Opinion

PM Trudeau’s “Monetary Policy” gaffe could cost the Liberals the election. But will it?

Back in 1993 things were not going well for Canada’s Progressive Conservative Government. Brian Mulroney’s government had served 2 mandates and Canadians were clearly ready to move on. The Conservatives decided Kim Campbell would be the best leader to bring a renewed excitement to their reelection hopes. Campbell was a fresh face and that was important to the party which was losing support quickly. She was also from Vancouver, which was a nice change for the party normally represented by leaders from Ontario or Quebec. Even more importantly, when she won the leadership she would become the first female leader of a country in North America. As Canadians would discover just a few months later though, no one cared about any of that. That campaign did not go well. The Conservatives not only lost. They were decimated right out of official party standing. The governing party won just 2 seats in the entire nation (Jean Charest in Quebec, and Elsie Wayne in New Brunswick). Kim Campbell did not even win her own seat. Henceforth the Reform Party represented the Conservative voice for the next two elections.

For one reason or another, Canadians simply did not connect with Kim Campbell. One of the biggest gaffes of that election campaign came when a reporter pressed Campbell for details on an issue and she replied “The election is not a time to discuss serious issues.” That was the wrong answer. Despite what she may have truly meant, all Canadians heard was “I don’t need to explain anything to you.”. That was exactly the wrong thing to say at the worst possible time.

Why bring this up now, 28 years later? Well Prime Minister Justin Trudeau has made his first major gaffe of this election campaign. And for those who care about monetary policy (which should be everyone who pays taxes and works or has savings, etc) it’s very likely as stunning a statement as Kim Campbell made three decades ago.

First some background. In 2021, Canadians find themselves in an astounding situation. When the covid pandemic hit last year governments all over the world shut down their economies for weeks, and then months. Government stimulus was the order of the day and Canada’s was among the most generous in the world. People were paid to stay at home. Businesses were paid to continue to provide jobs to people working from home. Landlords were paid to keep tenants afloat. All in all, government money is being spent at unprecedented rates.

To pay for all this the Trudeau government attempted to pass a bill through Parliament which would allow it to raise taxes at will without a budget and without even coming back to ask Parliament to present a plan or ask for approval. That didn’t go over so well. But instead of turning back the taps, or introducing a budget with higher taxes the government worked out a plan with the Bank of Canada. How this works basically is that every month the Bank of Canada prints out a few billion dollars, and the government uses that to pay for all the stimulus they want. Over the first year of covid that totalled about 350 Billion dollars!

The Bank of Canada has left the core function expressed in its mandate in order to print all this extra money. Despite it’s best efforts to decouple inflation from the printing of extra money, it’s not working. Canada’s inflation rate has been blowing through the target of 2% month after month after month.

This is the the mandate as expressed by the Bank of Canada itself on its website.

The Bank of Canada is the nation’s central bank. Its mandate, as defined in the Bank of Canada Act, is “to promote the economic and financial welfare of Canada.” The Bank’s vision is to be a leading central bank—dynamic, engaged and trusted—committed to a better Canada.

The Bank has four core functions:

- Monetary policy: The Bank’s monetary policy framework aims to keep inflation low, stable and predictable.

- Financial system: The Bank promotes safe, sound and efficient financial systems within Canada and internationally.

- Currency: The Bank designs, issues and distributes Canada’s bank notes.

- Funds management: The Bank acts as fiscal agent for the Government of Canada, managing its public debt programs and foreign exchange reserves.

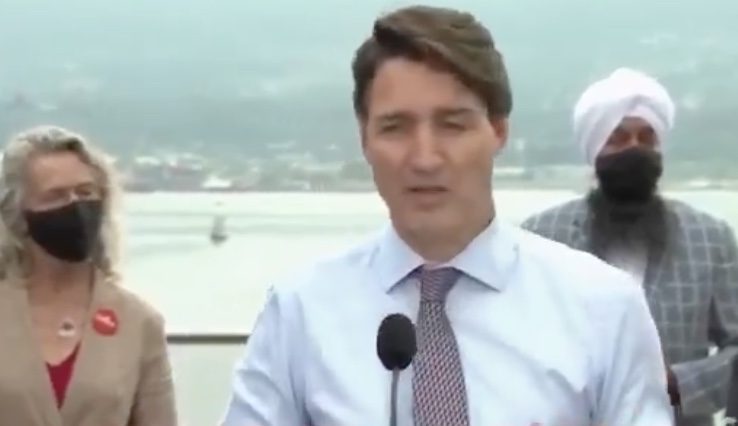

The Bank of Canada’s mandate is expiring at the end of this year and the new mandate could change. Some are saying the Bank should continue to print money at an unprecedented rate and Canadians will learn to live with high inflation. Considering this drives up the cost of everything from our homes and vehicles, to the food we eat there could hardly be a more important issue. That’s why PM Trudeau’s response to this question in Vancouver this week is so stunning. When asked if he would consider a higher tolerance for inflation going forward here’s what he said.

