Carbon Tax

The book the carbon taxers don’t want you to read

By Franco Terrazzano

Prime Minister Mark Carney wrote a 500-page book praising carbon taxes.

Well, I just wrote a book smashing through the government’s carbon tax propaganda.

It tells the inside story of the fight against the carbon tax. And it’s THE book the carbon taxers don’t want you to read.

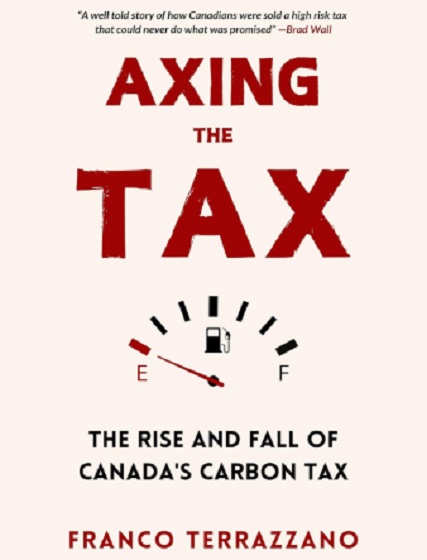

My book is called Axing the Tax: The Rise and Fall of Canada’s Carbon Tax.

Axing the Tax: The Rise and Fall of Canada’s Carbon Tax

Every now and then, the underdog wins one.

And it looks like that’s happening in the fight against the carbon tax.

It’s not over yet, but support for the carbon tax is crumbling. Some politicians vow to scrap it. Others hide behind vague plans to repackage it. But virtually everyone recognizes support for the current carbon tax has collapsed.

It wasn’t always this way.

For about a decade now, powerful politicians, government bureaucrats, academics, media elites and even big business have been pushing carbon taxes on the people.

But most of the time, politicians never asked the people if they supported carbon taxes. In other words, carbon taxes, and the resulting higher gas prices and heating bills, were forced on us.

We were told it was good for us. We were told carbon taxes were inevitable. We were told politicians couldn’t win elections without carbon taxes, even though the politicians that imposed them didn’t openly run on them. We were told that we needed to pay carbon taxes if we wanted to leave a healthy environment for our kids and grandkids. We were told we needed to pay carbon taxes if we wanted to be respected in the international community.

In this decade-long fight, it would have been understandable if the people had given up and given in to these claims. It would have been easier to accept what the elites wanted and just pay the damn bill. But against all odds, ordinary Canadians didn’t give up.

Canadians knew you could care about the environment and oppose carbon taxes. Canadians saw what they were paying at the gas station and on their heating bills, and they knew they were worse off, regardless of how many politicians, bureaucrats, journalists and academics tried to convince them otherwise. Canadians didn’t need advanced degrees in economics, climate science or politics to understand they were being sold a false bill of goods.

Making it more expensive for a mom in Port Hope to get to work, or grandparents in Toronto to pay their heating bill, or a student in Coquitlam to afford food won’t reduce emissions in China, Russia, India or the United States. It just leaves these Canadians, and many like them, with less money to afford everything else.

Ordinary Canadians understood carbon taxes amount to little more than a way for governments to take more money from us and dictate how we should live our lives. Ordinary Canadians also saw through the unfairness of the carbon tax.

Many of the elites pushing the carbon tax—the media, politicians, taxpayer-funded professors, laptop activists and corporate lobbyists—were well off and wouldn’t feel the brunt of carbon taxes. After all, living in a downtown condo and clamouring for higher carbon taxes doesn’t require much gas, diesel or propane.

But running a business, working in a shop, getting kids to soccer and growing food on the farm does. These are the Canadians the political class forgot about when pushing carbon taxes. These are the Canadians who never gave up. These are the Canadians who took time out of their busy lives to sign petitions, organize and attend rallies, share posts on social media, email politicians and hand out bumper stickers.

Because of these Canadians, the carbon tax could soon be swept onto the ash heap of history. I wrote this book for two reasons.

The first is because these ordinary Canadians deserve it. They worked really hard for a really long time against the odds. When all the power brokers in government told them, “Do what we say—or pay,” they didn’t give up. They deserve to know the time and effort they spent fighting the carbon tax mattered. They deserve all the credit.

