Alberta

Oil sands technology competition to generate low emissions carbon fibre moves into final phase

Bryan Helfenbaum, associate vice-president of clean energy with Alberta Innovates, holds a hockey stick made with carbon fibre derived from oil sands bitumen. Photo by Dave Chidley for the Canadian Energy Centre

From the Canadian Energy Centre

By Will Gibson and Deborah Jaremko

Study found carbon fibre made from oil sands bitumen has 69 per cent lower emissions than conventional sources

Having spent most of a long and distinguished academic career working with metals, Weixing Chen became fascinated by the potential of repurposing a heavy hydrocarbon from Alberta’s oil sands into a high-value product for a low-carbon economy.

The product is carbon fibre – thin as human hair but four times stronger than steel – and research has shown producing it from oil sands bitumen generates lower greenhouse gas emissions than today’s sources.

“This is a great opportunity for me to challenge myself moving forward to develop this technology that will benefit society,” says Chen, a chemical and material engineering professor at the University of Alberta.

His team at Edmonton-based Thread Innovations is one of five receiving a total $15 million in funding in the final round of the Carbon Fibre Grand Challenge, announced in December.

Great potential for carbon fibre

With its light weight and high strength, today carbon fibre is used in products like aircraft and spacecraft parts, racing car bodies, bicycles, hockey sticks and golf clubs.

It has great potential, but its use is limited by cost. Carbon fibre averages $10 to $12 per pound, compared to less than $1 per pound for steel.

Part of the Alberta competition is that the carbon fibre derived from oil sands bitumen must cost 50 per cent less than current carbon fibre products.

This would unlock new markets for carbon fibre, says Byran Helfenbaum, associate vice-president of clean energy for Alberta Innovates, which is funding the challenge along with Emissions Reduction Alberta.

“At the end of this phase, the intention is the technology is at a point where a company could make a funding decision for if not a commercial project, then at least a commercial demonstration project,” he says.

“It’s really to get it out of the lab and start hitting the key specifications, identifying the existing and new markets, and pumping out prototypes that can be tested. We have already generated our first two prototypes, a truck side mirror and a hockey stick, but we need to go bigger and faster and test a wide range of market opportunities.”

Long-term need for carbon-based products

The future is likely to be full of carbon fibre products, Helfenbaum says.

“This ‘low-carbon future’ is a misnomer. When we say low-carbon future, what we mean is let’s keep carbon out of the atmosphere. Carbon is still going to be around us in solid form, and probably in increasingly higher amounts,” he says.

“We’re going to have 10 billion people on the planet by mid-century. They need energy, but they also need stuff. They need housing, infrastructure, and consumer goods. And most of that stuff is or can be made of pure carbon.”

Lower emissions from oil sands carbon fibre

Most carbon fibre today is generated from a chemical compound called polyacrylonitrile (PAN), which is derived from a component of natural gas.

A recent study by researchers at the University of Alberta found that life cycle emissions from carbon fibre derived from oil sands bitumen are 69 per cent lower than PAN-based product.

It’s the high carbon content of oil sands bitumen that provides the benefit, Helfenbaum says.

“The heaviest fraction of bitumen takes more energy to break down to be turned into fuels. But that same fraction can be used to produce carbon fibre with fewer greenhouse gas emissions than the current PAN process,” he says.

“If we are successful in reducing its cost, then it can be deployed into new markets that will further reduce carbon emissions, such as lightening passenger vehicles and improving the longevity of concrete infrastructure.”

Adding value while reducing emissions

The Carbon Fibre Grand Challenge is part of Alberta Innovates’ broader Bitumen Beyond Combustion research program. The work considers opportunities to use bitumen to create value-added products other than fuels like gasoline and diesel.

“From an economic perspective, the Bitumen Beyond Combustion program could triple the value of a barrel of bitumen,” Helfenbaum says.

“Carbon fibre is among the most valuable of those products, but it’s not the only one. This is potentially in the tens of billions of dollars a year of gross revenue opportunity, so this is transformational.”

It also presents environmental benefits.

“Eighty per cent of the emissions associated with petroleum happen at combustion of gasoline, diesel, and jet fuel so by diverting into these products, that becomes carbon that is sequestered forever and doesn’t get into the atmosphere,” he says.

Pathway to commercial production

Winners of the grand challenge will have a credible pathway to manufacturing 2,000 tonnes or more of carbon fibre per year. The challenge is scheduled to end in summer 2026.

Thread Innovations is building a new facility to produce samples for potential buyers and demonstrate the ability to scale up production. This phase will also focus on improving characteristics of the carbon fibre produced by their technology to build commercial demand.

“Our target is to complete the current project and then establish a commercialization plan in 2025,” says Chen.

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

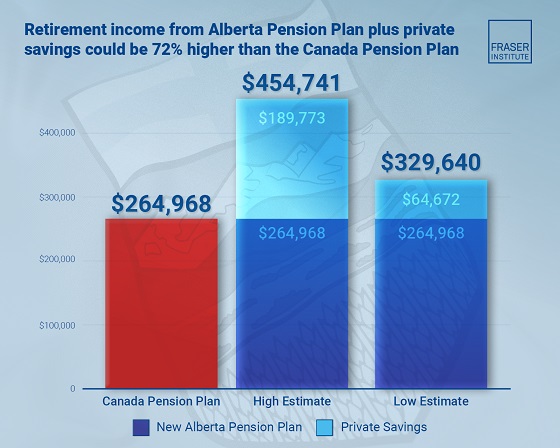

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

COVID-1924 hours ago

COVID-1924 hours agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Alberta24 hours ago

Alberta24 hours agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Entertainment2 days ago

Entertainment2 days agoStudy finds 99% of late-night TV guests in 2025 have been liberal

-

Energy20 hours ago

Energy20 hours agoActivists using the courts in attempt to hijack energy policy