Reporter Question about the renewal of the Bank of Canada mandate due at the end of 2021:

-Do you have thoughts about that mandate? Would you consider a slightly higher tolerance for inflation?

Prime Minister Justin Trudeau: “When I think about the biggest, most important economic policy this government, if re-elected, would move forward, you’ll forgive me if I don’t think about monetary policy.”

Of course this spurred an immediate reaction from the opposition Conservatives. That oppostion is perhaps best summed up in this address from Pierre Poilievre.

The question is, will Canadians punish Prime Minister Trudeau for either lacking basic economic knowledge, or not caring about it? Kim Campbell failed to win her own seat, but she did not seem to connect well with Canadians at all even before that election campaign. Justin Trudeau has so far been immune to gaffes. Even though he’s had more than 5 years in government, millions of Canadians stand by him loyally. Will this time be any different?

Disaster

Texas flood kills 43 including children at Christian camp

Quick Hit:

Flash flooding in Kerr County, Texas has left at least 43 people dead—including 15 children—after a wall of water tore through camps and neighborhoods along the Guadalupe River. Among the victims were young girls attending a Christian summer camp, as families grieve and recovery efforts intensify.

Key Details:

- Officials confirmed Saturday that 43 people have died—28 adults and 15 children—following early Friday morning floods in Kerr County. Seventeen victims remain unidentified.

- Four young girls who died—ages 8 and 9—were attending Camp Mystic, a nearly 100-year-old Christian summer camp for girls. Dozens of campers were briefly unaccounted for.

- The camp’s director, Dick Eastland, was among the dead after reportedly racing to a cabin in an effort to save girls trapped in rising waters. Another local camp director also died.

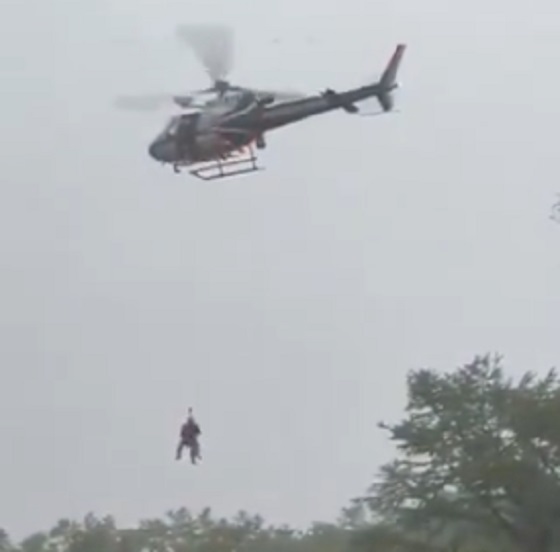

Air rescue missions like this are being done around the clock.

We will not stop until everyone is accounted for. pic.twitter.com/tqwTr1RkEi

— Greg Abbott (@GregAbbott_TX) July 4, 2025

Diving Deeper:

Texas is reeling from one of the deadliest flash floods in recent memory, with at least 43 confirmed dead—including 15 children—after floodwaters surged through Kerr County early Friday morning. Officials said 12 adults and five children have yet to be identified.

Much of the devastation centered around the historic Camp Mystic, a Christian summer camp for girls situated along the Guadalupe River, where dozens of campers were swept up in the flood. Family members have since confirmed that four of the victims—8-year-olds Renee Smajstrla and Sarah Marsh, and 9-year-olds Janie Hunt and Lila Bonner—had been attending the camp.

Renee’s uncle reportedly wrote on Facebook that she was “living her best life at Camp Mystic.” Sarah’s family shared that the Alabama girl was “a spunky ray of light,” while Lila’s relatives described their pain as “unimaginable.”

The camp’s longtime director, Dick Eastland, died heroically while trying to rescue girls from a cabin as waters rushed through the grounds. Another director, Jane Ragsdale of the nearby Heart O’ the Hills Camp, was also killed. Though her camp wasn’t in session, she was on the property when the flood struck.

Camp Mystic, which serves hundreds of girls each summer, was left in ruins. “The camp was completely destroyed,” said 13-year-old Elinor Lester, who was among those rescued. Photos show cabins torn open, trees ripped from the ground, and bunk beds submerged nearly to the top by river water.

As many as 27 girls at the camp were swept up by the flooding, but several have since been reunited with their families. Ashley Flack, whose daughter attended Mystic, said Saturday, “There are lots of families missing, children and friends… Our daughter is safe. Our son is safe. The operation to get the girl camp out did a good job.”

Rescue missions pulled at least 858 people to safety, and eight were reported injured. Officials noted that while other nearby camps were also impacted, those campers have been accounted for and are awaiting evacuation as crews work to repair damaged roads.

