patel of prejudicing the case with this post to X: “While Americans were locked down and desperate for PPE, Linda Sun and Chris Hu cashed in – allegedly lining their pockets while serving CCP interests. This is corruption that endangered lives. The FBI will not tolerate public officials who sell out their country.”

Under Governor Hochul, Sun’s alleged covert activities reportedly accelerated. Federal prosecutors say she obtained unauthorized gubernatorial proclamations honoring PRC officials, used back-channels to attempt to arrange an official visit to China’s Henan Province for Hochul while she served as lieutenant governor, and allowed PRC consular officials to preview and influence Hochul’s public remarks. In one instance, agents allege, Sun ensured Hochul made no public mention of China’s mass detention of Uyghurs in Xinjiang, after consular feedback was relayed to her directly.

Together, these allegations portray a striking level of access and manipulation. Operating from within her official diversity, equity, and inclusion role, Sun allegedly ran a parallel influence campaign that touched the highest levers of power in New York — the fourth-largest U.S. economy, with an annual budget exceeding $230 billion and nearly 180,000 employees.

If proven, Sun’s efforts would amount to the most successful Chinese influence campaign yet documented in open court — directly advancing President Xi Jinping’s foreign-policy objectives under the banner of United Front political warfare.

Yet a deeper investigation by The Bureau — combing through hundreds of pages of court records, financial exhibits, and suppression filings — suggests that money laundering, more than political access, may be the case’s more sophisticated and entrenched operational spine.

As striking as Sun’s apparent success in realigning New York’s political posture toward Beijing may be, that influence appears to be just one layer within a larger machinery — an engine designed not only to exert political leverage but to move massive flows of illicit capital, benefitting both the conspirators and their state-linked patrons.

In this context, Sun’s foreign-influence campaign increasingly resembles a node within a broader financial architecture — one that suggests Chinese intelligence may be providing the hidden hand behind similar cross-border dealings across North America. The pattern aligns with tactics long attributed to the United Front Work Department, which fuses economic infiltration with political co-option, often through trusted intermediaries embedded in diaspora communities and public institutions.

In Sun’s case, federal investigators say the FBI identified more than 80 financial accounts linked to the couple, tracking complex movements of capital between the U.S. and China, with the use of shell companies, luxury real estate, and boutique storefronts to disguise covertly sourced funds.

What emerges is not simply a corruption case — but a revealing blueprint of how modern state-backed influence operations can be financed, layered, and laundered through global finance and trade.

According to filings, the main unidentified Chinese diplomat and United Front conspirators included, CC-1, a naturalized U.S. citizen originally from China, playing a central behind-the-scenes role in Linda Sun’s alleged influence operation. As president of a New York–based nonprofit representing individuals from China’s Henan Province, CC-1 led an organization that federal prosecutors say was tightly linked to the Chinese Communist Party’s United Front Work Department — or UFWD — a political warfare unit tasked with cultivating support for Beijing among influential elites worldwide. According to the indictment, CC-1 issued strategic directives to Sun, including instructing her to draft invitation letters for Chinese delegations, organize official visits, and tailor communications to suit CCP interests. The UFWD, prosecutors noted, “attempted to manage relationships with and generate support for the CCP among elite individuals inside and outside the PRC, including by gathering human intelligence.”

CC-2, meanwhile, was a U.S. legal permanent resident who maintained active business interests in China’s Shandong Province. Identified as a principal in several U.S.-based Chinese associations — including a chamber of commerce for Chinese immigrants — CC-2 allegedly operated as another key intermediary in the broader influence network. Federal prosecutors also identified at least four high-ranking officials at the Chinese Consulate in New York — PRC Official-1 through PRC Official-4 — as central actors in the alleged foreign interference scheme. PRC Official-1 and PRC Official-2 held senior leadership roles, while PRC Official-3 and PRC Official-4 were assigned to the consulate’s Political Section. Based on similar job titles in Canada, such Political Section diplomats may fit the profile of undercover intelligence handlers of diaspora United Front agents — trained to operate within embassies and consulates as covert operatives.

In a statement to The New York Times following June’s superseding indictment, Jarrod Schaeffer, Sun’s attorney, said prosecutors were “publicizing feverish accusations unmoored from the facts.” Seth DuCharme, representing Hu, said the government was “scrambling to try to come up with some new charging theory” ahead of trial.

