Opinion

Red Deer – Lacombe MP Blaine Calkins calls on Prime Minister Justin Trudeau to resign

What We Know About Trudeau’s Latest Ethics Scandal

BLAINE CALKINS

Over the past several weeks Canadians have been shocked at the details coming to light regarding Justin Trudeau’s WE Scandal. Justin Trudeau and the Kielburgers have been happy to benefit from each other for years. While they are quick to downplay their relationship, the facts tell a different story. According to WE Charity, Justin Trudeau and his family have participated in over 50 WE Events where they have been able to share their political message with young Canadians.

In 2017 WE created a campaign style ad featuring Justin Trudeau for Canada 150 and even pressured employees to go to a political event for the Minister of Finance in his Toronto riding. The Kielburger brothers have donated to the Liberal Party in the past, and under the Trudeau government WE has received upwards of $5.5 million in government funding.

This reciprocal relationship is concerning all on its own, before even considering the current scandal regarding the Canada Student Service Grant, Justin Trudeau and WE. The twists and turns in the story can be difficult to track, but it is clear that Justin Trudeau and former Finance Minister Bill Morneau have once again failed to live up to their legal obligations laid out in Canada’s conflict of interest laws. Here is what we know so far.

In April, WE sent an unsolicited proposal for a youth entrepreneurship program to Minister Chagger and Minister Ng. Ten days later WE received a call from Rachel Wernick, a senior bureaucrat with Employment and Social Development Canada (ESDC) about the yet to be announced Canada Student Service Grant (CSSG). When the program was announced to the public a few days later WE co-founder Craig Kielburger sent Ms. Wernick a proposal to administer the grant that same day.

According to the Kielburgers someone at the Prime Minister’s Office (PMO) contacted them the next day about delivering the program, which they later recanted claiming it was a public servant who contacted them. Ms. Wernick is credited as being the public servant who recommended that WE was the only organization that could deliver the program.

On June 25th WE Charity was announced as the partner for the $900 million CSSG program, and Canadians were told they would receive $19.5 million to administer it. When asked, Trudeau suggested there was no conflict of interest because he and his wife had never been paid by the organization. A few days later Conservatives asked the Auditor General to probe the deal since parliamentary oversight was hindered by the program being outsourced, and due to concern over the well documented relationship between Trudeau and the Kielburgers.

By July 3rd Mark and Craig Kielburger announced that WE would be giving up the contract to administer the CSSG. On the same day, the Ethics Commissioner confirmed that he would be starting an investigation into Justin Trudeau for the third time. Less than a week later WE confirmed that the Prime Minister’s Mother, Margaret Trudeau had been paid $312,000 for 28 appearances since 2016 and that his brother, Alexandre Trudeau, was paid $40,000 for 8 events in 2017-2018. They also acknowledged that the Prime Minister’s wife, Sophie Gregoire Trudeau had received $1,400 for an appearance in 2012.

We later found out that on top of those fees WE Charity also paid an additional $212,846 in expenses between the three members of the Trudeau family. This brings the total remuneration to over $566,000. This revelation, in part, led to the Conservatives writing to the Commissioner of the RCMP to request that they look into this matter as it pertains to potential criminal code violations.

The Prime Minister isn’t the only one with an apparent conflict of interest in this matter, with former Minister Morneau also having close family ties with WE. Like the Prime Minister, he did not recuse himself despite the fact that his one daughter works for WE and another has been a speaker in the past and received a book endorsement. This led to the Ethics Commissioner launching an investigation into former Minister Morneau as well.

At an appearance before the Finance Committee former Minister Morneau would later go on to acknowledge that he and his wife had recently made two large donations, roughly $50,0000 each, and that he had also just written a cheque for over $41,000 to reimburse WE for expenses he and his family incurred on two vacations to Africa and South America, where they visited WE projects. WE later confirmed that the complementary trip was offered to former Minister Morneau and his family because of their history of significant donations to similar programs. These revelations led to the Conservative caucus calling for the now former Minister to resign.

The Finance Committee and the Ethics Committee began to look into this latest scandal, and the testimony and information they have received has painted a confusing and troubling picture. They uncovered a number of very concerning details before the Prime Minister prorogued Parliament in order to shut down the committees.

· WE stood to collect $45.53 million in fees, over double what was initially stated.

