Banks

The Great Exodus from the Net Zero Banking Alliance has arrived

From the Canadian Energy Centre

By Gina Pappano

Next, we need a Great Exodus from net zero ideology

In 2021, all of Canada’s Big Five Banks – TD, CIBC, BMO, Scotiabank and RBC – signed onto the Glasgow Financial Alliance for Net Zero (GFANZ) and the Net Zero Banking Alliance (NZBA).

U.N.-sponsored and Mark Carney-led, GFANZ is a sector-wide umbrella coalition whose goal is to accelerate global decarbonization and the emergence of a worldwide net zero global economy.

But now, in the first month of 2025, four of Canada’s Big Five Banks – TD, CIBC, BMO and Scotiabank – have announced their decision to exit the NZBA.

This came on the heels of similar announcements by six of the biggest U.S. banks – Bank of America, Citigroup, Goldman Sachs, JP Morgan, Morgan Stanley and Wells Fargo as well as the investment firm BlackRock leaving the Asset Management subgroup of the GFANZ.

That group, the Net Zero Asset Managers Initiative, has now suspended operations altogether, and the GFANZ and all of its subgroups are falling like a house of cards.

At InvestNow, the not-for-profit that I lead, we’re considering these developments a victory and a vindication of our work.

In November of 2024, we submitted shareholder proposals to Canada’s Big Five banks asking them to leave both the NZBA and the GFANZ. As of this writing, all but one of them have done just that.

But this is only a partial victory.

When they signed on to the NZBA, the banks pledged to align their lending, investment and banking activities with decarbonization goals, including achieving net zero emissions by 2050. They pledged to focus on higher emitting sectors first and foremost. In practice, this means they would be setting their sights on Canada’s natural resource sector.

That’s because the net zero ideology motivating these groups requires the drastic reduction of oil and gas production and use over a comparatively short period of time.

That is a serious threat to Canada since we’ve been blessed with an abundance of natural resources. Hydrocarbon energy has become the backbone of our economy, and the war being waged against it has already made our lives harder and more expensive. Left unchecked, these difficulties will compound, with ruinous results.

In joining the NZBA, the Big Five Banks agreed to divest from oil and gas, eliminating projects and companies from the investment pool simply because of the sector they work in, as part of a long-term goal of totally decarbonizing the economy.

Presumably, having left the Alliance, those banks could now change course, increasing investment in and lending to oil and gas firms with an eye toward increasing the return on investment for their shareholders.

Except the banks have stressed that they have no intention of doing so. In the press releases and articles about leaving the NZBA, each bank emphasized that this move should not be interpreted as them abandoning net zero itself. All of these banks remain committed to aligning their activities with decarbonization, no matter the cost to Canada, the Canadian economy or the good of its citizens.

This means we still have work to do. While we applaud the banks for exiting the NZBA, we will continue to work to get them to leave behind the net zero ideology as well. Then, and only then, will we claim a full victory.

Gina Pappano is the former head of market intelligence at the Toronto Stock Exchange and TSX Venture Exchange and executive director of InvestNow , a non-profit dedicated to demonstrating that investing in Canada’s resource sectors helps Canada and the world. Join the movement and pass the InvestNow resolution at investnow.org.