The Money Trail: From Pandemic Profits to Wine Cellars and Real Estate

Federal prosecutors say Linda Sun and Chris Hu built a life of stunning opulence — allegedly financed by laundering proceeds from covertly awarded pandemic contracts and PRC-connected business activity. Among the assets now under federal forfeiture: a $3.6 million mansion in Manhasset, a $1.9 million condo in Honolulu’s prestigious Ala Moana district, and a $1.5 million home in Forest Hills, Queens. Their vehicle collection rivaled that of global elites — including a 2024 Ferrari Roma, a new Range Rover, and a 2022 Mercedes SUV.

Agents also recovered $140,000 in cash, including $130,000 from a TD Bank safe-deposit box in Flushing, and nearly $83,000 frozen across various personal and brokerage accounts. Investigators uncovered a pattern of carefully orchestrated gifts from senior Chinese officials — most strikingly, the delivery of at least 18 salted ducks between 2021 and 2022. In Chinese culture, such ducks — especially the revered Nanjing variety — are not just festive delicacies, but symbols of insider favor and elite status.

The money trail, prosecutors allege, began in China. As laid out in the June 2025 indictment, Chris Hu’s business operations — including a PPE venture with an unnamed partner and a lobster-export business tied to China-based buyers — generated millions in revenue. Rather than transferring those funds legally, Hu allegedly relied on unlicensed money remitters — the hallmarks of Byzantine underground banking systems documented by DEA probes such as “Project Sleeping Giant.” These funds were then funneled into U.S. banks, including TD and Bank of America, via shell companies and family-linked accounts — among them, one associated with Leivine Wine & Spirits.

“There were no mortgage loans taken in connection with these acquisitions,” the indictment notes.

“Hu repatriated this wealth to the United States by, among other measures, using one or more unlicensed money-remitting businesses; depositing cash payments into multiple accounts associated with Hu’s family and businesses, including into an account associated with the Wine Store,” the indictment explains. The couple’s real-estate spree, prosecutors add, “occurred soon after Hu received a series of wire transfers totaling more than $2.1 million from a PRC-based account bearing the name of [Hu’s Chinese business partner].”

At the center of this alleged laundering web sits Leivine Wine & Spirits, a boutique liquor store inside an upscale Flushing development. Though marketed as a premium destination — with a temperature-controlled cellar housing bottles priced between $20,000 and $50,000, and a rare $5,200 Dalmore single malt — Hu’s reported financials, supposedly based largely on bulk-cash sales and $80,000 in monthly cash deposits, raised red flags.

“We partner with world-renowned brands to offer exclusive tastings, have sections of curated and rare bottles, and a knowledgeable staff to assist with your every need,” the store’s website declares. But as FBI Special Agent Devin Perry wrote in his affidavit: “Wine and liquor stores, such as Leivine, generally conduct primarily cashless transactions. Given Leivine’s location in a high-end development in Flushing, I assess it is unlikely that the large volume of cash Hu has been depositing in Leivine accounts constitutes Leivine’s actual income.”

That assessment proved pivotal. In May 2025, U.S. District Judge Brian Cogan denied Hu’s motion to suppress evidence gathered in the FBI’s 2024 warrant targeting the wine store — a ruling that cleared the path for expanded money-laundering and PPE-fraud charges in the June superseding indictment. Cogan’s decision laid out in striking detail how Leivine allegedly served as a conduit for cash flowing from Sun’s covert foreign-influence activities, presenting a textbook case of illicit financial engineering.

Among the key findings:

- $10,000 in unexplained cash was seized from Hu’s residence, which he claimed was store revenue awaiting deposit.

- More than $200,000 in cash deposits had been made into Leivine’s accounts before its official opening in November 2022.

- From August 2022 to February 2024, the store averaged $77,000 in monthly cash deposits.

- Hu personally wired $1.123 million from his private accounts into Leivine’s business accounts.

- Seven feeder accounts — all in Leivine’s name — funneled funds into a central Bank of America account, with four of them transferring over 97 percent of their deposits to that destination.

Judge Cogan found these flows consistent with structured layering techniques widely associated with professional money laundering. The transactions, he ruled, were sufficient to uphold the warrant, writing that “the affidavit still established probable cause,” and that Hu’s suppression arguments failed to overcome the weight of evidence.

Suppression and Dismissal

Beyond the 2024 Leivine warrant, federal investigators had been collecting evidence for years. The affidavit supporting the search of the couple’s Manhasset mansion laid out a web of digital communications, financial records, and testimonial evidence pointing to Sun’s role as an undeclared foreign agent for the People’s Republic of China.