· The program, originally announced at over $900 million, was actually contracted out at $544 million instead. Why the discrepancy?

· The Clerk of the Privy Council stated that there were no red flags when considering WE, but that the Public Service didn’t probe the organizations finances. This is quite odd.

· The President of the Public Service Alliance disputed that only WE could have delivered the CSSG, stating that to say the Public Service was unable to was insulting. He pointed to the various government grant programs, Canada Summer Jobs and the Canada Service Corps as comparable programs. The theory that only WE could handle the program was further dismantled when it turned out that they had to subcontract part of the program because they weren’t able to deliver it in French.

· The contract for the CSSG wasn’t actually with WE Charity, but with WE Charity Foundation, a shell foundation that had no previous experience in delivering these types of programs.

· The former Chair of the Board at WE Charity testified that she had been forced to resign by Craig Kielburger for requesting financial documents from WE Executives to justify the layoff of hundreds of employees.

· The Kielburger brothers testified, claiming that they were running the program as a favour to Canada, and that their organization was to be reimbursed for expenses, but not make money off of the program. In a leaked document, a draft budget dated May 4th outlined some expenses including for staff salary. This included 175 program managers at $30,0000 each for 4.5 months work, ten supervisors at $45,000 each for 5.5months work, five group leaders at $70,000 each for 6 months work, and two project leaders for $125,000 for eight months work.

· WE Charity started to incur eligible expenses on May 5th, despite Cabinet not approving the program until May 22nd. This was being done with the full knowledge of ESDC, and allegedly at the financial liability of WE.

· Trudeau testified that he only found out about WE’s involvement on May 8th, shortly before it was set to be discussed at Cabinet. He claims that he removed it from the agenda and asked the public service to complete additional due diligence given his family connection to WE. He did not contact the Ethics Commissioner despite the concerns. This additional due diligence did not unearth any of the problems disclosed by the former Chair of the Board. It is noteworthy that no Minister, prior to the Prime Minister making his claim, had a story that would corroborate this feeble explanation.

The Prime Minister’s Chief of Staff confirmed that a handful of employees in PMO were aware of WE’s involvement and had interactions with the organization in the lead up to the approval. This included an interaction on May 5th, the day WE started incurring eligible expenses. So far, every time someone has come forward to try and explain away the Liberal’s latest mess, Canadians are left with more questions than when they started. Canadians deserve answers, and my Conservative colleagues and I are committed to finding them using every tool at our disposal.

While the studies at committee may have been temporarily halted by Trudeau’s prorogation Conservatives will continue to investigate this matter, and pursue every whiff of corruption like when we called on the Elections Commissioner to look into the political benefits that the Liberals have been given by WE. While the Prime Minister may be attempting to prevent Canadians from knowing the truth, Members of the Finance committee received thousands of heavily redacted documents from the Liberal government on the same day that Trudeau prorogued Parliament. They paint a very different picture of how WE came to be selected for this program than the one that the Liberals have offered up.

These documents suggest that the Minister of Diversity and Inclusion and Youth told WE to develop a proposal for a summer service opportunity before the CSSG was even announced. They go on to claim that the former Minister of Finance was “besties” with WE and that senior members of the Prime Minister’s office were involved in the development of the program and were having conversations with WE from an early stage. You can see these documents for yourself at wedocuments.ca.

The timeline of Mr. Trudeau’s version of events simply doesn’t add up. The CSSG was announced on April 22nd. A member of PMO spoke with WE about their proposal on May 5th, the same day they started to charge expenses for administering the program, but Cabinet wouldn’t approve the program for two and a half weeks.

Why was a charity that had to recently lay off hundreds of employees due to financial hardship related to COVID-19 so willing to accept the liability of starting the program without approval? Why were they so sure they would be approved? Why were they told they could start charging expenses before approval?

To answer that, you only need to look at the cozy relationship between Justin Trudeau, former Minister of Finance, Bill Morneau, the Liberal Party and WE. Now that the former Minister Bill Morneau has resigned and more than 5000 pages of documents have been released for review, Canadians are hungrier for that truth than ever before. The Liberals are banking on Canadians forgetting about this scandal during their prorogation and hoping that they can change the channel later this month with a new Throne Speech, but it isn’t going to work. Despite prorogation and all of the confusion and misdirection, one thing is absolutely clear – Justin Trudeau must resign for his part in this scandal.