Banks

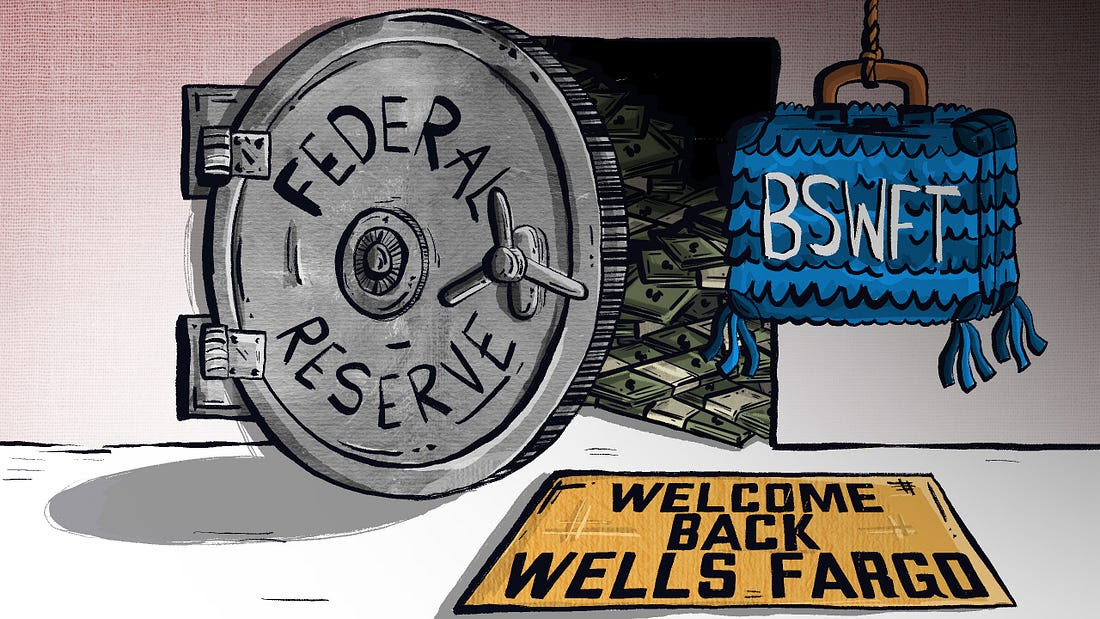

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

Banks

Scrapping net-zero commitments step in right direction for Canadian Pension Plan

From the Fraser Institute

By Matthew Lau

And in January, all of Canada’s six largest banks quit the Net-Zero Banking Alliance, an alliance formerly led by Mark Carney (before he resigned to run for leadership of the Liberal Party) that aimed to align banking activities with net-zero emissions by 2050.

The Canada Pension Plan Investment Board (CPPIB) has cancelled its commitment, established just three years ago, to transition to net-zero emissions by 2050. According to the CPPIB, “Forcing alignment with rigid milestones could lead to investment decisions that are misaligned with our investment strategy.”

This latest development is good news. The CPPIB, which invest the funds Canadians contribute to the Canada Pension Plan (CPP), has a fiduciary duty to Canadians who are forced to pay into the CPP and who rely on it for retirement income. The CPPIB’s objective should not be climate activism or other environmental or social concerns, but risk-adjusted financial returns. And as noted in a broad literature review by Steven Globerman, senior fellow at the Fraser Institute, there’s a lack of consistent evidence that pursuing ESG (environmental, social and governance) objectives helps improve financial returns.

Indeed, as economist John Cochrane pointed out, it’s logically impossible for ESG investing to achieve social or environmental goals while also improving financial returns. That’s because investors push for these goals by supplying firms aligned with these goals with cheaper capital. But cheaper capital for the firm is equivalent to lower returns for the investor. Therefore, “if you don’t lose money on ESG investing, ESG investing doesn’t work,” Cochrane explained. “Take your pick.”

The CPPIB is not alone among financial institutions abandoning environmental objectives in recent months. In April, Canada’s largest company by market capitalization, RBC, announced it will cancel its sustainable finance targets and reduce its environmental disclosures due to new federal rules around how companies make claims about their environmental performance.

And in January, all of Canada’s six largest banks quit the Net-Zero Banking Alliance, an alliance formerly led by Mark Carney (before he resigned to run for leadership of the Liberal Party) that aimed to align banking activities with net-zero emissions by 2050. Shortly before Canada’s six largest banks quit the initiative, the six largest U.S. banks did the same.

There’s a second potential benefit to the CPPIB cancelling its net-zero commitment. Now, perhaps with the net-zero objective out of the way, the CPPIB can rein in some of the administrative and management expenses associated with pursuing net-zero.

As Andrew Coyne noted in a recent commentary, the CPPIB has become bloated in the past two decades. Before 2006, the CPP invested passively, which meant it invested Canadians’ money in a way that tracked market indexes. But since switching to active investing, which includes picking stocks and other strategies, the CPPIB ballooned from 150 employees and total costs of $118 million to more than 2,100 employees and total expenses (before taxes and financing) of more than $6 billion.

This administrative ballooning took place well before the rise of environmentally-themed investing or the CPPIB’s announcement of net-zero targets, but the net-zero targets didn’t help. And as Coyne noted, the CPPIB’s active investment strategy in general has not improved financial returns either.

On the contrary, since switching to active investing the CPPIB has underperformed the index to a cumulative tune of about $70 billion, or nearly one-tenth of its current fund size. “The fund’s managers,” Coyne concluded, “have spent nearly two decades and a total of $53-billion trying to beat the market, only to produce a fund that is nearly 10-per-cent smaller than it would be had they just heaved darts at the listings.”

Scrapping net-zero commitments won’t turn that awful track record around overnight. But it’s finally a step in the right direction.

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoHow Did PEI Become A Forward Branch Plant For Xi’s China?

-

COVID-191 day ago

COVID-191 day agoJapan disposes $1.6 billion worth of COVID drugs nobody used

-

National2 days ago

National2 days agoLiberals push to lower voting age to 16 in federal elections

-

Alberta15 hours ago

Alberta15 hours agoPoilievre poised for comeback in Alberta stronghold

-

Business2 hours ago

Business2 hours agoCarney should rethink ‘carbon capture’ climate cure

-

Alberta1 day ago

Alberta1 day agoOPEC+ is playing a dangerous game with oil

-

International15 hours ago

International15 hours agoThis ends now: Trump orders Bondi to unseal Epstein grand jury testimony

-

Alberta1 day ago

Alberta1 day agoUpgrades at Port of Churchill spark ambitions for nation-building Arctic exports