Daily Caller

Pollsters Say RFK Jr. Endorsement ‘Could Have A Really Big Impact’ And ‘Help Trump’

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By Jason Cohen

Republican pollster Lee Carter and Democratic pollster Carly Cooperman on Friday said that independent candidate Robert F. Kennedy Jr.’s endorsement of former President Donald Trump could significantly boost his campaign.

Kennedy announced during a Friday speech that he would suspend his campaign and endorse Trump in states where he is not on the ballot, only withdrawing his name from consideration in key battleground states as not to spoil the vote. Carter and Cooperman, on “Your World With Neil Cavuto,” said that in such a close election, the votes that Trump could gain from Kennedy’s decision might boost his chances of defeating Vice President Kamala Harris.

WATCH:

“When you’re looking at these battleground states, we’re looking at averages where Donald Trump might be ahead by 0.2%, and just getting some of those votes could have a really big impact. And I think RFK Jr. knows this,” Carter said. “He was very, very keen to say, ‘I am withdrawing my name from these 10 states because I know it can have an impact.’ And so I think there is a very, very clear directive here.”

“It’s absolutely the case that the polls in these swing states show that with RFK removed, there is a small advantage that goes to Donald Trump. And in these states, every single vote really does matter. This makes a lot of sense,” Cooperman said. “Democrats are far more enthusiastic about Kamala Harris as their presidential candidate than they were about Joe Biden. And so you’re seeing much more coalescing among Democrats for Kamala, and therefore the support that RFK was getting in the most recent polls was certainly going to help Trump more so with him removed from it.”

Cooperman also noted “there is uncertainty” about what Kennedy’s supporters will do in November.

“It’s going to really depend, what are these voters going to do? Are they going to stay home or are they going to throw their support behind Donald Trump? I’m very curious now to see how RFK Jr. is integrated into Donald Trump’s campaign and what kind of role they’re going to talk about for him and how they might use this,” Carter added.

“I think Donald Trump’s got to return himself to sort of the underdog status that would help to get those RFK Jr. supporters on his side,” the Republican pollster said.

Kennedy’s support plunged to as low as 2% as of early August, according to an Economist/YouGov poll. Trump is presently beating Harris in the main battleground states by 0.1%, according to the RealClearPoltics average.

A “Morning Joe” panel sounded the alarm on Friday about how difficult it will be for Harris to beat Trump, with the race being so tight and the former president historically outperforming polls on election day.

“You got to look at states like North Carolina and Arizona and, of course, Georgia. Now, you may get a break with minority voting down in Georgia, but you could also come up short in Pennsylvania and not quite win in North Carolina,” former MSNBC host Chris Matthews said. “This could squeak. This could be the toughest election, because if Pennsylvania doesn’t go the Democratic way and North Carolina doesn’t go that way, it’s tough, it’s really tough.”

Business

Will Paramount turn the tide of legacy media and entertainment?

From the Daily Caller News Foundation

The recent leadership changes at Paramount Skydance suggest that the company may finally be ready to correct course after years of ideological drift, cultural activism posing as programming, and a pattern of self-inflicted financial and reputational damage.

Nowhere was this problem more visible than at CBS News, which for years operated as one of the most partisan and combative news organizations. Let’s be honest, CBS was the worst of an already left biased industry that stopped at nothing to censor conservatives. The network seemed committed to the idea that its viewers needed to be guided, corrected, or morally shaped by its editorial decisions.

This culminated in the CBS and 60 Minutes segment with Kamala Harris that was so heavily manipulated and so structurally misleading that it triggered widespread backlash and ultimately forced Paramount to settle a $16 million dispute with Donald Trump. That was not merely a legal or contractual problem. It was an institutional failure that demonstrated the degree to which political advocacy had overtaken journalistic integrity.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

For many longtime viewers across the political spectrum, that episode represented a clear breaking point. It became impossible to argue that CBS News was simply leaning left. It was operating with a mission orientation that prioritized shaping narratives rather than reporting truth. As a result, trust collapsed. Many of us who once had long-term professional, commercial, or intellectual ties to Paramount and CBS walked away.