Crime

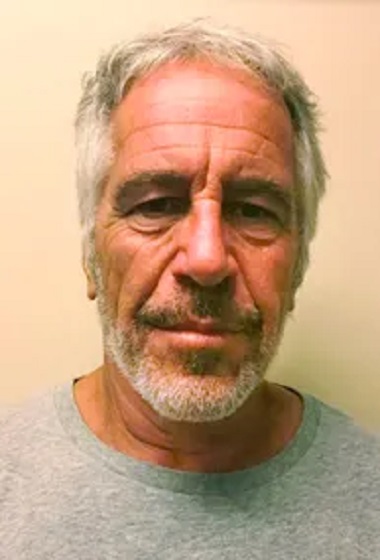

Former Epstein lawyer: There was never a client list

Quick Hit:

Jeffrey Epstein’s former attorney Alan Dershowitz says there was never a “client list,” calling the claim fiction in a Wall Street Journal op-ed. He also defended President Trump, saying there’s no evidence of any improper or questionable behavior.

Key Details:

- Dershowitz wrote that Epstein “never created a ‘client list,’” and clarified that the FBI only documented names brought up by alleged victims in interviews, which were redacted in released files.

- He stressed that none of the redacted names are current officeholders and added that the veracity of the accusations remains unknown.

- Dismissing rumors of hidden cameras used to entrap guests, Dershowitz said surveillance tapes existed only in public areas and were installed by law enforcement—not Epstein.

Diving Deeper:

In a Wall Street Journal op-ed this week, constitutional attorney Alan Dershowitz addressed lingering speculation surrounding the late Jeffrey Epstein, his alleged surveillance operation, and his reported ties to public figures. Dershowitz, who represented Epstein years ago and has consistently challenged many media narratives surrounding the case, said the facts don’t support the sensational claims.

“Epstein never created a ‘client list,’” Dershowitz wrote, pushing back on the widely circulated notion that Epstein maintained a record of high-profile individuals for the purpose of blackmail. He clarified that the FBI had compiled names mentioned by alleged victims during interviews, but that those names were redacted in publicly released documents. “We don’t know whether the accusations are true,” he added. “The names mentioned don’t include any current officeholders.”

Dershowitz also sought to debunk claims that Epstein maintained a secret camera system in his guest bedrooms to entrap powerful visitors. “There are videotapes, but they are of public areas of his Palm Beach, Fla., home,” he wrote. According to Dershowitz, those surveillance cameras were installed by police after Epstein reported that money and a firearm were stolen from the property. “I am not aware of video cameras in guest bedrooms,” he added.

Turning to President Donald Trump, Dershowitz flatly denied that any evidence exists linking him to wrongdoing. “Open records show an acquaintance between Epstein and President Trump many years ago,” he wrote, before emphasizing that the relationship ended long ago. “That relationship ended when President Trump reportedly banned Epstein from Mar-a-Lago, long before becoming president the first time.”

“I have seen nothing that would suggest anything improper or even questionable by President Trump,” Dershowitz concluded.

His remarks arrive amid a resurgence of political and media interest in Epstein’s associations. But Dershowitz’s message is clear: much of the speculation is unsupported by evidence, and President Trump’s name should not be dragged into narratives that have no basis in fact.

Business

PRC Money Laundering Probes Secured Beijing Influence Case Into New York Governors Office

Salted Ducks, Supercars, and State Access: How FBI Agents Say Beijing Bought Influence in the Heart of New York Government

The upcoming trial of Linda Sun — also known as Wen Sun — may prove to be the most sophisticated and high-level political infiltration operation in the United States publicly tied to Beijing’s United Front system. A youthful, naturalized immigrant from China, Sun rose through New York State’s bureaucracy to become a senior diversity official. Now, she stands accused of secretly manipulating two Democratic governors — effectively scripting Andrew Cuomo’s praise of Chinese pandemic mask shipments, while blocking Governor Kathy Hochul from meeting Taiwanese officials and ensuring her silence on the Chinese Communist Party’s mass detention of Uyghurs.

