Business

Pay increase for Governor General since 2019 is more than average Canadian annual salary

From the Canadian Taxpayers Federation

By Ryan Thorpe

The salary for Canada’s Governor General has skyrocketed by just over $75,000 since 2019. Meanwhile the average annual salary among all full-time workers in Canada was roughly $70,000 in 2024

Governor General Mary Simon pocketed a $15,200 pay raise this year, bumping her annual salary for 2025 up to $378,000.

This marks Simon’s fourth pay raise since she was appointed governor general in 2021, meaning she now makes $49,300 more than when she took on the role.

“Can anyone in government explain how Canadians are getting more value from the governor general, because her taxpayer-funded salary just increased by more than $1,200 a month,” said Franco Terrazzano, CTF Federal Director. “The automatic-pay-raise culture in Ottawa is ridiculous and politicians and bureaucrats shouldn’t expect more money every year just because they’re on the taxpayer payroll.”

The Canadian Taxpayers Federation confirmed Simon’s current salary and the details of her latest pay raise with the Privy Council Office.

“For 2025, the Governor General’s salary, which is determined in accordance with the provisions of the Governor General’s Act … is $378,000,” a PCO spokesperson told the CTF.

The federal government hiked the governor general’s annual salary by $75,200 (or 25 per cent) since 2019.

Meanwhile, the average annual salary among all full-time workers in Canada was roughly $70,000 in 2024, according to Statistics Canada data.

“Canadians can’t afford to keep paying more for a largely symbolic role,” Terrazzano said. “The governor general already takes a huge taxpayer-funded salary and she should show leadership by refusing this year’s pay hike.”

On top of the $378,000 annual salary, the governor general receives a range of lucrative perks, including a taxpayer-funded mansion, a platinum pension, a clothing budget, paid dry cleaning services and lavish travel expenses.

Former governors general are eligible for a full pension, of about $150,000 a year, regardless of how long they serve in office.

Even though Simon’s predecessor, Julie Payette, served in the role for a little more than three years, she will receive an estimated $4.8 million if she collects her pension till the age of 90.

The CTF estimates that Canada’s five former governors general will receive more than $18 million if they collect their pensions until the age of 90.

Even after leaving office, former governors general can also expense taxpayers for up to $206,000 annually for the rest of their lives, continuing up to six months after their deaths.

In May 2023, the National Post reported the governor general can expense up to $130,000 in clothing during their five-year mandates, with a $60,000 cap during the first year.

Simon and Payette combined to expense $88,000 in clothing since 2017, including a velvet dress with silk lining, designer gloves, suits, shoes and scarves, among other items.

Rideau Hall expensed $117,000 in dry-cleaning services since 2018, despite having in-house staff responsible for laundry – an average dry cleaning tab of more than $1,800 per month.

In 2022, Simon’s first full year on the job, she spent $2.7 million on travel, according to government records obtained by the CTF.

Simon’s travel has sparked multiple controversies, including a $100,000 bill for in-flight catering during a weeklong trip to the Middle East, and her $71,000 bill at IceLimo Luxury Travel during a four-day trip to Iceland.

“Platinum pay and perks for the governor general should have been reined in a long time ago,” Terrazzano said. “The government should stop rubberstamping pay raises for the governor general every year, end the expense account for former governors general, reform the platinum pension, scrap the clothing allowance and cut all international travel except for meetings with the monarchy.”

Table: Annual Governor General Salary, per PCO data

|

Year |

GG Salary |

|

2019 |

$302,800 |

|

2020 |

$310,100 |

|

2021 |

$328,700 |

|

2022 |

$342,100 |

|

2023 |

$351,600 |

|

2024 |

$362,800 |

|

2025 |

$378,000 |

Business

Top Canadian bank ditches UN-backed ‘net zero’ climate goals it helped create

From LifeSiteNews

RBC’s dropping of its ‘net zero’ finance targets came just one day after the Liberal Party under Mark Carney was re-elected in Canada.