Thank you for everything you did.

The second reason I wrote this book is so people know the real story of the carbon tax. The carbon tax was bad from the start and we fought it from the start. By reading this book, you will get the real story about the carbon tax, a story you won’t find anywhere else.

This book is important because if the federal Liberals’ carbon tax is killed, the carbon taxers will try to lay blame for their defeat on Prime Minister Justin Trudeau. They will try to say that carbon taxes are a good idea, but Trudeau bungled the policy or wasn’t a good enough salesman. They will try to revive the carbon tax and once again make you pay more for gas, groceries, and home heating.

Just like with any failed five-year plan, there is a lingering whiff among the laptop class and the taxpayer-funded desk rulers that this was all a communication problem, that the ideal carbon tax hasn’t been tried yet. I can smell it outside my office building in Ottawa, where I write these words. We can’t let those embers smoulder and start a fire again.

This book shows why the carbon tax is and always will be bad policy for ordinary Canadians.

Franco’s note: You can pre-order a copy of my new book, Axing the Tax: The Rise and Fall of Canada’s Carbon Tax, here: https://www.amazon.ca/Axing-

Alberta

Taxpayers: Alberta must scrap its industrial carbon tax

-

Carney praises carbon taxes on world stage

-

Alberta must block Carney’s industrial carbon tax

The Canadian Taxpayers Federation is calling on the government of Alberta to completely scrap its provincial industrial carbon tax.

“It’s baffling that Alberta is still clinging to its industrial carbon tax even though Saskatchewan has declared itself to be a carbon tax-free zone,” said Kris Sims, CTF Alberta Director. “Prime Minister Mark Carney is cooking up his new industrial carbon tax in Ottawa and Alberta needs to fight that head on.

“Alberta having its own industrial carbon tax invites Carney to barge through our door with his punishing industrial carbon tax.”

On Sept. 16, the Alberta government announced some changes to Alberta’s industrial carbon tax, but the tax remains in effect.

On Friday night at the Global Progress Action Summitt held in London, England, Carney praised carbon taxes while speaking onstage with British Prime Minister Keir Starmer.

“The direct carbon tax which had become a divisive issue, it was a textbook good policy, but a divisive issue,” Carney said.

During the federal election, Carney promised to remove the more visible consumer carbon tax and change it into a bigger hidden industrial carbon tax. He also announced plans to create “border adjustment mechanisms” on imports from countries that do not have national carbon taxes, also known as carbon tax tariffs.

“Carney’s ‘textbook good policy’ comments about carbon taxes shows his government is still cooking up a new industrial carbon tax and it’s also planning on imposing carbon tax tariffs,” Sims said. “Alberta should stand with Saskatchewan and obliterate all carbon taxes in our province, otherwise we are opening the door for Ottawa to keep kicking us.”

Business

Mark Carney’s “Worst of All Possible Worlds”

Matthew Ehret

Matthew Ehret

Originally published on Pluralia

Is it possible that Canadian Prime Minister Mark Carney has selected the worst of all possible pathways in his tight-rope balancing effort to resolve severe tensions with the USA on the one hand, while simultaneously increasing trade/security relations between Canada and the EU?

The incredible untapped resource potential of Canada, fused with a vast northern territories, undeveloped lands, and low population levels makes Canada a living embodiment of potential and value for the entire world.

If a spirit of genuine multipolarity, cooperation, and future-oriented thinking were alive among policy making circles of Ottawa, then there is no doubt that Canada could offer much to the world both in terms of resources, energy, and ingenuity. The vast Arctic, which Canada shares with partners like the USA, several European states, the Russian Federation (and near Arctic partners like China), provides an opportunity for dialogue, scientific cooperation, and economic development, the likes of which humanity has never seen.

Sadly, a different spirit is currently shaping Canadian policy, which lacks that positive vision.

Carney’s Canada–EU Integration Gambit

On June 23rd of this year, Mark Carney signed the Canada European Strategic Partnership for the Future on the basis of increasing trade and security relations with the European Union.