According to a sweeping superseding indictment filed in June 2025, Sun and her husband Chris Hu began enriching themselves through large-scale money laundering and corruption as early as March 2020, just weeks into the COVID-19 emergency. Prosecutors allege that Sun exploited her insider position to steer over $34 million in pandemic-era PPE contracts to companies tied to her husband and relatives — all while concealing her financial interests. In exchange, Sun and Hu allegedly received more than $8 million in kickbacks, routed through a constellation of opaque bank accounts and disguised as legitimate business revenue.

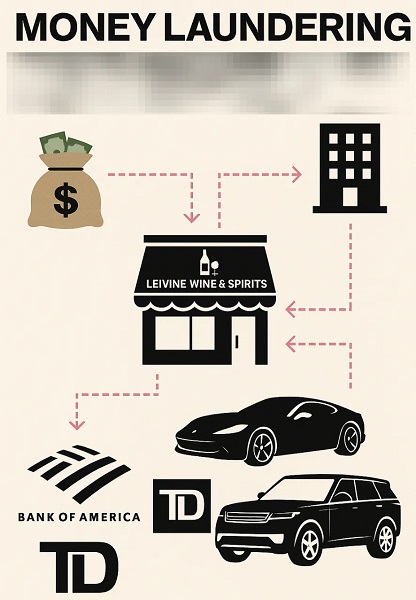

Luxury perks included gifts of Nanjing ducks and high-end travel to China, including a stay in a Beijing hotel suite previously used by former First Lady Michelle Obama. According to federal agents, much of the couple’s illicit income was funneled from China through underground banking and masked wire transfers into Leivine Wine & Spirits, a high-end boutique liquor store in Flushing that allegedly operated as a laundering front for Chinese-backed capital.

A criminal trial for Sun, 41, and Hu, 40, is scheduled for November.

The government further alleges that Sun’s influence reached into the core of New York’s executive branch. Under then-Governor Cuomo, Sun allegedly coordinated with senior officials from the Chinese Consulate in New York to orchestrate public expressions of gratitude toward Beijing during the early COVID-19 crisis. This culminated in Cuomo’s April 4, 2020 tweet: “We finally got some good news today. The Chinese government helped facilitate a donation of 1,000 ventilators that are coming in today. We thank @ConsulGeneralNY and the Chinese government.” According to FBI agents, this statement was not spontaneous — it was part of a covert diplomatic effort Sun was tasked with securing, even as she and her husband were allegedly profiting from tens of millions of dollars in pandemic-era contracts awarded to entities secretly tied to them.

Sun and Hu deny all allegations. Their attorneys have mounted a vigorous defense, filing numerous motions to dismiss the charges and suppress evidence obtained through federal search warrants. The most recent failed motion, filed a week ago, asked the government “to retract and delete its June 26, 2025 press release” regarding the new PPE-fraud and money-laundering allegations, and accused FBI Director Kash Patel of prejudicing the case with this post to X: “While Americans were locked down and desperate for PPE, Linda Sun and Chris Hu cashed in – allegedly lining their pockets while serving CCP interests. This is corruption that endangered lives. The FBI will not tolerate public officials who sell out their country.”

Under Governor Hochul, Sun’s alleged covert activities reportedly accelerated. Federal prosecutors say she obtained unauthorized gubernatorial proclamations honoring PRC officials, used back-channels to attempt to arrange an official visit to China’s Henan Province for Hochul while she served as lieutenant governor, and allowed PRC consular officials to preview and influence Hochul’s public remarks. In one instance, agents allege, Sun ensured Hochul made no public mention of China’s mass detention of Uyghurs in Xinjiang, after consular feedback was relayed to her directly.

Together, these allegations portray a striking level of access and manipulation. Operating from within her official diversity, equity, and inclusion role, Sun allegedly ran a parallel influence campaign that touched the highest levers of power in New York — the fourth-largest U.S. economy, with an annual budget exceeding $230 billion and nearly 180,000 employees.

If proven, Sun’s efforts would amount to the most successful Chinese influence campaign yet documented in open court — directly advancing President Xi Jinping’s foreign-policy objectives under the banner of United Front political warfare.

Yet a deeper investigation by The Bureau — combing through hundreds of pages of court records, financial exhibits, and suppression filings — suggests that money laundering, more than political access, may be the case’s more sophisticated and entrenched operational spine.

