Alberta

Province will pour in all the resources necessary to beat this COVID-19 downturn

From the Province of Alberta

Protecting Alberta’s families and economy

Government is providing immediate financial assistance to Albertans affected by the COVID-19 crisis.

New funding and supportive measures will provide immediate financial relief to Alberta’s families, vulnerable populations, local businesses and employers.

“Albertans are doing their part to keep each other safe and prevent the spread of COVID-19. We are doing ours by assisting Albertans and their families, protecting jobs and supporting workers and employers. We will help shelter Albertans from the economic disruption of COVID-19 now, and position Alberta’s industry and businesses to bounce back when the situation stabilizes. This is an initial set of measures, and more will follow in the days to come.”

Financial supports for Albertans

Albertans should be focused on their health and not worry about whether they can pay their bills, so the government has put a number of options in place for those struggling financially:

- Emergency Isolation Support: $50 million

- This will be a temporary program for working adult Albertans who must self-isolate because they meet the Government of Alberta’s published criteria for self-isolation, including persons who are the sole caregiver for a dependent who must self-isolate because they meet the public health criteria, and who will not have another source of pay or compensation while they are self-isolated.

- It will be distributed in one payment instalment and will bridge the gap until the federal emergency payments begin in April.

- We expect the program to be accessible by a simple online application through alberta.ca next week and that funds will be deposited in the accounts of eligible recipients beginning at that time.

- Utility payment holiday

- Residential, farm, and small commercial customers can defer bill payments for the next 90 days to ensure no one will be cut off from these services during this time of crisis.

- This will cover electricity and natural gas, regardless of the service provider.

- Student loans repayment holiday

- The government will implement a six-month, interest-free moratorium on Alberta student loan payments for all individuals who are in the process of repaying these loans.

Banks and credit unions

- ATB Financial customers impacted by COVID-19

- Personal banking customers can apply for a deferral on their ATB loans, lines of credit, and mortgages for up to six months.

- Small business customers, in addition to payment deferrals on loans and lines of credit, will be provided access to additional working capital.

- For other business and agriculture customers, ATB will work with customers on a one-on-one basis and further solutions are being considered at this time.

- For more information on ATB’s relief program, please visit their website.

- Alberta credit unions

- Credit union members will have access to a variety of programs and solutions designed to ease difficulties with loan payments and short-term cash flow.

- Both individual and business members are encouraged to proactively contact their credit union directly to work out a plan for their personal situation.

Employers

Alberta employers are facing significant challenges and uncertainty. To give them increased access to cash in order to pay employees, address debts and continue operations, the government will:

- defer the collection of corporate income tax balances and instalment payments, due after today, until Aug. 31, 2020. This gives Alberta businesses access to about $1.5 billion in funds to help them cope with the COVID-19 crisis.

“In these exceptional circumstances, having cash on hand is vital to families and employers and it’s critical we give Albertans this certainty and support. This tax measure will provide timely relief and additional runway for businesses to continue operating and compensating their employees during this difficult time.”

Alberta is pleased the federal government has responded to concerns and has taken the recommendation to increase supports to people receiving Employment Insurance. Alberta has contributed far more to the federal government in employment insurance (EI) premiums than it receives in EI support, so it is good to see the federal government providing the support Albertans need in these difficult times.

Relief measures already in place

Albertans, seniors and vulnerable groups

- Charitable and non-profit groups will immediately receive an additional $60 million to support seniors and other vulnerable populations disproportionately affected by COVID-19. This is in addition to the $3.9 billion for community and social services allocated in Budget 2020.

Health care for Albertans

- The Government of Alberta has committed $500 million extra this year to respond to the public health crisis and to support front-line health professionals working to keep Albertans safe and healthy. This is in addition to the record-high $20.6 billion allocated for health care in Budget 2020. A further $58 million has been allocated to Alberta health care for COVID-19 response by the federal government.

Alberta

Former senior financial advisor charged with embezzling millions from Red Deer area residents

News release from Alberta RCMP

Former senior financial advisor charged for misappropriating nearly $5 million from clients

On April 4, 2024, the RCMP’s Provincial Financial Crime Team charged a Calgary resident for fraud-related offences after embezzling millions of dollars from his clients while serving as a senior financial advisor.

Following a thorough investigation, the accused is alleged to have fraudulently withdrawn funds from client accounts and deposited them into bank accounts he personally controlled. A total of sixteen victims were identified in the Red Deer area and suffered a combined loss of nearly $5 million.

Marc St. Pierre, 52, a resident of Calgary, was arrested and charged with:

- Fraud over $5,000 contrary to section 380(1)(a) of the Criminal Code; and,

- Theft over $5,000 contrary to section 344(a) of the Criminal Code.

St. Pierre is scheduled to appear in Red Deer Provincial Court on May 14, 2024.

“The ability for financial advisors to leverage their position to conduct frauds and investment scams represents a significant risk to the integrity of Alberta’s financial institutions. The investigation serves as an important reminder for all banking clients to regularly check their accounts for any suspicious activity and to report it to their bank’s fraud prevention team.”

- Sgt. John Lamming, Provincial Financial Crime Team

The Provincial Financial Crime Team is a specialized unit that conducts investigations relating to multi-jurisdictional serious fraud, investments scams and corruption.

Alberta

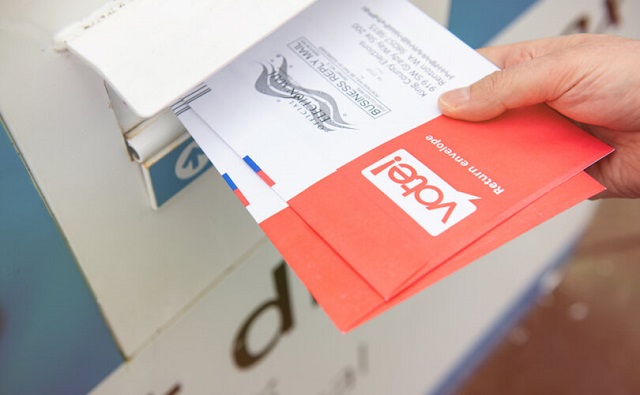

Political parties will be part of municipal elections in Edmonton and Calgary pilot projects

Strengthening Alberta’s local elections

Alberta’s government is introducing legislation to ensure Albertans can rely on transparent, free and fair elections, and municipally-elected officials have clearer accountability measures.

In a democratic society, Albertans expect their local elections to be free and fair, and their elected officials to be held to account by clear rules that govern their local councils. The Municipal Affairs Statutes Amendment Act proposes amendments to the Local Authorities Election Act (LAEA) and the Municipal Government Act (MGA) to add greater transparency to local election processes and ensure local councils and elected officials continue to remain accountable to the citizens who elected them.

“Our government is committed to strengthening Albertans’ trust in their local governments and the democratic process that elects local leaders. The changes we are making increase transparency for Alberta voters and provide surety their votes will be counted accurately. We know how important local democracy is to Albertans, and we will work with local authorities to protect and enhance the integrity of local elections.”

Local Authorities Election Act

Albertans expect free and fair elections and that’s why it’s important we strengthen the rules that govern local elections. To strengthen public trust in local elections, Alberta’s government will eliminate the use of electronic tabulators and other automated voting machines. All Albertans should be able to trust the methods and results of local elections; requiring all ballots to be counted by hand, clarifying rules and streamlining processes for scrutineers will provide voters greater assurance in the integrity of the results.

All eligible Albertans should be able to vote in local elections without impediment. Alberta’s government will limit the barriers for eligible voters to cast a ballot by expanding the use of special ballots. Currently, special ballots can only be requested for very specific reasons, including physical disability, absence from the municipality, or for municipal election workers. By expanding the use of special ballots, the government is encouraging more voter participation.

Amendments in the Municipal Affairs Statutes Amendment Act would increase transparency in local elections by enabling political parties at the local level. Political parties would be enabled in a pilot project for Edmonton and Calgary. The act will not require candidates to join a political party in order to run for a local or municipal office, but will create the opportunity to do so.

In addition, proposed changes to the Local Authorities Election Act would allow municipalities the option to require criminal record checks for local candidates, thus increasing transparency and trust in candidates who may go on to become elected officials.

