Business

Plan to delay federal budget makes it harder for Canadians to track spending and debt

From the Fraser Institute

By Jake Fuss and Grady Munro

Although Parliament is set to return next week for the first time in more than five months, Canadians are being asked for even more patience when it comes to a federal budget.

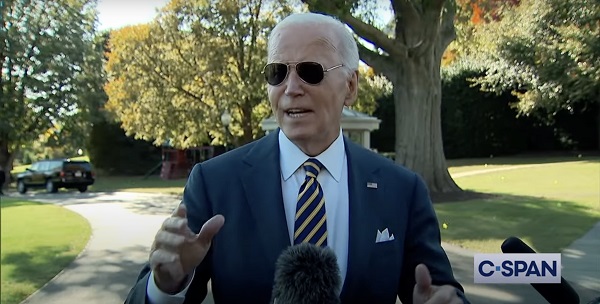

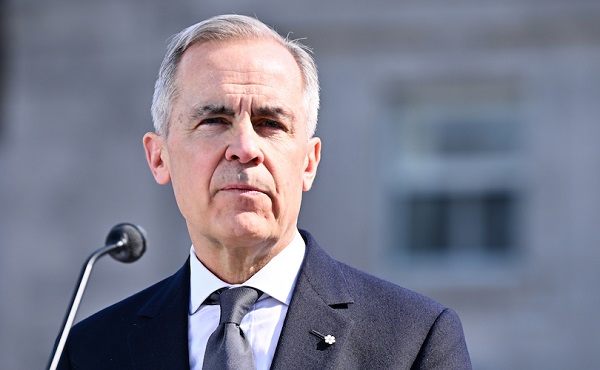

Last week, after conflicting messages from his finance minister, Prime Minister Mark Carney said his government will table a budget in the fall. While this is better than the government’s original plan to punt the budget into 2026, it’s still a long time to wait. Past federal governments have been able to quickly turn around a budget following an election. There’s no simply no reason why the government can’t deliver a budget within the next few months. Clearly, fiscal transparency and accountability are not high priorities for the Carney government.

While the federal government is not legislatively required to release a budget in the spring—spending is functionally approved in Parliament through periodic votes (the next vote is scheduled for June)—the budget provides a comprehensive and accessible outline of federal spending, taxing and borrowing plans now and for the coming years. In other words, an annual budget is a critically important financial and democratic document that informs Canadians on their government’s fiscal plan.

Budgets also help the public hold the government accountable to its campaign commitments. Without a budget, it’s virtually impossible for Canadians to know whether or not the government is actually staying true to its promises. For instance, the Carney government could run bigger deficits and accumulate more debt than promised, but Canadians would have little way of knowing. This only adds to the uncertainty around the government’s plan for certain key areas of policy—contradicting Prime Minister Carney’s promise of an “action-oriented” government that moves quickly.

The budget also allows parliamentarians to understand how the estimates and policies they vote on will impact the state of federal finances. For instance, the Carney government plans to cut income taxes, which will have a big impact on government finances. But without a timely budget, parliamentarians may not have the necessary information to make informed decisions on behalf of their constituents. Incidentally, the Trudeau government delayed the release of important fiscal documents to push off bad news until it garners less attention from the media and the public, and there’s reason to believe the Carney government is doing the same thing now.

The Liberal election platform—which currently provides the only indication of the new government’s fiscal plan—promises higher spending, larger deficits and more debt than the Trudeau government had planned in its last fiscal update. This flies in the face of Prime Minister Carney’s promise of a “very different approach” to fiscal policy. The Carney government also plans to split federal spending into two separate budgets: an operating budget and capital budget. This will further reduce government transparency by making it more difficult to identify the actual size of the deficit, while also giving the government leeway to get creative with its accounting.

Prime Minister Carney promised a new responsible approach to government finances. However, he’s off to a poor start on delivering this promise.

Business

New Towns Offer a Solution to Canada’s Housing Crisis

The postwar Canadian Dream: Don Mills, unveiled in 1953, was Canada’s first self-contained, suburban New Town. The brainchild of industrialist E.P. Taylor (top right), it offered young Canadian families the opportunity to abandon hectic downtown living for a more bucolic lifestyle in the suburbs.

