Business

Taxpayers Federation calls on premiers to join carbon tax court fight

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

The Canadian Taxpayers Federation is calling on all premiers to join New Brunswick Premier Blaine Higgs and launch a legal challenge against the federal carbon tax.

“Higgs is right that the carbon tax is an unfair punishment on Canadians and all premiers should stick up for their taxpayers by following his lead,” said Franco Terrazzano, CTF Federal Director. “Taxpayers are taking it on the chin every time we pay our heating bills and Prime Minister Justin Trudeau is blowing a hole through constitutional accountability with his unequal application of the carbon tax.”

Higgs announced that if he is re-elected, the New Brunswick government would launch a renewed legal challenge against the federal carbon tax.

The federal carbon tax “carve-outs violate the Supreme Court’s ruling, and the tax makes gas, groceries, and essential services more expensive,” according to the Progressive Conservative Party of New Brunswick.

Last year, the federal government announced it is removing the carbon tax from furnace oil for three years, but did not exempt other forms of home heating energy.

“Across Canada, fuel oil makes up just three per cent of residential heating energy,” according to the government of Nova Scotia. “Natural gas was the most commonly used energy source for residential heating.”

The average home uses 2,385 cubic metres of natural gas per year, according to the Canadian Gas Association. That means removing the current federal carbon tax would save the average home about $360 this year.

“When Trudeau announced his furnace oil carve out, he admitted the carbon tax makes life more expensive, he admitted the carbon tax is all about politics and he left 97 per cent of Canadian families out in the cold,” Terrazzano said. “All premiers should do everything in their power to fight the carbon tax.”

A 2023 Leger poll found 70 per cent of Canadians support removing the carbon tax from all home heating fuels.

Business

‘Taxation Without Representation’: Trump Admin Battles UN Over Global Carbon Tax

From the Daily Caller News Foundation

The Trump administration is fighting to block a global carbon tax that a United Nations (UN) agency is attempting to pass quietly this week.

The International Maritime Organization (IMO), a UN body based in London, is meeting this week to adopt a so-called “Net-Zero Framework,” which would levy significant penalties on carbon dioxide emissions from ships that exceed certain limits. The Trump administration argues the proposal could raise global shipping costs by as much as 10%, ultimately driving up prices for American consumers.

“President Trump has made it clear that the United States will not accept any international environmental agreement that unduly or unfairly burdens the United States or harms the interests of the American people,” Secretary of State Marco Rubio, Secretary of Energy Chris Wright and Secretary of Transportation Sean Duffy said in a joint statement Friday.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

“The Administration unequivocally rejects this proposal before the IMO and will not tolerate any action that increases costs for our citizens, energy providers, shipping companies and their customers, or tourists,” the cabinet secretaries wrote.

This week, the UN is attempting to pass the first global carbon tax , which will increase energy, food, and fuel costs across the world. We will not allow the UN to tax American citizens and companies.

Under the leadership of @POTUS, the U.S. will be a hard NO. We call on…

— Secretary Marco Rubio (@SecRubio) October 15, 2025

The proposed tax is part of the IMO’s broader goal to bring global shipping to net-zero emissions “by or around” 2050. Qualifying ships that fall short of emissions targets would face taxes ranging from $100 to $380 per ton of CO2.

Notably, the tax would be paid directly by shipowners rather than governments.

The Net-Zero Framework could generate between $11 billion and $12 billion annually from 2028 through 2030, paid into a UN-controlled fund, according to University College London. Meanwhile, other estimates warn that if the global fleet misses the IMO’s targets by even 10%, the annual cost of emissions could climb to $20 to $30 billion by 2030 and potentially exceed $300 billion by 2035.

Some critics equated the proposal to “taxation without representation,” noting that an unelected committee would have the authority to set and potentially raise the tax.

The Trump administration is urging member states to reject the proposal and has threatened retaliatory measures against countries that support it. These include investigations into anti-competitive practices, visa restrictions for maritime crews, commercial and financial penalties, higher port fees for ships tied to those nations, and possible sanctions on officials promoting climate policies.

“The Trump administration is right to draw a hard line against the UN’s latest scheme to export its climate agenda through global taxes and trade barriers,” Jason Isaac, CEO of the American Energy Institute, told the Daily Caller News Foundation.

Isaac said the proposed carbon tax, along with other measures — including the EU’s Corporate Sustainability Reporting Directive, which requires companies to disclose environmental and social impacts — “represent an alarming attempt to impose costly, extraterritorial regulations on American businesses and consumers.”

“These measures threaten U.S. sovereignty, inflate energy and transport costs, and weaponize climate policy as a tool of economic coercion,” Isaac said. “The United States must not tolerate foreign governments using environmental pretexts to dictate how we trade, build, and move goods. President Trump’s firm stance puts American workers and energy security first, where they belong.”

Steve Milloy, senior fellow at the Energy & Environment Legal Institute, also commended the administration’s efforts to block the UN measure.

“Not only does [Trump] oppose the UN carbon tax, but he has instructed his administration to take action against nations that try to implement it against the U.S.,” Milloy told the DCNF. “I am simply in awe of his commitment to ending the international climate hoax, which has long been aimed at stealing from and otherwise crippling our country’s economy and national security.”

