Uncategorized

The average Canadian family paid more in 2023 on taxes than it did on housing, food and clothing combined

From the Fraser Institute

By Jake Fuss and Callum MacLeod

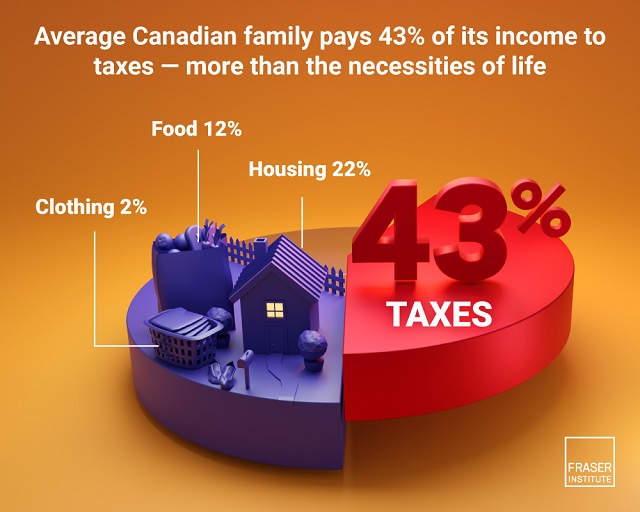

The average Canadian family spent 43.0 per cent of its income on taxes in 2023—more than housing, food and clothing costs combined, finds a new study published by the Fraser Institute, an independent, non-partisan Canadian public policy

think-tank.

“Taxes remain the largest household expense for families in Canada,” said Jake Fuss, director of Fiscal Studies at the Fraser Institute and co-author of Taxes versus the Necessities of Life: The Canadian Consumer Tax Index 2024 Edition.

In 2023, the average Canadian family earned an income of $109,235 and paid in total taxes equaling $46,988. In other words, the average Canadian family spent 43.0 per cent of its income on taxes compared to 35.6 per cent on basic necessities.

This is a dramatic shift since 1961 when the average Canadian family spent much less of its income on taxes (33.5 per cent) than the basic necessities (56.5 per cent). Taxes have grown much more rapidly than any other single expenditure for the average Canadian family.

The total tax bill for Canadians includes visible and hidden taxes (paid to the federal, provincial and local governments) including income, payroll, sales, property, carbon, health, fuel and alcohol taxes. Moreover, since 1961, the average Canadian family’s total tax bill has increased nominally by 2,705 per cent, dwarfing increases in annual housing costs (2,006 per cent), clothing (478 per cent) and food (901 per cent).

“Considering the sheer amount of income that goes towards taxes in this country, Canadians may question whether or not we’re getting good value for our money,” Fuss said.

- The Canadian Consumer Tax Index tracks the total tax bill of the average Canadian family from 1961 to 2023. Including all types of taxes, that bill has increased by 2,705% since 1961.

- Taxes have grown much more rapidly than any other single expenditure for the average Canadian family: expenditures on shelter increased by 2,006%, food by 901%, and clothing by 478% from 1961 to 2023.

- The 2,705% increase in the tax bill has also greatly outpaced the increase in the Consumer Price Index (901%), which measures the average price that consumers pay for food, shelter, clothing, transportation, health and personal care, education, and other items.

- The average Canadian family now spends more of its income on taxes (43.0%) than it does on basic necessities such as food, shelter, and clothing combined (35.6%). By comparison, 33.5% of the average family’s income went to pay taxes in 1961 while 56.5% went to basic necessities.

- In 2023, the average Canadian family earned an income of $109,235 and paid total taxes equaling $46,988 (43.0%). In 1961, the average family had an income of $5,000 and paid a total tax bill of $1,675 (33.5%).

Authors:

Uncategorized

Kananaskis G7 meeting the right setting for U.S. and Canada to reassert energy ties

Energy security, resilience and affordability have long been protected by a continentally integrated energy sector.

The G7 summit in Kananaskis, Alberta, offers a key platform to reassert how North American energy cooperation has made the U.S. and Canada stronger, according to a joint statement from The Heritage Foundation, the foremost American conservative think tank, and MEI, a pan-Canadian research and educational policy organization.

“Energy cooperation between Canada, Mexico and the United States is vital for the Western World’s energy security,” says Diana Furchtgott-Roth, director of the Center for Energy, Climate and Environment and the Herbert and Joyce Morgan Fellow at the Heritage Foundation, and one of America’s most prominent energy experts. “Both President Trump and Prime Minister Carney share energy as a key priority for their respective administrations.