David Ellison’s acquisition of Paramount marks the most consequential change to the studio’s identity in a generation. Ellison is not anchored to the old Hollywood ecosystem where cultural signaling and activist messaging were considered more important than story, audience appeal, or shareholder value.

His professional history in film and strategic business management suggests an approach grounded in commercial performance, audience trust, and brand rebuilding rather than ideological identity. That shift matters because Paramount has spent years creating content and news coverage that seemed designed to provoke or instruct viewers rather than entertain or inform them. It was an approach that drained goodwill, eroded market share, and drove entire segments of the viewing public elsewhere.

The appointment of Bari Weiss as the new chief editor of CBS News is so significant. Weiss has built her reputation on rejecting ideological conformity imposed from either side. She has consistently spoken out against antisemitism and the moral disorientation that emerges when institutions prioritize political messaging over honesty.

Her brand centers on the belief that journalism should clarify rather than obscure. During President Trump’s recent 60 Minutes interview, he praised Weiss as a “great person” and credited her with helping restore integrity and editorial seriousness inside CBS. That moment signaled something important. Paramount is no longer simply rearranging executives. It is rethinking identity.

The appointment of Makan Delrahim as Chief Legal Officer was an early indicator. Delrahim’s background at the Department of Justice, where he led antitrust enforcement, signals seriousness about governance, compliance, and restoring institutional discipline.

But the deeper and more meaningful shift is occurring at the ownership and editorial levels, where the most politically charged parts of Paramount’s portfolio may finally be shedding the habits that alienated millions of viewers.The transformation will not be immediate. Institutions develop habits, internal cultures, and incentive structures that resist correction. There will be internal opposition, particularly from staff and producers who benefited from the ideological culture that defined CBS News in recent years.

There will be critics in Hollywood who see any shift toward balance as a threat to their influence. And there will be outside voices who will insist that any move away from their preferred political posture is regression.

But genuine reform never begins with instant consensus. It begins with leadership willing to be clear about the mission.

Paramount has the opportunity to reclaim what once made it extraordinary. Not as a symbol. Not as a message distribution vehicle. But as a studio that understands that good storytelling and credible reporting are not partisan aims. They are universal aims. Entertainment succeeds when it connects with audiences rather than instructing them. Journalism succeeds when it pursues truth rather than victory.

In an era when audiences have more viewing choices than at any time in history, trust is an economic asset. Viewers are sophisticated. They recognize when they are being lectured rather than engaged. They know when editorial goals are political rather than informational. And they are willing to reward any institution that treats them with respect.

There is now reason to believe Paramount understands this. The leadership is changing. The tone is changing. The incentives are being reassessed.

It is not the final outcome. But it is a real beginning. As the great Winston Churchill once said; “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning”.

For the first time in a long time, the door to cultural realignment in legacy media is open. And Paramount is standing at the threshold and has the capability to become a market leader once again. If Paramount acts, the industry will follow.

Bill Flaig and Tom Carter are the Co-Founders of The American Conservatives Values ETF, Ticker Symbol ACVF traded on the New York Stock Exchange. Ticker Symbol ACVF

Learn more at www.InvestConservative.com

Daily Caller

Laura Ingraham’s Viral Clash With Trump Prompts Her To Tell Real Reasons China Sends Students To US

From the Daily Caller News Foundation

On Monday, Ingraham pressed Trump on why a plan to admit 600,000 Chinese nationals into U.S. universities qualifies as a “pro-MAGA” move, challenging him directly after he defended the influx as vital to maintaining Washington’s relationship with Beijing. During a Wednesday broadcast, Ingraham said no modern president has fought harder for American workers than Trump and predicted he will “honor that distinction for the next three years.”

“There was also more consternation over the approach to allowing Chinese and other foreign students to take spots at U.S. universities. A lot of MAGA folks didn’t like that at all. And it’s not, by the way, as some Chinese influencers today said on X, I love this, it’s not that the MAGA folks, certainly not myself, dislike the Chinese people. It’s ridiculous,” Ingraham said.