By John Roe

Prime Minister Mark Carney says his plan to end Canada’s interminable housing crisis is to “Build Baby Build”. We can hope.

Unfortunately, Carney’s current plan is little more than a collection of unproven proposals and old policy mistakes including modular homes, boutique tax breaks, billions of taxpayer dollars in loans or subsidies and a new federal building authority.

The enormity of the task demands much broader thinking. Rather than simply encouraging a stacked townhouse here, and a condo there, Canada needs to remember what has worked in the past. And what other countries are doing today. With this in mind, Carney should embrace New Towns.

Also known as Garden Cities or Satellite Cities, New Towns are brand-new, planned communities of 10,000 or more citizens and that stand apart from existing urban centres. These are more than the suburbs reflexively loathed by so many planners and environmentalists. Rather, New Towns can offer a diverse mixture of living options, ranging from ground-level housing to built-to-purpose rental apartments and condominiums. As self-contained communities, they include schools, community centres along with shopping and employment opportunities.

New Towns represent the marriage of inspired utopianism with pragmatic realism. And they can provide the home so many of us crave.

Originally conceived in Britain during the Industrial Age, Canada witnessed its own New Town building boom during the post-war era. Communities built in the 1950s and 1960s including Don Mills, Bramalea, and Erin Mills in Ontario were all designed as separate entities meant to relieve population pressure on nearby Toronto. Other New Towns took advantage of new resource opportunities. Examples here including Thompson, Manitoba which sprang up around a nickel mine, and Kitimat, B.C., which was built to house workers in the aluminum industry.

While New Town development largely died off in the 1970s and 1980s, it is enjoying a revival today in many other countries.

Facing his own housing crisis and building on his country’s past experience, British Labour Prime Minister Keir Starmer has established a New Towns Taskforce that will soon choose 12 sites where construction on new communities will begin by 2029.

On the other side of the Atlantic — and the political spectrum — U.S. President Donald Trump — has proposed awarding 10 new city charters for building New Towns on underdeveloped federal land.

Meanwhile, several Silicon Valley billionaires are backing Solano, a planned city 60 miles east of San Francisco with a goal of creating a new community of up to 400,000 people by 2040. And Elon Musk is already building a New Town at Starbase, Texas as the headquarters for his SpaceX rocket firm.

To be fair, not every New Town has been a success. In the late 1960s, Ontario tried to build a brand-new city on the shores of Lake Erie known as Townsend. Planned as a home for up to 100,000 people, the project fizzled for a variety of reasons, including a lack of proper transportation links and other important infrastructure, such as schools or a hospital. Today, fewer than 1,000 people live there.

Despite the lessons of the past, there are three compelling reasons why Carney should include New Towns as part of his solution to Canada’s housing crisis.

First, by starting with a blank canvas, a New Town offers the chance to avoid the stultifying NIMBYism of existing home owners and municipal officials who often stand in the way of new development. The status quo is one of the biggest obstacles to ending the housing crisis, and New Towns are by their very nature new.

Second, because New Towns are located outside existing urban centres, they offer the promise of delivering ground-level homes with a yard and driveway that so many young Canadians say they want. Focusing growth exclusively in existing urban centres such as Toronto, Vancouver and Montreal – as Carney seems to be doing – will deliver greater density, but not fulfil the housing dreams of Canadian families.

Third, New Towns can herald a more prosperous and unified Canada for the 21 st century. New Towns could be built in regions such as Ontario’s Ring of Fire, rich with minerals the world demands. New Towns could also tighten the east-west ties that bind the country together. Further, this growth can be focused on areas with marginal farmland, such as the Canadian Shield, which in Ontario starts just a 90 minute drive north of

Toronto.

New Towns are already beginning to pop up in Canada. In 2017, for example, construction began on Seaton Community, a satellite town adjacent to Pickering Ontario that will eventually grow into six neighbourhoods with up to 70,000 residents. And this spring, the southwestern Ontario municipality of Central Elgin unveiled plans for a New Town of 9,000 residents on the edge of St. Thomas.