Despite proposing to increase Canada–EU trade and Canada energy/mineral exports to the EU, the program is entirely driven by a military agenda, which sadly threatens the lives of all Europeans and Canadians alike. The “Strategic Partnership” moves in tandem with another pact enmeshing Canada into the $800 billion Re-Arm Europe plan and additionally ties Canada into the Security Action for Europe (SAFE) program. The ironically-named “SAFE” program serves as a sort of “World Bank,” specifically designed for building up the military defense capabilities of participating nations.

Capitalized with $235 billion, this fund allows the European Union to take loans out at preferential rates and then extend those loans to all European (and soon possibly Canadian) members who may then invest in military industrial capabilities while simultaneously evading the 3% of GDP debt ceiling imposed on all EU nations.

With Trump’s recent appeal to EU states to increase their NATO spending to a dizzying 5% GDP, it appears that both SAFE and Canada’s participation in the EU War gambit are two vital parts of solving this bewildering challenge.

The new Canada–EU Strategic Partnership promises to “boost cooperation on maritime security, cyber security, and other threats to peace, expand Maritime security cooperation and coordination activities, increase defense industrial cooperation” and will “increase ties between Canada and The European Defense Agency.”

De-Growth and Militarization: The Challenge of Mixing Water and Oil

After many decades of slow de-industrialization, Europe now finds itself trapped within a paradigm that demands military confrontation with Russia, on the one hand (requiring a robust industrial powerhouse that hasn’t existed in generations), while simultaneously holding firm to the decarbonization program outlined by Agenda 2030, Paris Accords, and EU–Canada Green Alliance.

The Fraud of ‘Global Warming’ |

||

|

In a recent article, Defeating the Depopulation Agenda, I took aim at an insidious ideology which has infiltrated society in the form of a movement to ‘protect nature from humanity’. |

||

|

While satisfying both dynamics may be impossible (as decarbonization, carbon prices, and windmills have not been known to enhance industrial growth), the ivory-tower technocrats surrounding the likes of Mark Carney and Mario Draghi appear to believe that this circle can be squared… and hence Canada’s participation in the new plan is vital.

In tandem with Canada’s partnership with the EU, on June 26, 2025 Canada’s Governor General gave “Royal Assent” to the passage of one of the most comprehensive omnibus bills in history called the “One Canada Economy Act” (Bill C5).

This bill sets the stage for the repeal of decades of environmental legislation and the end of all trade barriers, which have held back inter-provincial cooperation for generations. An Ottawa press release stated: “The government of Canada is fulfilling its promise to build one Canadian economy out of thirteen” (referencing the 13 provinces and territories making up Canada).

Despite a backlash of First Nations leaders who have recognized that a cancellation of centuries of treaties is taking place amidst a dictatorial gambit to override their voice in any economic or military plans for Canada, it appears the reset in governance is going forward in full steam.

If this bill had been advanced as a genuine endeavor to create for the first time in history a unified Canada capable of executing top-down mega-projects devoid of red tape (not dissimilar from China’s capacity to wield the forces of the nation state in the building of the Belt and Road Initiative), it would appear that Bill C5 were a truly positive blessing. After all, Canada has never been permitted to have free trade among the provinces since its earliest days and has thus been kept artificially underdeveloped and divided within itself, so an end to this unfortunate fate would be most welcomed.

However, when we are reminded that a logic of Orwellian geopolitics is shaping the new emerging iron walls and AI-driven-space-based warfare is now threatening world peace, then a more dystopic reality presents itself.

Not Just Canada: Three of Five Eyes Go for a Eurotrip

However, it is not only Canada that is being drawn into this new dystopic vision of an Eastasia, Eurasia, Oceania division of the globe, but other British Commonwealth nations have also been brought onboard with simultaneous Strategic Partnerships with the EU, beginning with the UK–EU Strategic Partnership, first announced in April 2025, and followed weeks after by an Australian–EU Strategic Partnership, which reads like a replica of the Canada–EU pact.

In all three Commonwealth/Five Eyes pacts with the EU, we find a special focus on intelligence sharing, minerals exports, cybersecurity, countering disinformation, and military industrial/national cooperation enhancement.