She added, “The G7 should embrace energy abundance by cooperating and committing to a rapid expansion of energy infrastructure. Members should commit to streamlined permitting, including a one-stop shop permitting and environmental review process, to unleash the capital investment necessary to make energy abundance a reality.”

North America’s energy industry is continentally integrated, benefitting from a blend of U.S. light crude oil and Mexican and Canadian heavy crude oil that keeps the continent’s refineries running smoothly.

Each day, Canada exports 2.8 million barrels of oil to the United States.

These get refined into gasoline, diesel and other higher value-added products that furnish the U.S. market with reliable and affordable energy, as well as exported to other countries, including some 780,000 barrels per day of finished products that get exported to Canada and 1.08 million barrels per day to Mexico.

A similar situation occurs with natural gas, where Canada ships 8.7 billion cubic feet of natural gas per day to the United States through a continental network of pipelines.

This gets consumed by U.S. households, as well as transformed into liquefied natural gas products, of which the United States exports 11.5 billion cubic feet per day, mostly from ports in Louisiana, Texas and Maryland.

“The abundance and complementarity of Canada and the United States’ energy resources have made both nations more prosperous and more secure in their supply,” says Daniel Dufort, president and CEO of the MEI. “Both countries stand to reduce dependence on Chinese and Russian energy by expanding their pipeline networks – the United States to the East and Canada to the West – to supply their European and Asian allies in an increasingly turbulent world.”

Under this scenario, Europe would buy more high-value light oil from the U.S., whose domestic needs would be back-stopped by lower-priced heavy oil imports from Canada, whereas Asia would consume more LNG from Canada, diminishing China and Russia’s economic and strategic leverage over it.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

As the nation’s largest, most broadly supported conservative research and educational institution, The Heritage Foundation has been leading the American conservative movement since our founding in 1973. The Heritage Foundation reaches more than 10 million members, advocates, and concerned Americans every day with information on critical issues facing America.

Uncategorized

Poilievre on 2025 Election Interference – Carney sill hasn’t fired Liberal MP in Chinese election interference scandal

From Conservative Party Communications

“Yes. He must be disqualified. I find it incredible that Mark Carney would allow someone to run for his party that called for a Canadian citizen to be handed over to a foreign government on a bounty, a foreign government that would almost certainly execute that Canadian citizen.

“Think about that for a second. We have a Liberal MP saying that a Canadian citizen should be handed over to a foreign dictatorship to get a bounty so that that citizen could be murdered. And Mark Carney says he should stay on as a candidate. What does that say about whether Mark Carney would protect Canadians?

“Mark Carney is deeply conflicted. Just in November, he went to Beijing and secured a quarter-billion-dollar loan for his company from a state-owned Chinese bank. He’s deeply compromised, and he will never stand up for Canada against any foreign regime. It is another reason why Mr. Carney must show us all his assets, all the money he owes, all the money that his companies owe to foreign hostile regimes. And this story might not be entirely the story of the bounty, and a Liberal MP calling for a Canadian to be handed over for execution to a foreign government might not be something that the everyday Canadian can relate to because it’s so outrageous. But I ask you this, if Mark Carney would allow his Liberal MP to make a comment like this, when would he ever protect Canada or Canadians against foreign hostility?

“He has never put Canada first, and that’s why we cannot have a fourth Liberal term. After the Lost Liberal Decade, our country is a playground for foreign interference. Our economy is weaker than ever before. Our people more divided. We need a change to put Canada first with a new government that will stand up for the security and economy of our citizens and take back control of our destiny. Let’s bring it home.”

-

Business2 days ago

Business2 days agoCarney government should recognize that private sector drives Canada’s economy

-

Alberta1 day ago

Alberta1 day agoAlberta school boards required to meet new standards for school library materials with regard to sexual content

-

Environment1 day ago

Environment1 day agoEPA releases report on chemtrails, climate manipulation

-

Crime1 day ago

Crime1 day agoSweeping Boston Indictment Points to Vast Chinese Narco-Smuggling and Illegal Alien Labor Plot via Mexican Border

-

Business2 days ago

Business2 days agoCannabis Legalization Is Starting to Look Like a Really Dumb Idea

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoThe Covid 19 Disaster: When Do We Get The Apologies?

-

Alberta2 days ago

Alberta2 days agoFourteen regional advisory councils will shape health care planning and delivery in Alberta

-

Business19 hours ago

Business19 hours agoCBC six-figure salaries soar