Having promised Canadians fast and decisive “elbows up” leadership, our prime minister should throw his weight behind New Towns. To begin, he could appoint a New Town Task Force, similar to the one in Britain to get to work identifying potential locations. Even better, he could simply say his government thinks New Towns are a good idea and let the private sector do all the heavy lifting.

If the millions of Canadians currently shut out of the housing market are to have any chance at owning the home of their dreams, New Towns need to be in the mix.

John Roe is a Kitchener, Ont. freelance writer and former editorial page editor of the Waterloo Region Record. The original and longer version of this story first appeared at C2CJournal.ca

Business

MPs take six-figure send off

News release from the Canadian Taxpayers Federation

Don’t feel too bad for politicians who lost the election because they’re still cashing in big time at your expense.

Defeated or retiring MPs will take about $5 million in annual pension payments from taxpayers. That totals about $187 million by the time they reach the age 90.

The former MPs who didn’t qualify for a pension (because they served for less than six year or are younger than 55) won’t be leaving empty handed.

The severance payment for a former backbencher is just shy of $105,000. There were three MPs who served for less than one year and will still collect a severance. The total severance payments for former MPs will cost taxpayers like you $6.6 million this year.

There are 13 MPs who will take more than $100,000 per year in pensions. The largest annual pension goes to Prince Edward Island’s Lawrence MacAulay, who will take $171,000 in pension payments every year.

If you thought that was bad, just wait until you hear about the golden parachute that is strapped to former prime minister Justin Trudeau.

Trudeau is collecting not one, but TWO pensions from you.

Combined, Trudeau’s two pensions will cost taxpayers $8.4 million, according to CTF estimates. His first pension will cost Canadians $141,000 per year, starting as soon as he turns 55. That first pension will cost taxpayers a total of $6.5 million if he lives to 90.

The second pension is a special bonus just for former prime ministers. It will kick in when Trudeau reaches 67 years old. He’ll be lining his pockets with an extra $73,000 per year, which shakes out to $1.9 million by the time he’s 90 years old.

That’s right. Even after leaving office Trudeau will continue to cost you millions of dollars over the coming years.

Trudeau is also getting a severance payment of $104,900.

So don’t feel too bad for the politicians who you fired during the last election.

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoNew AI Model Would Rather Ruin Your Life Than Be Turned Off, Researchers Say

-

Energy2 days ago

Energy2 days agoTrump signs executive orders to help nuclear industry in U.S.

-

International2 days ago

International2 days agoSecDef Hegseth orders “comprehensive review” of Biden Afghanistan withdrawal

-

Business2 days ago

Business2 days agoThe promise and peril of Canadian energy corridors

-

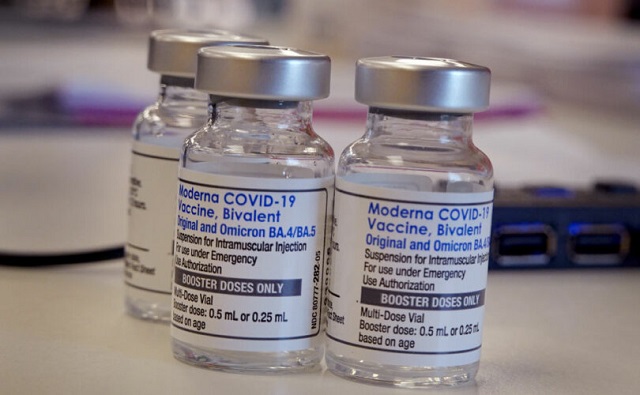

COVID-191 day ago

COVID-191 day agoFDA says Pfizer, Moderna must expand warnings for COVID shots to young men

-

International2 days ago

International2 days agoHarvard sues Trump Administration over foreign student ban

-

International2 days ago

International2 days agoWho really ran the country under Biden?

-

Business2 days ago

Business2 days agoBill would prevent congressional members from trading stocks