Just one day after the re-election of the Liberal Party under Mark Carney, the Royal Bank of Canada joined the growing list of top banks withdrawing from a United Nations-backed “net zero” alliance that supports the eventual elimination of the nation’s oil and gas industry in the name of “climate change.”

The Royal Bank of Canada (RBC) on Tuesday quietly dumped its UN-backed Net-Zero Banking Alliance (NZBA) sustainable finance targets, which called for banks to come in line with the push for net-zero carbon emissions by 2050. The NZBA is a subgroup of the Glasgow Financial Alliance for Net Zero (GFANZ), which Carney was co-chair of until recently.

RBC’s departure comes despite the fact that it was one of the NZBA’s founding members.

RBC joins Toronto-Dominion Bank (TD), Bank of Montreal (BMO), National Bank of Canada, and the Canadian Imperial Bank of Commerce (CIBC) who earlier in the year said they were withdrawing from the NZBA.

The bank announced the move away from a green agenda in its 2024 sustainability report, noting it would no longer look to pursue a $500 billion sustainable finance goal. It cited changes to Canada’s federal Competition Act as the reason.

The changes to the act, known as the “greenwashing law,” now mandate that companies provide proof of their environmental claims.

“We have reviewed our methodology and have concluded that it may not have appropriately measured certain of our sustainable finance activities,” noted RBC in its report.

RBC also noted it would not make public any of its metrics regarding its energy supply ratio.

Monday’s election saw Liberal leader Carney beat out Conservative rival Poilievre, who also lost his seat. The Conservatives managed to pick up over 20 new seats, however, and Poilievre has vowed to stay on as party leader, for now.

Carney worked as the former governor of the Bank of Canada and Bank of England and spent many years promoting green financial agendas.

The GFANZ was formed in 2021 while Carney was its co-chair. He resigned from his role in the alliance right before he announced he would run for Liberal leadership to replace former Prime Minister Justin Trudeau.

Large U.S. banks such as Morgan Stanley, JPMorgan Chase & Co, Wells Fargo and Bank of America have all withdrawn from the group as well.

Since taking office in 2015, the Liberal government, first under Trudeau and now under Carney, has continued to push a radical environmental agenda in line with those promoted by the World Economic Forum’s “Great Reset” and the United Nations’ “Sustainable Development Goals.” Part of this push includes the promotion of so called net-zero energy by as early as 2035.

Business

Overregulation is choking Canadian businesses, says the MEI

From the Montreal Economic Institute

From the Montreal Economic Institute

The federal government’s growing regulatory burden on businesses is holding Canada back and must be urgently reviewed, argues a new publication from the MEI released this morning.

“Regulation creep is a real thing, and Ottawa has been fuelling it for decades,” says Krystle Wittevrongel, director of research at the MEI and coauthor of the Viewpoint. “Regulations are passed but rarely reviewed, making it burdensome to run a business, or even too costly to get started.”

Between 2006 and 2021, the number of federal regulatory requirements in Canada rose by 37 per cent, from 234,200 to 320,900. This is estimated to have reduced real GDP growth by 1.7 percentage points, employment growth by 1.3 percentage points, and labour productivity by 0.4 percentage points, according to recent Statistics Canada data.

Small businesses are disproportionately impacted by the proliferation of new regulations.

In 2024, firms with fewer than five employees pay over $10,200 per employee in regulatory and red tape compliance costs, compared to roughly $1,400 per employee for businesses with 100 or more employees, according to data from the Canadian Federation of Independent Business.

Overall, Canadian businesses spend 768 million hours a year on compliance, which is equivalent to almost 394,000 full-time jobs. The costs to the economy in 2024 alone were over $51.5 billion.

It is hardly surprising in this context that entrepreneurship in Canada is on the decline. In the year 2000, 3 out of every 1,000 Canadians started a business. By 2022, that rate had fallen to just 1.3, representing a nearly 57 per cent drop since 2000.

The impact of regulation in particular is real: had Ottawa maintained the number of regulations at 2006 levels, Canada would have seen about 10 per cent more business start-ups in 2021, according to Statistics Canada.

The MEI researcher proposes a practical way to reevaluate the necessity of these regulations, applying a model based on the Chrétien government’s 1995 Program Review.

In the 1990s, the federal government launched a review process aimed at reducing federal spending. Over the course of two years, it successfully eliminated $12 billion in federal spending, a reduction of 9.7 per cent, and restored fiscal balance.

A similar approach applied to regulations could help identify rules that are outdated, duplicative, or unjustified.

The publication outlines six key questions to evaluate existing or proposed regulations:

- What is the purpose of the regulation?

- Does it serve the public interest?

- What is the role of the federal government and is its intervention necessary?

- What is the expected economic cost of the regulation?

- Is there a less costly or intrusive way to solve the problem the regulation seeks to address?

- Is there a net benefit?

According to OECD projections, Canada is expected to experience the lowest GDP per capita growth among advanced economies through 2060.

“Canada has just lived through a decade marked by weak growth, stagnant wages, and declining prosperity,” says Ms. Wittevrongel. “If policymakers are serious about reversing this trend, they must start by asking whether existing regulations are doing more harm than good.”

The MEI Viewpoint is available here.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

-

Alberta2 days ago

Alberta2 days agoAlberta’s future in Canada depends on Carney’s greatest fear: Trump or Climate Change

-

Agriculture2 days ago

Agriculture2 days agoLiberal win puts Canada’s farmers and food supply at risk

-

Alberta2 days ago

Alberta2 days agoIt’s On! Alberta Challenging Liberals Unconstitutional and Destructive Net-Zero Legislation

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoThe Liberals torched their own agenda just to cling to power

-

International2 days ago

International2 days agoNigeria, 3 other African countries are deadliest for Christians: report

-

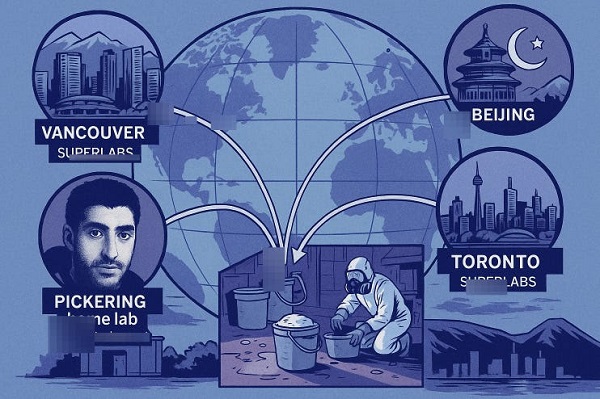

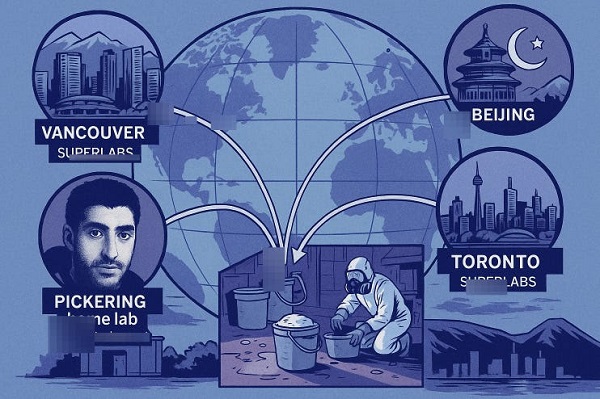

Crime16 hours ago

Crime16 hours agoCanada Blocked DEA Request to Investigate Massive Toronto Carfentanil Seizure for Terror Links

-

COVID-197 hours ago

COVID-197 hours agoTulsi Gabbard says US funded ‘gain-of-function’ research at Wuhan lab at heart of COVID ‘leak’

-

Business1 day ago

Business1 day agoTrump says he expects ‘great relationship’ with Carney, who ‘hated’ him less than Poilievre