FBI Special Agent Devin Perry cited messages between Sun and her parents as key proof that she “acted to benefit the PRC government and traded access for various PRC government representatives and agents, in return for economic considerations.” These communications included “numerous WeChat messages” in which Sun and her parents discussed her alleged assignments — such as when a figure referred to as “Chairman Xia” upgraded her airfare, and Sun assumed Xia “would start asking her to do him favors such as arranging peoples’ visits (to the Governor’s office).”

WeChat logs also allegedly showed Sun, Hu, and Sun’s parents receiving gifts from PRC officials, and Sun and Hu using her parents as straw purchasers for vehicles. Judge Cogan ruled that Hu’s motion to dismiss the related warrant lacked foundation.

While Sun sought to dismiss all charges, claiming there was no evidence she knowingly acted as an unregistered foreign agent, Judge Cogan disagreed. In a sweeping May 5 ruling, he rejected her motion and dismantled her core argument — that she lacked authority to influence New York’s highest offices and therefore could not qualify as a foreign agent under U.S. law.

Among the most explosive allegations: Sun boasted to senior Chinese consular officials that she had blocked Taiwan’s representative office, known as TECO, from any contact with top New York officials. In January 2019, she wrote to a senior Chinese diplomat, “Certainly I have managed to stop all relations between the TECO and the state. I have denied all requests from their office.” By February 27, 2019, she went further, instructing a staffer for Governor Cuomo to reject a meeting request from a visiting Taiwanese mayor: “No to the request. Explain in person.”

Judge Cogan highlighted what may be the most damning element of the case: many of Sun’s alleged clandestine acts occurred after she had been explicitly warned by federal authorities. On July 15, 2020, Sun voluntarily sat for an FBI interview, during which agents advised her of the Foreign Agents Registration Act (FARA) and warned that “if someone operated on behalf of the Chinese government without registering as a foreign agent, they could be in violation of FARA.”

But the FBI was already watching long before that warning. The indictment cites a 2018 episode in which a senior United Front agent, identified as CC-1, allegedly tasked Sun with arranging an official visit to New York for a Henan Province delegation — including a meeting with then-Lieutenant Governor Kathy Hochul. Sun allegedly drafted two versions of an invitation letter on official governor’s-office letterhead — despite having no authority to issue such invitations.

The scheme deepened in 2018 and 2019. CC-1 again tasked Sun — this time with coordinating a return visit for Hochul to Henan, a trip aimed at showcasing Beijing’s ties with a prominent U.S. state. On November 26, 2018, CC-1 instructed Sun to send Hochul’s résumé and propose an itinerary. She complied immediately, sending both the résumé and Hochul’s official email address. She was then instructed to update and reissue invitation letters on May 17 and September 16, 2019, tailoring them to Chinese diplomatic preferences.

Judge Cogan also cited Sun’s alleged role in facilitating fraudulent invitation letters to support illegal visa applications for the Henan delegation. The diplomatic trip, pitched as part of a proposed $1 billion joint-campus project with New York universities, appeared to be a United Front cover operation to deepen Beijing’s political and economic influence in America.

Through these efforts, Sun allegedly used her access not only to open doors for Chinese officials — but to slam them shut on geopolitical rivals, especially Taiwan.

The indictment also shows that Sun, even after the FBI warning, allegedly continued acting on behalf of PRC officials — including repeated interventions to shape New York State policy toward Taiwan and giving consular officials advance access to official state communications.

In early 2021, Sun allegedly provided the Chinese consulate with a draft of Governor Hochul’s public remarks, allowing Beijing to sanitize the language and strip references to sensitive topics such as the Uyghur detentions. “Based on feedback from a PRC government official, [Hochul] did not publicly address the detention of Uyghurs in PRC state-run camps in Xinjiang,” the judge noted, citing FBI evidence.

“These actions, as alleged, demonstrate Sun using her authority and power to induce action or change the decisions or acts of another,” Judge Cogan wrote, concluding that they were “sufficient to constitute the ‘influence’ element of a FARA offense, even as Sun defines it.”

Finally, Judge Cogan emphasized that the indictment establishes Sun’s understanding that her alleged United Front handlers — CC-1 and CC-2 — were acting as agents of the PRC and the Communist Party. As the indictment puts it: “Sun understood that CC-1 and CC-2 were themselves acting as agents of the PRC government and the CCP when they made requests of Sun.”

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

Business

Coffee price explosion a self-inflicted wound: Liberal tariff drives up cost of coffee

This article supplied by Troy Media.

Since March 3, Canadian importers have been paying an additional 25 per cent tariff on imported coffee. This counter-tariff, introduced as part of Ottawa’s retaliatory response to a trade dispute triggered by new United States duties on Canadian agricultural exports earlier this year, directly affects a product that isn’t even grown in Canada.

Coffee is up 19 per cent—and global markets aren’t to blame. Ottawa’s political posturing is burning your wallet, one cup at a time

Canadians are paying 19 per cent more for ground coffee this year—and it’s not because of global supply issues. It’s because of a self-inflicted policy

mistake: a 25 per cent tariff imposed by Ottawa on imported coffee, a product Canada doesn’t even grow.

Many consumers may attribute the spike to global market volatility, especially after coffee futures soared to a record high of more than US$4.40 per

pound in February. But that explanation no longer holds—futures have since dropped by more than 30 per cent, yet retail prices remain stubbornly high. So, what’s driving this divergence?

The answer lies, in part, in trade policy.

Since March 3, Canadian importers have been paying an additional 25 per cent tariff on imported coffee.

This counter-tariff, introduced as part of Ottawa’s retaliatory response to a trade dispute triggered by new United States duties on Canadian agricultural exports earlier this year, directly affects a product that isn’t even grown in Canada.

Unlike dairy or poultry, coffee has no domestic farming sector to protect. These tariffs aren’t shielding Canadian producers—they’re punishing

Canadian consumers and businesses.

To grasp the scale of this impact, consider the size of the industry. According to Introspective Market Research, retail coffee sales in Canada total more than $2.7 billion annually and are projected to grow steadily over the next decade. Meanwhile, coffee shops and quick-service restaurants, from Tim Hortons to independent cafés, generate an additional $6.4 billion per year. Tim Hortons alone sells more than five million cups of coffee per day.

This is not a fringe sector; it’s a critical part of both our economy and our culture.

Ironically, the U.S.—our supposed trade adversary in this case—doesn’t grow coffee either. Yet both countries are now entangled in a tariff tug-of-war that serves no practical purpose. The same logic applies to tea, which is also subject to retaliatory measures.

The tariffs were introduced under the Trudeau government in a broader geopolitical strategy that often felt more performative than pragmatic. Trudeau’s combative approach to trade, seemingly crafted on a whiteboard without regard for economic fallout, may have resonated politically, but it ignored basic economic principles. Consumers were never part of the equation.

In contrast, Prime Minister Mark Carney appears to be taking a more measured approach. Tariffs on U.S. alcohol and citrus products remain, but those can be sourced from other markets with relatively little disruption. Coffee and tea, however, are a different matter. There are no alternative domestic sources. The cost of these tariffs is being passed directly to roasters, grocers, restaurants, and ultimately, to the consumer.

Compounding the problem is the volatility of American trade policy under U.S. President Donald Trump, which continues to inject uncertainty into food markets. Tariffs come and go with the political winds, forcing companies to engage in “buffer pricing.” Much like travelers buying insurance for

unpredictable weather, companies build in extra costs to guard against political surprises. It’s effectively a tax on unpredictability, and it’s now embedded in the price Canadians pay at the till.

And while consumers might not feel the same pinch at their local café, where coffee is a smaller fraction of the total cost of a cup, the grocery aisle tells a different story. That’s where the full weight of these policies lands.

Whether a new trade agreement can be reached by the self-imposed July 21 deadline—or a damaging 35 per cent tariff Trump has set for August 1 can be avoided—remains uncertain. But what should be obvious is this: both Canada and the U.S. need to keep essential agri-food imports like coffee and tea out of their geopolitical fights.

Canada has a vibrant coffee ecosystem, built on roasting, innovation and consumer culture, not cultivation. There is no economic rationale for taxing it. Canadians shouldn’t be paying more for their morning brew just to send a symbolic message to Washington.

It’s time Ottawa led by example and scrapped these pointless tariffs.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Immigration2 days ago

Immigration2 days agoUnregulated medical procedures? Price Edward Islanders Want Answers After Finding Biomedical Waste From PRC-Linked Monasteries

-

Business2 days ago

Business2 days agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

Addictions2 days ago

Addictions2 days agoAfter eight years, Canada still lacks long-term data on safer supply

-

COVID-191 day ago

COVID-191 day agoJapan disposes $1.6 billion worth of COVID drugs nobody used

-

National2 days ago

National2 days agoLiberals push to lower voting age to 16 in federal elections

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoHow Did PEI Become A Forward Branch Plant For Xi’s China?

-

COVID-191 day ago

COVID-191 day agoWATCH: Big Pharma scientist admits COVID shot not ‘safe and effective’ to O’Keefe journalist

-

Food1 day ago

Food1 day agoTrump says Coca-Cola will switch to real cane sugar in U.S.