Economy

Poor policies responsible for stagnant economy and deteriorating federal finances

From the Fraser Institute

By Jake Fuss and Jason Clemens

The Trudeau government was elected in 2015 based in part on a new approach to government policy, promising greater prosperity for Canadians through short-term deficit spending, lower taxes for most Canadians, and a more direct and active role for government in economic development. However, the result has been economic stagnation and a marked deterioration in the country’s finances. If Canada is to restore its economic and fiscal health, Ottawa must enact fundamental policy reform.

The Trudeau government has significantly increased spending from $256.2 billion in 2014-15 to a projected $449.8 billion in 2023-24 (excluding debt interest costs) to expand existing programs and create new programs.

In 2016, the government increased the top personal income tax rate on entrepreneurs, professionals and businessowners from 29 per cent to 33 per cent. Consequently, the combined top personal income tax rate (federal and provincial) now exceeds 50 per cent in eight provinces and the country’s average top combined rate in 2022 ranked fifth-highest among 38 OECD countries. This represents a serious competitive challenge for Canada to attract and retain entrepreneurs, investors and skilled professionals (e.g. doctors) we badly need.

And while the Trudeau government reduced the middle personal income tax rate, it also eliminated several tax credits. Due to the combination of these two policy changes, 86 per cent of middle-income families now pay higher personal income taxes.

The Trudeau government also borrowed to help finance new spending, triggering a string of budget deficits. As a result, federal gross debt has ballooned to $1.9 trillion (2022-23) and will reach a projected $2.4 trillion by 2027-28, fueling a marked growth in interest costs, which now consume substantial levels of revenue unavailable for government services or tax reduction.

Simply put, the Trudeau government has produced large increases in government spending, taxes and borrowing, which have not translated into a more robust and vibrant economy.

For example, from 2013 to 2022, growth in per-person GDP, the broadest measure of living standards, was the weakest on record since the 1930s. Prospects for the future, given current policies, are not encouraging. According to the OECD, Canada will record the lowest rate of per-person GDP growth among 32 advanced economies during the periods 2020 to 2030 and 2030 to 2060. Countries such as Estonia, South Korea and New Zealand are expected to vault past Canada and achieve higher living standards by 2060.

Canada’s economic growth crisis is due in part to the decline in business investment, which is critical to increasing living standards because it equips workers with tools and technologies to produce more and provide higher-quality goods and services. The Trudeau government has dampened investment by increasing regulatory barriers, particularly in the energy and mining sectors, and running deficits, which imply tax increases in the future.

Business investment (inflation-adjusted, excluding residential construction) has declined by 1.8 per cent annually, on average, since 2014. Between 2014 and 2021, business investment per worker (inflation-adjusted, excluding residential construction) decreased by $3,676 in Canada compared to growth of $3,418 in the United States.

There’s reason for optimism, however, since many of Canada’s challenges are of Ottawa’s own making. The Chrétien Liberals in the 1990s faced many of the same challenges we do today. By shifting the focus to more prudent government spending, balanced budgets, debt reduction and competitive tax rates, the Chrétien Liberals—followed in large measure by the Harper Tories—paved the way for two decades of prosperity. To help foster greater prosperity for Canadians today and tomorrow, the federal government should learn from the Chrétien Liberals and Harper Tories and enact fundamental policy reform.

Authors:

Alberta

COWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

Fr0m Energy Now

As Calgarians take a break from the incessant news of tariff threat deadlines and global economic challenges to celebrate the annual Stampede, Conservative party leader Pierre Poilievre gave them even more to celebrate.

Poilievre returned to Calgary, his hometown, to outline his plan to amplify the legitimate demands of Western Canada and not only fight for oil and gas, but also fight for the interests of farmers, for low taxes, for decentralization, a stronger military and a smaller federal government.

Speaking at the annual Conservative party BBQ at Heritage Park in Calgary (a place Poilievre often visited on school trips growing up), he was reminded of the challenges his family experienced during the years when Trudeau senior was Prime Minister and the disastrous effect of his economic policies.

“I was born in ’79,” Poilievre said. “and only a few years later, Pierre Elliott Trudeau would attack our province with the National Energy Program. There are still a few that remember it. At the same time, he hammered the entire country with money printing deficits that gave us the worst inflation and interest rates in our history. Our family actually lost our home, and we had to scrimp and save and get help from extended family in order to get our little place in Shaughnessy, which my mother still lives in.”

This very personal story resonated with many in the crowd who are now experiencing an affordability crisis that leaves families struggling and young adults unable to afford their first house or condo. Poilievre said that the experience was a powerful motivator for his entry into politics. He wasted no time in proposing a solution – build alliances with other provinces with mutual interests, and he emphasized the importance of advocating for provincial needs.

“Let’s build an alliance with British Columbians who want to ship liquefied natural gas out of the Pacific Coast to Asia, and with Saskatchewanians, Newfoundlanders and Labradorians who want to develop their oil and gas and aren’t interested in having anyone in Ottawa cap how much they can produce. Let’s build alliances with Manitobans who want to ship oil in the port of Churchill… with Quebec and other provinces that want to decentralize our country and get Ottawa out of our business so that provinces and people can make their own decisions.”

Poilievre heavily criticized the federal government’s spending and policies of the last decade, including the increase in government costs, and he highlighted the negative impact of those policies on economic stability and warned of the dangers of high inflation and debt. He advocated strongly for a free-market economy, advocating for less government intervention, where businesses compete to impress customers rather than impress politicians. He also addressed the decade-long practice of blocking and then subsidizing certain industries. Poilievre referred to a famous quote from Ronald Reagan as the modus operandi of the current federal regime.

“The Government’s view of the economy could be summed up in a few short phrases. If anything moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

The practice of blocking and then subsidizing is merely a ploy to grab power, according to Poilievre, making industry far too reliant on government control.

“By blocking you from doing something and then making you ask the government to help you do it, it makes you reliant. It puts them at the center of all power, and that is their mission…a full government takeover of our economy. There’s a core difference between an economy controlled by the government and one controlled by the free market. Businesses have to clamour to please politicians and bureaucrats. In a free market (which we favour), businesses clamour to impress customers. The idea is to put people in charge of their economic lives by letting them have free exchange of work for wages, product for payment and investment for interest.”

Poilievre also said he plans to oppose any ban on gas-powered vehicles, saying, “You should be in the driver’s seat and have the freedom to decide.” This is in reference to the Trudeau-era plan to ban the sale of gas-powered cars by 2035, which the Carney government has said they have no intention to change, even though automakers are indicating that the targets cannot be met. He also intends to oppose the Industrial Carbon tax, Bill C-69 the Impact Assessment Act, Bill C-48 the Oil tanker ban, the proposed emissions cap which will cap energy production, as well as the single-use plastics ban and Bill C-11, also known as the Online Streaming Act and the proposed “Online Harms Act,” also known as Bill C-63. Poilievre closed with rallying thoughts that had a distinctive Western flavour.

“Fighting for these values is never easy. Change, as we’ve seen, is not easy. Nothing worth doing is easy… Making Alberta was hard. Making Canada, the country we love, was even harder. But we don’t back down, and we don’t run away. When things get hard, we dust ourselves off, we get back in the saddle, and we gallop forward to the fight.”

Cowboy up, Mr. Poilievre.

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

Alberta

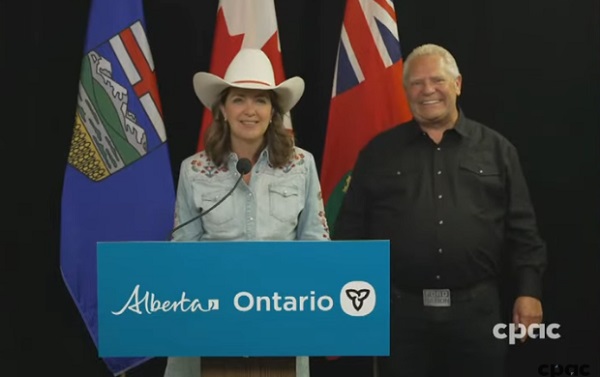

Alberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

Alberta-Ontario MOUs fuel more pipelines and trade

Alberta Premier Danielle Smith and Ontario Premier Doug Ford have signed two memorandums of understanding (MOUs) during Premier Ford’s visit to the Calgary Stampede, outlining their commitment to strengthen interprovincial trade, drive major infrastructure development, and grow Canada’s global competitiveness by building new pipelines, rail lines and other energy and trade infrastructure.