Texas Governor Greg Abbott expanded a disaster declaration on Saturday to include 21 counties. More than 1,000 state personnel and 800 vehicles are assisting in rescue and recovery, while FEMA, the Texas National Guard, and Coast Guard aircraft have been deployed to aid in the search.

President Trump posted on Truth Social Saturday, saying: “Melania and I are praying for all of the families impacted by this horrible tragedy. Our Brave First Responders are on site doing what they do best. GOD BLESS THE FAMILIES, AND GOD BLESS TEXAS!”

Forecasters say more rain could fall over the next 48 hours, raising the risk of additional flooding across Central Texas. The Guadalupe River last saw similar tragedy in 1987, when 10 teenagers died after a church bus was swept away.

Daily Caller

Trump’s One Big Beautiful Bill Resets The Energy Policy Playing Field

From the Daily Caller News Foundation

Make no mistake about it, the One Big Beautiful Bill Act (OBBBA) signed into law on Friday by President Donald Trump falls neatly in line with the Trump energy and climate agenda. Despite complaints by critics of the deal that Majority Leader John Thune struck with Alaska Sen. Lisa Murkowski to soften the bill’s effort to end wind and solar subsidies from the Orwellian 2022 Inflation Reduction Act, the OBBBA continues – indeed, accelerates – the Trumpian energy revolution.

Leaders in the oil and gas industry, hamstrung at every opportunity by the Biden presidency, hailed the bill as a chance to move back into some semblance of boom times. Tim Stewart, President of the U.S. Oil and Gas Association, told his members in a memo that, “For the oil and gas industry, the bill…signals a transformative opportunity to enhance domestic production.”

API CEO Mike Sommers also praised the OBBBA as a positive step for his members: “This historic legislation will help usher in a new era of energy dominance by unlocking opportunities for investment, opening lease sales and expanding access to oil and natural gas development.

While leaders of organizations like those must curb their enthusiasm to some extent in their public statements, they and their peers must be somewhat amazed at how much real substantive change the thin GOP majorities shepherded by Thune and House Speaker Mike Johnson managed to stuff into this bill. This industry, historically an easily demonized bogeyman for Democrats and too often ignored by previous Republican presidents, does not experience days as encouraging as July 3 was in the nation’s capital.

Even so, many Republicans, especially in the House, remained unsatisfied by amendments the Senate made to the bill related to IRA subsidy rollbacks. To help Speaker Johnson hold the party’s narrow House majority together, President Trump committed the executive branch to strict enforcement of the new limitations, and promised the White House will work with congressional allies to move a major deregulation package ahead of the 2026 midterm elections.

But the OBBBA as passed is chock full of energy and environment-related provisions. FTI Consulting, a business consultancy with a major presence in Washington, DC, published a quick analysis Thursday that projects natural gas and nuclear as the biggest winners as the OBBBA’s impacts begin to take hold across the United States. Interestingly, the analysis also projects battery storage to expand more rapidly over the next five years even as wind and solar suffer from the phasing-out of their IRA subsidies.

The side deal struck by Thune and Murkowski is likely to result in significant new investment into wind and solar facilities as developers strive to get as many projects on the books as possible to meet the “commenced construction” requirement by the July 4, 2026 deadline. The bill’s previous language would have required projects to be placed into service by that time. But even that softer requirement will almost certainly cause a flow of capital investment out of wind and solar once that deadline passes, given the reality that many of their projects are not sustainable without constant flows of government subsidies.

What it all means is that the OBBBA, combined with all the administration’s prior moves to radically shift the direction of federal energy and climate policy away from intermittent energy and electric vehicles back to traditional forms of power generation and internal combustion cars, effectively reset the policy playing field back to 2019, prior to the COVID pandemic. That was a time when America had become as energy independent as it had been in well over half a century and was approaching the “Energy Dominance” position so dear to President Trump’s heart.

Trump’s signing of the OBBBA gives the oil and gas, nuclear, and even the coal industry a chance at a do over. It is an opportunity that comes with great pressure, both from government and the public, to perform. That means rapid expansion in gas power generation unseen in 20 years, rapid development of next generation nuclear, and even a probable chance to permit and build new coal capacity in the near future.

Second chances like this do not come around often. If these great industries fail to grab this brass ring and run with it, it may never come around again. Let’s go, folks.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

Alberta2 days ago

Alberta2 days agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

armed forces2 days ago

armed forces2 days agoCanada’s Military Can’t Be Fixed With Cash Alone

-

Business2 days ago

Business2 days agoCarney’s spending makes Trudeau look like a cheapskate

-

Business2 days ago

Business2 days agoCanada’s loyalty to globalism is bleeding our economy dry

-

International2 days ago

International2 days agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Alberta2 days ago

Alberta2 days agoAlberta Next: Alberta Pension Plan

-

Alberta2 days ago

Alberta2 days agoAlberta uncorks new rules for liquor and cannabis

-

Business14 hours ago

Business14 hours agoDallas mayor invites NYers to first ‘sanctuary city from socialism’