As striking as Sun’s apparent success in realigning New York’s political posture toward Beijing may be, that influence appears to be just one layer within a larger machinery — an engine designed not only to exert political leverage but to move massive flows of illicit capital, benefitting both the conspirators and their state-linked patrons.

In this context, Sun’s foreign-influence campaign increasingly resembles a node within a broader financial architecture — one that suggests Chinese intelligence may be providing the hidden hand behind similar cross-border dealings across North America. The pattern aligns with tactics long attributed to the United Front Work Department, which fuses economic infiltration with political co-option, often through trusted intermediaries embedded in diaspora communities and public institutions.

In Sun’s case, federal investigators say the FBI identified more than 80 financial accounts linked to the couple, tracking complex movements of capital between the U.S. and China, with the use of shell companies, luxury real estate, and boutique storefronts to disguise covertly sourced funds.

What emerges is not simply a corruption case — but a revealing blueprint of how modern state-backed influence operations can be financed, layered, and laundered through global finance and trade.

According to filings, the main unidentified Chinese diplomat and United Front conspirators included, CC-1, a naturalized U.S. citizen originally from China, playing a central behind-the-scenes role in Linda Sun’s alleged influence operation. As president of a New York–based nonprofit representing individuals from China’s Henan Province, CC-1 led an organization that federal prosecutors say was tightly linked to the Chinese Communist Party’s United Front Work Department — or UFWD — a political warfare unit tasked with cultivating support for Beijing among influential elites worldwide. According to the indictment, CC-1 issued strategic directives to Sun, including instructing her to draft invitation letters for Chinese delegations, organize official visits, and tailor communications to suit CCP interests. The UFWD, prosecutors noted, “attempted to manage relationships with and generate support for the CCP among elite individuals inside and outside the PRC, including by gathering human intelligence.”

CC-2, meanwhile, was a U.S. legal permanent resident who maintained active business interests in China’s Shandong Province. Identified as a principal in several U.S.-based Chinese associations — including a chamber of commerce for Chinese immigrants — CC-2 allegedly operated as another key intermediary in the broader influence network. Federal prosecutors also identified at least four high-ranking officials at the Chinese Consulate in New York — PRC Official-1 through PRC Official-4 — as central actors in the alleged foreign interference scheme. PRC Official-1 and PRC Official-2 held senior leadership roles, while PRC Official-3 and PRC Official-4 were assigned to the consulate’s Political Section. Based on similar job titles in Canada, such Political Section diplomats may fit the profile of undercover intelligence handlers of diaspora United Front agents — trained to operate within embassies and consulates as covert operatives.

In a statement to The New York Times following June’s superseding indictment, Jarrod Schaeffer, Sun’s attorney, said prosecutors were “publicizing feverish accusations unmoored from the facts.” Seth DuCharme, representing Hu, said the government was “scrambling to try to come up with some new charging theory” ahead of trial.

The Money Trail: From Pandemic Profits to Wine Cellars and Real Estate

Federal prosecutors say Linda Sun and Chris Hu built a life of stunning opulence — allegedly financed by laundering proceeds from covertly awarded pandemic contracts and PRC-connected business activity. Among the assets now under federal forfeiture: a $3.6 million mansion in Manhasset, a $1.9 million condo in Honolulu’s prestigious Ala Moana district, and a $1.5 million home in Forest Hills, Queens. Their vehicle collection rivaled that of global elites — including a 2024 Ferrari Roma, a new Range Rover, and a 2022 Mercedes SUV.

Agents also recovered $140,000 in cash, including $130,000 from a TD Bank safe-deposit box in Flushing, and nearly $83,000 frozen across various personal and brokerage accounts. Investigators uncovered a pattern of carefully orchestrated gifts from senior Chinese officials — most strikingly, the delivery of at least 18 salted ducks between 2021 and 2022. In Chinese culture, such ducks — especially the revered Nanjing variety — are not just festive delicacies, but symbols of insider favor and elite status.

The money trail, prosecutors allege, began in China. As laid out in the June 2025 indictment, Chris Hu’s business operations — including a PPE venture with an unnamed partner and a lobster-export business tied to China-based buyers — generated millions in revenue. Rather than transferring those funds legally, Hu allegedly relied on unlicensed money remitters — the hallmarks of Byzantine underground banking systems documented by DEA probes such as “Project Sleeping Giant.” These funds were then funneled into U.S. banks, including TD and Bank of America, via shell companies and family-linked accounts — among them, one associated with Leivine Wine & Spirits.

“There were no mortgage loans taken in connection with these acquisitions,” the indictment notes.

“Hu repatriated this wealth to the United States by, among other measures, using one or more unlicensed money-remitting businesses; depositing cash payments into multiple accounts associated with Hu’s family and businesses, including into an account associated with the Wine Store,” the indictment explains. The couple’s real-estate spree, prosecutors add, “occurred soon after Hu received a series of wire transfers totaling more than $2.1 million from a PRC-based account bearing the name of [Hu’s Chinese business partner].”

At the center of this alleged laundering web sits Leivine Wine & Spirits, a boutique liquor store inside an upscale Flushing development. Though marketed as a premium destination — with a temperature-controlled cellar housing bottles priced between $20,000 and $50,000, and a rare $5,200 Dalmore single malt — Hu’s reported financials, supposedly based largely on bulk-cash sales and $80,000 in monthly cash deposits, raised red flags.

“We partner with world-renowned brands to offer exclusive tastings, have sections of curated and rare bottles, and a knowledgeable staff to assist with your every need,” the store’s website declares. But as FBI Special Agent Devin Perry wrote in his affidavit: “Wine and liquor stores, such as Leivine, generally conduct primarily cashless transactions. Given Leivine’s location in a high-end development in Flushing, I assess it is unlikely that the large volume of cash Hu has been depositing in Leivine accounts constitutes Leivine’s actual income.”

That assessment proved pivotal. In May 2025, U.S. District Judge Brian Cogan denied Hu’s motion to suppress evidence gathered in the FBI’s 2024 warrant targeting the wine store — a ruling that cleared the path for expanded money-laundering and PPE-fraud charges in the June superseding indictment. Cogan’s decision laid out in striking detail how Leivine allegedly served as a conduit for cash flowing from Sun’s covert foreign-influence activities, presenting a textbook case of illicit financial engineering.

Among the key findings:

- $10,000 in unexplained cash was seized from Hu’s residence, which he claimed was store revenue awaiting deposit.

- More than $200,000 in cash deposits had been made into Leivine’s accounts before its official opening in November 2022.

- From August 2022 to February 2024, the store averaged $77,000 in monthly cash deposits.

- Hu personally wired $1.123 million from his private accounts into Leivine’s business accounts.

- Seven feeder accounts — all in Leivine’s name — funneled funds into a central Bank of America account, with four of them transferring over 97 percent of their deposits to that destination.

Judge Cogan found these flows consistent with structured layering techniques widely associated with professional money laundering. The transactions, he ruled, were sufficient to uphold the warrant, writing that “the affidavit still established probable cause,” and that Hu’s suppression arguments failed to overcome the weight of evidence.

Suppression and Dismissal

Beyond the 2024 Leivine warrant, federal investigators had been collecting evidence for years. The affidavit supporting the search of the couple’s Manhasset mansion laid out a web of digital communications, financial records, and testimonial evidence pointing to Sun’s role as an undeclared foreign agent for the People’s Republic of China.

FBI Special Agent Devin Perry cited messages between Sun and her parents as key proof that she “acted to benefit the PRC government and traded access for various PRC government representatives and agents, in return for economic considerations.” These communications included “numerous WeChat messages” in which Sun and her parents discussed her alleged assignments — such as when a figure referred to as “Chairman Xia” upgraded her airfare, and Sun assumed Xia “would start asking her to do him favors such as arranging peoples’ visits (to the Governor’s office).”

WeChat logs also allegedly showed Sun, Hu, and Sun’s parents receiving gifts from PRC officials, and Sun and Hu using her parents as straw purchasers for vehicles. Judge Cogan ruled that Hu’s motion to dismiss the related warrant lacked foundation.

While Sun sought to dismiss all charges, claiming there was no evidence she knowingly acted as an unregistered foreign agent, Judge Cogan disagreed. In a sweeping May 5 ruling, he rejected her motion and dismantled her core argument — that she lacked authority to influence New York’s highest offices and therefore could not qualify as a foreign agent under U.S. law.