Business

Over two thirds of Canadians say Ottawa should reduce size of federal bureaucracy

From the Fraser Institute

By Matthew Lau

From 2015 to 2024, headcount at Natural Resources Canada increased 39 per cent even though employment in Canada’s natural resources sector actually fell one per cent. Similarly, there was 382 per cent headcount growth at the federal department for Women and Gender Equality—obviously far higher than the actual growth in Canada’s female population.

According to a recent poll, there’s widespread support among Canadians for reducing the size of the federal bureaucracy. The support extends across the political spectrum. Among the political right, 82.8 per cent agree to reduce the federal bureaucracy compared to only 5.8 per cent who disagree (with the balance neither agreeing nor disagreeing); among political moderates 68.4 per cent agree and only 10.0 per cent disagree; and among the political left 44.8 per cent agree and 26.3 per cent disagree.

Taken together, “67 per cent agreed the federal bureaucracy should be significantly reduced. Only 12 per cent disagreed.” These results shouldn’t be surprising. The federal bureaucracy is ripe for cuts. From 2015 to 2024, the federal government added more than 110,000 new bureaucrats, a 43 per cent increase, which was nearly triple the rate of population growth.

This bureaucratic expansion was totally unjustified. From 2015 to 2024, headcount at Natural Resources Canada increased 39 per cent even though employment in Canada’s natural resources sector actually fell one per cent. Similarly, there was 382 per cent headcount growth at the federal department for Women and Gender Equality—obviously far higher than the actual growth in Canada’s female population. And there are many similar examples.

While in 2025 the number of federal public service jobs fell by three per cent, the cost of the federal bureaucracy actually increased as the number of fulltime equivalents, which accounts for whether those jobs were fulltime or part-time, went up. With the tax burden created by the federal bureaucracy rising so significantly in the past decade, it’s no wonder Canadians overwhelmingly support its reduction.

Another interesting poll result: “While 42 per cent of those surveyed supported the government using artificial intelligence tools to resolve bottlenecks in service delivery, 32 per cent opposed it, with 25 per cent on the fence.” The authors of the poll say the “plurality in favour is surprising, given the novelty of the technology.”

Yet if 67 per cent of Canadians agree with significantly shrinking the federal bureaucracy, then solid support for using AI to increasing efficiency should not be too surprising, even if the technology is relatively new. Separate research finds 58 per cent of Canadian workers say they use AI tools provided by their workplace, and although many of them do not necessarily use AI regularly, of those who report using AI the majority say it improves their productivity.

In fact, there’s massive potential for the government to leverage AI to increase efficiency and control labour expenses. According to a recent study by a think-tank at Toronto Metropolitan University (formerly known as Ryerson), while the federal public service and the overall Canadian workforce are similar in terms of the percentage of roles that could be made more productive by AI, federal employees were twice as likely (58 per cent versus 29 per cent) to have jobs “comprised of tasks that are more likely to be substituted or replaced” by AI.

The opportunity to improve public service efficiency and deliver massive savings to taxpayers is clearly there. However, whether the Carney government will take advantage of this opportunity is questionable. Unlike private businesses, which must continuously innovate and improve operational efficiency to compete in a free market, federal bureaucracies face no competition. As a result, there’s little pressure or incentive to reduce costs and increase efficiency, whether through AI or other process or organizational improvements.

In its upcoming budget and beyond, it would be a shame if the federal government does not, through AI or other changes, restrain the cost of its workforce. Taxpayers deserve, and clearly demand, a break from this ever-increasing burden.

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoCanada’s privacy commissioner says he was not consulted on bill to ban dissidents from internet

-

Energy2 days ago

Energy2 days agoIndigenous Communities Support Pipelines, Why No One Talks About That

-

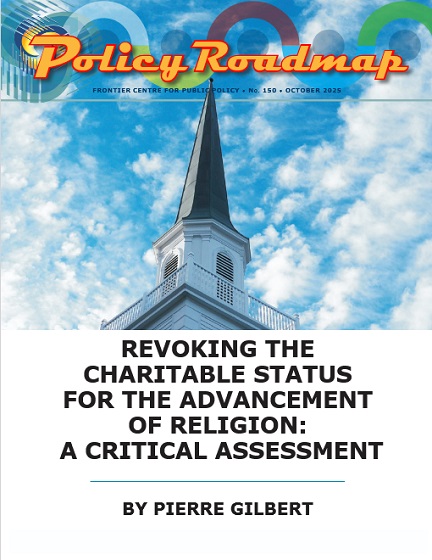

Business2 days ago

Business2 days agoFinance Committee Recommendation To Revoke Charitable Status For Religion Short Sighted And Destructive

-

Alberta2 days ago

Alberta2 days agoOil Sands are the Costco of world energy – dependable and you know exactly where to find it

-

Alberta1 day ago

Alberta1 day agoEnbridge CEO says ‘there’s a good reason’ for Alberta to champion new oil pipeline

-

Business1 day ago

Business1 day agoFormer Trump Advisor Says US Must Stop UN ‘Net Zero’ Climate Tax On American Ships

-

Health1 day ago

Health1 day agoColorado gave over 500 people assisted suicide drugs solely for eating disorders in 2024

-

International1 day ago

International1 day agoNumber of young people identifying as ‘transgender’ declines sharply: report