Municipal Government Act

The role of an elected official is one with tremendous responsibility and expectations. Changes proposed to the Municipal Government Act (MGA) will strengthen the accountability of locally elected officials and councils. These include requiring mandatory orientation training for councillors, allowing elected officials to recuse themselves for real or perceived conflicts of interest without third-party review and requiring a councillor’s seat to become vacant upon disqualification.

If passed, the Municipal Affairs Statutes Amendment Act will also unlock new tools to build affordable and attainable housing across Alberta. Proposed amendments under the MGA would also create more options for municipalities to accelerate housing developments in their communities. Options include:

- Exempting non-profit, subsidized affordable housing from both municipal and education property taxes;

- Requiring municipalities to offer digital participation for public hearings about planning and development, and restricting municipalities from holding extra public hearings that are not already required by legislation; and

- Enabling municipalities to offer multi-year residential property tax exemptions.

Municipal Affairs will engage municipalities and other partners over the coming months to hear perspectives and gather feedback to help develop regulations.

Quick facts

- The LAEA establishes the framework for the conduct of elections in Alberta municipalities, school divisions, irrigation districts and Metis Settlements.

- The MGA establishes the rules governing the conduct of local elected officials once on council, as well as the overall administration and operation of municipal authorities in Alberta, including any policy those authorities may wish to implement.

Related information

-

espionage24 hours ago

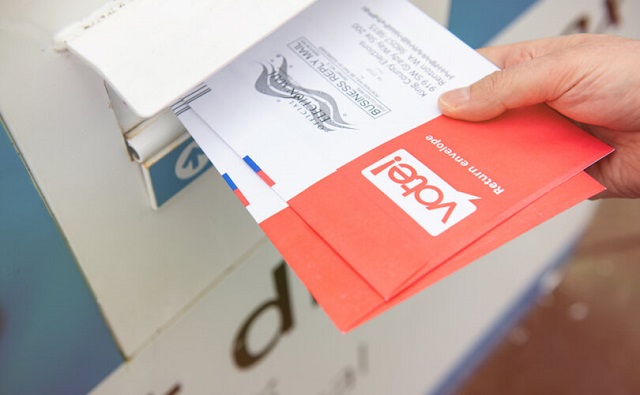

espionage24 hours agoOne in five mail-in voters admitted to committing voter fraud during 2020 election: Rasmussen poll

-

Business23 hours ago

Business23 hours agoHonda deal latest episode of corporate welfare in Ontario

-

COVID-192 days ago

COVID-192 days agoTrudeau gov’t has paid out over $500k to employees denied COVID vaccine mandate exemptions

-

International2 days ago

International2 days agoRFK Jr tells EWTN: Politicization of the CIA, FBI, Secret Service under Biden is ‘very troubling’

-

Automotive16 hours ago

Automotive16 hours agoThe EV ‘Bloodbath’ Arrives Early

-

Addictions2 days ago

Addictions2 days agoWhy can’t we just say no?

-

CBDC Central Bank Digital Currency7 hours ago

CBDC Central Bank Digital Currency7 hours agoA Fed-Controlled Digital Dollar Could Mean The End Of Freedom

-

Brownstone Institute6 hours ago

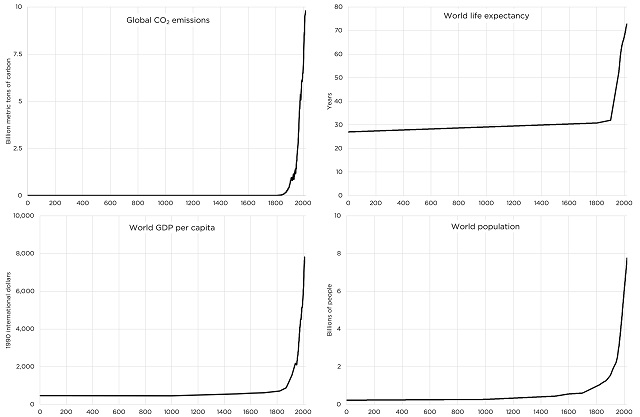

Brownstone Institute6 hours agoThe Numbers Favour Our Side