Among the most explosive allegations: Sun boasted to senior Chinese consular officials that she had blocked Taiwan’s representative office, known as TECO, from any contact with top New York officials. In January 2019, she wrote to a senior Chinese diplomat, “Certainly I have managed to stop all relations between the TECO and the state. I have denied all requests from their office.” By February 27, 2019, she went further, instructing a staffer for Governor Cuomo to reject a meeting request from a visiting Taiwanese mayor: “No to the request. Explain in person.”

Judge Cogan highlighted what may be the most damning element of the case: many of Sun’s alleged clandestine acts occurred after she had been explicitly warned by federal authorities. On July 15, 2020, Sun voluntarily sat for an FBI interview, during which agents advised her of the Foreign Agents Registration Act (FARA) and warned that “if someone operated on behalf of the Chinese government without registering as a foreign agent, they could be in violation of FARA.”

But the FBI was already watching long before that warning. The indictment cites a 2018 episode in which a senior United Front agent, identified as CC-1, allegedly tasked Sun with arranging an official visit to New York for a Henan Province delegation — including a meeting with then-Lieutenant Governor Kathy Hochul. Sun allegedly drafted two versions of an invitation letter on official governor’s-office letterhead — despite having no authority to issue such invitations.

The scheme deepened in 2018 and 2019. CC-1 again tasked Sun — this time with coordinating a return visit for Hochul to Henan, a trip aimed at showcasing Beijing’s ties with a prominent U.S. state. On November 26, 2018, CC-1 instructed Sun to send Hochul’s résumé and propose an itinerary. She complied immediately, sending both the résumé and Hochul’s official email address. She was then instructed to update and reissue invitation letters on May 17 and September 16, 2019, tailoring them to Chinese diplomatic preferences.

Judge Cogan also cited Sun’s alleged role in facilitating fraudulent invitation letters to support illegal visa applications for the Henan delegation. The diplomatic trip, pitched as part of a proposed $1 billion joint-campus project with New York universities, appeared to be a United Front cover operation to deepen Beijing’s political and economic influence in America.

Through these efforts, Sun allegedly used her access not only to open doors for Chinese officials — but to slam them shut on geopolitical rivals, especially Taiwan.

The indictment also shows that Sun, even after the FBI warning, allegedly continued acting on behalf of PRC officials — including repeated interventions to shape New York State policy toward Taiwan and giving consular officials advance access to official state communications.

In early 2021, Sun allegedly provided the Chinese consulate with a draft of Governor Hochul’s public remarks, allowing Beijing to sanitize the language and strip references to sensitive topics such as the Uyghur detentions. “Based on feedback from a PRC government official, [Hochul] did not publicly address the detention of Uyghurs in PRC state-run camps in Xinjiang,” the judge noted, citing FBI evidence.

“These actions, as alleged, demonstrate Sun using her authority and power to induce action or change the decisions or acts of another,” Judge Cogan wrote, concluding that they were “sufficient to constitute the ‘influence’ element of a FARA offense, even as Sun defines it.”

Finally, Judge Cogan emphasized that the indictment establishes Sun’s understanding that her alleged United Front handlers — CC-1 and CC-2 — were acting as agents of the PRC and the Communist Party. As the indictment puts it: “Sun understood that CC-1 and CC-2 were themselves acting as agents of the PRC government and the CCP when they made requests of Sun.”

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

-

Immigration2 days ago

Immigration2 days agoUnregulated medical procedures? Price Edward Islanders Want Answers After Finding Biomedical Waste From PRC-Linked Monasteries

-

Business2 days ago

Business2 days agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

Addictions2 days ago

Addictions2 days agoAfter eight years, Canada still lacks long-term data on safer supply

-

COVID-191 day ago

COVID-191 day agoJapan disposes $1.6 billion worth of COVID drugs nobody used

-

National2 days ago

National2 days agoLiberals push to lower voting age to 16 in federal elections

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoHow Did PEI Become A Forward Branch Plant For Xi’s China?

-

COVID-191 day ago

COVID-191 day agoWATCH: Big Pharma scientist admits COVID shot not ‘safe and effective’ to O’Keefe journalist

-

Food1 day ago

Food1 day agoTrump says Coca-Cola will switch to real cane sugar in U.S.