Alberta

Norad, Haiti, migration, critical minerals to top agenda for Trudeau and Biden

WASHINGTON — U.S. President Joe Biden is embarking on a 27-hour whirwind visit to Ottawa, where he will meet Friday with Prime Minister Justin Trudeau and speak to a joint session of Parliament — his first bilateral sojourn north as commander-in-chief.

Here are some of the issues the two leaders are likely to discuss:

Migration breakthrough: The two countries are already close to an agreement to expand the 2004 migration treaty known as the Safe Third County Agreement, which is designed to limit asylum claims in both countries but currently only applies to official entry points. As a result, critics say it encourages asylum seekers to enter Canada at unofficial border crossings, which allows them to make a claim. Sources familiar with the details say the two sides have been working on extending the agreement to cover the length of the Canada-U.S. border since the Summit of the Americas in Los Angeles last June. Such an agreement would help resolve a major political headache for Trudeau, while giving Biden the political cover he would need to devote more spending to northern border security.

Modernizing Norad: Until last month, the binational early-warning system known as the North American Aerospace Defence Command might have been best known for tracking Santa Claus on Christmas Eve. But a February flurry of unidentified flying objects drifting through North American airspace, most notably what U.S. officials insist was a Chinese surveillance balloon, exposed what Norad commander Gen. Glen VanHerck described as a “domain awareness gap”: the archaic, Cold War-era system’s ability to track small, high-flying, slow-moving objects. Coupled with the brazen ambitions of Russian President Vladimir Putin, the ongoing but largely opaque joint effort to upgrade Norad — rarely mentioned in past Trudeau-Biden readouts — is suddenly front and centre for both governments. Media reports suggest Canada could agree to an accelerated timeline.

Helping Haiti: The list of foreign-policy hotspots around the world that instantly bring Canada to mind is a short one, but Haiti is surely near the top. And as Haiti has descended ever deeper into lawlessness in the wake of the 2021 assassination of president Jovenel Moise, the need for military intervention has been growing — and some senior U.S. officials have expressly name-checked Canada as the perfect country to lead the effort. Trudeau’s response has been diplomatic but firm: the crisis is best addressed from a distance. “Canada is elbows deep in terms of trying to help,” he said last month. “But we know from difficult experience that the best thing we can do to help is enable the Haitian leadership … to be driving their pathway out of this crisis.” Military experts in Canada say the Canadian Armed Forces are in no state to be able to lead any sort of intervention. U.S. officials said Wednesday they are pursuing a solution with urgency, but insist the discussions are multilateral in nature and will have to involve Haiti itself, and perhaps even the United Nations.

Mission-critical minerals: No high-level conversation between the U.S. and Canada these days would be complete without talking about critical minerals, the 21st-century rocket fuel for the electric-vehicle revolution that Trudeau calls the “building blocks for the clean economy.” Canada has the minerals — cobalt, lithium, magnesium and rare earth elements, among others — and a strategy to develop them, but the industry is still in its infancy and the U.S. wants those minerals now. The issue has profound foreign-policy implications: China has long dominated the critical minerals supply chain, something the Biden administration is determined to change. “This really is one of the most transformative moments since the Industrial Revolution,” said Helaina Matza, the State Department’s deputy special co-ordinator for the G7’s Partnership for Global Infrastructure and Investment. “We understand that we can’t do it alone.”

Water, water everywhere: Canada and the U.S. have been negotiating since 2018 to modernize the Columbia River Treaty, a 1961 agreement designed to protect a key cross-border watershed the size of Texas in the Pacific Northwest. Despite 15 separate rounds of talks, progress has been middling at best. Meanwhile, Canada is under U.S. pressure to allow the International Joint Commission — the investigative arm of a separate 1909 boundary waters agreement — to investigate toxic mining runoff in the B.C. Interior that Indigenous communities on both sides of the border say has been poisoning their lands and waters for years. Add to all of that the mounting pressure on Canada to supercharge efforts to extract and process critical minerals, and the plot promises to thicken.

Border blues: The flow of irregular migration isn’t the only bilateral issue focused on the border. Critics on both sides say travel between the two countries hasn’t been the same since the COVID-19 pandemic. The Nexus trusted-traveller program, a popular fast-tracking system in Canada, broke down last year amid a dispute over U.S. border agents working on Canadian soil; the fix is widely seen as less streamlined than the old system. Many of those same critical voices are taking issue with Canada’s imposed new tax measures to discourage foreigners from owning real estate north of the border; some on Capitol Hill have been vociferous in pressing the Biden administration to demand an exemption.

A trade deal by any other name: Regardless of what the two leaders end up talking about, it will happen within the framework of the U.S.-Mexico-Canada Agreement, known in Canada as CUSMA. The USMCA era of continental trade, which began in earnest in 2020, has not been without its hiccups, including disputes over U.S. access to Canada’s dairy market and the way the U.S. defines foreign automotive content. The Biden administration is also staunchly opposed to Canada’s plans for a digital services tax, which it considers a violation. The agreement is due to be reviewed in 2026, and a lot could happen — especially on Capitol Hill and in the White House — between now and then. It’s also worth noting that while it’s not covered by the trade deal, the softwood lumber dispute remains a perennial irritant. International Trade Minister Mary Ng met earlier this month with industry leaders to discuss “unwarranted and illegal U.S. duties” on softwood lumber, vowing that a solution that protects Canadian jobs “is the only resolution that we will accept.” In other words, don’t hold your breath for a breakthrough on a dispute “that’s been going on since Adam and Eve,” said Tony Wayne, a former U.S. ambassador to Mexico and the former U.S. assistant secretary of state for economic and business affairs.

This report by The Canadian Press was first published March 23, 2023.

James McCarten, The Canadian Press

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

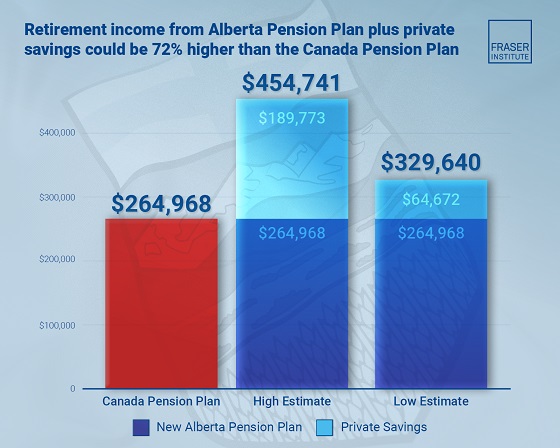

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

COVID-191 day ago

COVID-191 day agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Energy22 hours ago

Energy22 hours agoActivists using the courts in attempt to hijack energy policy

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Alberta1 day ago

Alberta1 day agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says