The two provinces agree on the need for the federal government to address the underlying conditions that have harmed the energy industry in Canada. This includes significantly amending or repealing the Impact Assessment Act, as well as repealing the Oil Tanker Moratorium Act, Clean Electricity Regulations, the Oil and Gas Sector Greenhouse Gas Emissions Cap, and all other federal initiatives that discriminately impact the energy sector, as well as sectors such as mining and manufacturing. Taking action will ensure Alberta and Ontario can attract the investment and project partners needed to get shovels in the ground, grow industries and create jobs.

The first MOU focuses on developing strategic trade corridors and energy infrastructure to connect Alberta and Ontario’s oil, gas and critical minerals to global markets. This includes support for new oil and gas pipeline projects, enhanced rail and port infrastructure at sites in James Bay and southern Ontario, as well as end-to-end supply chain development for refining and processing of Alberta’s energy exports. The two provinces will also collaborate on nuclear energy development to help meet growing electricity demands while ensuring reliable and affordable power.

The second MOU outlines Alberta’s commitment to explore prioritizing made-in-Canada vehicle purchases for its government fleet. It also includes a joint commitment to reduce barriers and improve the interprovincial trade of liquor products.

“Alberta and Ontario are joining forces to get shovels in the ground and resources to market. These MOUs are about building pipelines and boosting trade that connects Canadian energy and products to the world, while advocating for the right conditions to get it done. Government must get out of the way, partner with industry and support the projects this country needs to grow. I look forward to working with Premier Doug Ford to unleash the full potential of our economy and build the future that people across Alberta and across the country have been waiting far too long for.”

“In the face of President Trump’s tariffs and ongoing economic uncertainty, Canadians need to work together to build the infrastructure that will diversify our trading partners and end our dependence on the United States. By building pipelines, rail lines and the energy and trade infrastructure that connects our country, we will build a more competitive, more resilient and more self-reliant economy and country. Together, we are building the infrastructure we need to protect Canada, our workers, businesses and communities. Let’s build Canada.”

These agreements build on Alberta and Ontario’s shared commitment to free enterprise, economic growth and nation-building. The provinces will continue engaging with Indigenous partners, industry and other governments to move key projects forward.

“Never before has it been more important for Canada to unite on developing energy infrastructure. Alberta’s oil, natural gas, and know-how will allow Canada to be an energy superpower and that will make all Canadians more prosperous. To do so, we need to continue these important energy infrastructure discussions and have more agreements like this one with Ontario.”

“These MOUs with Ontario build on the work Alberta has already done with Saskatchewan, Manitoba, Northwest Territories and the Port of Prince Rupert. We’re proving that by working together, we can get pipelines built, open new rail and port routes, and break down the barriers that hold back opportunities in Canada.”

“Canada’s economy has an opportunity to become stronger thanks to leadership and steps taken by provincial governments like Alberta and Ontario. Removing interprovincial trade barriers, increasing labour mobility and attracting investment are absolutely crucial to Canada’s future economic prosperity.”

Together, Alberta and Ontario are demonstrating the shared benefits and opportunities that result from collaborative partnerships, and what it takes to keep Canada competitive in a changing world.

Quick facts

- Steering committees with Alberta and Ontario government officials will be struck to facilitate work and cooperation under the agreements.

- Alberta and Ontario will work collaboratively to launch a preliminary joint feasibility study in 2025 to help move private sector led investments in rail, pipeline(s) and port(s) projects forward.

- These latest agreements follow an earlier MOU Premiers Danielle Smith and Doug Ford signed on June 1, 2025, to open up trade between the provinces and advance shared priorities within the Canadian federation.

Related information

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Immigration

-

Business2 days ago

Business2 days agoThe Digital Services Tax Q&A: “It was going to be complicated and messy”

-

International2 days ago

International2 days agoElon Musk forms America Party after split with Trump

-

Crime15 hours ago

Crime15 hours agoNews Jeffrey Epstein did not have a client list, nor did he kill himself, Trump DOJ, FBI claim

-

COVID-1913 hours ago

COVID-1913 hours agoFDA requires new warning on mRNA COVID shots due to heart damage in young men

-

Business11 hours ago

Business11 hours agoCarney’s new agenda faces old Canadian problems

-

Bruce Dowbiggin11 hours ago

Bruce Dowbiggin11 hours agoEau Canada! Join Us In An Inclusive New National Anthem

-

Alberta Sports Hall of Fame and Museum24 hours ago

Alberta Sports Hall of Fame and Museum24 hours agoAlberta Sports Hall of Fame 2025 Inductee Profiles – Para Nordic Skiing – Brian and Robin McKeever