But does Canada’s re-alignment with the EU indicate that Ottawa’s relations with Washington are truly as dismal as some have been led to believe, or is there evidence of another game afoot?

The Golden Dome

Beyond the threats of tariffs, the shattering of rules-based order, and US ambition to acquire Canada as a 51st state, another more insidious war plan has emerged in the form of a $540-billion continental defensive shield, first announced as an Israeli-modelled “Iron Dome” for North America by Trump in January of 2025.

Rebranded “The Golden Dome” after its first two weeks of dismal publicity, both Mark Carney and leading strata of Canada’s defense establishment have shown themselves to be remarkably in favor of the integrated “defensive” security shield, which calls for surrounding North America with medium- and long-range ballistic missiles, space-based weapons, and integrated AI command systems.

This shouldn’t be entirely surprising, since it was only in April 2024 that then-Prime Minister Justin Trudeau (advised by Mark Carney and Chrystia Freeland) approved a Canadian Arctic Defense strategy upgrade permitting for the first time in history long-range missiles installed in Canada’s high Arctic.

The Golden Dome appears to simply be the next logical step.

Instead of showcasing his typical nationalist bravado in opposition US jingoism, which served him well in winning the latest Canadian elections, Carney has shown himself to be in favor of Canada’s participation in the Golden Dome, which will cost Canadian tax-payers approximately $100 billion, according to current estimates.

After meeting with President Trump and Defense Secretary Pete Hegseth on May 21, Carney stated: “We are conscious that we have an ability, if we so choose, to complete the Golden Dome with investments in partnership. And it’s something that we are looking at, and something that has been discussed at a very high level.”

Carney ended by stating: “Is it a good idea for Canada? Yes, it is good to have protections in place for Canadians.”

On June 10, CBC (the official state broadcasting service of Canada) featured a report outlining ongoing secret meetings being held between Ottawa and Washington policy makers to craft a final agreement on the Golden Dome says the draft agreement now under negotiation states “that Canada is willing to participate in the Golden Dome security program, originally proposed by U.S. President Donald Trump… It also mentions Canadian commitments to build more infrastructure in the Arctic, Canada’s pledge to meet its NATO defense spending targets, as well as previously announced border security investments.”

It is clear that a vast re-alignment of global relations is now underway, and it also appears that a consensus has been reached to adapt to a multipolar model… at least for a limited time. However, the word “multipolar” does not mean the same thing to everyone.

While a multipolar model premised on inter-civilizational cooperation and respect for the UN Charter would be a blessing for all nations, it appears increasingly likely that the pilots at the helm of the trans-Atlantic ship have read their George Orwell and prefer to live according to the rules of the jungle instead of embracing a more civilized identity at this stage of history.

-

Business2 days ago

Business2 days agoThe Grocery Greed Myth

-

Business2 days ago

Business2 days agoCarney government plans to muddy the fiscal waters in upcoming budget

-

Business2 days ago

Business2 days agoTax filing announcement shows consultation was a sham

-

Frontier Centre for Public Policy15 hours ago

Frontier Centre for Public Policy15 hours agoCanada’s Democracy Is Running On Fumes

-

Education15 hours ago

Education15 hours agoClassroom Size Isn’t The Real Issue

-

Business16 hours ago

Business16 hours agoYour $350 Grocery Question: Gouging or Economics?

-

Media16 hours ago

Media16 hours agoResponse to any budget sleight of hand will determine which audience media have decided to serve

-

International9 hours ago

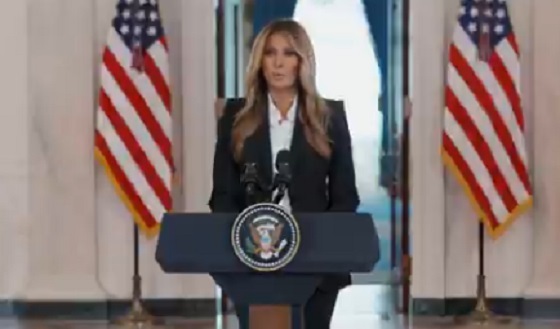

International9 hours agoMelania Trump quietly reunites children divided by Ukraine war