“What they dislike is the Chinese system that represses Chinese people and uses them as human spies and saboteurs. Remember, when the CCP greenlights hundreds of thousands of their people to come study here, they’re not sending them so they can learn about the wonders of Western civilization, Plato and Socrates, Greek history, become champions of individual freedom and take that message back home. They’re sent here to do whatever is necessary to learn how to push the People’s Republic closer to crushing America, to stealing from us, and for spying on us,” Ingraham added.

Ingraham said that people “understandably perplexed by some of the president’s comments, we cannot forget, what American president has ever been tougher on China than Donald Trump? None.”

Ingraham told viewers that Beijing does not send its students to America to study the Western canon or return home as advocates of individual liberty.

WATCH:

Ingraham warned that China’s rise didn’t happen overnight, saying that decades of inattentive presidents allowed Beijing to gain the strength Trump now must confront.

“Given China’s growing strength that’s been amassed over decades of presidents who were out to lunch, President Trump inherited the most challenging situation,” Ingraham said. “I don’t think it’s an exaggeration to say this, that any president has faced in the last 50 years. He and his entire team are dedicated to countering the Chinese aggression that’s building.”

Washington and Beijing struck a deal in June clearing the way for Chinese nationals to enroll in American universities, a shift that followed the administration’s June 5 move blocking Harvard from bringing in additional international students. Officials justified the restriction by pointing to security vulnerabilities and rising campus turmoil, including allegations of antisemitic activity, as reasons to tighten the flow of foreign applicants.

Trump acknowledged at the time that admitting large numbers of students from a country controlled by the Chinese Communist Party carries real intelligence concerns, saying in June that the government “must be vigilant” about who enters U.S. classrooms. National security experts told the Daily Caller News Foundation that the policy could create openings for the CCP to exploit America’s higher-education system and potentially endanger U.S. interests.

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

Business2 days ago

Business2 days agoSluggish homebuilding will have far-reaching effects on Canada’s economy

-

Business2 days ago

Business2 days agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

Business13 hours ago

Business13 hours agoParliamentary Budget Officer begs Carney to cut back on spending

-

International1 day ago

International1 day agoBondi and Patel deliver explosive “Clinton Corruption Files” to Congress

-

International1 day ago

International1 day agoUS announces Operation Southern Spear, targeting narco-terrorists

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoEU’s “Democracy Shield” Centralizes Control Over Online Speech

-

Business2 days ago

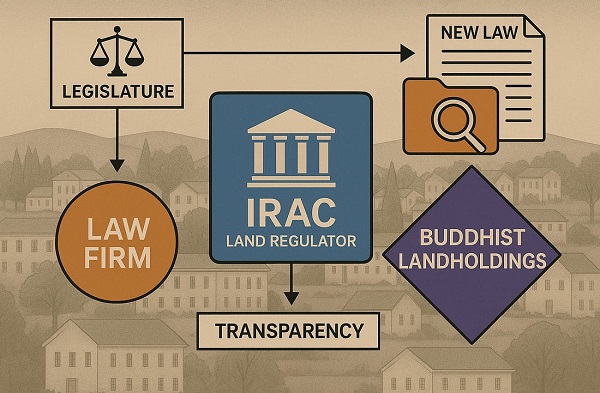

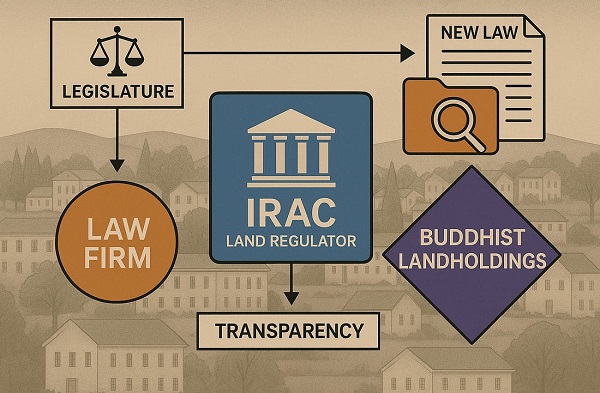

Business2 days agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation